Mind over matter: behavioral finance and quality investing

Asset management

Key takeaways

- Investors can sometimes act irrationally.

- Quality investing can introduce a rigor that encourages a more rational and considered approach that can tame investor irrationality.

- Quality investing has historically performed well under different market environments.

The early part of a new year is often when we look to take stock, re-assess, and change the way we behave. However, new year’s resolutions are not the only triggers for behavioral changes – it’s been shown that the right investment approach can tame our behavioral flaws.

From inspiring confidence to encouraging discipline, the investment style – and specifically, we believe, quality investing – can have positive effects on investor behavior and help investors to sleep better during roller-coaster days at the financial markets.

What is Quality Investing?

The aim of quality investing is to pick stocks (or other assets such as bonds) that are high quality. The question is: what really defines the quality of an asset? The characteristics that are usually used to define the quality of an asset fall into several categories such as profitability, earnings stability, capital structure, accounting quality, payout/dilution and investment level.1&2

Investors see high quality firms as companies that have high profitability, stable earnings growth, a relatively low leverage in the capital structure (i.e. are financially stable and do not carry a lot of debt), high accounting quality, pay out more and do not issue a lot of equity and debt, and invest conservatively but steadily.

When assessing complex characteristics such as the quality of a company's financial reporting or its investment decisions, which can vary widely from sector to sector, an active approach using analyst judgements can help to add value when selecting high-quality stocks. With such characteristics it is not surprising that, particularly during negative times in the business cycle, i.e. during slowdowns and contractions, high quality stocks usually outperform stocks that are not of high quality . High quality stocks can provide drawdown protection and, historically, exhibit a lower volatility in returns compared to other investment styles.3

So, lets see how quality characteristics help investors to alleviate or at least dampen certain behavioral biases that the typical investor has, and which are well documented in a vast array of scientific empirical studies.4

Understanding behavioral finance

Behavioral finance involves the study of behavioral biases as they relate to investing. Behavioral biases are systematic patterns of deviation from rationality in judgment and decision-making. These biases can lead investors to make decisions that are influenced by emotions, cognitive errors, and social influences rather than purely rational analysis. And this applies to both sides of the coin, clients of funds and fund managers. Clients tend to pull out of the market at lows while fund managers sometimes losing their discipline and are overwhelmed by their own behavioral biases. So, applying a structured investment approach via quality investing can help mitigating behavioral biases.

Key behavioral biases in finance that quality investing can help mitigate

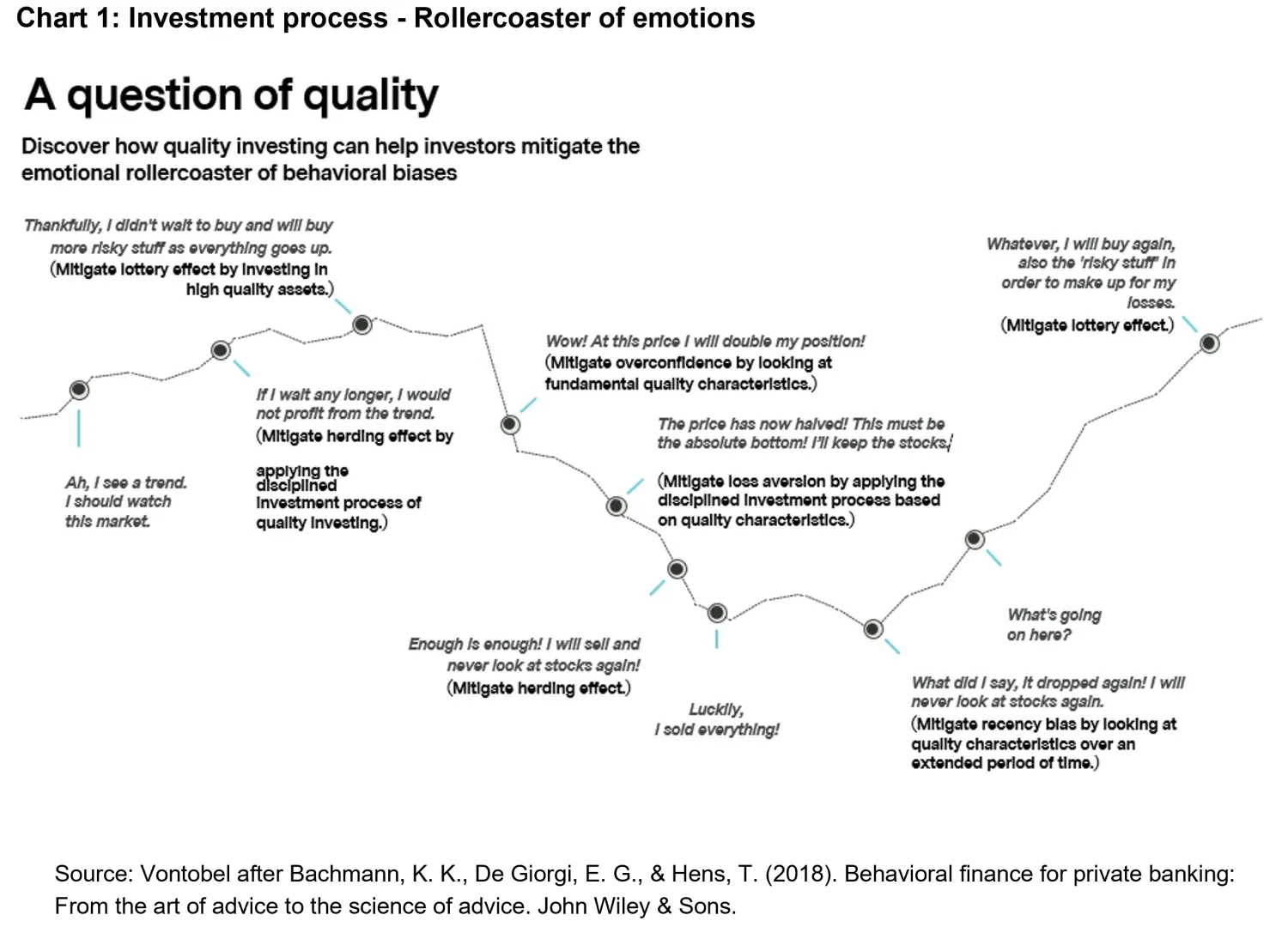

(see the emotional rollercoaster chart).

Lottery Effect This refers to the tendency of people to overestimate the likelihood of winning a high-risk, high-reward investment, like winning a lottery. It can lead to irrational investment decisions based on the unrealistic expectations of large gains.

Loss Aversion Loss aversion is a behavioral bias where individuals place more emphasis on avoiding losses than on acquiring equivalent gains. Investors tend to feel the pain of losses more intensely than the pleasure of gains, leading them to often make decisions too late, e.g. in selling a bad stock to avoid potential losses.

Overconfidence Investors often overestimate their skills and may believe that, for example, opting for companies with higher leverage, more fluctuating earnings, and greater potential for earnings growth is the path to the best rewards, instead of focusing on companies that are fundamentally sound and more likely to succeed.

Herd mentality Herding occurs when investors opt to follow the crowd rather than relying on their own instincts or conducting fundamental analysis. Yet, it's important to note that the crowd's judgment can often be flawed, leading to short-lived trends with potentially costly consequences, such as the internet stocks bubble at the turn of the millennium or the phenomenon of meme stocks in 2021.

Recency bias and present bias People have an innate inclination to give excessive importance to recent events and outcomes, regardless of whether they are the most pertinent or reliable.

How quality investing can help overcome behavioral biases

The quality investing process has a rigor and discipline that promotes and modifies behaviors in ways that can be beneficial to investors:

Understanding Investor Behavior

Behavioral finance helps investors understand their own biases and emotions, which can affect investment decisions. Quality investing emphasizes making rational, informed decisions based on the fundamentals of a company rather than reacting to short-term market fluctuations driven by emotions (see also the emotional roller-coaster chart).

Identifying Quality Companies

Quality investing often involves identifying companies with strong fundamentals such as stable earnings, low debt, and consistent growth prospects. Behavioral finance can help investors avoid falling prey to cognitive biases that might lead them to overlook or undervalue these qualities. An active approach to implementing the quality concept can help to assess difficult questions such as whether a company has a fundamentally conservative balance sheet or whether it has an appropriate capital structure, which can vary greatly depending on the sector.

Promoting Long-Term Perspectives

Both behavioral science and quality investing advocate for taking a long-term perspective. Behavioral finance helps investors overcome the tendency to focus on short-term gains or losses, while quality investing focuses on companies with durable competitive advantages that can generate sustainable returns over time.

Emphasizing Risk Management

Behavioral finance can help investors recognize when they are taking excessive risks or succumbing to the lottery effect, for example. Quality investing incorporates risk management by seeking companies with strong balance sheets and competitive positions, reducing the likelihood of permanent capital loss and the volatility of asset returns.

Encouraging Contrarian Investing

Behavioral finance highlights the importance of contrarian thinking and avoiding herd behavior. Quality investing often involves contrarian strategies, such as buying high-quality companies when they are temporarily undervalued due to market pessimism.

Disciplined Decision-Making Processes

Both fields emphasize the importance of disciplined decision-making processes. Behavioral finance provides frameworks for making decisions more objectively and alleviate behavioral biases, while quality investing involves rigorous analysis of company fundamentals to assess intrinsic value.

The benefits of quality

I believe that the rigor of quality investing can help investors make more rational, disciplined decisions. Think of the emotional rollercoaster that everyone who has invested in stock markets has experienced at some time:

The quality investing approach can help dampen the negative effects that the typical emotional rollercoaster has on our investment behavior. By applying a disciplined investment process based on fundamental qualitative characteristics, it helps us not to sell with the herd when the market is tanking but rather to adapt our portfolio in a continuous screening process: replacing stocks that have lost their quality characteristics with the ones that newly gained it (thereby avoiding herding behavior and loss aversion bias). This could also help to avoid becoming overconfident (next bias avoided) about stocks that performed well in the past but are lacking in certain quality characteristics and, hence, should be divested from the portfolio.

Secondly, by applying quality measures, we know that the underlying company is solidly financed, profitable and has more stable earnings than lower quality stocks, which may help to sleep well even during market downturns. This may also help to stay invested, even in harsh times, and not to engage in the typical rollercoaster behavior of selling when the market has already reached the bottom and to stay away from the market even if it is about to recover, in other words it could help to reduce recency bias.

And lastly, you do not fall prey to the lottery effect when the financial markets are turning from a sell-off into a booming period when many investors try to make-up for their former losses and put their money into high risk and high reward assets. Quality measures could keep your feet on the ground in those periods (and another bias is avoided).

The characteristics of quality investing – where stable earnings and strong fundamentals instill confidence and encourage a long-term perspective – could help investors to stay disciplined and avoid reactionary behavior. This is true for both the clients and fund managers. We believe that these disciplines are critical factors in building any successful portfolio.

1&2&3. For an in-depth discussion about what "quality investing» is and how high-quality characteristics can lead to a selection of stocks that show superior empirical performance results, see, e.g. Hsu et al. 2019 Hsu, J., Kalesnik, V., & Kose, E. (2019). What is quality? Financial Analysts Journal, 75(2), 44-61.

4. See, for example, Baker, H. K., Filbeck, G., & Nofsinger, J. R. (2019). Behavioral finance: what everyone needs to know®. Oxford University Press. or Statman, Meir, “Behavioral Finance: The Second Generation,” CFA Institute Research Foundation, 2019. Available at SSRN:

https://ssrn.com/abstract=3621505

Important Information: The views expressed in this material are the views of Vontobel through the period ended on March 2024. Historical analysis and current forecasts do not guarantee future results. The information herein reflects our judgments, which are subject to change without notice, as of the date of this document. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Opinions and estimates involve assumptions that may not prove valid. There is no guarantee that any forecasts or opinions in this material will be realized. Charts are provided for illustrative purposes only. © 2024 Vontobel.