How to keep your portfolio warm in a sub-zero yield world

Fixed Income Boutique

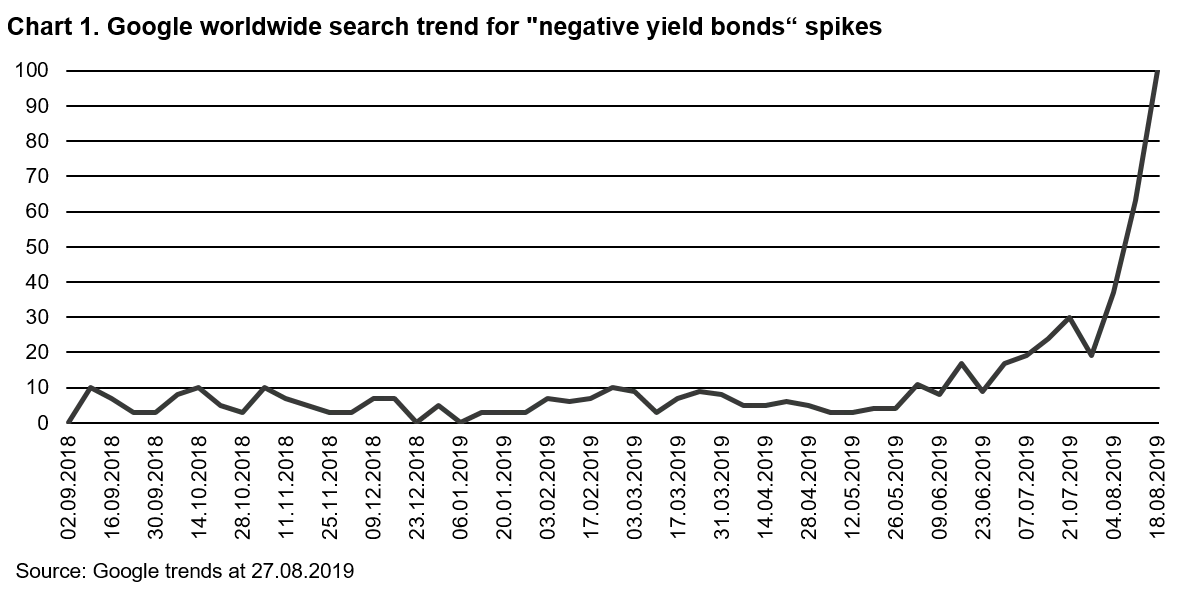

Sub-zero bonds are now the hottest subject in global markets, just ask the ultimate referee of popularity, Google.

Google Trends tracks search patterns giving a value from zero to 100 to any given search term. In August, the search term “negative yield bonds” hit the roof, literally (see chart 1)

With the whole of the Internet now ignoring cat memes and what’s happening with the Kardashians, in favor of reading up on negative yielding bonds, the key question is: how does a bond investor make money in a market that is shivering below zero?

Here are some chilling facts for all bond investors:

- nearly a third of all bonds are now trading at a negative yield

- Around 10% of investment-grade corporate bonds are in negative yield territory…

- … as are some short-dated high-yield bonds

Just a few weeks ago, Germany released a 31-year government bond at -0.1% yield and still investors queued around the block like techies at the Apple store waiting for the release of the new iPhone. What’s more, that specific bond is not an anomaly, it’s the norm. Right now, each and every German Bund trades at negative yields.

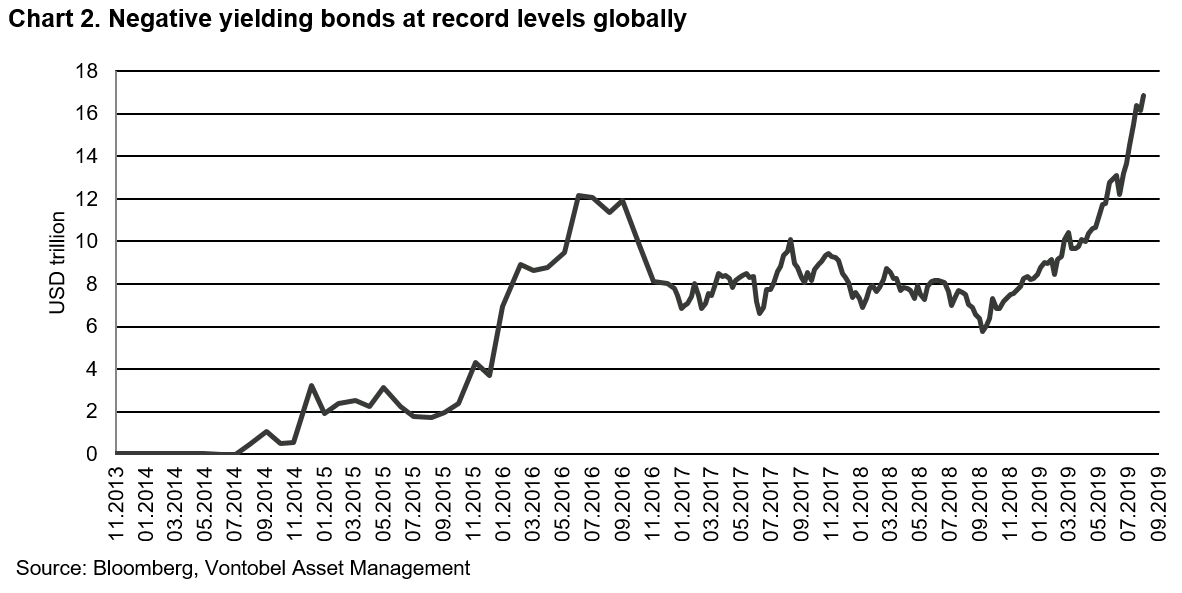

When we add it all up, a total of more than 16 trillion US dollars’ worth of bonds are now in negative territory (see chart 2). The biggest share of this submerged debt pile is, unsurprisingly, Japanese government bonds, followed by the usual suspects – mainly European countries.

It’s not just government bonds in Europe and Japan that are affected, over one trillion US dollars’ worth of corporate bonds are trading in negative territory. That’s a sizeable chunk in itself, but what is notable is the speed that corporate credit is diving below the water line. Just nine months ago, at the beginning of 2019, the number of corporate bonds in negative territory was zero.

A tepid compromise

To find yield in a low-yield environment, investors tend to look at three options in unison or separately. These three options do make for a rather ominous acronym – dip.

- Decrease the rating

- Increase duration

- Purge liquidity

Decreasing the rating means taking on additional credit risk and increasing the chances of a default or a drop in rating. It is a viable option, but requires in-depth analysis of the underlying corporate’s creditworthiness. Increasing duration means piling on interest-rate risk, but interest rate movements are notoriously difficult to predict. The riskiest option is the purging of liquidity from a portfolio, by going into less liquid bonds. Poor liquidity comes with larger bid-offer spreads so as a starting point, you’re already in the red, but the biggest risk with illiquid bonds is that they exhibit their illiquidity at the very worst moments – when markets turn risk off, there’s not a buyer to be found for illiquid bonds. We would advise no compromise on any of the above options. Here’s how to do it:

Go global or drown

The good news in this frosty fixed income universe is that the corporate bond category is global and globally there are positive yields available.

For euro-based corporate-bond investors, there is a strong case to open up to the warm embrace of positive yields on offer from global corporate bonds – and many are already doing just that. Currently, we are seeing European and Japanese investors buying US investment-grade corporate bonds, which help tighten US corporate spreads and strengthen the US dollar.

So, it is no surprise that we are witnessing significant inflows into global corporate-bonds, making this asset class one of the fastest growing hot spots in the fixed income universe. Keeping the amount of negative yielding bonds in mind, the only way now is to go global or have your portfolio freeze in a sub-zero environment.