Fixed Income and ESG - where are we now?

TwentyFour

ESG remains at the forefront of discussions within the investment industry.

Despite challenges related to liquidity and diversification, fund flows into green and sustainable bonds continue to impress, with investors increasingly recognising the far-reaching impact of sustainable investment practices - not just for the good of the planet but for the long-term financial gains.

In this whitepaper, we will delve deeper into this flourishing sector and examine the trends, challenges, and opportunities that have emerged in recent years, with a particular focus on data quality, the expansion of ESG labelled bonds, action from central banks and whether or not the green premium or ‘greenium’ makes sense for issuers.

Overview

ESG considerations carry significant weight, particularly when it comes to investment-grade assets, where the occurrence of defaults is far less frequent than in the high-yield sector. Here, the emphasis shifts from simply backing potential winners to avoiding potential losers.

The integration of ESG credentials into our investment decision-making process assumes a pivotal role in helping us steer clear of potential risky investments. These ESG red flags can serve as early warning signals for potential future issues. Traditionally, these red flags have primarily revolved around governance concerns, but we have observed an increasing focus on environmental and social aspects. For instance, when an issuer hesitates to address an environmental concern or provide emissions data, it may underscore deeper governance issues that could surface in the future, and we have seen evidence of this.

As fixed-income investors, we lack voting rights, which means expressing our views is challenging compared to our equity-investing counterparts. Nevertheless, active engagement empowers us with an influential voice.

We believe that engaging directly with issuers enables us to shape their behaviour and foster positive change, extending our objectives beyond mere profit growth. This is in sharp contrast to the often short-term focus of equity investors.

Engaging with companies, especially those within the unlisted sector, (private companies not traded on public markets and often lacking data transparency) presents an opportunity to influence a company's sustainability strategy and exert longer-term positive impacts on society.

We find that our engagement with smaller issuers, where we are often a key investor, can yield more significant results, given our greater influence over the company's direction and our more personal relationships with management. This stands in contrast to our efforts with large, well-established corporations, where our engagements can still have impact but only when in conjunction with similar concerns from other investors.

Data Challenges

One of the central challenges confronting fixed-income investors is the scarcity of readily available third-party ESG data for a significant portion of the global investment universe. In fact, over half of global credit issuers belong to the category of unlisted or specialised entities, making standardised off-the-shelf ESG scores non-existent. Consequently, we find ourselves tasked with the responsibility of assessing and scoring these companies independently. This undertaking demands substantial resources and thorough scrutiny. However, this unlisted cohort also presents a distinctive opportunity for us to engage meaningfully and catalyse positive change, particularly in the ABS sector.

And issuers are now helping. They have begun acknowledging the significance of ESG considerations and dedicating considerable time to discussing these topics during roadshows. It has become a rare occurrence to encounter an issuer that does not allocate a substantial portion of their presentation to ESG matters, a stark contrast to the landscape just three years ago when such discussions were much less common. This encouraging shift demonstrates that issuers are increasingly attuned to the material implications of ESG, particularly in relation to climate change and more recently social considerations.

Despite the coverage challenges, we have found that data is improving.

The progress in data advancements has been remarkable, especially concerning scope one, two, and three emissions data. Nearly all investment-grade issuers have now adopted the practice of reporting at least scope one and two emissions data. The coverage of scope three emissions, however, remains a persistent challenge, marked by inconsistent reporting that complicates meaningful comparisons. Nevertheless, smaller companies, particularly within the US high-yield sector, have been relatively slow in embracing ESG practices. However, it is becoming evident that they are increasingly receptive to the importance of ESG considerations, and we are witnessing positive developments in data reporting across the entire spectrum of fixed-income investments.

One trend witnessed over the past year is investors and issuers increasingly moving away from ESG scores alone as a measure of a company's sustainability. ESG scores can be gamed and are largely backward-looking, which limits their impact on investment returns and future ESG developments. Instead, investors and issuers are increasingly focusing on forward-looking temperature commitments, such as the Science-Based Targets initiative (SBTi). SBTi targets are a stronger signal of a company's commitment to sustainability and climate change specifically. They are based on the latest climate science and require companies to reduce their greenhouse gas emissions in line with the Paris Agreement goals.

The momentum behind temperature commitments is very encouraging and we expect these numbers to continue to rise. This is a hugely positive development for investors, issuers, and ultimately the environment.

Already 44% of the Sterling Investment Grade index have either verified SBTi targets or are committed to doing so. Looking wider in global investment grade, approximately one third of the global investment grade index are companies that are aligned to some form of temperature commitment. Overall, we are somewhat surprised but encouraged by the speed of adoption of temperature commitments. We believe the momentum in this area will continue to build, and we fully expect these numbers to continue to rise aggressively.

Overall, there has been huge progress in the data available across all areas of Fixed Income. While challenges do remain, the direction of travel is very positive. We have been pleased with the speed of progress, particularly regarding net zero temperature backed commitments and those actively making changes to their business model to align the interests of investors, customers, and the business. We are optimistic about the future, with further data improvements on the horizon and growing opportunities for engagement.

How do investors evaluate the social side of ESG?

The social aspect of ESG is more challenging to evaluate and score than the environmental and governance aspects. This is because it involves more qualitative considerations, such as how a company treats its employees and customers, rather than quantitative metrics, such as greenhouse gas emissions where data disclosures continue to improve as mentioned above.

However, the evaluation process can be simplified by asking a fundamental question: Is the company acting in the best interest of its customers, employees, and the community around it? If the answer is yes, then the company's social profile can be considered satisfactory, even if it may not warrant a top score of 95 out of 100.

Smaller issuers may not have the resources to publish all the policies and processes that third-party scoring providers typically seek. As a result, they may receive unjustifiably low social scores, which may not accurately represent their actual commitment to social responsibility.

For example, some building societies may have low social scores even though they are actively working for the benefit of their members and communities, not shareholders. This is because third party ESG scoring models are built for listed companies and not smaller or private entities and do not adapt well. Therefore, it is important to question and re-evaluate social scores provided by ESG scoring companies, keeping in mind the unique circumstances of each company and the efforts they make to serve stakeholders.

When conducting research and scoring in the social category, common factors to consider include:

• Employee welfare: This includes factors such as staff turnover, employee satisfactions, proportion of female employees, and staff training programs.

• Human rights: This includes factors such as human rights policy, involvement in child or forced labour and customer service, and ethical testing.

• Community engagement: This includes factors such as donations to charity, volunteer work, environmental initiatives and bribery or corruption risks.

• Product responsibility: This includes factors such as customer satisfaction, fair trade, data protection and health and safety.

It is important to note that there is no single, universally accepted way to evaluate the social aspect of ESG. ESG scoring companies use a variety of methods, and their methods are not always transparent. Investors should be aware of this and carefully sense check the social scores of any company they are considering investing in.

In summary, while social evaluations are more complex, adopting a more nuanced approach that considers the broader impact of a company's actions can provide a fairer assessment of its social profile. It is important to avoid rigid, one-size-fits-all scoring methods and to appreciate the unique circumstances and efforts of each company when evaluating their social responsibility.

ESG labelled issuance

The expansion of ESG-labelled issuance has been one of the biggest growth areas in the Fixed Income market over the past three years. ESG-labelled bonds include sustainable, green, social, and sustainability-linked bonds. As a reminder, green bonds raise capital against a specific ring-fenced asset or project, as do social bonds. Sustainability-linked bonds raise capital for general corporate purposes, but the company's overall ESG performance is linked to certain key performance indicators (KPIs). If the company fails to achieve its KPIs, the coupon on the bond will step up.

This area of the Fixed Income market has been in the spotlight for several reasons, both positive and negative. We previously wrote a white paper on green bonds, and we thought it would be worthwhile revisiting some of the key themes surrounding diversification, liquidity, volatility, and the green premium or ‘greenium’.

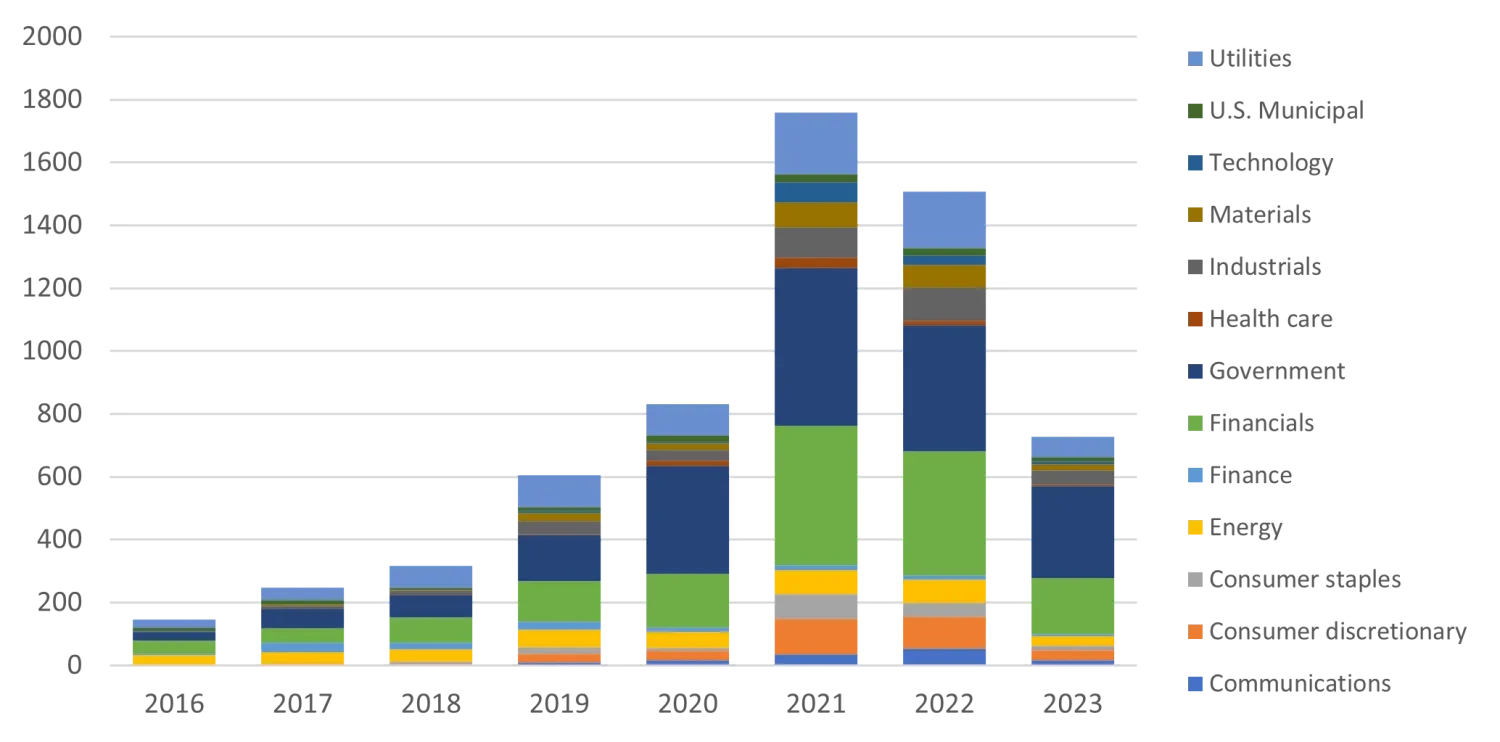

Let's start with diversification. The chart below shows the breakdown of ESG-labelled issuance by sector over time.

Figure 1, Source Bloomberg: 29 August 2023

The ESG-labelled bond market grew rapidly from 2020 to 2021, more than doubling in size to reach almost $2trn in supply. This growth was driven by two factors:

1. The widespread adoption of ESG investing principles across the entire market, which put pressure on issuers to offer ESG-labelled bonds.

2. The strong macroeconomic backdrop and central bank support in 2021, which fuelled a boom in primary supply across the Fixed Income landscape.

Looking at the key sectors, financials took the lead in adopting the ESG label in 2021. Much of their supply was in the senior part of the capital stack, but there was also some limited issuance of subordinated green bonds. In addition to financials, governments and utilities were the other key sectors contributing to the issuance growth in 2021. However, outside of these sectors, there was very limited supply.

This means that diversification in the ESG-labelled bond market remains an issue. For example, if you are running an ESG bond-focused fund and want to allocate to a sector such as telecommunications, you may be limited to very few issuers or bonds.

Looking ahead, we expect primary supply to decline in 2023. However, this is not indicative of negative trends in the sector. Rather, it is a response to the current higher rates environment and issuers' limited funding needs, given that many locked in favourable rates during 2020 and 2021.

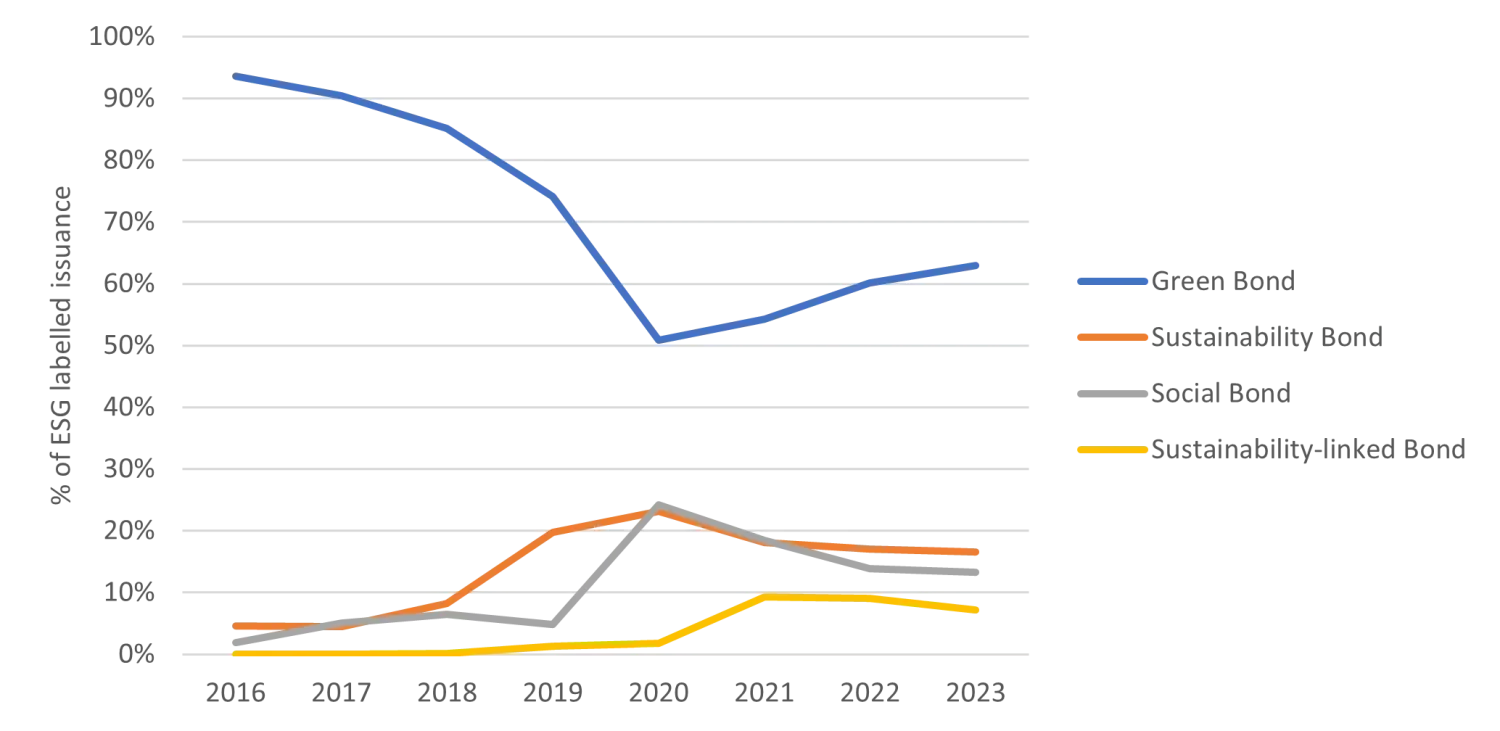

What format are being issued?

The growth of social, sustainable, and sustainability-linked bonds has shifted some of the attention away from green bonds.

Figure 2, Bloomberg: 29 August 2023

In 2016, the ESG-labelled bond market was very small, and green bonds were really the only option. However, in 2020, there was a major surge in social bond issuance. This was primarily driven by governments, especially the European Union (EU), which was seeking substantial capital for pandemic-related relief funding. Other governments have since followed suit.

It is important to note that the social bond category, while growing, remains relatively small and niche. It is primarily dominated by government issuance, which typically accounts for 80% of supply. As a result, only a limited number of issuers, mainly banks, can tap into the social bond market. This means that widespread growth and diversification of social bonds will be limited.

Sustainability-linked bonds (SLBs) are an encouraging type of bond that aligns well with the interests of both issuers and investors. Unlike green bonds, SLBs do not need to be tied to a specific project or asset, giving issuers more flexibility in how they use the proceeds. For investors, SLBs come with KPIs that have coupon step-ups. If the company fails to meet its KPIs, usually related to emissions reduction targets, the coupon rate increases. This creates a financial incentive for management to remain committed to its sustainability goals.

We believe that SLBs offer great potential, but we have been somewhat disappointed with the limited supply and growth in this category. This is partly due to the lack of ambition in the KPIs that are being set. Investors are looking for robust and ambitious targets, rather than insignificant ones that are aligned with the market's expectations. This is why green bonds remain the dominant part of the market and without a meaningful shift in issuer KPIs, we anticipate this trend to persist moving forward.

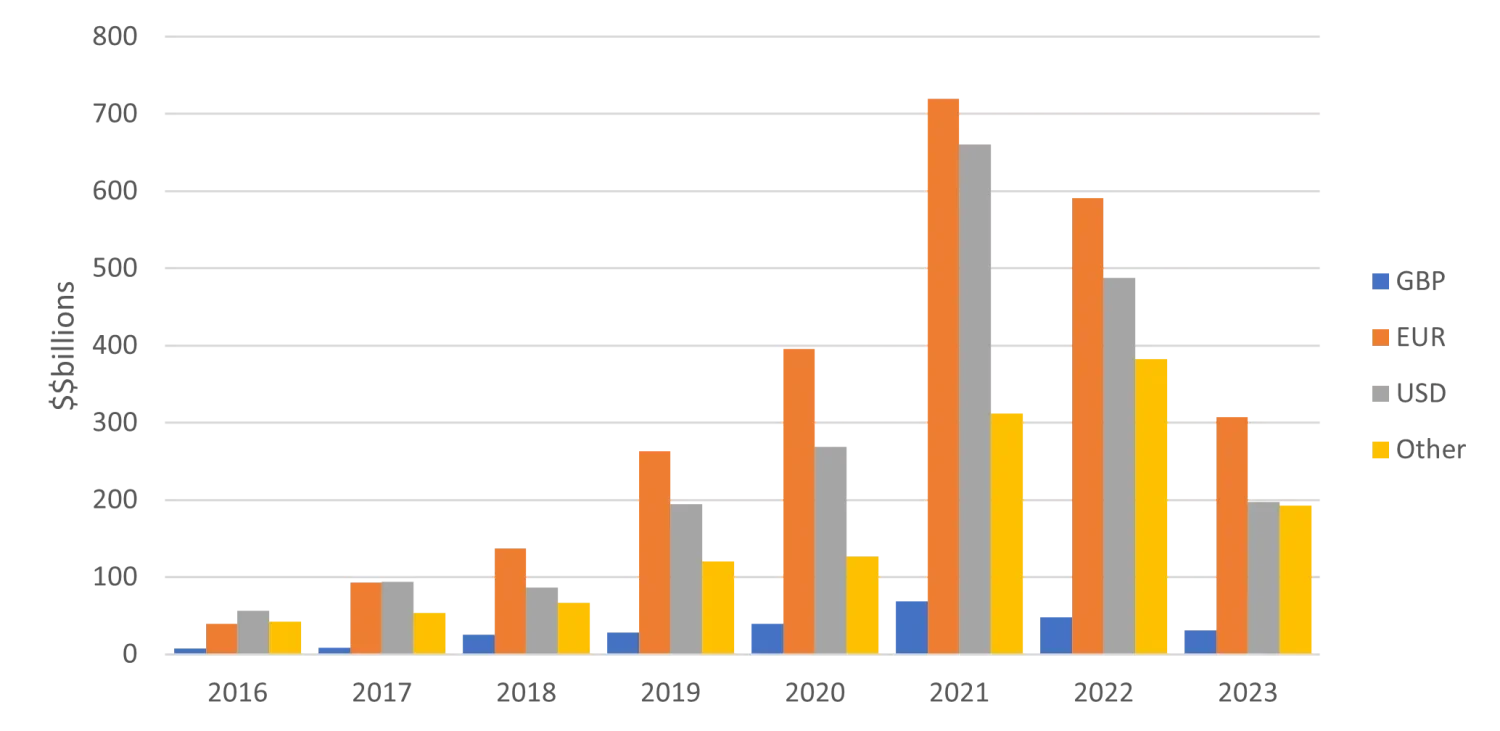

Where is issuance coming from?

In terms of currency, Europe was the first mover into ESG and unsurprisingly it continues to dominate ESG labelled supply.

Figure 3, Bloomberg: 29 August 2023

The United States dollar (USD) is not far behind the euro in terms of ESG-labelled bond issuance. Given the size of the market, it is not unimaginable that the USD could soon become the dominant currency for ESG-labelled bonds. However, the complicated political landscape in the US makes broad-based adoption of ESG bonds particularly challenging. Until this changes, we may not see a significant increase in ESG bond supply in USD.

The decrease in euro and USD issuance in 2022 and 2023 reflects the challenging primary market conditions driven by macroeconomics rather than any fundamental concerns. What is most interesting is the increase in the "other" category. Surprisingly, China was the main driver of this, emerging as the largest issuer of green bonds in 2022. This is even though China is also the world's largest polluter. Additionally, we are seeing an uptake in supply from several emerging market issuers, such as Chile and Brazil. These countries are tapping into the ESG-labelled bond market to access more investor demand and secure cheaper funding for their environmental goals.

Looking ahead, we do not anticipate any major shifts in the currency makeup of ESG-labelled bond issuance. While we may see a potential increase in USD issuance, any drastic changes would likely hinge on a transformation in the political landscape. However, we do expect the "other" category to continue growing as emerging markets press ahead with their sustainability objectives.

Who are the issuers and why are they issuing?

ESG bonds can take a variety of different forms in terms of what the proceeds are used for. For example, Vattenfall, the European utility company, is a good example of the traditional green bond issued by the utilities sector. Its Use of Proceeds is focused on projects related to renewable energy, transmission and distribution of electricity, energy efficiency and clean transportation. There are several very similar green bonds from the European utilities sector from household names, such as Iberdrola, SSE and National Grid, which take the same form. This is not surprising given the vast capital needs to fund the transition, in addition to the cheaper funding these bonds offer in comparison to vanilla issuance. Going forward we expect green bonds to continue to be the label of choice for the utilities sector.

Sustainability-linked bonds have been the choice for issuers without the asset base or business need to issue under the green label. Weir Group is a good example of this. The company has set emissions reduction targets that have been verified by the Science Based Targets initiative (SBTi). If Weir Group fails to meet these targets, the coupon on its bond will increase by 75bps. As an investor, setting targets that are aligned to the Paris Agreement and externally verified is a big positive compared with other issuers who have opted for somewhat arbitrary internally set targets that lack credibility. It is crucial for companies committed to sustainable practices to have access to the ESG market, and the sustainability-linked bond structure provides a suitable avenue for them.

While green and sustainable bonds are typically used to fund projects with environmental or climate change-related objectives, social bonds can be used for a wider range of purposes. For example, government entities have issued social bonds to fund Covid-19 relief efforts, while banks have used them to target lending to lower-income households.

A recent deal from NatWest highlighted the diversity of purposes for which ESG bonds can be issued. NatWest issued a social bond to refinance existing and new loans for women-led enterprises. This example shows how syndicate desks are increasingly demonstrating creativity in identifying projects and initiatives that align with social and environmental objectives. We expect this trend to continue, with ESG bonds financing more niche and impactful objectives in the future.

In summary, these three examples showcase the vast array of possibilities for ESG bond issuance and how companies are leveraging this market to support their sustainability goals.

How does ESG issuance fare in the primary markets?

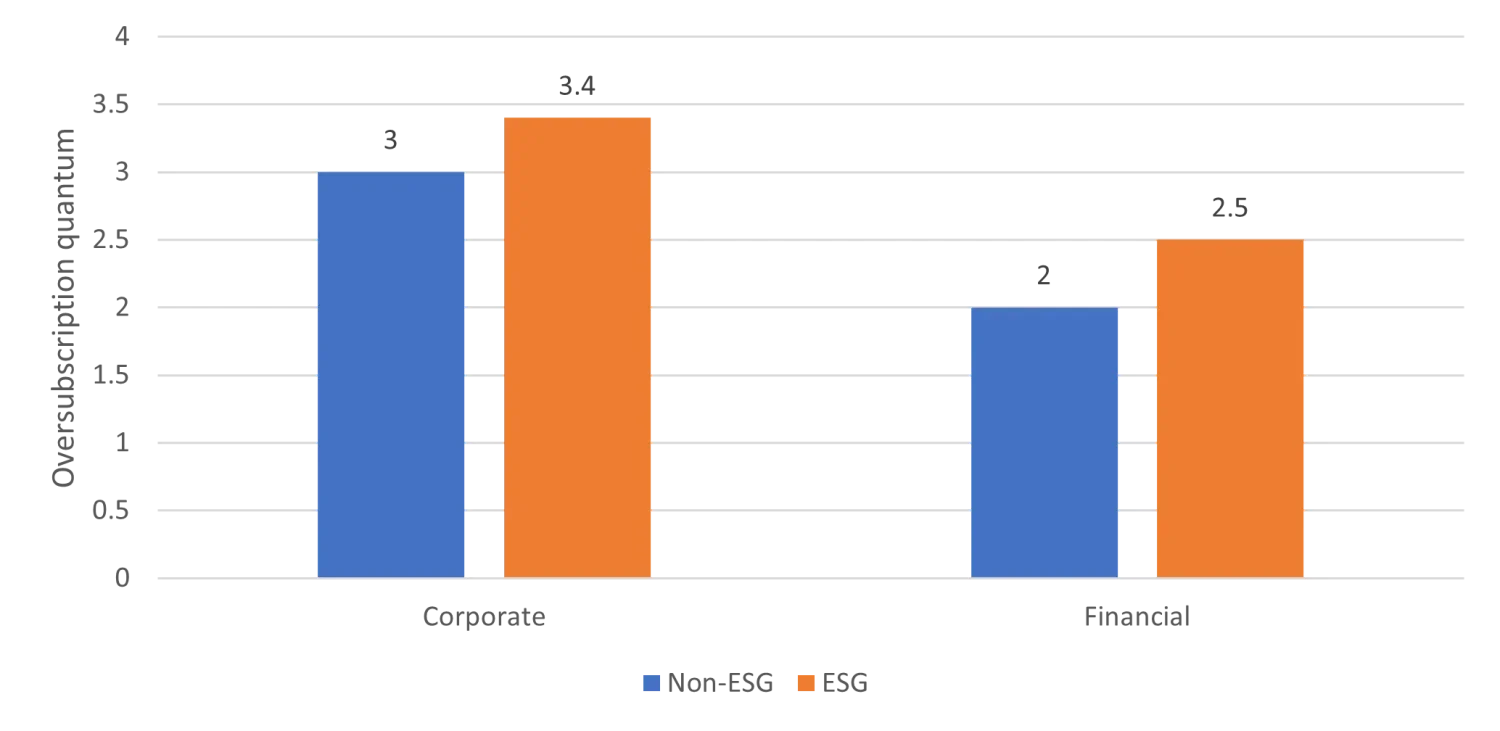

Figure 4, Santander: 29 August 2023

The chart demonstrates that the demand for ESG labelled bonds consistently outpaces that for non-labelled bonds, with order books typically half a turn larger for both corporates and financials. This is because investors are increasingly looking to support sustainable companies and projects. As a result, issuers of ESG bonds can price their bonds closer to fair value, or even inside fair value, which means they can issue them at a lower cost. This difference is known as the ‘greenium’, which represents the spread differential between a green bond and a conventional bond from the same issuer. For example, the average new issue premium for a green bond is 16bps, compared to 21bps for a non-labelled bond. The greenium here is approximately 5bps, implying that it is 5bps cheaper for a company to issue green or sustainability bond as opposed to a conventional one.

But is the greenium consistent?

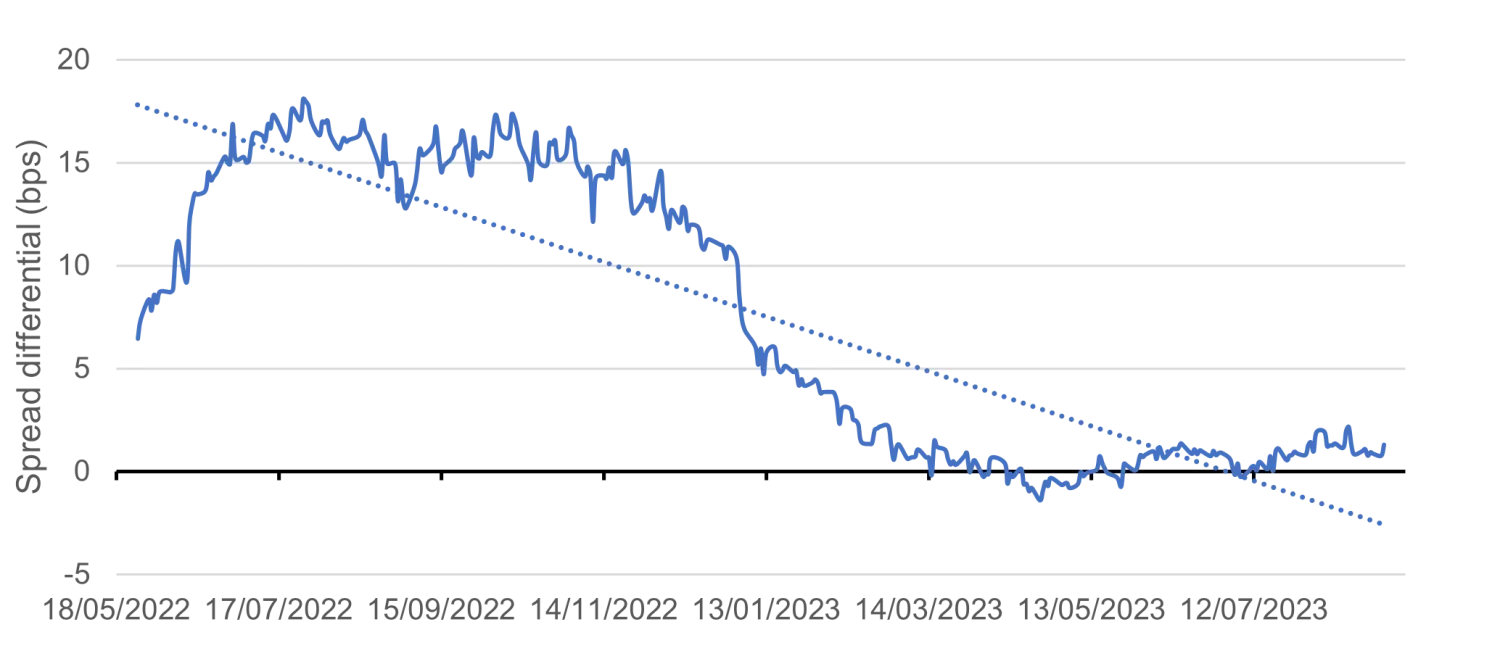

For some issuers it is, such as the example from Engie below where the greenium has been anchored at around 1bps year to date despite a big decline at the end of 2022.

ENGIFP 0 ⅜ 06/11/27 Corp vs ENGIFP 0 ⅜ 06/21/27 Corp (green bond)

Figure 5, Bloomberg: 29 August 2023.

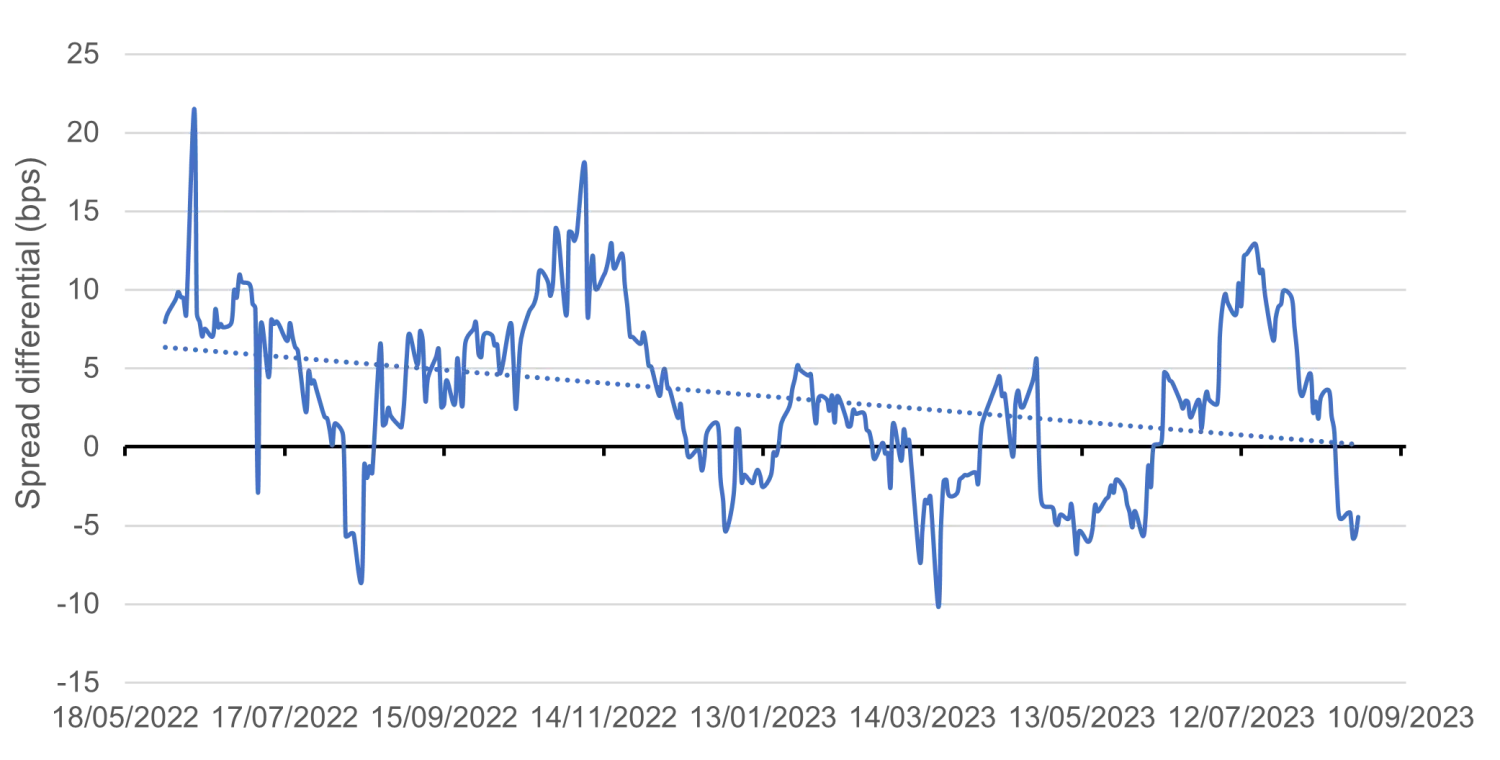

In contrast in the chart below the greenium of Credit Agricole the greenium is incredibly volatile.

ACAFP 0 ⅜ 10/21/25 Corp vs. ACAFP 1 ⅜ 03/13/25 Corp (green)

Figure 6, Bloomberg: 29 August 2023.

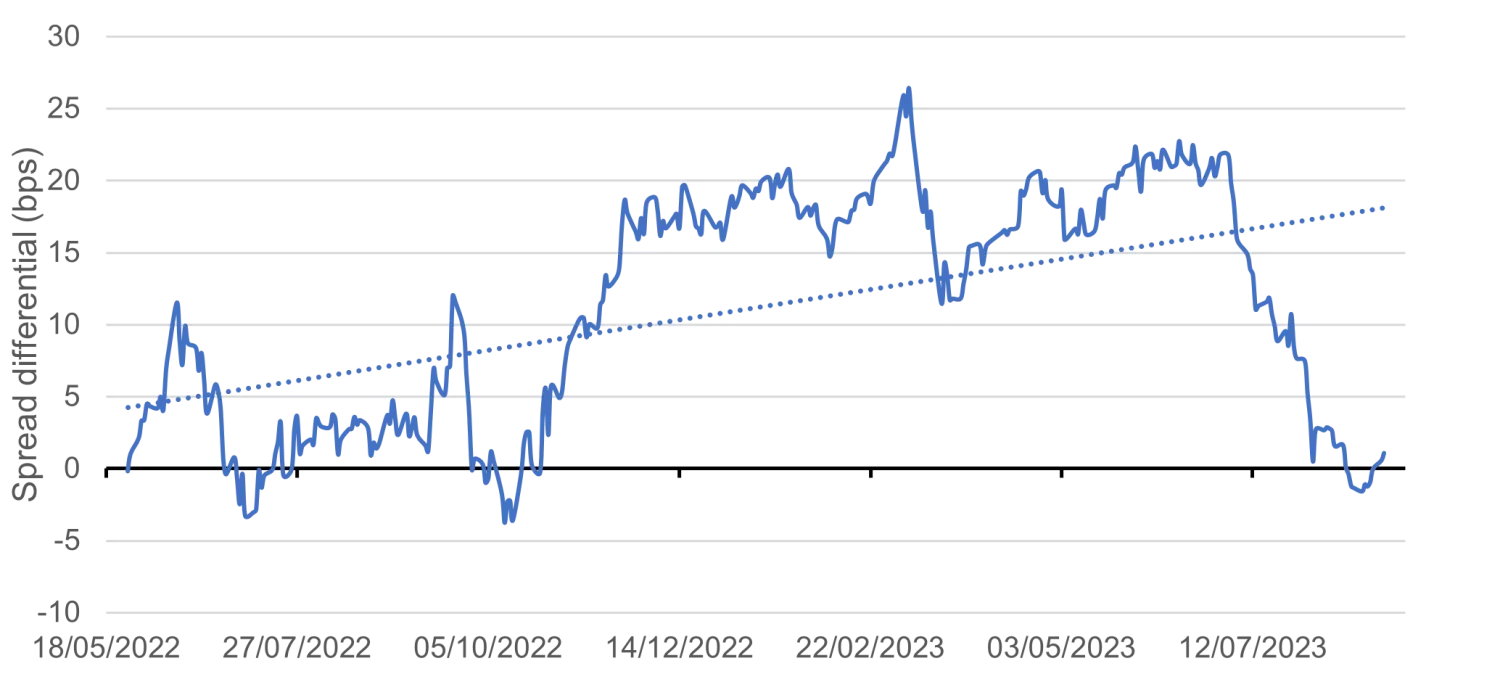

A similar trend can be observed at Orange (the French telecommunications company).

ORAFP 0 ⅛ 09/16/29 Corp vs. ORAFP 1 ⅜ 01/16/30 Corp (sustainable bond)

Figure 7, Bloomberg: 29 August 2023.

While the absolute value of the greenium of Orange and Credit Agricole is different, the volatility profile does have similarities. The greenium, tends to be stable or increase during periods of market stability or mild volatility. However, during times of market stress, such as the regional banking crisis in the US and Credit Suisse's difficulties earlier this year, the greenium can break down, become more volatile, and often turn negative.

We cannot explain the entirety of the movement in these spreads, but we believe that this somewhat abnormal volatility profile is due to liquidity challenges. The green bond market is still relatively small, and these bonds are typically held tightly by institutional investors who are a key investor in the asset class. During stressed market conditions, these investors may be reluctant to sell these assets, but they may be forced to do so due to liquidity constraints and this can lead to significant spread moves in certain green bonds as evident in Credit Agricole and Orange.

For many companies, the greenium is consistent like in the Engie example above. However, the uncertainty of abnormal spread moves is what makes us cautious about the sector.

For companies where green bonds make up a large part of their outstanding debt, aggressive spread moves are less likely as liquidity is less of an issue. As the green bond market continues to expand, we expect it to grow out of these challenges as ESG-labelled bonds take a larger share of the Fixed Income market. However, until that happens, we believe it is prudent to remain slightly cautious on the asset class.

We believe you must evaluate the ESG profile of the company as a whole rather than the particular asset or project that a green bond finances. Therefore, when we like the ESG profile of a company we are indifferent to whether we invest in their green or non-green bond and our investment decision will be based on relative value. This approach can often result in investing in the non-green bond, which typically yields on average 5-10bps more than their green counterpart.

Central Bank influence?

Investors have long been aware of the influence of central banks on Fixed Income markets. However, this influence has become increasingly evident in recent years, particularly with the actions of central banks related to quantitative easing (QE). QE bond purchases have played a significant role in shaping market dynamics and fuelled the swift recovery and rally in credit spreads following the aggressive sell-off at the onset of Covid-19.

Therefore, it is essential for investors to stay on top of the actions of central banks, particularly any changes in their methodology or process that could influence spreads.

The most recent major change has been how they will or won’t incorporate net zero and sustainability into their bond purchasing programs. Although QE has now finished, central banks are actively reducing their balance sheets by either not reinvesting maturing bonds or actively selling in the market. Although some might believe that the framework they established is now less pertinent since they are no longer active buyers, this assumption is mistaken. It continues to influence their selling strategy, as they now hold preferences for specific bonds, which will inevitably impact credit spreads.

The most recent major change in central bank policy has been their approach to net zero and sustainability. In the past year central banks have been considering whether to incorporate these factors into their bond purchasing programs.

Firstly, starting with the European Central Bank (ECB) who have been clear about their intention to decarbonise its corporate bond holdings in line with the Paris Agreement.

Rationale: “support the gradual decarbonisation of the Eurosystem’s corporate bond holdings, in line with the goals of the Paris Agreement”.

How?

Reinvestments will be phased out of the primary market with the exception of ‘non-bank corporate issuers with a better climate performance and green corporate bonds’ and secondary purchases will be more strongly tilted towards issuers with ‘better climate performance’.

What are the ECB looking at?

Not third-party scores but rather an internal methodology comprised of three scoring pillars:

1. Emissions sub-score - how do current emissions rank against peers, best in class, etc. (backward-looking).

2. Target sub-score - how credible and ambitious are forward-looking emission reduction targets.

3. Disclosure sub-score - whether these interim and long-term targets have been verified or not, referring to Science Based Targets initiative (SBTi) status or similar.

Ultimately, the ECB plans to continue buying green bonds and prefers issuers with better climate performance, even for non-green bonds. This performance is not assessed by third-party scores, but rather by the ECB's internal assessment based on the following factors: emissions ranking against peers, ambition, and credibility of net-zero targets and whether net-zero targets are verified.

The ECB's commitment to green bonds and best-in-class companies will influence secondary spreads when the ECB decides to sell specific bonds from its portfolio. For example, the ECB is more likely to sell a non-green bond from BP than a green bond.

In a similar vein, the Bank of England (BOE) has set a target of reducing carbon intensity by 25% by 2025. While they have already sold their entire corporate bond purchasing portfolio, their criteria for climate performance are akin to the ECB's, focusing on emissions reductions, net-zero targets, and verification. If the BOE resumes quantitative easing (QE) in the future, its approach could influence market dynamics.

Targets:

• Near term target of 25% reduction in the weighted average carbon intensity of the CBPS portfolio by 2025.

• Full alignment with net zero emissions by 2050.

Eligibility criteria:

• Firms must have public climate disclosures in line with the UK Government’s requirements from 2022.

• For higher-emitting sectors (energy and utilities), public emissions reduction targets must be published.

• Firms with any coal mining activities are ineligible; issuers using thermal coal in their activities are also ineligible unless they meet stringent criteria.

Tilting:

• ‘Tilting’ or skewing purchases towards stronger climate performers within company sectors and away from weaker performers.

• This will be done using a scorecard incorporating emissions intensity, past reductions in emissions, publication of a climate disclosure and publication and third-party verification of an emissions reduction target.

Escalation:

• Annual reviews and increasing requirements as coverage and robustness of data improves.

• Escalating intensity of actions, including loss of eligibility and divestment where climate performance is considered inadequate.

Finally, in contrast to ECB and the BOE, the Federal Reserve (Fed) has taken a different stance on climate change. The Fed has made it clear that it does not consider itself a climate policymaker.

Fed Chair Jerome Powell has said that the Fed "is not, and we don't seek to be, climate policymakers as such". He has also said that the Fed views climate policies as beyond its economic and financial stability mandate.

Given the political divide and complexities with climate change in the US, it is unlikely that the Fed's position will change in the near term.

Despite the mixed perspectives from central banks, the overall technical picture for ESG-labelled bonds is very positive, driven by demand, regulatory initiatives, and the market's focus on sustainability. However, as always it is essential for investors to stay informed about how central bank actions and policies may influence the fixed-income market going forward.

Conclusion

The ESG-labelled bond market is growing rapidly and broadly investor perception is positive, but it still faces several challenges. Liquidity remains an issue, as evidenced by the meaningful spread moves observed in certain bonds. Diversification is also a concern, as the market is currently dominated by three main sectors: governments, utilities, and financials. Additionally, the asset class's longer duration may not be suitable for short duration focused investors.

The sector is also plagued by data challenges and is one of the central stumbling blocks confronting fixed-income investors.

However, the strong technical factors that are currently supporting the ESG bond market cannot be ignored. The direction of travel is very strong with investors and the public are increasingly aware of the challenges posed by climate change, with fund flows into sustainable and green bond funds remaining strong despite the recent market volatility.

Regulatory pressure is also pushing portfolio managers to consider these assets more favourably, as observed from the communications of central banks like the ECB and BoE. History tells us that it is unwise to fight central banks, and on ESG it is no different.