Under Pressure: Checks and balances in central banks

Asset management

Key takeaways

- Over time, the need for financial stability and crisis prevention emphasized the importance of central bank independence. However, in recent decades, the Global Financial Crisis, the Euro Area Crisis, and Covid-19 forced many central banks to blur the lines between monetary and fiscal policy.

- Compromised central bank independence can erode investor confidence and disrupt financial markets. Despite concerns today, checks and balances within the US Federal Reserve limit President Trump’s influence over monetary policy.

- We explore various scenarios, ranging from zero influence to a mild erosion of the Fed’s independence, and even to outright political capture. We aim to help investors navigate the potential impact on investor confidence, the bond markets, the USD, and the broader economy.

- Further risks of a pressured Fed include restricted access to USD swap lines for political reasons and limited access to the Fed’s discount window and Standing Repo Facilities to foreign banks with US operations.

Central bank primer

In pursuit of economic stability

Central banks typically implement either expansionary ("dovish") or contractionary ("hawkish") monetary policies to influence economic activity. Dovish policymakers aim to stimulate economic growth by lowering interest rates, which increases money supply to promote spending and investment. Hawkish policymakers, on the other hand, seek to prevent the economy from overheating and control inflation. They do this by raising interest rates, which reduces money supply and curbs demand.

Economic activity can also be influenced by fiscal policy. Unlike monetary policy, fiscal policy is managed by governments or their respective branches and involves decisions about taxation, fiscal spending, and allocation of public resources.

Influencing short-term interest rates

Short-term policy rates are typically the “first line of defense” as the key policy tool for major central banks. This includes the US Federal Reserve’s (Fed) Federal Funds rate, the European Central Bank’s (ECB) main refinancing rate, and the Swiss National Bank’s policy rate. Central banks typically employ three tools to influence short-term interest rates:

- Forward guidance: Central banks usually communicate their short-term policy rate targets to financial markets, which allows them to help shape market expectations about monetary policy decisions, a practice known as forward guidance. Over the past decades, the way central banks and their representatives communicate with financial markets and the public has changed significantly, representing the growing importance of transparency and clarity.

- Repo market operations: In the repo market, one institution sells securities to another party with an agreement to repurchase them at a higher price on a specified date. This allows central banks to lend money against collateral at a specific interest rate, which is often set via an auction. Financial institutions typically use repo transactions to secure short-term funding, such as overnight or for a few days, ensuring liquidity in the financial system.

- Standing facilities: Central banks can also exert influence on short-term rates via standing facilities or discount windows, where commercial banks can borrow money at a fixed interest rate, or via foreign currency transactions such as foreign exchange swaps.

For nearly all lending and repo transactions with central banks, collateral is required. By adjusting the eligibility criteria for collateral or its valuation, central banks can influence the availability of liquidity to financial institutions.

Steering medium- to longer-term rates

To influence medium- to long-term interest rates (typically those with maturities ranging from one to 30 years), central banks employ quantitative easing (QE), which involves the purchase or sale of medium- to long-term securities. By doing so, they seek to lower the interest rates on savings and loans with longer maturities and give an incentive to financial institutions to lend money and invest it in even longer maturities. These can include a wide range of assets, such as government bonds, commercial paper, corporate bonds, and in special cases, equities. By buying or selling securities, central banks can affect their supply and influence interest rates and prices. QE results in an increase in liquidity in financial markets and in the money supply of an economy and expands the central bank’s balance sheet.

Quantitative tightening (QT), on the other hand, can be viewed as “reverse QE” or balance sheet normalization. When engaging in QT, a central bank usually reduces or stops the reinvestment of proceeds from maturing government bonds or even actively sells bonds outright, which decreases the amount of money in circulation and reduces the size of the central bank’s balance sheet.

Mandates may differ, but all major central banks focus on price stability

The US Federal Reserve (Fed)

The Fed’s task is to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates,” according to the Federal Reserve Act of 1913. However, the goal of moderate long-term interest rates is often seen as redundant, as it is naturally achieved by focusing on the first two objectives – stable prices (low inflation) and maximum employment. As a result, the Fed's mandate is commonly referred to as the “dual mandate.”

When it comes to maximum employment, the Fed does not set a fixed numerical target. This is because it believes that maximum employment is "largely determined by non-monetary factors that affect the structure and dynamics of the labor market," and that "these factors may change over time and may not be directly measurable." Instead, the Fed monitors a wide range of labor market indicators, including the unemployment rate, the underemployment rate, and the ease or difficulty employers face in hiring new staff. As for price stability, the Fed has a clear goal: it aims for an annual inflation rate of 2%, as measured by the headline Personal Consumption Expenditures Index (PCE).

Figure 1: The US Federal Reserve’s structure

| Board of Governors | Federal Reserve Banks | Federal Open Market Committee (FOMC) |

|

|

|

Source: www.federalreserve.gov/, September 2025

The European Central Bank (ECB)

Based in Frankfurt, Germany, the ECB serves as the central bank for the 20 European Union countries that use the euro as their currency. The ECB formally replaced the European Monetary Institute in 1998, with its full operations beginning on January 1, 1999, following the introduction of the euro.

The ECB’s mandate differs from the Fed in that it mainly focuses on one goal: maintaining price stability in the Eurozone. By doing so, the ECB seeks to support economic growth and job creation. For the ECB, price stability is defined as maintaining “low, stable and predictable” inflation of two percent over the medium term. To monitor inflation, the ECB uses the Harmonized Index of Consumer Prices (HICP). The harmonized term reflects the fact that all countries within the currency bloc use the same methodology, ensuring that data from one country can be compared with data from another. The ECB’s commitment to its inflation target is described as symmetric, meaning that inflation rates that are too low are viewed just as negatively as inflation rates that are too high.

Figure 2: The European Central Bank’s structure

| Governing Council | Executive Board | General Council |

|

|

|

Source: https://www.ecb.europa.eu/home/html/index.en.html, October 2025

The Swiss National Bank (SNB)

The SNB traces its origins back to 1905, when the “National Bank Act” was established. The Act entered into force in early 1906, and the SNB began operations in 1907.

The SNB’s primary goal is “to ensure price stability, while taking due account of economic developments.” By doing so, it aims to create “an appropriate environment for economic growth.” However, reaching this goal is not without its challenges, given Switzerland is a small open economy that is highly dependent on foreign trade. As a result, external disruptions, such as exchange rate fluctuations, can significantly impact both inflation and economic growth. Compounding this challenge is the strength of the Swiss franc, which is influenced by several factors. These include Switzerland’s political stability, which bolsters the franc’s status as a safe-haven currency, and the low interest rate environment that emerged following the global financial crisis.

Against this backdrop, the SNB’s definition of price stability is more flexible than that of other central banks. Specifically, the SNB targets consumer price inflation of less than two percent per year, within an inflation band of zero to two percent.

It is noteworthy that the SNB is expected to enjoy independence, which spans across four aspects: financial, institutional, personnel, and functional independence. The first three aspects form the foundation upon which, ultimately, functional independence is ensured. According to the SNB, functional independence “refers to the fact that the SNB and its organizational bodies are prohibited from seeking or accepting instructions from either the Federal Council or the Federal Assembly or any other body in fulfilling its monetary tasks.” This independence has several implications. It forbids the SNB to grant loans to the Swiss Confederation. It also means that the SNB cannot purchase newly issued debt instruments – whether from the Confederation, cantons or municipalities.

The SNB’s main executive body is the Governing Board, which consists of three members and is responsible for monetary policy decisions. The SNB also has a Bank Council with 11 members, a Secretariat General, and internal auditors. Geographically, the SNB operates from two head offices, located in Berne and Zurich. It also maintains a branch office in Singapore and six representative offices in Basel, Geneva, Lausanne, Lugano, Lucerne, and St. Gallen.

The SNB has a unique legal structure as an “Aktiengesellschaft,” more precisely that of a “special statute joint-stock company,” and is listed on the Domestic Standard segment of the Swiss stock exchange (SIX). Approximately 55 percent of SNB voting shares are held by public shareholders, such as cantons or cantonal banks, while the remaining shares are held by private individuals. Notably, the Swiss Confederation does not hold any SNB shares.

Under the National Bank Act, shareholders may receive a dividend of up to six percent of the share capital, which is paid from the SNB’s net profit. Due to this limitation, SNB shares are often considered similar to long-term bonds.

The Bank of England (BOE)

Originally created to fund the government during a time of war, the BOE, established in 1694, has evolved into a key institution responsible for maintaining monetary and financial stability.

The BOE’s mandate includes setting monetary policy to achieve price stability, supporting economic growth, and ensuring the resilience of the financial system. The Bank operates independently, with its Monetary Policy Committee (MPC) tasked with setting interest rates to meet inflation targets. Its structure includes various committees and departments focused on monetary policy, financial stability, and market operations, all working to uphold the Bank's core objectives.

The Bank of Japan (BOJ)

The BOJ was established in 1882. According to the Bank of Japan Act, the BOJ’s monetary policy should be “aimed at achieving price stability, thereby contributing to the sound development of the national economy.” The bank’s price stability target is set at two percent. The BOJ is also responsible for maintaining financial stability and issuing the national currency, the yen.

While the National Bank Act states that the BOJ’s autonomy regarding currency and monetary control “shall be respected,” it also stipulates that the BOJ must “always maintain close contact with the government and exchange views sufficiently.”

Join us for an exclusive webinar where our experts will discuss how political influence could shape the future of central banks and what it means for investors like you.

18 November 2025 — 11 am CET | 10 am GMT | 6 pm HKT/SGT

Part 1: The evolution of monetary policy

Despite the focus on central bank independence today, they were established, at least in part, to serve political interests. Indeed, the world’s oldest central bank – the Swedish Riksbank (1668) – was created to lend funds to the government and serve as a clearinghouse for commerce. Other European nations soon followed, using central banks to implement government policies. For instance, the BOE was founded primarily to finance England’s war against France.

In the early 20th century, a new wave of central banks emerged, focusing on crisis prevention and financial stability. Among these “second-generation” central banks was the US Federal Reserve (Fed). Before its creation, the US experienced frequent market panics, bank runs, and failures. The Panic of 1907 was particularly severe, with the New York Stock Exchange losing nearly 50 percent of its value from the previous year’s peak. Lacking a central bank, wealthy individuals like J.P. Morgan and John D. Rockefeller intervened to stabilize the financial system. This provided the catalyst for President Woodrow Wilson to sign the Federal Reserve Act of 1913.

Turning points: how global crises shaped central bank independence

The Fed faced its first major test barely one year later. During World War I (1914-1918), it played a significant role in stabilizing the economy and supporting the war effort. So-called Liberty Bonds were sold to the public to raise funds for military expenses. The higher government spending and greater demand for goods put upward pressure on prices. The Fed attempted to manage this by influencing interest rates and credit conditions, although its tools were still limited at the time.

World War I marked a significant turning point in monetary policy, as many countries (e.g., the UK, Germany, and France) abandoned the gold standard to print more paper money to finance higher spending. The resulting inflation served as a stark reminder of the risks when governments instruct their own central banks to print money at will.

In the years following the war, the concept of central bank independence began to take root. This idea emphasized that central banks should have the autonomy to set interest rates and monetary policies without short-term political interference.

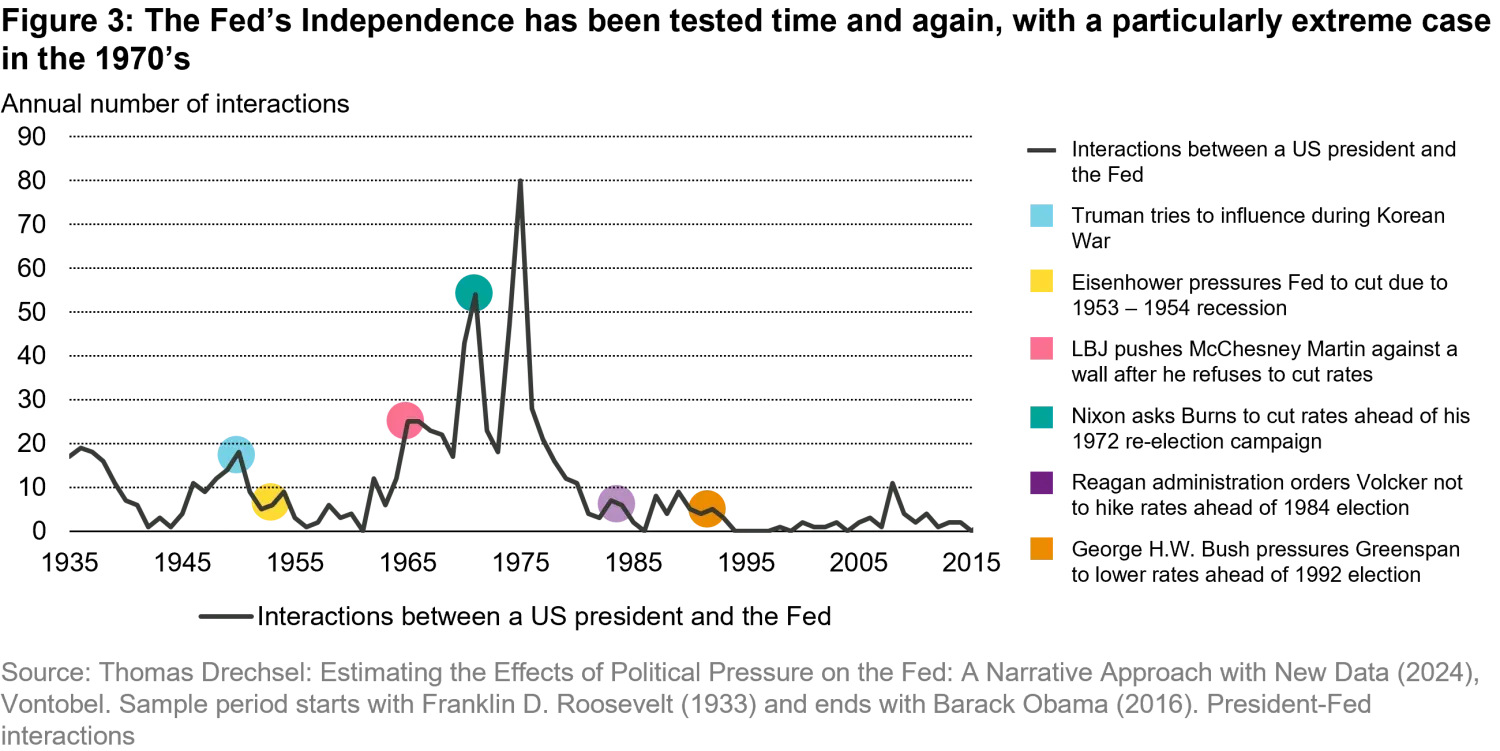

Despite growing awareness of the importance of central bank independence, the economic collapse of the 1930s and World War II saw governments exert greater control over central banks once again. This was done to address unemployment and deflation (during the Great Depression) or to finance government spending (during the war). After the establishment of the Bretton Woods system (1944), central banks played a pivotal role in maintaining fixed exchange rates. As they had to defend currency pegs, their independence remained limited. In the decades that followed, political pressure on central banks intensified, particularly in the US (Figure 3).

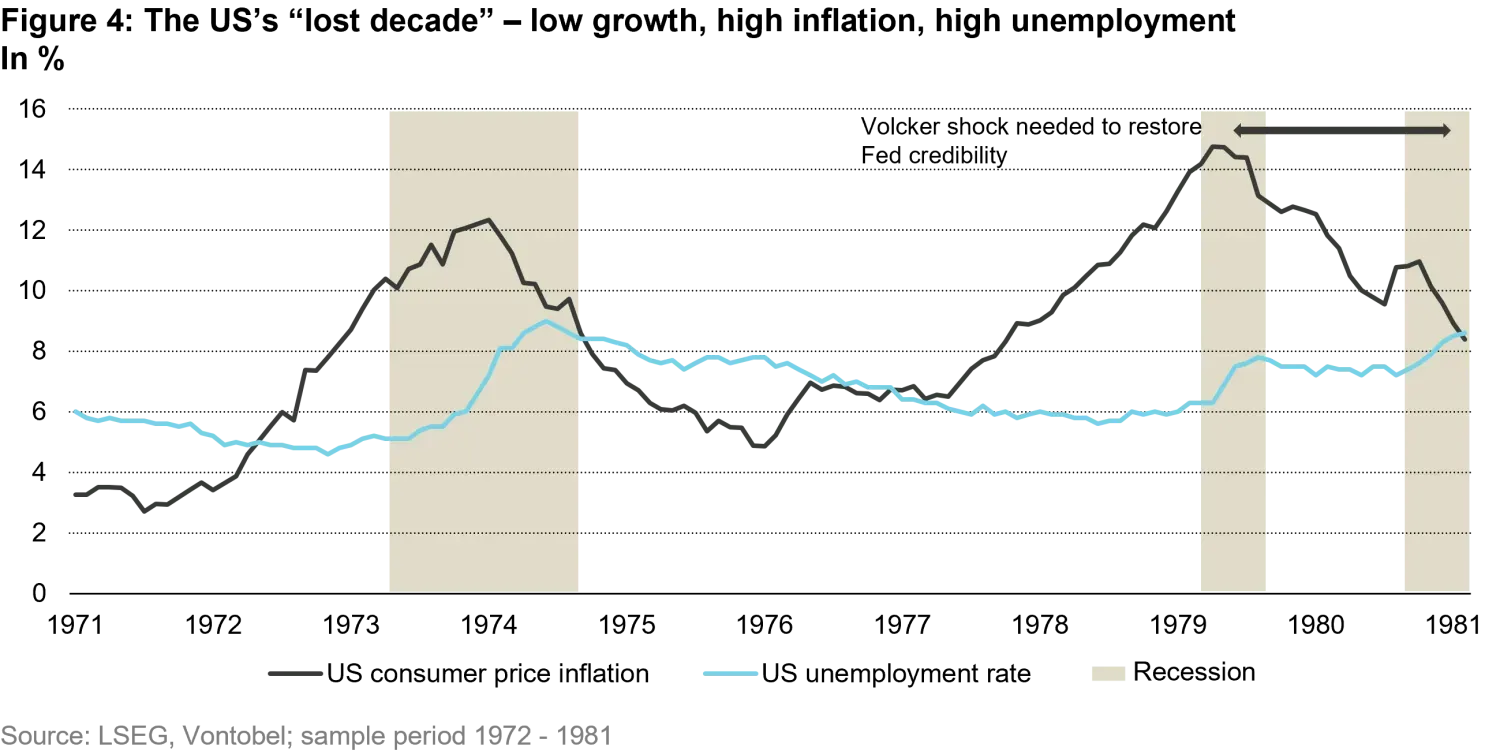

It wasn’t until the so-called Volcker Shock (1979–1982) that the US successfully restored the Fed’s credibility (Figure 4). Appointed as Chair in 1979, Paul Volcker aggressively raised the federal funds rate from approximately 10 percent to 20 percent, triggering double-dip recessions. In doing so, Volcker resisted political pressure from both Democrat President Carter (who appointed him) and Republican President Reagan (who wasn’t happy with the recession he “inherited”).

The era of central bank reform and inflation targeting

The 1990s to early 2000s are widely regarded as the “golden age” of central bank independence (Figure 5). Four factors contributed to this trend:

- Many countries enacted statutory reforms or treaty provisions that explicitly defined central bank independence, such as the Maastricht Treaty of 1992.

- Many central banks were assigned clear and focused mandates. The adoption of so-called inflation targeting as a key policy framework was arguably one of the most significant developments, as it enabled central banks to prioritize managing inflation, thereby reducing scope for political interference.

- Many central bank governors and board members were often granted longer, non-renewable terms to shield them from political influence.

- Central banks also began emphasizing greater transparency and accountability to build public trust.

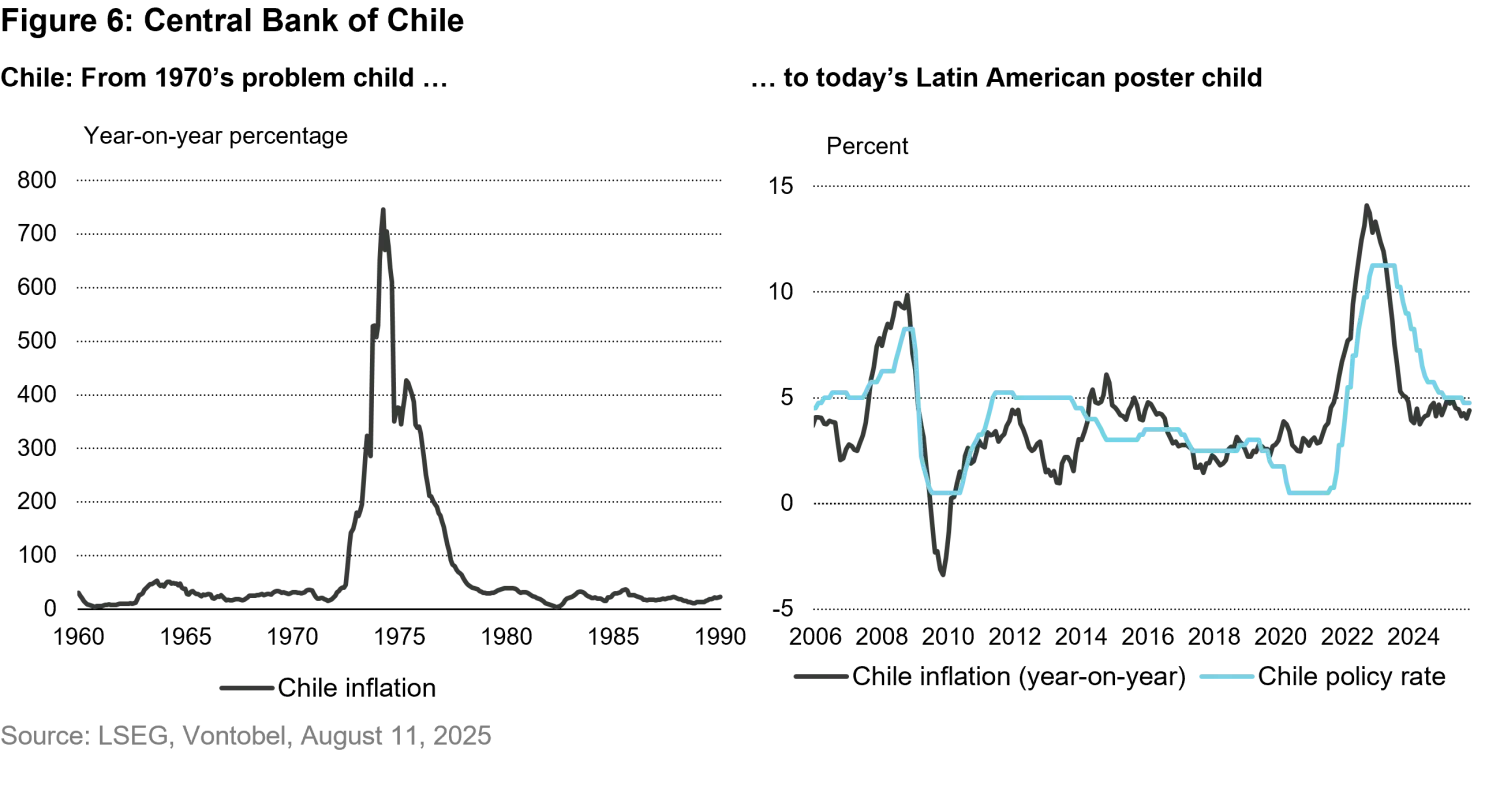

Progress and pitfalls: Lessons from Chile and Turkiye

These positive changes were not limited to developed markets. In fact, emerging-market economies like Chile serve as powerful reminders of how past crises can drive meaningful progress. In the early 1970s, Chile was plagued by weak economic growth, elevated fiscal deficits, and triple-digit inflation, while real interest rates were in negative (i.e., accommodative) territory. The military government’s push for rapid deregulation and liberalization, combined with an overvalued exchange rate, led to a deep economic and banking crisis in the early 1980s. The Central Bank of Chile was granted independence in 1989 and started to pursue an inflation-targeting regime in the early 1990s. Today, it is considered one of the most independent and stable central banks in the region.

Despite this progress, one cannot help but notice that the role of many central banks has shifted once again. The Global Financial Crisis (2007 – 2009), the Euro Area Crisis (2009 – 2010), and the Covid-19 Crisis (2020) forced many central banks to take on broader roles: they were not only expected to act as “lenders of last resort” to stabilize financial institutions (e.g., through bailouts) but also to deploy unconventional monetary tools (e.g., quantitative easing) to support the post-crisis recovery. These expanded roles arguably blurred the lines between monetary and fiscal policy, as governments grew increasingly reliant on central banks to finance deficits and stabilize markets.

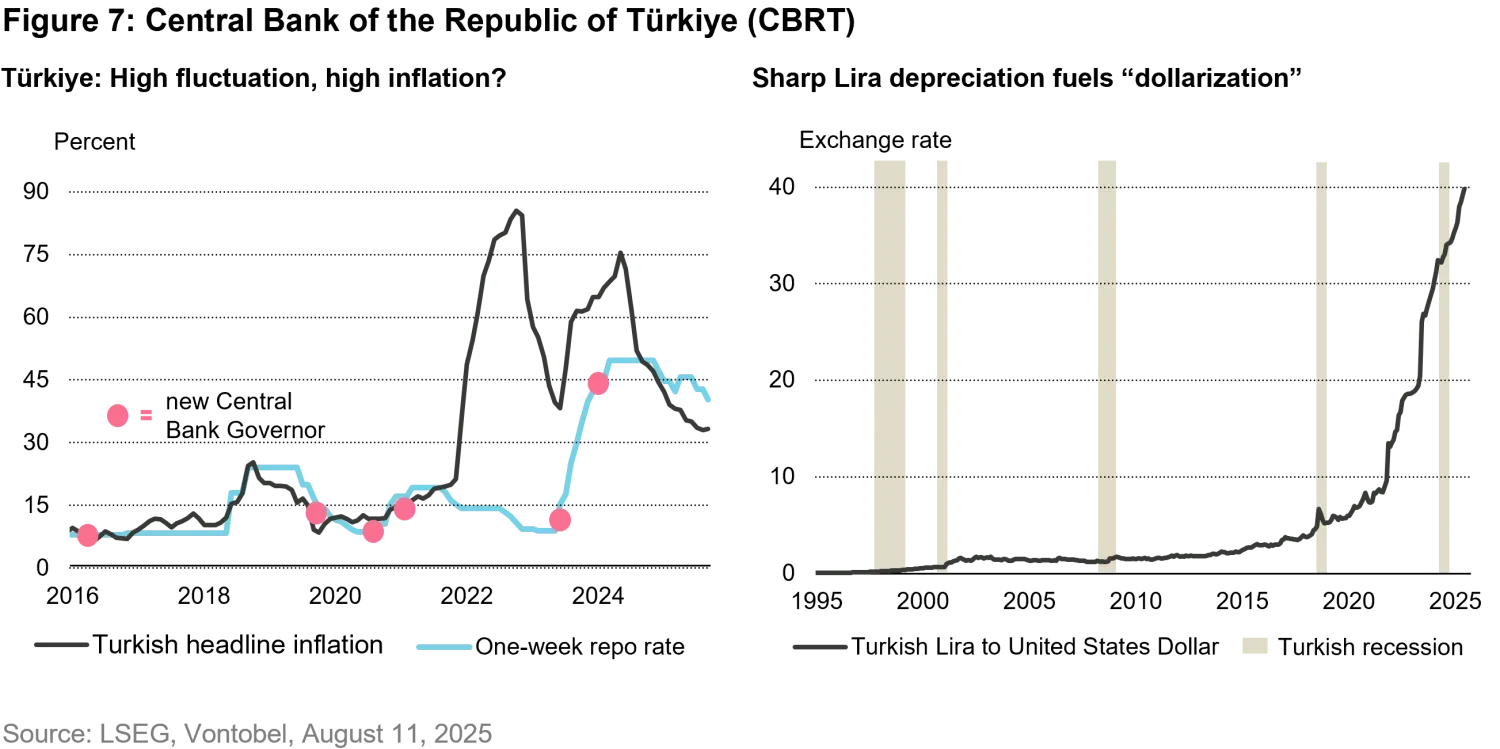

Turkiye offers one of the clearest examples of how political interference can undermine a central bank and destabilize an economy. While the Central Bank of the Republic of Turkiye (CBRT) is formally independent, its governor can be appointed or dismissed at the president’s discretion. President Recep Tayyip Erdoğan, known for his unorthodox belief that cutting interest rates reduces inflation, has dismissed five CBRT governors since 2019, including one just two days after a rate hike. This has led to double-digit inflation, capital flight, and widespread dollarization of the economy.

Tactics a US President could use to pressure the Fed

A US president has several avenues to exert pressure on the Fed and potentially undermine its independence. One primary tactic is to influence the Fed’s policy direction through personnel choices – by nominating sympathetic candidates for upcoming Board and Chair vacancies, the president can gradually shift the Federal Open Market Committee’s (FOMC) center of gravity. Another method is pre-emptive successor signaling, where the president publicly floats or backs a preferred future Chair before the incumbent’s term ends, thereby undermining the current Chair’s authority and influencing policy decisions. Direct public pressure is another tool, with the president using speeches, social media, or interviews to criticize Fed officials or their decisions, raising the political cost of resisting presidential preferences.

Legal or structural challenges present a more formal route, such as exploring revisions to the Federal Reserve Act or revisiting the 1951 Treasury–Fed Accord to narrow the Fed’s independence, even if such moves face significant political hurdles. Finally, the president could attempt to force turnover or threaten removal, pressuring the Chair or governors to resign, even if outright dismissal is legally contested, thereby creating a chilling effect on independent decision-making.

Beyond direct pressure on the Fed, US political actions can also indirectly affect other central banks, such as the SNB. For example, tariffs and trade policy spillovers can impact Switzerland’s economy and monetary policy, while the risk of being labeled a “currency manipulator” by the US can further constrain the SNB’s actions and expose it to additional scrutiny or sanctions.

But there are limits on Presidential influence

Despite these potential tactics, there are significant institutional checks and balances that limit how much influence a US president can exert over the Fed. For example, President Trump’s repeated threats to fire Fed Chair Jerome Powell, coupled with his history of dismissing other government officials, have heightened concerns about possible attempts to remove Powell. The most market-friendly outcome, in our view, would be for Trump to allow Powell to serve out his term, which expires in May, and then appoint someone more aligned with his preferences.

Several safeguards are in place to prevent Trump from appointing overly dovish or outright unorthodox candidates. Chief among them is the Senate confirmation process, which acts as a critical gatekeeper.

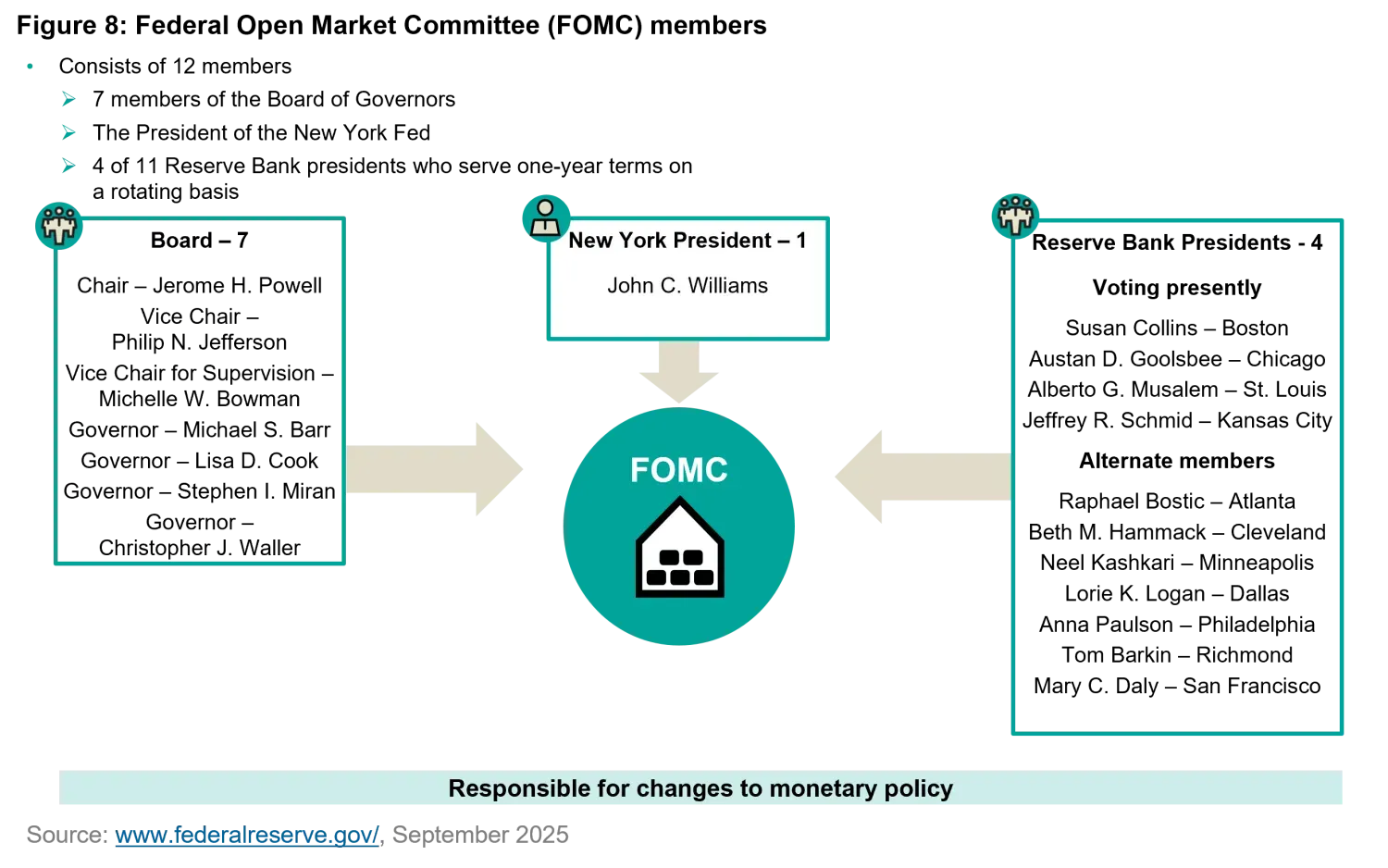

That said, Trump may still have to contend with Powell as a voting member of the FOMC. This is because Powell holds two distinct terms: one as chair (until 2026) and another as an FOMC governor (until 2028). The FOMC comprises 12 members: seven members of the Board of Governors and five of the 12 regional Reserve Bank presidents. Governors are appointed by the US President; however, a US President can directly appoint or re-appoint at most two governors during a typical four-year term.

Trump has little influence over the remaining Reserve Bank presidents as they are selected by the Board of Directors of each independent Reserve Bank. Only three Reserve Bank presidents have terms expiring during Trump’s term, and none before 2028. The rest serve terms extending into the 2030s, well beyond the end of Trump’s second term.

Additionally, successors to the Fed Chair are typically announced about 4.5 months before the current term ends, which for Powell would be early 2026 – a timing that could have implications for financial markets.

Part 2: Risks of compromising the Fed’s independence

When a central bank’s credibility weakens, markets stop interpreting policy through the lens of economic data and begin viewing it through the lens of politics. That shift first becomes evident in expectations. Survey-based measures may appear stable for some time, because households and professional forecasters tend to adjust their views slowly. However, market pricing reacts faster. Investors add an inflation risk premium to their central view, which is why breakeven inflation rates typically exceed survey-based expectations once credibility is questioned.

At the same time, uncertainty around the central bank’s reaction function raises the term premium on longer-dated maturities. Long yields start to reflect additional compensation for policy errors and inflation volatility, rather than just the expected path of short-term interest rates. If fiscal objectives, such as the desire to keep borrowing costs low relative to nominal growth, begin to influence monetary policy, decisions may tilt toward financing convenience. While this may ease near-term funding pressures for the public sector, it functions like an inflation tax on savers and lifts required returns across private assets.

Financial conditions tend to evolve in a predictable sequence. The yield curve steepens as the short end tracks easier policy guidance, while the long end resists. Credit spreads settle at higher levels as lenders price in greater uncertainty. The dollar often strengthens during periods of stress, as liquidity becomes scarce during a shock, but then weakens if real yields are suppressed and the policy framework appears less robust.

Looking ahead, we present three plausible scenarios, ranging from a mild erosion of Fed independence to outright political capture. Each scenario carries different probabilities and market outcomes:

Scenario 1: Back-off and reset, no further influence – Probability 10–20%

In this scenario, a market wobble prompts the Fed to implement a somewhat larger rate cut to restore stability. The administration steps back, refraining from pressuring the Fed. The shift marks a return to a clear, rules-based, data-anchored reaction function. Guidance becomes intentionally boring on purpose. Speeches focus on the target, the forecast, and the tools. Balance sheet and liquidity moves are described as technical decisions rather than political gestures. With external interference removed, monetary policy operates within the framework of the Fed’s dual mandate, and interest rate decisions are guided by incoming data rather than headlines. This reset rebuilds credibility and fosters a more predictable policy path. As a result, markets read less policy noise into every print, term-premium pressure eases, and the conversation shifts back to fundamentals instead of politics.

With the Fed’s inflation-fighting credibility re-established, long-term inflation expectations are likely to re-anchor near the 2% target. Earlier, the drumbeat of political interference had begun to destabilize these expectations – indeed, markets were starting to price in higher future inflation when Fed independence was in doubt. Now, the clear commitment to orthodox monetary policy sends a powerful signal that the central bank will not tolerate above-target inflation.

Breakeven inflation rates (market-derived inflation expectations) are likely to stabilize or edge lower, reflecting reduced fears of an unhinged inflation trajectory. The restoration of Fed independence provides a foundation for well-anchored expectations, which helps prevent a wage-price spiral mentality from taking hold. In practical terms, this means that five-year forward inflation breakevens would return to levels consistent with the Fed’s mandate. By contrast, under scenarios of political interference, these measures would creep higher on fears that the Fed might be “behind the curve.” The return to credible, rules-based policy thus keeps both survey-based and market-based inflation expectations in check. Any modest initial uptick in prices resulting from liquidity measures is likely to be viewed as transitory, as investors trust the Fed will swiftly counteract any persistent inflationary pressures.

The revival of Fed independence has immediate implications for the US yield curve. Investors will demand a smaller term premium on long-term bonds, as the risks of fiscal dominance or erratic policy have receded. Previously, when political pressure on the Fed was mounting, traders had anticipated a steeper yield curve – expecting long-dated yields to rise relative to front-end rates – due to concerns about higher inflation and eroding credibility. However, these fears subside in this scenario.

As policy credibility is restored, long-term Treasury yields ease back down relative to the “interference” case, even if short-term rates were cut during the crisis. This would likely result in a flatter yield curve compared to an environment of Fed capture. Short-maturity yields would remain anchored by a data-dependent policy outlook, with the Fed not over-easing beyond what the economy warrants. Meanwhile, longer-maturity yields fall into a lower equilibrium range as the inflation risk premium shrinks. Essentially, the bond market removes the additional yield it had priced in due to concerns about an unanchored Fed. Indeed, the Fed’s operational autonomy bolsters confidence among Treasury buyers and dampens volatility at the long end of the curve.

Credit markets would likely breathe a sigh of relief under a regime of renewed Fed independence. During the independence scare, credit spreads had widened as investors feared higher inflation and a destabilized economy, which would impair borrowers’ ability to service debt. Now, with a credible Fed backstopping price stability, those worst-case fears recede. An independent Fed is also less likely to allow inflation to erode the real value of debt repayments, which reassures creditors. Moreover, by decisively stepping in to stabilize markets, through rate cuts and other liquidity measures, the Fed has reduced near-term default risks and signaled it will act as lender of last resort during periods of stress – all without compromising its longer-term anti-inflation stance. This approach supports creditworthiness.

The USD is likely to strengthen as Fed independence is restored. In the politicized-Fed scenarios, the dollar had been trending weaker, undermined by fears of deficit monetization and declining real yields. A credible, apolitical Fed is a cornerstone of the dollar’s reserve currency status. By re-establishing this credibility, the US avoids the capital flight that could have severely weakened the dollar in an “overt capture” scenario. Instead, global buyers continue to view US assets as safe and reasonably yielding, which renews demand for the greenback.

As a result, the USD would trade more on fundamental drivers, such as growth differentials and interest rate expectations, rather than at a discount for political risk. With the Fed not capitulating to political demands for ultra-easy policy, US interest rates remain higher than they would be under a more pliant Fed, all else being equal. This interest rate differential further supports the dollar. Moreover, greater confidence in US monetary governance encourages foreign central banks and global investors to maintain dollar exposure, slowing any de-dollarization trends that might have accelerated if the Fed’s independence were in doubt.

Scenario 2: Soft erosion (no legal change) – Probability 45–65%

In this scenario, there is no formal change to the Fed’s mandate or statutes, but subtler political influences create a dovish lean. While the Fed still operates independently on paper, officials occasionally err on the side of easier policy decisions than a purely data-driven approach would suggest. Forward guidance becomes less strictly data-anchored. For instance, the Fed might emphasize goals like “balanced growth” or downplay slightly above-target inflation to justify modest rate cuts. Markets would perceive that while the Fed isn’t overtly controlled by politicians, it is more tolerant of inflation drifting above 2%.

The yield curve tends to steepen in this environment. Short-term maturities reflect the easier policy tone, while longer maturities resist, as investors ask for insurance against a softer anchor. Credit markets reprice to higher, but still manageable spread levels. Primary markets remain accessible for strong issuers, while companies with weaker balance sheets can still secure funding, albeit at a higher cost. Since this scenario still assumes relatively stable economic growth, corporate fundamentals remain solid. The outcome is a moderate repricing in credit markets, rather than a crisis. Default risks might tick up slightly, but “fallen angel” risk (where investment-grade companies are downgraded to junk) would remain low in this mild case.

The US dollar in this scenario would likely trade range-bound after an initial period of volatility. The removal of some tail risks (e.g., no drastic political takeover of the Fed, just a mild bias) reduces the likelihood of a sharp surge or collapse in the dollar. With US real rates slightly lower and inflation marginally higher, the overall pressure on the dollar would be downward, but not dramatically so. Trading partners like the euro area are also dealing with their own constraints, so relative credibility would still favor only a gradual USD drift.

Scenario 3: Episodic Interference (visible politics) – Probability 15–25%

In this scenario, political intervention in monetary policy becomes intermittently obvious. There is no formal change to the Federal Reserve Act, but markets and the public witness episodes of direct political pressure affecting Fed decisions. For instance, the administration might lean on the Fed to cut rates ahead of an election or publicly criticize Fed officials, and the Fed, in turn, might occasionally capitulate or alter its course in response. The key feature of this scenario is intermittent political influence – not constant, but frequent enough to erode credibility. The Fed’s reaction function becomes harder to predict, with policy sometimes easing even when inflation or financial conditions wouldn’t warrant it, then possibly having to tighten later when inflation rises.

Rate cuts occur earlier than the data alone would justify, forward guidance appears reactive, and the subsequent pause in policy that follows becomes uncomfortable as inflation proves sticky. The risk of the central bank having to reverse course later is not just theoretical – it becomes part of market narratives. Expectations become less anchored, prompting investors to build a larger buffer for inflation risk and policy errors into every asset they price.

As a result, the yield curve bear steepens more noticeably. Funding becomes trickier, particularly for lower quality corporate borrowers, and the probability of downgrades rises as interest costs climb and earnings face pressure from slower demand. In banks, risk appetite tightens, and lending standards rise, which pushes more refinancing risk into the bond and private credit markets. Companies at the lower end of the ratings spectrum would have much more difficulty refinancing debt; indeed, “fallen angel” risk rises in this scenario, meaning some BBB-rated firms might become downgraded to junk status if their interest costs rise and earnings are squeezed.

The US dollar in this intermediate scenario would experience brief “flight-to-safety” rallies during moments of acute stress. However, as the pattern of political interference becomes apparent and real rates in the US fall behind those of other major economies, the dollar would likely weaken over time. Notably, one outcome of episodic Fed easing is that once the dust settles, the dollar often loses support as interest rate differentials move against it and confidence deteriorates.

Scenario 4: Overt capture or legal statute change – Probability 2–5%

This is the most extreme scenario: the central bank’s independence is effectively overturned or severely compromised by political forces. This situation would arise through an overt legal change (e.g., legislation that amends the Federal Reserve’s mandate to include credit or grant the executive branch greater control over appointments and policy decisions) or through outright “capture” (e.g., the administration replaces key Fed officials with loyalists and openly directs policy). In this scenario, the Fed is no longer viewed as an independent inflation-fighter; rather, it is perceived as an arm of the Treasury or administration, focused on keeping borrowing costs low to achieve political or fiscal objectives. While this scenario is less likely, it carries the most significant market implications, essentially introducing a regime shift in how the US economy is managed.

Under overt capture, the Fed would maintain real interest rates at very low or even negative levels, despite persistent inflation. The central bank might formally or informally target specific yields on government debt to ensure cheap financing (a practice akin to post-WWII yield curve control). For instance, we believe the Fed could cap the 10-year Treasury yield at a predetermined level (e.g., 4% or 4.5%) by committing to purchase unlimited bonds above that yield – a scenario of explicit yield targeting. Alternatively, even without explicit caps, the Fed’s reaction function becomes one where any rise in yields or unemployment triggers swift rate cuts or renewed quantitative easing, regardless of whether inflation is above its target. The political mandate in such a scenario might emphasize growth and employment “at all costs,” or focus on keeping government interest expense low. In effect, monetary policy would become subjugated to fiscal needs, aligning with the textbook definition of fiscal dominance. We could even see extreme measures like direct financing of government spending (larger-scale QE or “helicopter money”) emerge, depending on legal constraints. Importantly, if yields are capped, the pressure would be redirected elsewhere – either into higher inflation, a weaker dollar, or asset price bubbles, since the money would inevitably flow into other areas.

The bond market’s reaction would depend heavily on whether the Fed implements yield caps. If no yield curve caps are in place (i.e., the Fed is captured but refrains from intervening directly in long-term maturities), then we could see an aggressive bond market revolt: 10-year Treasury yields could surge as investors demand a substantial premium to compensate for inflation and currency risks. Historical precedent, such as in the late 1970s, shows that 10-year yields eventually rose to double-digits when the Fed’s credibility was shattered.

If the Fed caps long-term yields (e.g., by reviving a version of QE Infinity), then nominal yields might be forcibly suppressed. However, that pressure would not be eliminated; instead, it would likely manifest in a plunging dollar and surging breakeven inflation rates. In this sub-scenario, the bond market might appear calm (yields suppressed), but the pressure would show up in wider breakevens, a weaker currency, and risk premia elsewhere.

In our opinion, either case poses significant risks to financial stability: without yield caps, a bond market rout is likely; with yield caps, a currency crisis becomes a possibility. It’s worth noting that in a yield-cap regime, the Fed essentially commits to unlimited balance sheet expansion. This raises the risk of monetary inflation (money supply surge) and further undermines investor confidence. Investors may recall that monetary financing and the loss of central bank credibility have historically led to runaway inflation or even hyperinflation in extreme cases. Even with yield controls in place, investors might seek protection through other assets.

A regime of overt capture would also create significant challenges for credit markets. Investment-grade and high-yield spreads could widen to levels consistent with severe recessions or fundamental stress, effectively shutting out many marginal borrowers from the market. For example, if Treasury yields were at 5%, a 1,000 basis point spread would translate to a 15% yield for a junk-rated issuer – an untenable level for most companies. Refinancing risk would increase sharply, as companies with debt coming due in this environment would face either prohibitively high interest rates or an inability to refinance, which would likely lead to a spike in defaults.

Investors would not only price in cyclical default risk, but also the risk that high inflation could erode real debt repayments. While this could benefit borrowers at the expense of lenders, it would also mean that any new debt issued could later be inflated away. Essentially, creditors would demand heavy inflation and default premiums, leaving less creditworthy firms at risk of insolvency. The term “fallen angels” could take on new significance, as numerous BBB-rated issuers might be downgraded as their metrics deteriorate under higher interest costs.

Furthermore, the banking sector might tighten lending standards dramatically or be compelled to hold government debt as part of financial repression, effectively crowding out private credit. In this scenario, financial conditions for businesses would remain very tough despite low policy rates, because market rates (absent yield control) would remain high and risk aversion would be elevated. But if yield caps were implemented to keep nominal yields low, banks and investors might ration credit by quantity rather than price, still resulting in a credit crunch. In either case, credit availability would be constrained.

Initially, the US dollar might strengthen in a panic, especially if yield caps are not immediately implemented – global investors might scramble for dollars as a reflex, or if a crisis is brewing (there is often a “dash for cash” in early crisis stages). However, as it becomes clear that US policy is fundamentally accommodative and willing to tolerate higher inflation, the dollar’s status as a reserve currency could tarnish. Foreign holders of US debt might start reducing exposure, concerned about being paid back in ever-depreciating dollars. One would expect the dollar to become structurally weaker.

In fact, if Europe and other advanced economies maintain more orthodox policies, the dollar could experience a significant slide. This shift would represent a major realignment in foreign exchange (FX) markets. Some countries might even start discussing alternatives to heavy dollar reliance (diversifying reserves), which could further pressure the dollar. Gold and other alternative stores of value would likely surge. Gold, in particular, could gain substantially as both individuals and central banks seek refuge from currency debasement.

US trade and fiscal policy, and President Donald Trump’s attacks on the Fed as well as weaponizing the USD can be seen as the main driving forces behind the strong gold price rally since the beginning of 2025. Central banks, particularly those in emerging markets, became worried that their own FX reserves could be confiscated, prompting a shift toward gold. Concerns about Fed independence could become a more prominent factor driving gold purchases going forward.

Figure 9: Scenario Overview and Impact

| Scenario 1: Back-off and reset, no further influence 10% - 20% probability | Scenario 2: Soft Erosion (No Legal Change) 45% - 65% probability | Scenario 3: Episodic Interference (Visible Politics) 15% - 25% probability | Scenario 4: Overt Capture or Legal Statute Change 2% - 5% probability | |

| Description | Fed regains autonomy; predictable and orthodox policy path | Subtle political influence leads to dovish lean; Forward guidance less data-anchored | Fed occasionally capitulates; Policy becomes less predictable | Fed acts as arm of Treasury; Yield caps or direct financing possible |

| Fed Independence | Independence intact in practice | Intact on paper, but less strict in practice | Eroded, with frequent visible interference | Severely compromised or lost |

| Policy Stance | Clear, rules-based, data-anchored reaction function; Fed remains committed to inflation target | Easier policy, modest rate cuts, inflation tolerance | Rate cuts ahead of data, reactive guidance, policy reversals | Ultra-easy policy, yield curve control, fiscal dominance |

| Yield Curve | Flattens | Steepens moderately | Bear steepens noticeably | Depends on caps |

| Credit Markets | Spreads narrow, Fed actions support creditworthiness | Spreads rise moderately; funding accessible for strong issuers, higher cost for weaker ones | Spreads widen further; refinancing risk rises for lower-rated borrowers | Spreads surge to recessionary levels; marginal borrowers shut out |

| Default Risk | Mitigated, Fed signals its role as lender of last resort | Slightly higher, but fallen angel risk remains low | Fallen angel risk rises | Defaults spike; severe fallen angel risk |

| USD | Strengthens; avoids capital flight and attracts inflows | Range-bound after initial volatility; gradual drift down | Brief flight-to-safety rallies, then weakens as real rates lag | Plunges if yield caps; surges in breakevens; possible currency crisis |

| Investor Confidence | Improves, increasing demand for US assets | Moderately erodes, but still stable | Erodes; expectations less anchored | Collapses; flight to other assets |

Source: Vontobel. October 2025

Impact of central bank independence on commodity prices

Concerns over central bank independence can influence commodity prices, but the extent and direction of the impact depend on both the time horizon and the specific market dynamics of each commodity. In the short term, accommodative monetary policy is generally supportive of economic growth, creating a favorable environment for this cyclical asset class. Additionally, commodities may benefit from a weaker US dollar. Since most commodities are priced in US dollars, a weaker greenback can boost demand from buyers using non-USD-denominated currencies.

Over the longer term, however, concerns about economic growth are likely to weigh on commodities, particularly those that are cyclically sensitive, such as crude oil and copper. Key producers’ output policies, such as OPEC’s oil production strategies, also play a significant role in shaping prices. In contrast, agricultural commodities may experience less direct impact from central bank policies, as their prices are more heavily influenced by weather patterns and supply chain dynamics. That said, broader inflationary pressures could still affect agricultural commodities, as higher input costs (e.g., fuel and fertilizers) and currency fluctuations influence production and pricing.

Gold stands out as the commodity most likely to benefit from the interplay of weaker policy credibility, eroding trust in “paper money,” rising inflation and inflation expectations, and heightened safe-haven demand. These factors position gold as a key asset in times of economic uncertainty.

How to read the landscape and prepare

The telltale signs are straightforward. Watch the gap between market-based measures of inflation compensation and surveys. A persistent wedge suggests the market is buying insurance against policy drift. Watch estimates of the term premium. A sustained break above recent norms signals a regime where policy variance is priced as a first-order risk. Watch auction metrics and the composition of demand for government paper. If bid quality deteriorates, the market is asking for greater compensation or a different clearing channel. Watch rate volatility relative to equity volatility. When rates volatility decouples to the upside, it often reflects uncertainty about the inflation anchor. Watch funding markets and cross-currency bases. Stress in these areas tends to precede broader tightening of financial conditions. Finally, read the language. When communication tilts away from data-driven decisions and toward political calendars, markets notice.

For policymakers, the safer path is simple to describe but harder to execute: keep the framework legible, keep the mandate intact, and keep the door open to whichever mix of tools re-anchors expectations at the least macroeconomic cost.

For risk takers, the response is a menu, not a script. In a soft erosion world, curve steepening risk, modest inflation protection, and a quality bias in credit and equities do the heavy lifting. In an episodic world, optionality matters because the path zigs and zags. In an overt capture world, the center of gravity shifts toward real assets, shorter duration cash flows, stronger balance sheets, and explicit inflation hedges. Across all paths, liquidity is a position, not an afterthought. The common thread is respect for the anchor. When the anchor looks loose, everything else needs a wider margin of safety.

Global liquidity at risk

USD swap lines

In times of stress in the financial markets, US dollars supplied by the Federal Reserve Bank of NY to other central banks via USD swap lines have become an important policy tool to avoid liquidity shortages outside the US.

In particular, since the Great Financial Crisis in 2007/08 swap lines have been established, renewed, and operationally implemented on a regular basis.

The funding costs for the respective central banks using USD swap lines were usually capped at 50 basis points above the Fed Funds Rate; this helped limit funding costs for foreign financial institutions in need of USD liquidity, in particular if money markets stopped functioning smoothly. Disorderly volatility in FX and interest rate swap markets could be reduced and thus market risks were mitigated.

If the Fed were to base decisions on dollar swap lines on political considerations, it could deny access to countries not aligned with the US administration. This powerful tool could disrupt financial markets in developed nations, but dollar swaps are even more critical for emerging market economies, as they serve as a backstop for central banks when their banking systems face USD shortages.

Discount Window and Standing Repo Facilities

The Fed´s Discount Window and Standing Repo Facilities primarily provide liquidity to US banks. However, non-US banks with affiliations or branches in the US, such as Swiss, German, or Japanese banks, can also access the discount window. During periods of market stress, some foreign banks relied on these liquidity facilities to some extent for liquidity. If the Fed were to restrict access to USD liquidity to US institutions only or change the set of eligible collateral, foreign banks would have to consider more costly alternatives to secure a backstop for USD funding.

Fed retrenchment: threats to global financial stability and erosion of USD dominance

In a world dominated by the USD and strong financial interconnectedness, a retreat by the Fed from international cooperation on monetary policy and regulatory issues could prompt other countries to insulate themselves from US coercion risks. This shift would lead to more fragmented financial markets, higher costs of capital, reduced market efficiency, and increased volatility and financial risks. The safe-haven status of US Treasuries may be impaired and the USD’s dominance as both a transaction and reserve currency may diminish as other currencies seek to fill the gap. To serve as a leading world reserve currency, four criteria must be met: backing by a big economy, deep and liquid capital markets as well as a strong credit rating, strong military power to defend its interests, and democratic structures with rule of law. The current surge in gold demand may signal that the search for alternatives has already begun.