AI: an infrastructure megatrend

Quantitative Investments

“The next Industrial Revolution has begun,” says Jensen Huang, founder, president, and CEO of NVIDIA Corp. Companies and countries are transforming the $1 trillion installed base of traditional data centers into AI factories, creating a compelling investment opportunity for infrastructure investors. Many technology companies worldwide have a dual mandate in achieving this transformation: harness enough electricity to reliably power their data centers while doing so with clean energy.

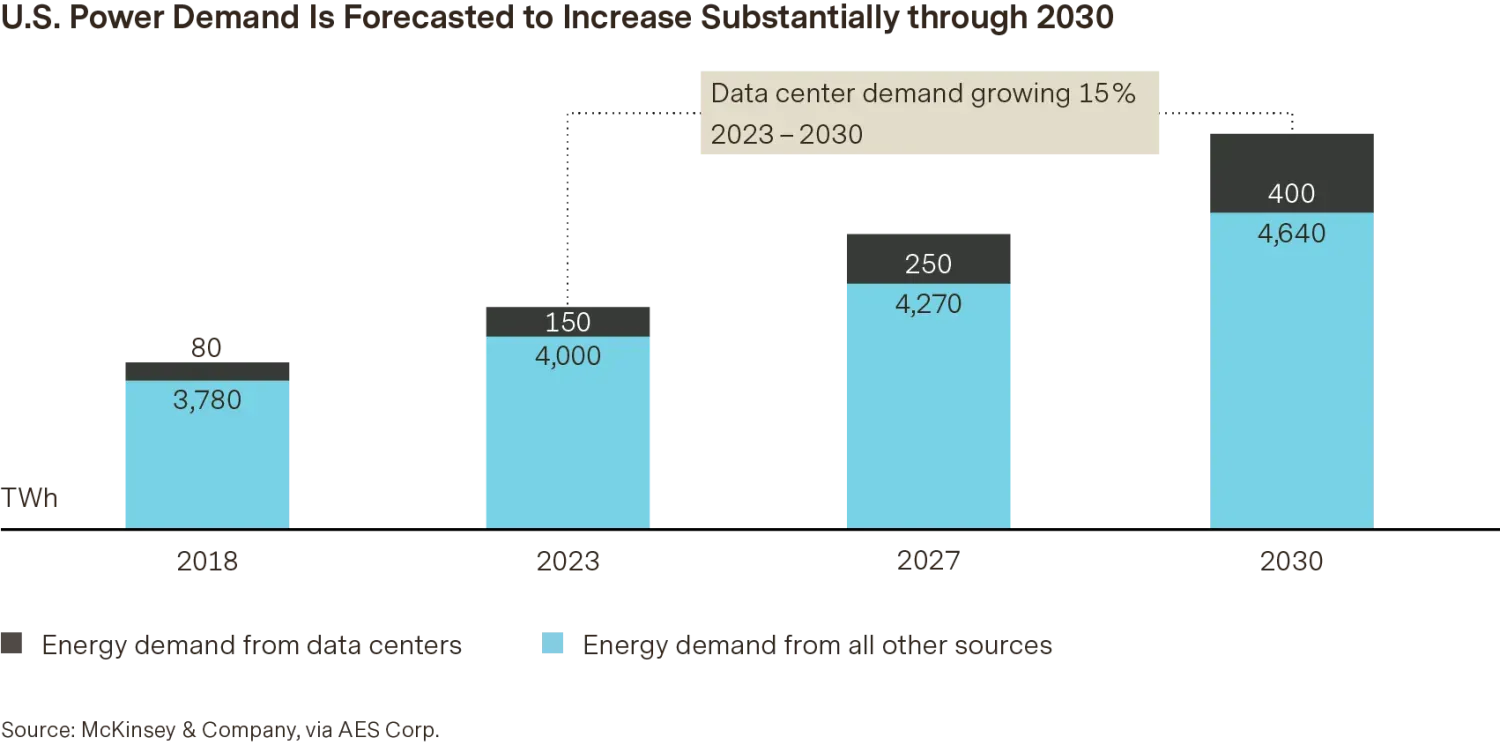

The first part of the mandate is demand for power. Electricity consumption from data centers, AI and the cryptocurrency sector could double by 2026.1 Data centers are among the most energy-intensive buildings. RBN Energy, a consulting firm, estimates that data centers consume anywhere from 10 to 50 times more energy per foot of floor space than a typical commercial building. U.S. data center demand for electricity is expected to grow ~15% annually through 2030.2 It is expected that power-hungry data centers’ share of U.S. total electricity consumption will grow from 2.5% today to 6%-7.5% through 2030.3

The second part of the mandate is sourcing power and technology companies want to power their data centers with clean energy. Google is targeting the use of 24/7 carbon-free energy by 2030 to operate their offices and data centers. Microsoft’s long-term vision for all of the world’s electric grids is that 100% of the electrons they consume, 100% of the time, will be generated from carbon-free resources. Amazon is on a path to powering their operations with 100% renewable energy by 2025. Meta’s operations have already reached net zero emissions and are supported by 100% renewable energy. Meta is now reaching toward the goals of net zero emissions across their value chain and becoming water-positive throughout their operations, aiming to achieve both milestones in 2030.

Satisfying the dual mandate of increasing power output and clean generation will require a significant investment. Technology company capex forecasts show that spending plans are still accelerating. Alphabet has suggested that this year's annual commitment to renewable energy investment could be close to $50 billion. So has Microsoft. In both cases, this would represent an increase of approximately 50% compared to 2023. Amazon estimates that their $14 billion in capex for the first quarter could be at the low end for the year. Combined, four of the world’s largest data center companies are expected to invest close to $200 billion in 2024.4 For perspective, the entire U.S. utility industry deployed ~$150 billion in capex in 2023.5

We see evidence of this significant demand outlook in real time. For example, Microsoft announced plans to invest €6.69 billion to develop new data centers in Spain's northeastern region of Aragon, which is becoming a major cloud computing hub within Europe. The company also announced a €2.1 billion data center investment in Madrid. In May 2024, Amazon announced it would invest €15.7 billion over the next 10 years to build data centers in Aragon. Amazon said it would power its data centers fully with renewable energy. Additionally, our channel checks with engineering and construction (E&C) companies offer some early-cycle insight that demand for renewables to power not only data centers but also other clean energy use-cases is real and growing. Research indicates that backlogs for E&C companies have recently doubled compared to prior years. From a growth rate perspective, some E&Cs are seeing ~20% growth this year, with expectations for 10%-20% annual growth in the future. Other E&C observations are more anecdotal, including our recent conversation with a private E&C company, which indicated that demand is as strong as ever and renewable developers have ample access to capital despite the higher interest rate environment.

Easy access to renewable or other carbon-free power is a top criteria for data center site selection. Of course, cost matters as well. Fortunately, the cost curve for renewable technology continues to improve. In many parts of the U.S., unsubsidized wind and solar generation is cheaper than natural gas generation. The Inflation Reduction Act (IRA) tax credits serve as an extra tailwind.

Along with more clean energy investment, the new demand from AI/data centers creates a need for more regulated utility investments in electricity generation such as clean power as well as grid investments to connect data centers to the grid. This is an especially exciting opportunity for utilities since for the last 20 years or so, utility demand growth has been essentially flat due to economic growth being offset by energy efficiency gains. Now, economic development, with data centers as a major contributor, is driving a significant acceleration in utility demand with the potential to put a heavy strain on generation capacity and the electric grid.

Texas is seeing an influx of electricity demand. The Electric Reliability Council of Texas, or ERCOT, the grid operator in Texas, recently published a report stating that this large increase in new demand could cause ERCOT to approach negative reserve margins (reserve margin is the amount of unused available capacity of an electric power system as a percentage of total capacity). Typically, 15%-20% reserve margins are considered adequate, and inadequate reserves can increase the risk of utility outages during extreme weather events.

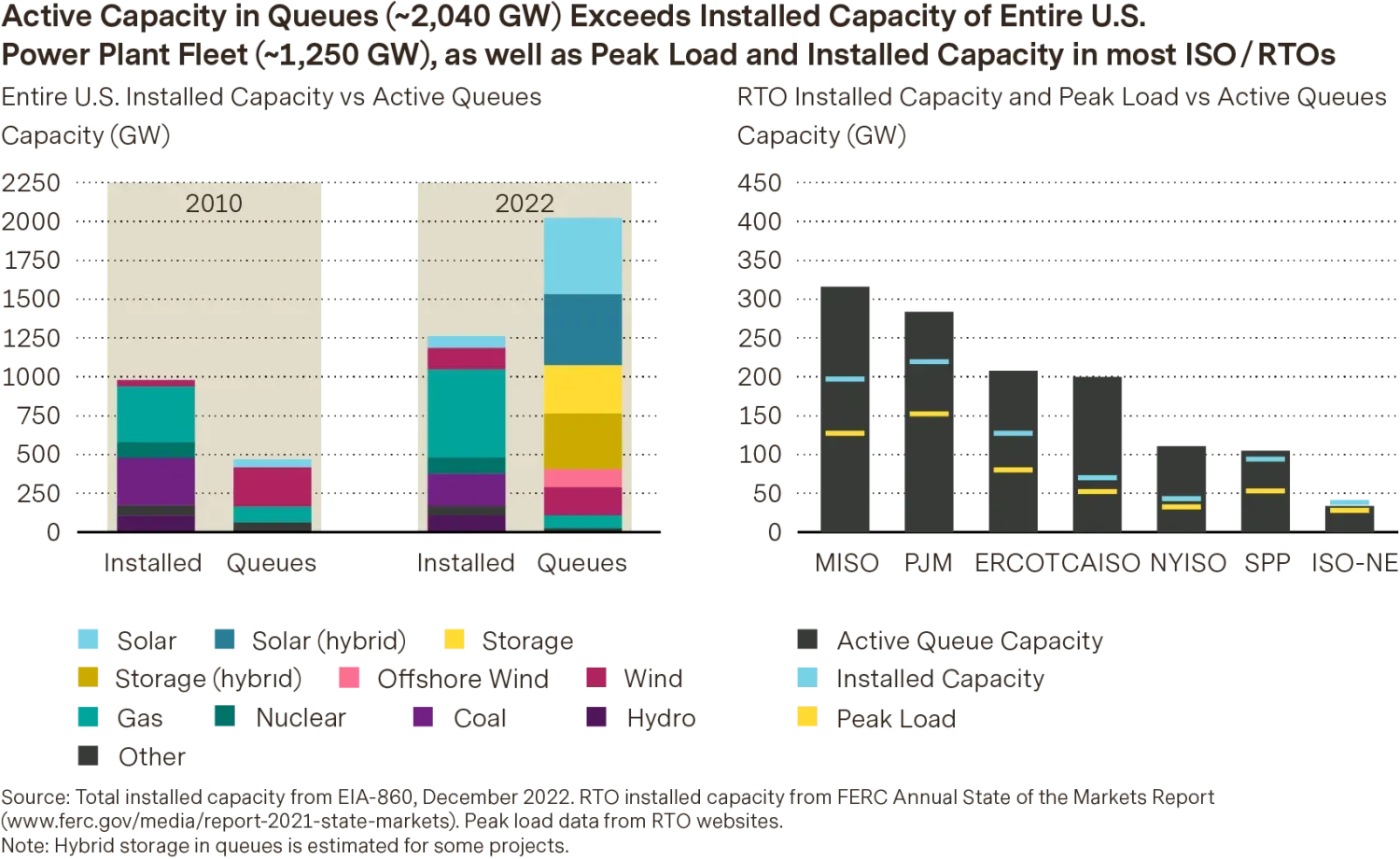

Data center growth has been a long-term trend in certain geographies such as Texas and Northern Virginia, which is the largest data center market in the world. Data center demand has been so high in Virginia that there has been transmission interconnection issues, leading to a long queue of projects waiting to be hooked up to the grid. The chart below shows the capacity in queue for various regions throughout the country and includes PJM, the grid operator whose territory includes Northern Virginia.

While the transmission interconnection issues are a short-term constraint to data center growth, this is a meaningful long-term opportunity for utility investment to connect these data centers to the electric grid. Projected transmission and distribution investment accounts for more than $5 trillion and is the largest proportion of expected energy sector investment to 2050, as shown in the chart below.

Once ultimately connected to the grid, a data center’s need for continuous power is critical. A “five-9s” level of availability (i.e., the data center should be available 99.999% of the time for its customers) sets a rigorous bar when it comes to accessing power. This requirement equates to no more than 5.3 minutes of downtime per year. As efficient and reliable as renewable generation and battery storage have become, their intermittent nature requires a bridge solution when the sun isn’t shining or the wind isn’t blowing. Accordingly, we see a long-term need for generation sources like natural gas and nuclear. The Williams Companies Inc. (WMB) recently said, “These [Mid-Atlantic and Southeast U.S.] markets are experiencing increasing gas demand from power generation and the reshoring of industrial loads […] the large utilities that we serve in this area have come back and provided dramatic increases to their generation needs based on data centers to be built in the region as well as the reshoring of industrial markets.”

To manage the challenges of accessing clean, reliable power with a connection to the grid, we are seeing data centers being built in more and more states outside the common locations like Northern Virginia. In addition, more states are looking to attract data centers and they are using financial incentives to do so. Wisconsin recently passed a law exempting data centers from the state’s sales and use tax. The Michigan legislature is expected to pass a similar law in the next couple of months.

One recent example of a data center being built in an atypical location is Microsoft’s announced plans to build a $3.3 billion AI data center in WEC Energy Group's (WEC) footprint in Southeastern Wisconsin. On the latest earnings call, WEC Chairman Gale Klappa noted, “speaking of growth, Microsoft is moving full speed ahead on the construction of a massive data center complex in the I-94 corridor south of Milwaukee […] and looking broadly across the landscape, I can tell you that the number of prospects looking at expanding or locating in the Milwaukee 7 region is stronger, literally, than at any time in the past two decades.” Due to this new growth, WEC late last year increased its electricity sales growth forecast from 0.7%-1% to 4.5-5% from 2026-2028. To service this growing demand, WEC is planning to invest $2 billion in building 1400 MW of new generation. For reference, WEC's current generation capacity is around 8000 MW, so this is a significant increase.

The “next Industrial Revolution” offers a significant change in electricity demand relative to the last couple of decades. This adds to an already strong underlying electrification theme supported by country and company net zero policies. Technology companies need lots of power to grow their AI platforms and they want that power to be clean. This secular theme presents an exciting opportunity for companies along the power value chain, from clean energy technology and equipment providers to those companies transforming our transmission and distribution infrastructure to support this growth.

1. International Energy Agency.

2. AES Corp.

3. AES Corp.

4. Financial Times.

5. 5UBS.

This marketing document was produced by one or more companies of the Vontobel Group (collectively "Vontobel") for institutional clients. This document is for information purposes only and nothing contained in this document should constitute a solicitation, or offer, or recommendation, to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. This document is not the result of a financial analysis and therefore the “Directives on the Independence of Financial Research” of the Swiss Bankers Association are not applicable. Vontobel and/or its board of directors, executive management and employees may have or have had interests or positions in, or traded or acted as market maker in relevant securities. Furthermore, such entities or persons may have executed transactions for clients in these instruments or may provide or have provided corporate finance or other services to relevant companies. Although Vontobel believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this document. Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, uploaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any process without the specific written consent of Vontobel. To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law. Persons who receive this document should make themselves aware of and adhere to any such restrictions. In particular, this document must not be distributed or handed over to US persons and must not be distributed in the USA.