TwentyFour

Diverging dynamics in savings ratios

As governments around the world provided support in various manners during the pandemic, savings ratios increased to levels that were twice as large as the previous all time highs in some countries. Felipe Villarroel takes a look at some countries' spending vs savings monthly data patterns and lays out what he thinks this means for fixed income investors.

TwentyFour

Banks have done their part – now will markets catch up

Bank bonds have been amongst the best performing asset classes in fixed income over the last few months, doing their bit in proving their strength.

Fixed Income Boutique

Are emerging market bonds on the mend? Video updates by our experts

Luc D’hooge and Wouter Van Overfelt review the developments of the Vontobel Fund – Emerging Markets Debt and Vontobel Fund – Emerging Markets Corporate Bond and share their forecast for the remainder of 2023.

TwentyFour

PMIs below expectations in Europe and the UK

Felipe Villarroel looks at the preliminary numbers for July PMI Manufacturing and PMI Services data, and how from a markets point of view, he thinks volatility will remain in place while both rates and spreads should trade in a range as we await for more clarity on whether inflation will allow Central Banks to pause and the extent of the slowdown in H2, particularly considering August is looming.

TwentyFour

Reinvestment risk growing, along with the soft landing narrative

What level of risk are investors willing to take? As central bank rates hike and a soft landing narrative makes its way into analysts’ forecasts, Eoin Walsh takes a look at what affects this has on investment risk and reinvestment risk.

TwentyFour

Soft landing narrative taking hold

What sort of landing will the global economy experience? With the recent release of the US CPI report, inflation has been on a downward trend and the resilient activity data has continued to surprise many. This report has acted as a trigger of sorts for increasing calls for a soft landing.

Fixed Income Boutique

Planets align for emerging market local currency bonds

After a tumultuous decade, the stars may be set to favor emerging market local currency bonds again. Portfolio manager Carl Vermassen says there are good reasons to believe their outperformance so far this year isn’t just a one-off lucky shot.

Conviction Equities Boutique

Can EM equities play catch-up in the second half of the year? Spoiler alert: we believe so!

Investors can look back at having had to navigate a difficult first half of the year. Emerging-market equities, though posting positive returns, trailed their developed-market counterparts. Could things turn around in the remainder of the year, leading to an outperformance of EM stocks?

Fixed Income Boutique

Are EM bonds about to shine?

Last year's bond market disappointments now seem far behind us and investors tell us they are once again bullish on fixed income.

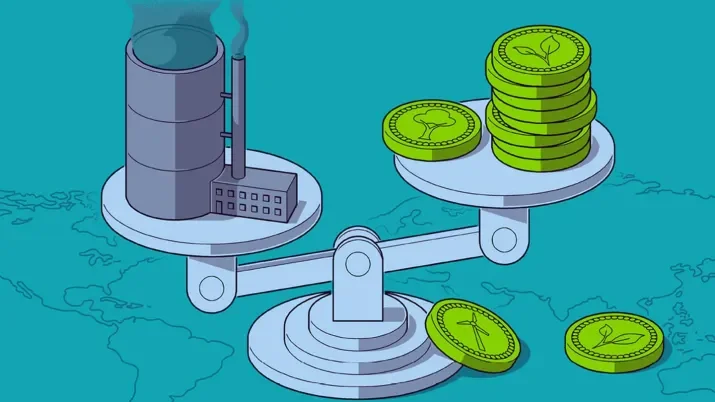

Asset management

Fighting the good fight: The role of carbon markets

To say addressing carbon emissions is urgent errs on the side of understatement. Tackling the transition toward decarbonization requires a collective effort, and carbon markets have a key role to play in the climate change fight – though those opportunities also come with some challenges.

Fixed Income Boutique

Central banks at the fork in the road

As the US Federal Reserve meets this week, what should investors brace for? Our Head of Corporate Credit Mondher Bettaieb Loriot suggests Fed officials are likely to hit the pause button on rate hikes as inflation and growth keep trending down. Across the Atlantic, however, the European Central Bank might not be ready to apply the brakes just yet.

TwentyFour

BBVA take a significant step forward for AT1s

BBVA have announced they are issuing a new AT1. What does this mean for the market? Eoin Walsh believes this could be the catalyst investors have been waiting for to help AT1 spreads grind tighter.

TwentyFour

A busy week ahead for central banks

What can we expect from central banks this week? Felipe Villarroel looks at how recent CPI prints in the Eurozone and in the United States are expected to influence upcoming central bank monetary policy decisions.

TwentyFour

European consumers not expecting a hard landing

What have we learnt from the ECB’s Consumer Expectations Survey? Felipe Villarroel discusses how latest changes in the consumer’s expectations of the economy reflect that the ECB’s monetary policy is actually working.

Quality Growth Boutique

The fallout of the US banking crisis and how quality can provide resilience

With regional banks in the US concerned about deposit flight, financial conditions are tightening, increasing the probability of a hard landing for the economy. Quality companies that do not rely on leverage and whose earnings tend to be more resilient during times of economic weakness can be an attractive option for investors.

TwentyFour

US debt - stuck in a vicious cycle

In recent weeks the US debt ceiling has been dominating headlines with investors focused on the imminent threat of a US default which would be extremely unnerving for global markets. We look at the wider implications facing the US economy.

Quality Growth Boutique

International Equities: A compelling growth story unfolds

Multinationals listed in the US can provide exposure to global revenues. But an international approach also offers access to world leading companies that have no equivalent in domestic markets. And with valuations at a wide discount to the US, and below long-run averages, the story in international equities is both timely and compelling.

Fixed Income Boutique

Hunting alpha in China's real estate bond jungle

Is China’s property market on the mend? Are there any more humps in the road before it turns the corner? Our emerging markets credit specialists Cosmo Zhang and Wouter van Overfelt explain how contrarian investors who may have missed the strong rebound in December can now spot potential opportunities for generating alpha.

Quality Growth Boutique

Measured growth wins races: compounding capital in tougher conditions

Low interest rates, declining tax rates, and constrained wages contributed to margin expansion for large US companies over the past decade. Companies whose growth is driven by these temporary factors may be more vulnerable in tough conditions, while quality companies with structural growth drivers designed to succeed in all conditions may prevail.

Fixed Income Boutique

Emerging Market Bonds - First quarter 2023 review and outlook

Wouter Van Overfelt, Head of Emerging Market Corporates and Luc D’hooge, Head of Emerging Markets Bonds, provide a review on the developments in the first quarter, the current positioning of the strategies as well as an outlook for the remainder of 2023.

TwentyFour

European banks continue to deliver, on earnings and calls

As earnings season kicks off in Europe, Eoin Walsh looks at what impact, if any, recent volatility in the banking sector has had on European banks.

Fixed Income Boutique

Ready for takeoff? Are corporate bonds set for a smooth climb?

After the “great repricing” of 2022, is corporate credit now ready for takeoff? Our corporate credit experts, Mondher Bettaieb Loriot and Christian Hantel, analyze the reasons behind the revival of high-grade corporate credit and explain why they remain optimistic about investment-grade markets in Europe and the US.

TwentyFour

Short Term Bond Quarterly Update – April 2023

Partner and Portfolio Manager Chris Bowie discusses recent Q1 events and gives an outlook for Investment Grade for the next quarter.

TwentyFour

Fixed Income 101: Roll-down

Roll-down is the capital gain created by the natural fall in a bond’s yield as it approaches maturity. As a fixed income investor, it is probably the most you will ever get paid for doing nothing.