Why short term bonds can be the ideal tonic for rampant inflation

TwentyFour

Inflation’s resurgence has created a huge challenge for fixed income investors so far in 2022.

Central banks finally appear to be taking multi-decade highs in inflation seriously and have pivoted sharply to a hawkish stance. Markets are pricing in four rate hikes from the ECB by the end of the year, as well as five more from the Bank of England and seven more from the Fed. Russia’s invasion of Ukraine has not only added to inflationary pressures but introduced the risk of economic slowdown and even recession, as well as bringing a nasty bout of volatility to the bond markets.

As a result, bond investors face the unenviable task of navigating the capital-eroding effects of rising rates and the mark-to-market misery of volatility. In our view, this backdrop means investors must engage with the risks posed by excess duration.

Rising rates and the problem with duration

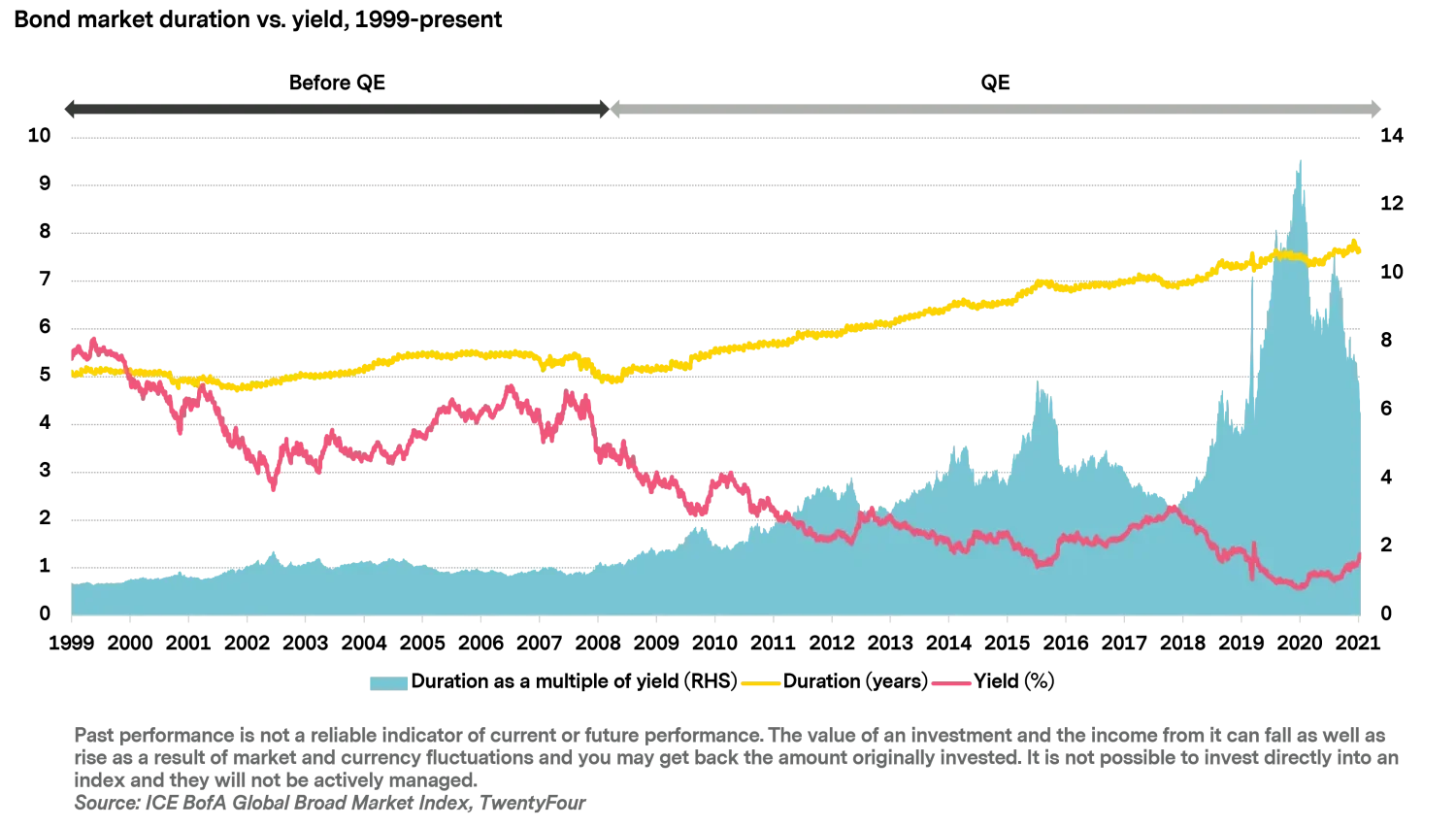

Central banks are actively discussing a faster pace of quantitative tightening (QT) as they look to withdraw stimulus and shrink their balance sheets, which has the potential to remove what has been a key pillar of support for risk assets during the last two economic cycles. As the graph below shows, the introduction of quantitative easing (QE) in the wake of the global financial crisis sent average yields tumbling at the same time as average duration – a measure of bonds’ sensitivity to interest rates – was steadily on the rise, as companies and governments extended maturities and took advantage of lower funding costs.

As a result, the relationship between risk in the form of duration and reward in the form of yield became increasingly stretched. This relationship has recently become less distorted, and we expect the gap between duration and yield to narrow further in the coming months. However, as interest rates and yields rise, retaining a high level of duration in a bond portfolio could lead to substantial capital losses, especially for strategies that are limited to fixed rate bonds which have longer durations and lower yields.

The protection offered by short term bonds

We believe portfolios composed of short duration, primarily investment grade bonds can help answer some of the biggest questions posed by the present market environment.

However, merely investing in short dated bonds in a mechanical fashion is unlikely to represent the best strategy for dealing with market volatility. In our experience, to achieve the best possible risk-adjusted returns much depends on how a short term bond fund is constructed.

Our research has shown that by restricting the number of individual bond positions to less than 100 (to allow the opportunity for stock selection alpha) and predominantly investing in BBB rated corporate bonds with maturities below five years (in order to target a more attractive yield), a short term bond portfolio has the ability to shield investors from the worst effects of duration and market volatility. In fact, we have found this remains true even during periods with multiple interest rate hikes, as the typical yield and yield curve roll-down achieved by this kind of strategy often exceeds the degree of capital losses you would expect in periods of extreme stress.

For example, during 1994 the Fed continually exceeded market expectations and implemented the equivalent of ten rate hikes, bringing the federal funds rate to a peak of 6%.

The chart above displays the drawdown experienced by the US investment grade corporate bond index (blue line), against a theoretical Optimal Index 67.5%, which is invested in BBB rated corporate bonds with maturities below five years and the rest in other short dated investment grade bonds (yellow line), through 1994 and early 1995. It shows our theoretical short term bond index would have experienced much more modest declines and exhibited less volatility than broader US corporate bond markets over this period. In fact, such an index could still have posted positive returns despite enduring interest rate rises totalling 250bp1.

While some differences exist between the prevailing conditions in 1994 and those present today, we believe the natural advantages of short term bonds can mitigate some of the key risks facing investors in 2022.

The natural advantages of short term bonds

One such advantage is ‘roll-down’. Roll-down is the capital gain created by the natural fall in a bond’s yield as it approaches maturity. The steeper the curve, the bigger the potential for roll-down gains, since the bond’s yield has further to fall (generating a bigger capital gain) with each passing year of maturity. Roll-down potential is generally much larger in short term bonds than in longer maturities because yield curves tend to be much steeper at the short end.

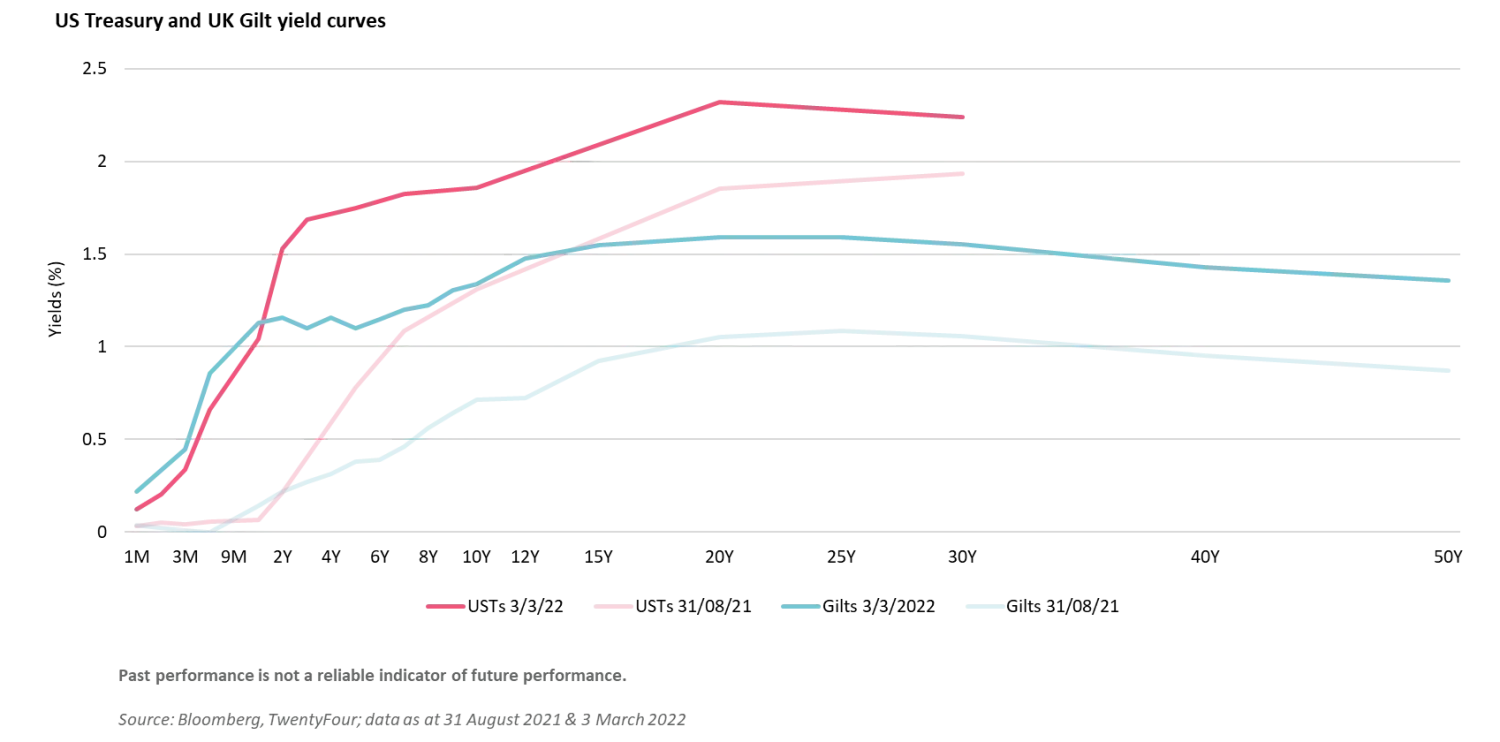

As the chart below shows, the front end of both the US and the UK government bond yield curve today is especially steep, having moved sharply over the last six months as investors have begun to price in multiple rate hikes from both the Fed and the Bank of England. Once you move past the four-year mark in the US and the two-year mark in the UK, the curve becomes so flat that the extra roll-down potential of buying a longer bond is overwhelmed by the extra duration risk you’re taking on.

The opportunity for roll-down gains is also typically more pronounced in short dated corporates rather than government bonds since corporate bond curves tend to remain steep throughout market cycles, and of course offer investors a higher yield for a similar level of duration risk. With two-year US Treasuries now yielding over 2%, a typical two-year investment grade US corporate bond could be offering over 3%, which in our view is an attractive prospect given the latter’s potential for roll-down gains and its relative lack of duration.

Another natural advantage of short term bonds, particularly those with around 12 months to maturity, is ‘pull-to-par’. Pull-to-par reflects the reality that as a bond approaches its maturity date, it will begin to ‘pull’ to its par value as default risk becomes increasingly negligible and the cash price of the bond amortises to 100. Investors holding longer dated bonds don’t benefit from this pull effect since the maturity date is too far away to provide the same level of certainty around principal repayment and the general level of market yields. Importantly, pull-to-par occurs whether a bond is trading at a discount or a premium as both would repay at 100 regardless.

Finally, short maturities give short term bond strategies the opportunity to pursue yield enhancement and this is typically done via a couple of distinct strategies. Firstly, in an environment of rising yields like we are experiencing today, a large allocation to bonds with 12 months to maturity or less means a short term bond strategy receives regular principal repayments which can be re-invested at higher yields. Those invested in longer dated bonds have far longer to wait for this re-investment opportunity and may have to resort to asset sales (that may incur capital losses and spread costs) to speed up the process.

Secondly, short term bond strategies will try to boost the portfolio yield via making high conviction allocations to riskier assets but with ultra-short maturities, where default risk has been dramatically reduced but the yield remains relatively high when compared with traditionally less risky assets. For example, we currently see many opportunities in short dated corporate hybrids and subordinated bank bonds, which can yield over 6% for maturities of just two years.

By themselves, these natural advantages of short term bonds cannot guarantee positive returns. However, they do give fixed income investors the ability to help insulate against possible capital losses while protecting income, and in our view they can provide a more solid platform than longer dated strategies for managers to target enhanced portfolio returns through asset allocation and stock selection.

Given the twin pressures of inflation and volatility, we believe the inherent strengths of short term bond strategies can give investors some comfort through this uncertain phase of the cycle.

1. TwentyFour, modelling conducted in March 2022

Important Information