More China and the Herd

Quality Growth Boutique

As ancient as China is, it’s going through an uncomfortable modern-day adolescence. As it evolves from successful work horse to challenger, the U.S. is calling time on core Chinese trade practices and geopolitical direction. The fact that China is fighting rather than bowing is leading to uncertainty in a theatre where the plodding World Trade Organization has lost its relevance. We find it hard to imagine that momentum will be fundamentally redirected with a couple of signatures later this year.

Alongside these risks is the perception that the FTSE and MSCI index guardians appear to be stumbling over each other to see who can increase the weights of locally-listed Chinese A shares in their benchmarks first. How could a slab of new ‘Old China’ A share weight in the benchmarks affect investors? Is the herd being led down a dark alley?

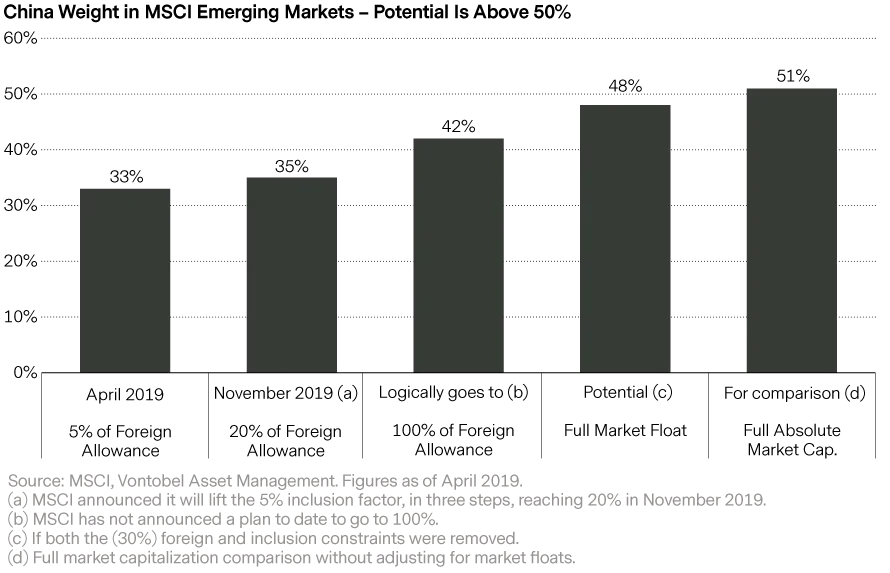

Start with context. Getting your hands around a risk is helped by balancing magnitude against probability. The magnitudes are large – starting with the fundamentals. At around $7.6 trillion, China’s equity market is much larger than its 3.8% weight looks in the MSCI All Country World Index (ACWI). The share of revenue generated by Chinese and Hong Kong firms in the MSCI ACWI went from 1% in 2000 to just under 20%1 in 2018. But China’s size is mechanically constrained in the benchmarks. By our calculations, if you compare China’s constrained weight in the ACWI against its straight absolute dollars capitalization without any constraints, its weight rises from 3.8% to just under 12%2. This makes it the second largest country in the benchmark – and almost three times the size of the UK! And in the emerging markets, China’s actual size versus its benchmark weight is even more noticeable.

However, we see the probability of a rapid increase in China’s weights as low, for now. MSCI already has A shares in its China index, but they only account for a 3% weight, with the rest listed in Hong Kong or the U.S. The reason A share exposure is so low is the huge (and somewhat arbitrary) 98.5% haircut taken off the weight of local Chinese names in the Index. MSCI plans to reduce the haircut to 94% by November 2019. This action is not likely to move the needle far. Which is important. But it’s the potential next step that keeps our attention.

If MSCI is comfortable with China market risk, it’s reasonable to assume they eventually go from 20% to 100% inclusion. They have not indicated they will – but if they did, China would rise to around 42% of MSCI EM. It’s a bit of a stretch given the current markets, but from there it could lead to a full market float weighting, which would make it a very big boy at just under 48%.

What The A Shares Look Like

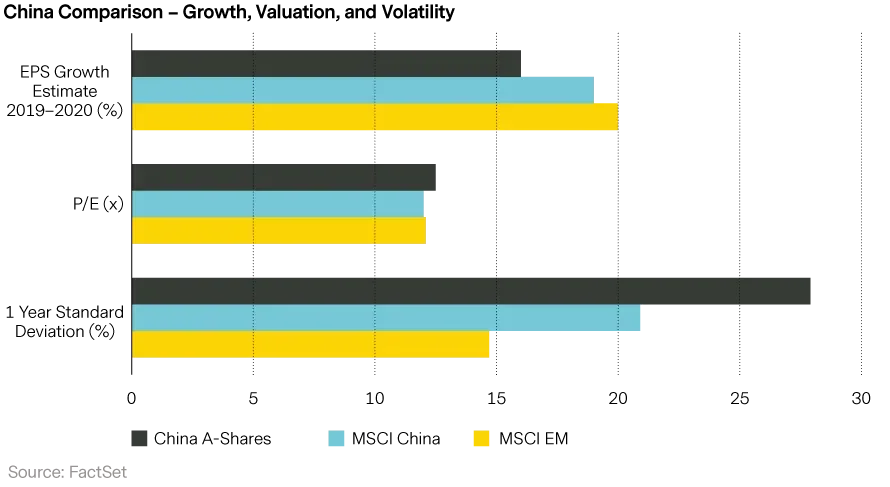

Chinese A shares are listed in local currency on the Shanghai and Shenzhen markets. At the time of writing, the A shares included by MSCI are on average smaller, more volatile and have slightly less growth forecast than the MSCI China and MSCI EM averages.

The A shares are often described skewing to ‘Old China’ – sectors that grew during China’s earlier growth phases dominated by fixed asset investment. 58% of A shares weight3 is in 3 sectors: Industrials (26%), Materials (17%) and Information Technology (15%). While MSCI China is dominated by ‘New China’ exposure to consumer and services with 71% of its weight in 3 sectors: Communication Services (26% including Tencent), Consumer Discretionary (23% including Alibaba) and Financials (22%).

As Investors

We always tread with caution in China. There are structural fundamentals that are often different in China compared to most other markets. The Chinese Communist Party can play a significant role in how companies operate, but its role is not always clear – and there are levels of authorities from central, to provincial to city. A good number of A shares are State Owned Companies (SOEs), including China Mobile and China Construction Bank, but a company does not need to be an SOE to be heavily state influenced in China.

There are some A share companies that are interesting to quality growth investors like us, but understanding the ESG and regulatory risks can take deep research. A broad-based example we see as important for sustainability is that interests of companies and their managements need to align well with those of the authorities. But bottom-up, there are many areas of potential risk that need to be considered – such as where cash is held. Looking at these types of risks, it must be remembered that foreign auditors are not allowed to operate in China. And this is on top of the challenge that many documents are only available in Chinese.

MSCI’s Next Move: We Prefer Slow And Steady

China’s a difficult balance. MSCI’s clients know any benchmark shift drives huge volumes of savers’ wealth in passive (or passive mind-set) funds. Walking blind into a disaster or liquidity trap led by a benchmark provider would be bad for savers, let alone passive investing. And China is unusual in many ways. Even without discussing the issues of profit maximization in a communist system, practical issues such as buying shares as foreigners through a closed capital account have been awkward. Slow and steady is better in our view.

A change to the benchmark would not likely affect the way company-by-company investors work. However, a large increase in benchmark exposure to China A shares, which tend to be more volatile, would likely increase the tracking error for investors like us, that limit their holdings to stable and sustainable ‘quality’ businesses. We do not expect the added weight of A shares to the MSCI indices this year will move the needle for investors. But we also believe these are early days and we strongly recommend understanding what you own with conviction as, at times, tracking error can bring great pressure from the herd.

1. Source: FactSet, latest reported full year revenue by company, with index weights as of 23 May 2019.

2. MSCI holds A shares exposure down in two ways - a ‘Foreign limit’ reduces the potential weight to 30% of its market value. On top is an ‘Inclusion factor’ which stood at 5% (of the 30%) at the end of April. MSCI will raise its inclusion rate in three steps to 20% by November 2019 which we estimate will lift China’s MSCI EM weight by just 1.6% to 34.6%. In November MSCI also plans to add mid-cap China-A shares under the same structure.

3. Source: SG Cross Asset Research.