TwentyFour

An Italian Summer Renaissance?

Since the two anti-establishment parties (The League and Five-Star) formed a coalition and took control in Italy, markets have been uncertain on the domestic government policy that was promising many things to many people and ultimately creating considerable friction with the European Commission (EC).

TwentyFour

ABS Summer Synopsis

The embers of the European ABS H1 primary pipeline are now cooling down for the summer break. After a slow start to the year driven by the delayed implementation of new regulations, we saw an increasingly busy pipeline as Q2 developed and became the third busiest quarter of issuance post crisis. July saw almost €20bn equiv. of supply, taking the year to date total to €58bn including a record €19bn in CLOs. This accords with our somewhat contrarian view that 2019 issuance would eventually keep pace with 2018 (a post crisis record). July’s total went a long way in achieving this, bringing YTD issuance just 6% short of the 2018 run rate. In late June this was 28%.

TwentyFour

Global Coordinated Slowdown Plus Event Risk

August has been a very challenging month so far for risk markets, while in traditional risk off, UST treasuries have seen sharp declines in yield back to the lows last seen in October 2016. We can’t help but think that this sharp adjustment will become more ingrained in August, following 6 months of relatively benign markets.

TwentyFour

Taking Back Control

It was a dramatic night last night as the Fed cut interest rates by 25bps, the first cut since December 2008, along with the premature ending to the balance sheet run off – however markets hardly moved!

TwentyFour

Slim Premiums a Signal for Caution in High Yield

Over the past few weeks there has been a noticeable increase in high yield new issuance, bringing a welcome flurry of activity to what has so far been a relatively benign year.

TwentyFour

Is Bank Tightening Ammo For ECB Stimulus?

The euro area bank lending survey for the second quarter of 2019, released yesterday, suggests European banks are becoming more cautious and beginning to tighten lending criteria to various parts of the economy.

TwentyFour

PIC’s RT1: The Brexit Premium in Practice

The UK’s political situation, and in particular the harder Brexit stance of the frontrunner for next prime minister, Boris Johnson, has provided the market with a steady stream of headlines over the past few weeks. As a direct consequence sterling is close to 6% off recent highs and domestic credit spreads have also underperformed their European and US peers.

TwentyFour

What Can Q2 Earnings Tell Us About The Fed?

One of the market’s chief obsessions in 2019 has understandably been the shifting stance of the US Federal Reserve in relation to the path for interest rates, with investors now pricing in a 100% chance of a rate cut at the end of this month. Now that the June FOMC minutes, Nonfarm payrolls, Jerome Powell’s testimony to Congress, the June CPI and PPI numbers and the Trump-Xi meeting at the G20 in Osaka are behind us, what is the next set of data that may shed some light on the Fed’s next policy move?

TwentyFour

Powell: The Bigger Picture

Yesterday we heard from US Federal Reserve Chairman, Jerome Powell, as he testified at the House Committee on Financial Services. Obviously the main focus for markets was to glean any additional information regarding the future timing and path of the Fed Funds rate. However, as important for fixed income investors as the future path for rates is, listening carefully to central bankers can also provide insight into the bigger picture economic environment. My ears pricked up in particular at two important and related topics Mr Powell discussed.

TwentyFour

Bond Market Relief at Change of Lagarde

European bond markets can breathe a sigh of relief this morning as Christine Lagarde is poised to be the new president of the European Central Bank, succeeding Mario Draghi in October.

TwentyFour

Dollar Hedging is About to Get Cheaper

As we approach the end of Q2, a time when the price of currency hedging can typically spike, we have been reviewing the likely changes in the so-called ‘costs’ of currency hedging. I use the term so-called as these are not really costs, merely a differential in short term interest rates, which for some investors can be a gain and for others it will be a reduction in the yield or return of an asset.

TwentyFour

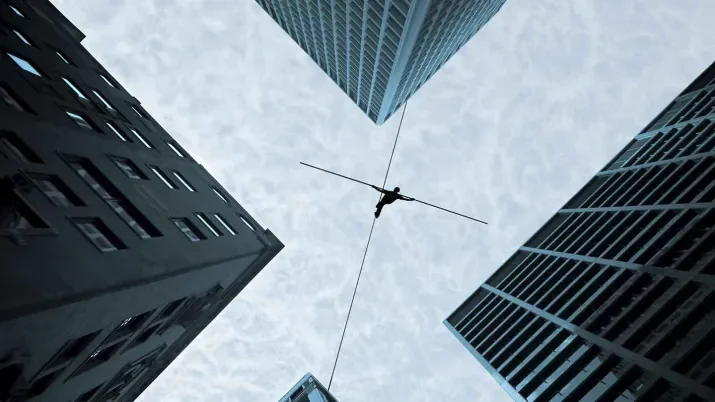

Powell’s Balancing Act

This week Jerome Powell and his fellow FOMC members sit down to determine the Fed Funds rate, and despite the expectation of no move, this meeting is going to be very closely monitored with market participants analysing every word of the subsequent comment.

TwentyFour

Due Diligence Critical for New Cohort of ABS Issuers

As we wrote on Friday, one of our biggest takeaways from last week’s Global ABS conference was the growing number of prospective new issuers in the market.

TwentyFour

Global ABS 2019: Issuers Out in Force

This week Asset-Backed Securities (ABS) market participants from across the globe gathered for the 23rd annual three-day Global ABS conference in Barcelona. And this year it proved more popular than ever with over 4,000 attendees (a post-crisis record) made up of issuers, arrangers, service providers, traders, analysts, market regulators, the industry press, and of course investors like ourselves. In particular, we felt the number of issuers represented was noticeably higher than we have seen in recent years.

TwentyFour

Cashing in on the Brexit Premium

Brexit deliberations are currently at a standstill in the UK parliament, as are negotiations with EU representatives. The next steps in the exit process are clouded in uncertainty, with numerous options on the table. In this environment, it’s no surprise that investors are still demanding a spread premium for sterling denominated credit, over and above comparable euro denominated issues.

TwentyFour

Five things to consider when investing in ABS

Despite boasting some of the lowest default rates across the global fixed income market, as well as higher yields and greater investor protections than vanilla corporate bonds of the same rating, Asset-Backed Securities (ABS) remains an under-utilised market for many pension funds.

TwentyFour partner Ben Hayward outlines five things every investor should keep in mind when looking at this compelling asset class.

TwentyFour

What Would it Take For the Fed to Cut?

With markets now pricing in two cuts in the Fed Funds rate this year, and a 97% chance of at least one cut, once again the FOMC members are at odds with the financial markets.

TwentyFour

Pricing a US Recession Won’t Make it Real

One of the main drivers of global markets at the moment is the exact status of the economic cycle in the United States, and on a related note, what the Federal Reserve’s next moves are likely to be. One question we are being asked more and more often by investors is whether we think a recession is coming in the US, and if so, when?

TwentyFour

The Problem With Gilts

Since the result of the UK referendum in June 2016 there has been a noticeable ‘Brexit-premium’ associated with most sterling denominated assets.

TwentyFour

Markets are Still Fighting the Fed on Rates

Last Friday’s strong US GDP reading for the first quarter has sparked several days of debate between TwentyFour portfolio managers. The 3.2% reading was 100bp ahead of consensus, so a strong beat at the headline level, but the components accounting for it, such as inventory building, suggested the figure was an aberration and likely to reverse in Q2.

TwentyFour

Thoughts on EM

Emerging Market (EM) bonds have had a good year so far. While they are not at the very top of the performance table, the hard currency CEMBI (Corporate Emerging Markets Bond Index) is up 5.69% in $ since the start of the year, and the EMBI (Sovereigns) is up 6.32%; not bad at all.

TwentyFour

Capital, Calls and Comfortable Coupons

The cycle of banks calling outstanding capital bonds continued this week and we’ll soon be bidding fond farewells to two of our long held and favourite positions; Nationwide’s 6.875% Additional Tier 1 (CoCo) and Barclays’ 14% hybrid Tier 1.

TwentyFour

Diligence Due in AT1 as Spreads Tighten

Since the start of the year credit markets have been very well supported, reversing much of the sharp period of spread widening we experienced in the final quarter of 2018.

TwentyFour

Have European Regulators Just Tightened Financial Conditions?

The ECB published the result of its Supervisory Review and Evaluation Process (SREP) yesterday, which increased the average capital requirements for European banks, and overall, increased the average SREP requirement by approx. 100bps.