Five things to consider when investing in ABS

TwentyFour

Despite boasting some of the lowest default rates across the global fixed income market, as well as higher yields and greater investor protections than vanilla corporate bonds of the same rating, Asset-Backed Securities (ABS) remains an under-utilised market for many pension funds.

TwentyFour Asset Management is one of Europe’s most prominent ABS buyers, and one of the few whose funds invest across the entire spectrum of the market, from triple-A rated residential mortgage-backed securities to the lower rated tranches of collateralised loan obligations (CLOs).

TwentyFour partner Ben Hayward, who manages the firm’s range of ABS funds, outlines five things every investor should keep in mind when looking at this compelling asset class.

1. Look properly at performance

It is a common misconception that the credit performance of ABS transactions structured around the time of the global financial crisis has been a horror show.

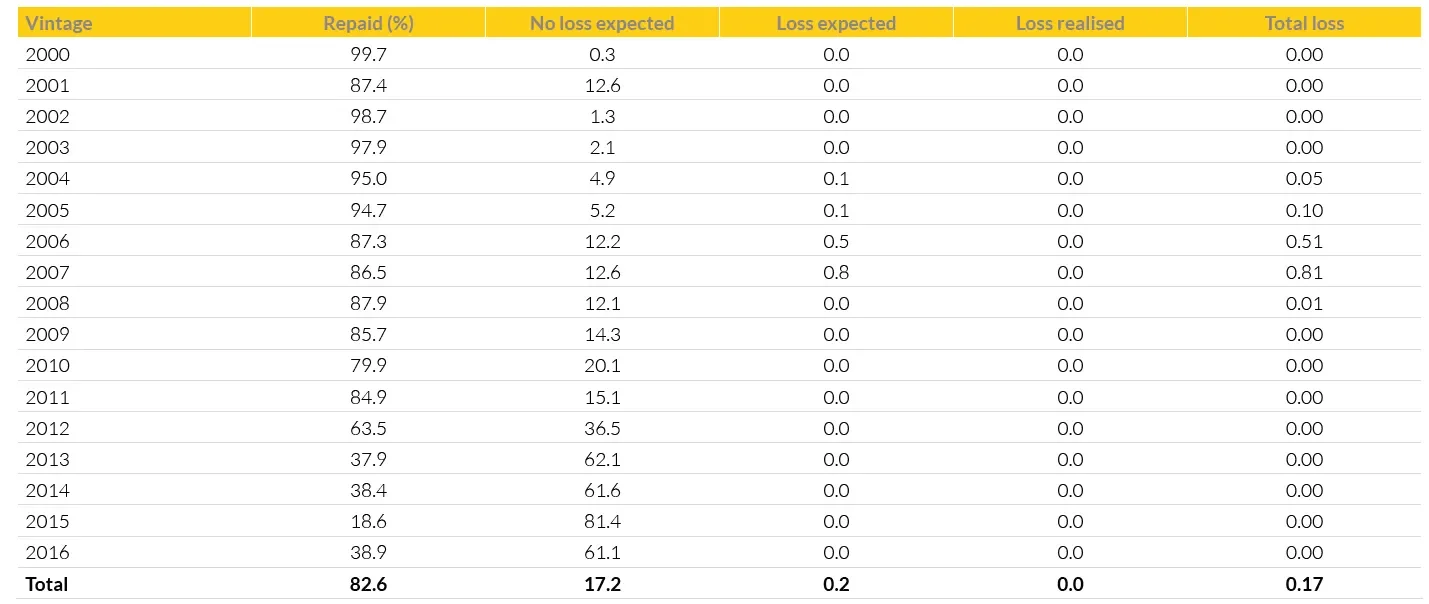

The data shows this is not the case. As fixed income investors, our number one priority is capital preservation – getting our principal back. From this perspective, even if we take what are widely perceived to be the ‘worst’ issuance years for performance (2005, 2006 and 2007), we see that well over 80% of all the European RMBS issued in those years has already redeemed, while expected and realised losses for that entire period are both well under 1% (Chart 1). On all of European RMBS issued since 2009, losses already incurred or expected to be incurred in future by investors have been exactly zero.1

ABS is also unique within fixed income investments in terms of its transparency to the end investor. For any publicly sold ABS, loan-level data on repayments, arrears and defaults is available for anyone to scrutinise. At TwentyFour, this means we can rely on our own analysis of the collateral backing transactions, and conduct bespoke modelling of loan performance.

Chart 1: European RMBS Redemptions, Expected and Realised Losses 2000-20161

1 Source: Fitch Ratings ‘Structured Finance Losses - EMEA 2000-2016 Issuance’ (Jul 2017)

2. Liquidity is relative

ABS is sometimes unfairly branded as a more “illiquid” asset class than regular corporate or government bonds, often simply because it is seen as an ‘exotic’ alternative to these markets. However, the vast majority of senior tranches in the European ABS market are eligible collateral for central banks, and are therefore highly liquid.

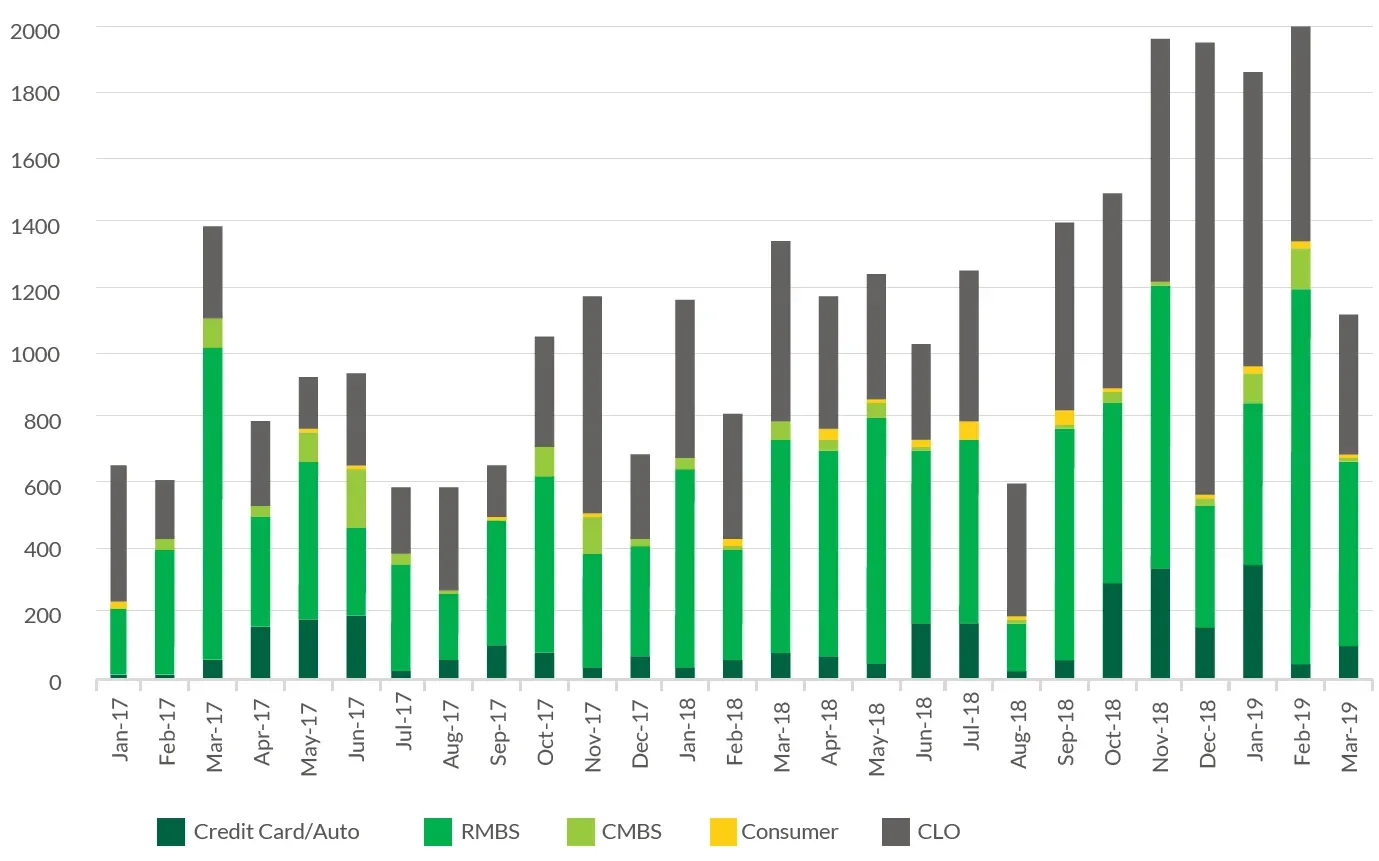

ABS investors are also able to trade via an ongoing process of ‘Bids Wanted in Competition’ (or BWIC) lists. These are essentially public auctions where a bondholder sends out a list of securities they wish to sell, inviting bids from investors. End investors can provide liquidity when investment banks are unwilling, and the BWIC process is more economical for participating investors as banks charge a lower bid-offer spread than for regular intermediary trading.

One particularly useful feature of BWIC trading is that activity tends to increase during periods of volatility, such as the period covering late 2018 and early 2019. At times of market stress, when liquidity in traditional markets typically deteriorates, ABS investors benefit from transparent liquidity.

Chart 2: ABS & CLO BWICs ($mm) 2017-2019

Source: Citigroup, JP Morgan, Mar 2019

3. Geography matters

In some asset classes, broad similarities in regulation and structuring mean the governing jurisdiction of a security is of little consequence to investors. In ABS, geographical nuances can make a big difference to returns.

One reason for this is physical proximity to the assets backing the transactions. TwentyFour portfolio managers devote significant time and resources to visiting, for example, the office buildings and logistics centres that are typical collateral for Commercial Mortgage-Backed Securities (CMBS), and talking to the management of such properties. This is a critical part of our investment process, and would be impossible to carry out effectively on a global basis.

Another reason for this is the important differences between the regulatory frameworks governing the major ABS markets. For example, stricter lending rules, lower default rates and compulsory risk retention for issuers are three nvestor-friendly advantages European ABS has over its US counterpart.

4. Favour flexibility

ABS is a specialist asset class where experience and expertise are well rewarded. However, do not confuse ‘specialist’ with ‘narrow’. ABS is probably the most flexible part of the fixed income universe.

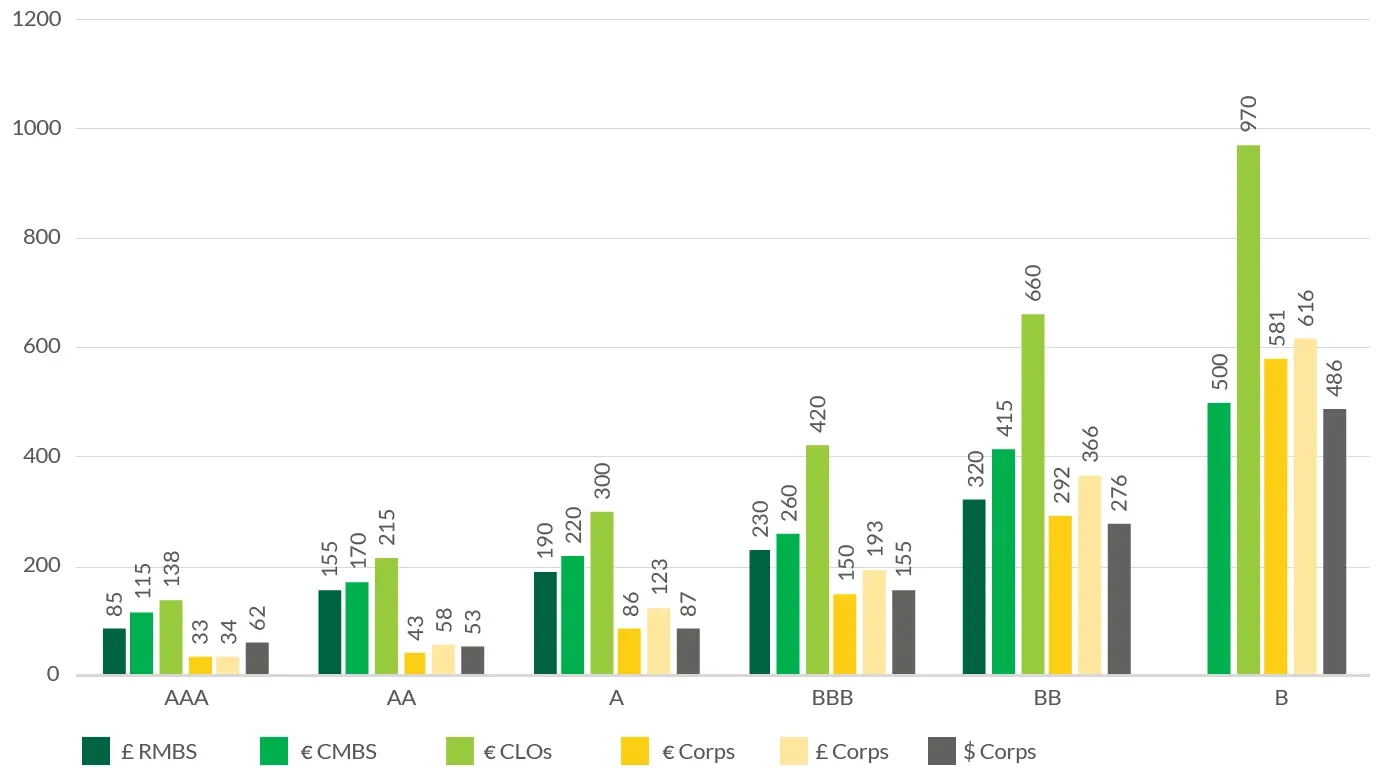

Because each ABS is structured into a number of tranches, each with different levels of credit protection for bondholders, investors have a wide choice of ratings and yields within each transaction from the same issuer. In the corporate bond market, if you like Vodafone, only triple-B rated bonds are available; there is no way of getting triple-A or single-B rated exposure to Vodafone. In ABS a single RMBS transaction, such as Kensington Mortgages’ Finsbury Square 2019-1, offers bonds with ratings from triple-A down to triple-B.

Beyond ratings, there is also a huge range of geographies, asset types and yields present across the market, meaning ABS funds can target an equally large range of investment objectives. TwentyFour currently runs mandates that range from high quality investment-grade to subinvestment grade funds seeking to maximise income and capital growth. These various strategies can be compared with cash, sovereign bonds, senior secured loans, corporate bonds and high yield bonds, but typically offer a better risk-return profile.

Chart 3: ABS & Corporate Bond Spreads by Rating and Sector

Source: TwentyFour, Barclays, Mar 2019

5. Get clarity from your manager

Despite its admittedly long list of acronyms, ABS is not an overly complicated asset class when it is explained properly. Unfortunately, we believe there are those in the market that can sometimes miscommunicate certain aspects of their investment process to investors, and it is important to get clarity on these.

Some managers, for example, are frequent investors in ‘private’ ABS trades, which are not distributed publicly via a syndication process and prices are not disclosed to the market. While there may be nothing wrong with the underlying credit, private trades are typically illiquid and unrated. If they are illiquid, then we believe they do not belong in openended funds. If they are unrated, managers will sometimes apply their own internal or ‘shadow’ ratings, and it is important to question whether these are conservative enough to accurately reflect the risk.

Another thing to watch out for is how a fund’s yield is calculated. At TwentyFour, we quote the fund’s yields based on the current Libor rate and on a currency hedged basis, as this is the most accurate reflection of the true yield of a portfolio combining securities denominated in multiple currencies. Yield figures are shown gross of expenses, while performance is net. If a manager is quoting based on forward Libor (a yield calculation relying on future rate rises) or on an unhedged basis (allowing higher-yielding currencies to push up the yield), then investors should be mindful that they are not comparing like with like.