Are Fixed Income Bets All Pointing the Same Way?

TwentyFour

With investors eyeing economic recovery and stimulus firmly in place, credit spreads look set to break through previous tights in 2021. But what could happen if they do? TwentyFour Asset Management CEO, Mark Holman, explains why he believes portfolio rebalancing will likely be the key strategic decision for fixed income investors this year, and why now is the time to plan for it.

Of all the things that were remarkable about 2020 from a markets perspective, it is hard to overlook the sheer speed of the transition between the old economic cycle and the new.

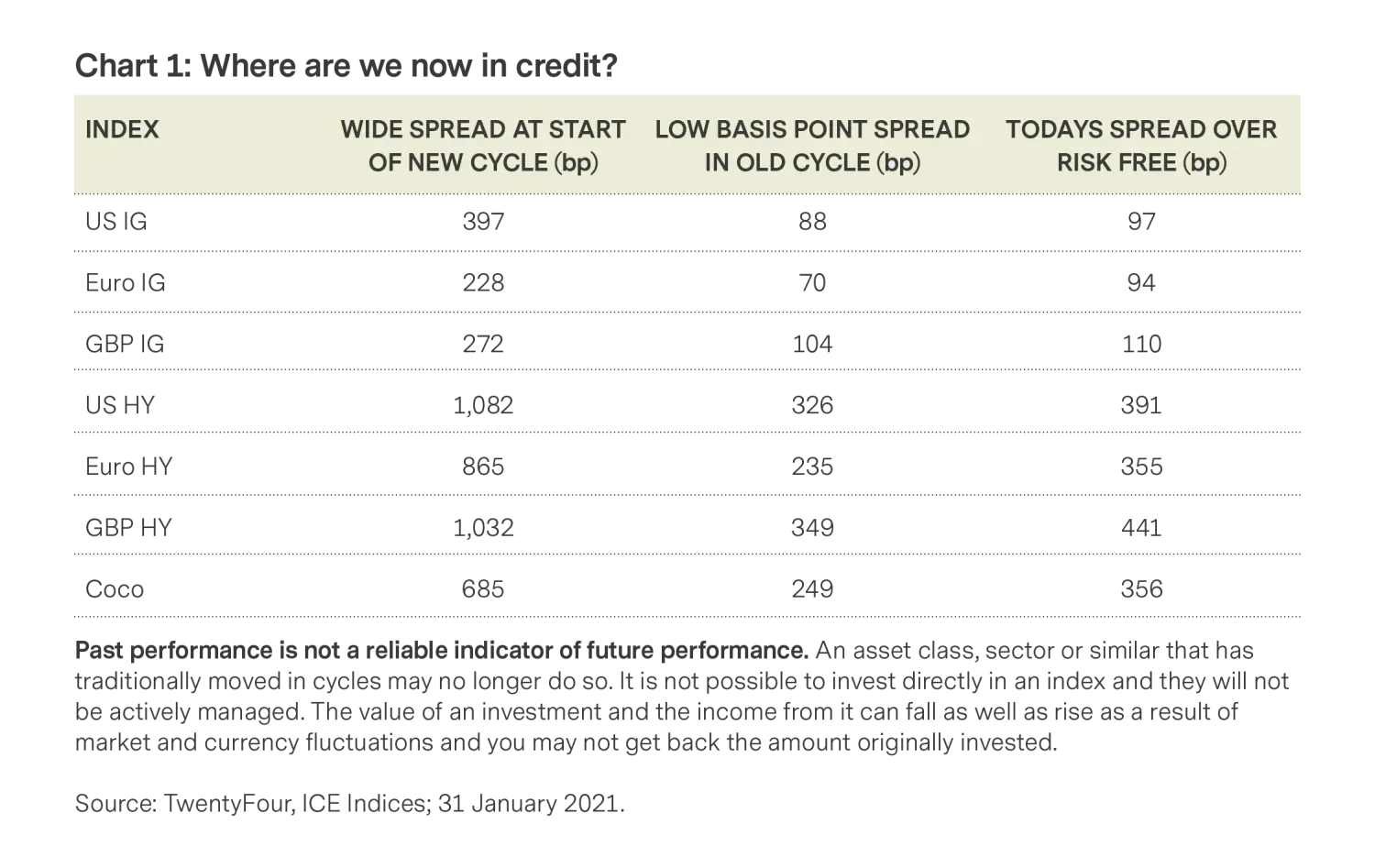

In a matter of months since COVID-19 brought the global economy to a virtual standstill, investors have witnessed a rapid shift from late-cycle into severe recession and then the recovery phase, a process that typically takes years. This speed has been mirrored in the bond markets; investment grade spreads have not only broken through their pre-COVID tights but are already threatening the tights of the previous cycle, while high yield bonds are within shouting distance of their 2020 lows.

In our view, this mammoth rally has so far been justified. Governments and central banks unleashed a staggering level of stimulus in 2020 and this, combined with the recent rollout of a number of effective COVID-19 vaccines, means we expect pent-up consumer demand to help drive a strong economic recovery later this year. Our roadmap for the rest of this year involves credit spreads continuing to grind tighter and government bond yields ticking up.

As such, we entered 2021 wanting to be well invested in credit. Recent evidence suggests this is a popular stance in fixed income today; primary bond issuance in January didn’t quite hit the pace we saw at times in 2020, but the bloated order books have remained and so it appears has the reach for yield, which in our view has helped to turbocharge the credit recovery.

As an active fund manager, being well-aligned with consensus can feel slightly uncomfortable, but our call that the credit rally has more room to run is a high conviction one. In fact, we see IG spreads breaking through their previous cycle tights as early as Q1, and we also expect to see material spread compression between ratings bands this year as high yield catches up.

I don’t believe this is the time for being contrarian. Governments and central banks appear committed to maintaining monetary and fiscal stimulus, and with government bond curves offering very low or even negative yields there remains an overwhelming demand for income across the global investor base that we think credit is best placed to fulfil.

However, I do believe it is important to plan well ahead for possible rebalancing options should you think your spread targets are going to be hit. So when – and how – might bond investors rebalance?

The reflation trade

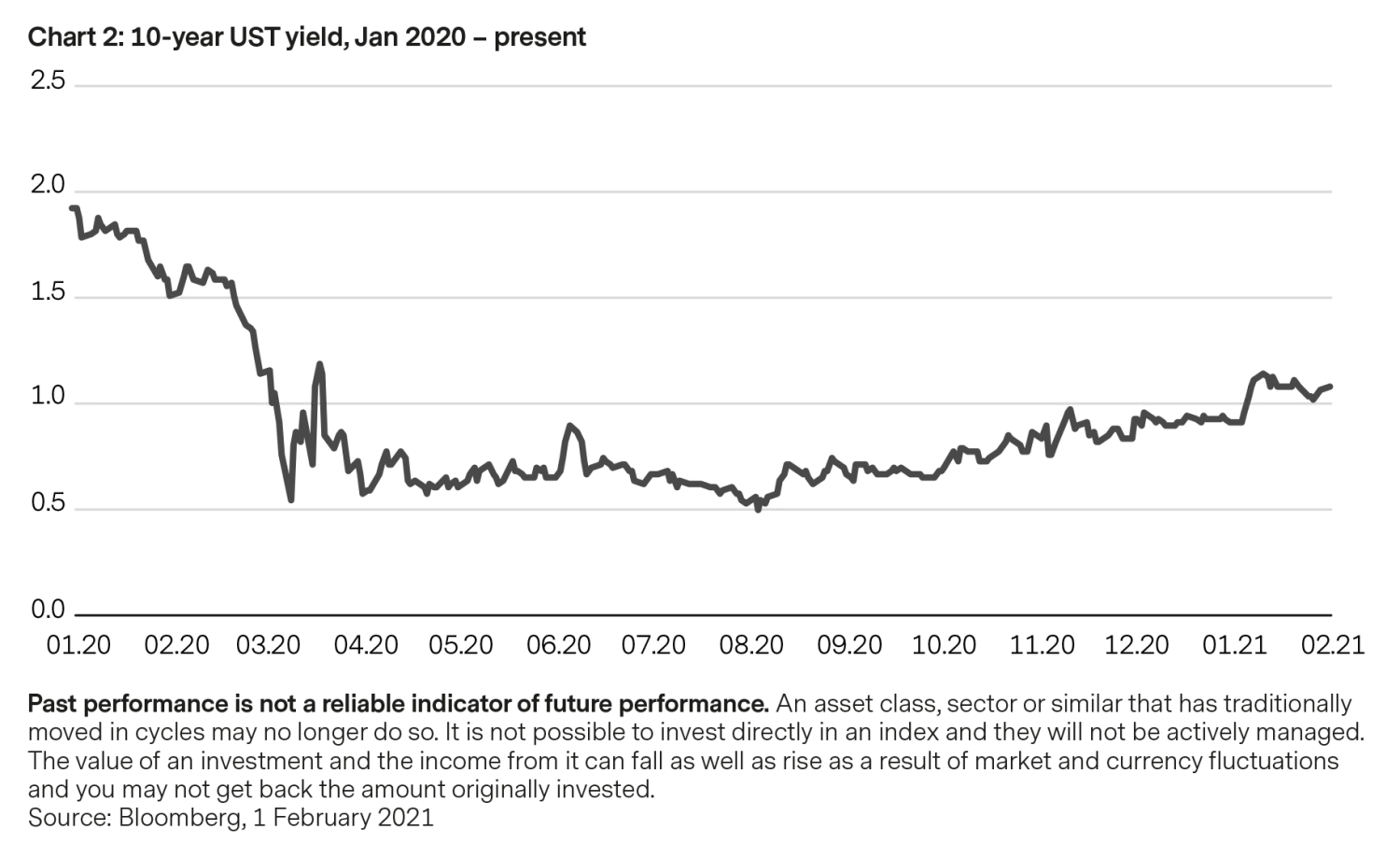

We expect a big part of the answer to this question will come from the US Treasury market. Treasuries are generally the current risk-off product of choice globally, and with 10-year yields falling well below 1% for most of 2020, in our view they lost much of their usefulness as a portfolio balancing tool since we thought them unlikely to perform well enough in a market slump to make up for a sell-off in risk assets.

For those feeling a little exposed without their familiar UST counterbalance, there was a welcome development in the early days of 2021 as 10-year UST yields rose quickly from 92bp on January 4 to a high of 115bp by January 11, giving them greater scope to help protect a fixed income portfolio from a sell-off in credit – though still not enough in our view.

This sharp move in yields was mostly driven by the Democrats taking control of the US Senate, paving the way for more ambitious stimulus plans from the incoming Biden administration and potentially fanning the flames of inflation. 10-year yields have since fallen back to around 1%, but our base case is for a bear steepening in the Treasury curve – where long end yields rise while the short end stays anchored – to send them back up to around 1.5% by year-end.

At that level, we think longer dated US Treasuries would be a more serious contender in portfolio managers’ asset allocation decisions, which is why inflation, particularly in the US, will be one of the most closely watched metrics for bond investors this year. The Fed’s forward guidance is that interest rates will be on hold through 2023 and it will let the economy “run hot” with inflation above the 2% target. US 10-year inflation expectations moved above 2% for the first time since May 2018 in January, leading to speculation around how big a shift would be required for the Fed to begin talking about tapering its stimulus efforts.

In our view inflation will pick up across 2021 but we don’t expect it to become an issue for the Fed, or other central banks for that matter, in the short term. The US economy lost around nine million jobs in 2020, and it is hard to see inflation running away until that labour market slack is taken up. One of the material differences between this cycle and its predecessor is that banks are not deleveraging in the way they were forced to by regulators in the years following the 2008 global financial crisis, so we expect bank balance sheet expansion to help drive inflation as the year goes on, but in general we expect inflation to be more of a 2022 story.

The credit conundrum

The other side of this debate is of course the credit market, and how quickly our expected tightening will occur. In an ideal world, this would happen gradually alongside a gradual steepening of the US Treasury curve, allowing portfolio managers to consider rotating in risk-off exposure equally gradually. But given the speed of the cycle, we can’t rule out one happening faster than the other.

As Chart 1 above shows, spreads in some parts of IG are within a whisker of their tights of the previous cycle. Our rationale tells us that making these tights would be justified, but at that point if our rationale hasn’t changed, we think the right thing to do would likely be to change positioning. Anything else could be mission creep. We are already wary of longer duration exposure since we don't believe there is enough spread in these higher rated bonds to absorb the steepening in the US yield curve.

Another option available is to look to rotate between credit sectors to seek relative value opportunities as the year plays out. Looking at global high yield indices today, US dollar index spreads are around 50bp from their tights of the previous cycle, whereas euro spreads are around 100bp away and the sterling index some 200bp away.

However this year plays out, as investors we think we have a strong rationale for why credit spreads will hit and may even break through their previous tights in 2021. The key point is that if that happens, we should consider whether our rationale for holding the same positioning has changed. If it hasn’t, then it could be the time to rebalance portfolios.

It is typically in the later stages of the recovery phase that investors are challenged on whether to remain fully invested in risk-on assets or to start importing some risk-off products with the intention of adding some balance to their portfolios. However, the speed of this cycle could mean your spread targets arrive sooner than they normally would.

We expect many fixed income investors will be reaching this inflection point some time in 2021, and we think the time to plan for it is now.