Fixed Income 2023: A return to returns

TwentyFour

“This time next year, Rodney…”

After what is on course to be one of the worst years on record for the performance of a typical 60-40 portfolio, the vast majority of investors globally will be impatient to leave 2022 behind and focus on their prospects for the year ahead.

As of November 30, virtually every non-currency asset class (with the exception of certain commodities) was in deeply negative territory year-to-date, with markets having repriced rapidly to take account of inflation and central banks’ increasingly aggressive attempts to tame it. With monetary policy being the root cause, fixed income has obviously been at the centre of market pain in 2022. It has been one of the worst (if not the worst) ever years for government bond performance, hitting credit with the double whammy of rates weakness and spread widening as markets began to fear central banks would steer the global economy into a hard landing.

There is good reason for fixed income investors to expect better in 2023. Markets have taken a lot of pain, and on top of that they look to have priced in a substantial amount of bad news already. When we sat down to debate and construct this outlook, there was confidence among the team that the worst should finally be in the rear-view mirror. We think we are unlikely to see a straight-line recovery such as the one we enjoyed from April 2020 through mid-2021, for example, but given current yields, we believe fixed income markets are well placed to produce positive returns in 2023.

Banks look compelling across the capital stack, as do high quality European RMBS and CLOs where we think spreads can tighten significantly. The speed and scale of the 2022 downturn means that even short dated investment grade bonds are yielding more than at any point since the global financial crisis1, so we see good value opportunities even at the higher quality, safer end of the traditional risk spectrum. Since we anticipate an uneven recovery we think the best fixed income opportunities will be stock specific in 2023, but there is no denying that starting yields across the asset class mean we also think investors won’t need to reach for risk to generate positive returns.

Fewer unknowns heading into 2023

As we approached year-end 2021, we felt very strongly that central banks’ mantra of transitory inflation was incorrect, and that they were well behind the curve on hiking rates to help tackle inflation. It looks like we were right on both counts, but like many we were mistaken on just how strong inflation would prove to be, and on the subsequent speed and scale of hikes that would be required to help tame it.

Russia’s invasion of Ukraine in February changed the game on the inflation outlook completely. The war sparked a global commodity price shock, which, combined with still-disrupted supply chains, pushed inflation to levels not previously contemplated. Rather than the intra-cycle dip we anticipated then, what we got was one of the fastest rate hike cycles in US history from a US Federal Reserve playing catch-up, with the Bank of England and European Central Bank latterly following suit. The resulting move in rates markets was equally aggressive, and the impact of this on performance across the rest of fixed income (and most other assets) is well documented.

The last 11 months could perhaps be summarised as markets’ fear of the unknown, or rather a series of unknowns: inflation, monetary policy, supply chain disruption, the war in Ukraine, a European energy crisis, China’s COVID policy, political turmoil in the UK, the resilience of the consumer, the timing and depth of recession.

If there is a positive to be taken from a torrid 2022, then it is that the rapid pace of this cycle has helped to remove or at least reduce a good portion of these unknowns.

US inflation looks to have finally turned and we think could come down quite rapidly over the next six months. We believe we are therefore very close to terminal rates in the US, and we look to have more certainty around the Fed’s plans today than we have had at any point during 2022. Given the scale of the sell-off it was no surprise to see a succession of bear market rallies emerge as this year progressed, but we believe the strong recovery in credit following the landmark US inflation print in early November feels overdue and well justified. The simultaneous comeback of primary market supply has shown investors have plenty of cash on the side-lines, and more importantly are ready to put it to work.

Forecasting geopolitical crises is typically unproductive, but recent developments in the Russia-Ukraine war would appear to suggest the most severe scenarios can be avoided. On a related note, it appears the worse-case scenario of blackouts and energy rationing in Europe this winter should also be avoided, thanks to a softening of prices and successful efforts to source alternatives to Russian supply.

By far the biggest positive for 2023 though is starting yields across fixed income, which in our view are still pricing in far more bad news than we are likely to see in the next 12 months. Breakeven yields are now offering bondholders substantial downside mitigation, and we think investors can build their portfolios for 2023 without fearing the same level of disruption they faced in 2022.

Of the unknowns that remain, we believe the most significant is the amount of damage ‘high for longer’ rates might do to economic fundamentals. In macro terms, broadly we see three potential outcomes in 2023:

- Hard landing (20% probability) – In our worse-case scenario we see a sharp spike in unemployment, big hits to GDP, bad ratings migration and default rates spiking. In the face of this, we would expect the Fed to cut rates sharply and US Treasuries to rally, but credit spreads would go even wider. However, we see strong banking sector fundamentals and corporate debt service coverage ratios making a hard landing fairly unlikely.

- Soft landing (30%) – In our best-case scenario inflation starts to come down, it doesn’t get anywhere near the 2% target but it does get down to around 4%. Unemployment does rise but not sharply or to too high a level, so not enough unemployment for a hard landing. The Fed stays on pause, so portfolios wouldn’t get much help from rates, but would get help from high rates giving us higher income. Credit spreads would also be expected to rally considerably.

- ‘Soft-ish’ landing (50%) – Our base case sees inflation still coming down to a more acceptable level for the Fed, but with unemployment growing moderately, enough for it to consider easing at least. We might not see a cut in 2023, but we believe there is a catalyst for policy change and we’ll see Fed rhetoric pivot later in the year to set up a loosening. We would expect rates to see a late rally in this scenario, and although we wouldn’t anticipate credit spreads rallying significantly, we do see certain sectors outperforming, and with the help from rates, portfolios could make their yield and a little capital gain.

The US and the Fed

Despite the Fed’s aggressive approach to tightening financial conditions, the US economy has so far remained robust, with the consumer absorbing the cost-of-living crisis better than would be expected, helped in no small part by a very tight labour market and a continuing low unemployment rate.

US unemployment could prove to be a key indicator for asset performance next year, as it will be one of the key components that determines the path of rates, and in particular the potential for a policy ‘pivot’ from the Fed. If the unemployment rate stays below 4.5% (currently 3.6%), then we don’t think the Fed will feel much pressure to ease policy. However, it is worth noting that despite the tightness of the jobs market, when the unemployment rate does begin to move higher it typically does so aggressively, and we will therefore be listening very closely to company CEOs for any early indicators that the job cutting we have seen from various tech giants is spreading to the broader economy.

While there are plenty of unknowns regarding the ultimate impact of the rate hiking policy from the Fed – and we have to acknowledge that there will be a lag on this policy’s full impact – we expect the US economy to remain robust, and that if a recession occurs in 2023 it will be relatively mild. Overall, we think the US economy should manage to grow slightly next year, helped by a pause from the Fed as inflation continues to fall.

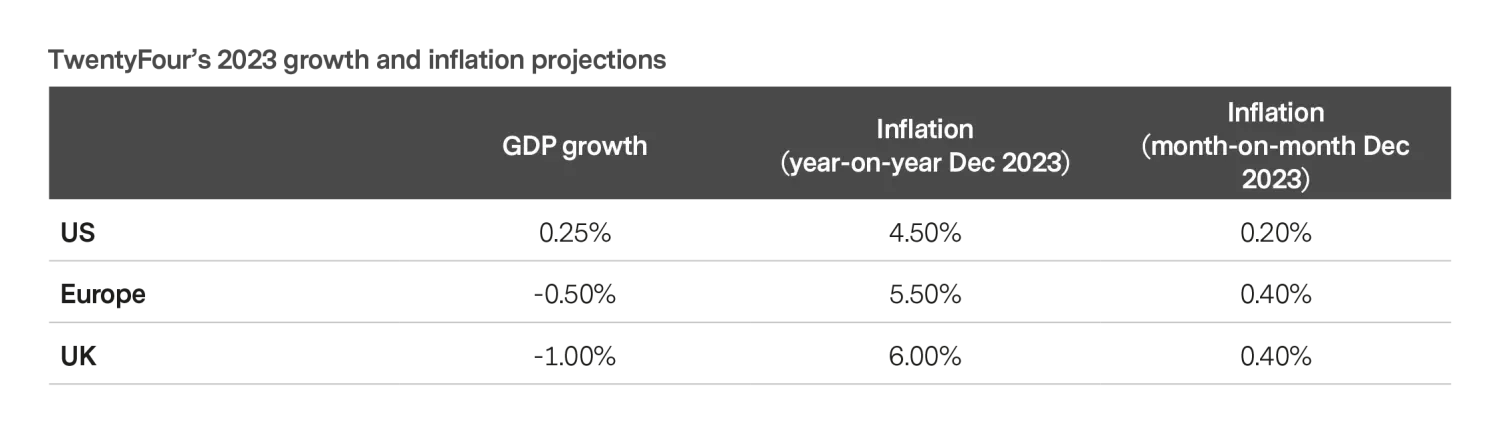

We expect inflation to remain quite sticky in the US, but we do think the hard work has already been done by the Fed and thus we expect the Consumer Price Index (CPI) rate to fall below 5% again next year, perhaps as low as 4%. We think the monthly rate of inflation will also fall quite significantly in the US across 2023, reaching around 0.2% by the end of the year.

The Fed is expected to hike by 50bp at its December 14 meeting, taking the upper bound of the Fed Funds rate to 4.5%, and there is some confidence that this may be the peak for rates, though we think there is certainly a case to be made for another 25-50bp of hikes being needed in 2023. While we believe we are approaching terminal rates, we are not in the ‘Fed pivot’ camp. We don’t think we will see a cut next year, as we think the unemployment rate will remain low enough for the Fed to keep its focus solely on inflation.

Extrapolating that view across to US Treasury performance, if we assume the US gets neither a recession nor a Fed pivot in 2023, then for much of the year we will be absent a catalyst for UST yields to tighten. Ultimately we think 10-year Treasuries will end the year close to where they are currently, at around 3.75%, though markets could start to price in rate cuts for 2024, late next year. We expect a flat curve right out to the 30-year point, but with the inverted 2s-10s curve persisting as we think base rates will remain either unchanged or slightly higher for all of 2023.

The Fed is also expected to achieve $1tr of quantitative tightening (QT) during the year, and we should note here that we have little historic guidance as to how this will play out in terms of its likely impact on the economy or on UST yields in general. Like we said, uncertainties remain.

Europe and the ECB

The Eurozone is facing many challenges: a war on its doorstep, external drivers (mainly energy costs) forcing inflation to levels never experienced by the ECB, a seemingly inflexible labour force forcing unemployment rates to record lows, and fears that wage inflation could ultimately become a broader issue in the region (though as yet we believe union demands remain reasonable).

We expect the Eurozone to be in a recession next year, though again we think this should be relatively mild, helped by the recent improvement in the energy outlook. Of course, there are also a lot of unknown factors when looking at the outlook for the European economy, the biggest clearly being the ongoing war in Ukraine. If a path to a ceasefire can be found, this would be a very positive development for the Eurozone economy and would likely change our views.

The Eurozone is also in a more difficult place than the US on inflation, with the ECB having been slower to hike and also dealing with a lot of external inflation, over which it has little power. We do expect inflation to fall, but to remain at much higher levels than previously seen, probably coming in around 5.5%. We expect the monthly inflation rate to be double that of the US by the end of 2023. Clouding that view of course is government interventions such as energy price caps, whose impact on the official inflation rate is hard to quantify at this stage.

The ECB has hiked rates by 200bp to 1.5% this year, and markets project rates will be a further 150bp higher during 2023, which we are broadly in agreement with. That said, we had a lively debate on ECB policy and 150bp of hikes could well prove too ambitious, given the economic pressures. Much will be down to how inflation responds to the hikes we have seen so far. As recently as September, the ECB had rates at 0% when the Fed was already at 2.5%, so we think you can expect a continued lagging effect in Europe.

With 10-year Bund yields currently just below 2%, we see these tracking higher by 50-75bp next year. However, there is obviously a range of opinions on the ECB Governing Council, and with Eurozone countries clearly on different tracks, opinions could diverge further in 2023, which could influence rates significantly.

The team were also split on whether the ECB would achieve lift-off on QT next year, with most votes saying no and at most €200bn being achieved.

The UK and the BoE

The UK is facing many of the same problems as the Eurozone, and while the disastrous response to the ‘mini-Budget’ of late September appears to be behind us, we think the impact could be longer lasting; the Autumn Statement from the new administration made it clear that the books need to be balanced. We expect a more severe recession in the UK, with a contraction of around 1% in 2023 as businesses and consumers confront higher rates and higher taxes. While unemployment has remained very low, consumer expenditure is expected to slow materially. Inflation should fall fairly sharply from its current very high level in the UK, but we think it will be slightly higher than in the Eurozone in 12 months’ time, with the same caveat that the impact of a substantial government intervention in the energy market is yet to be fully understood.

The BoE has been very clear that in its view external factors have been the biggest driver of inflation, but it is determined to hike rates until inflation is under control. That said, Andrew Bailey and co will also have one eye on their own gloomy outlook for economic growth.

The BoE has hiked rates by 275bp to 3% this year, but we think it needs to continue on this path and so we expect rates to reach 4% in 2023 as it looks to tackle inflation, which is currently running at over 11%. UK Gilt yields have rallied strongly since the Truss administration dissolved, but given the likely path of rate hikes, we think the 10-year yield needs to move back toward 4%, though there was plenty of debate and divergence on the team regarding BoE policy and rates. The 2s-10s curve is also expected to remain inverted, but again, the curve being flat from 10 to 30 years. The BoE is also expected to achieve £75-100bn of QT.

It should be said that our outlook for global growth is more positive, with the potential for a relaxation of China’s zero-COVID policy being a welcome and potentially significant development. We expect global GDP growth to exceed 2% in 2023, higher than in the US or Europe.

Prospect of strong returns from credit

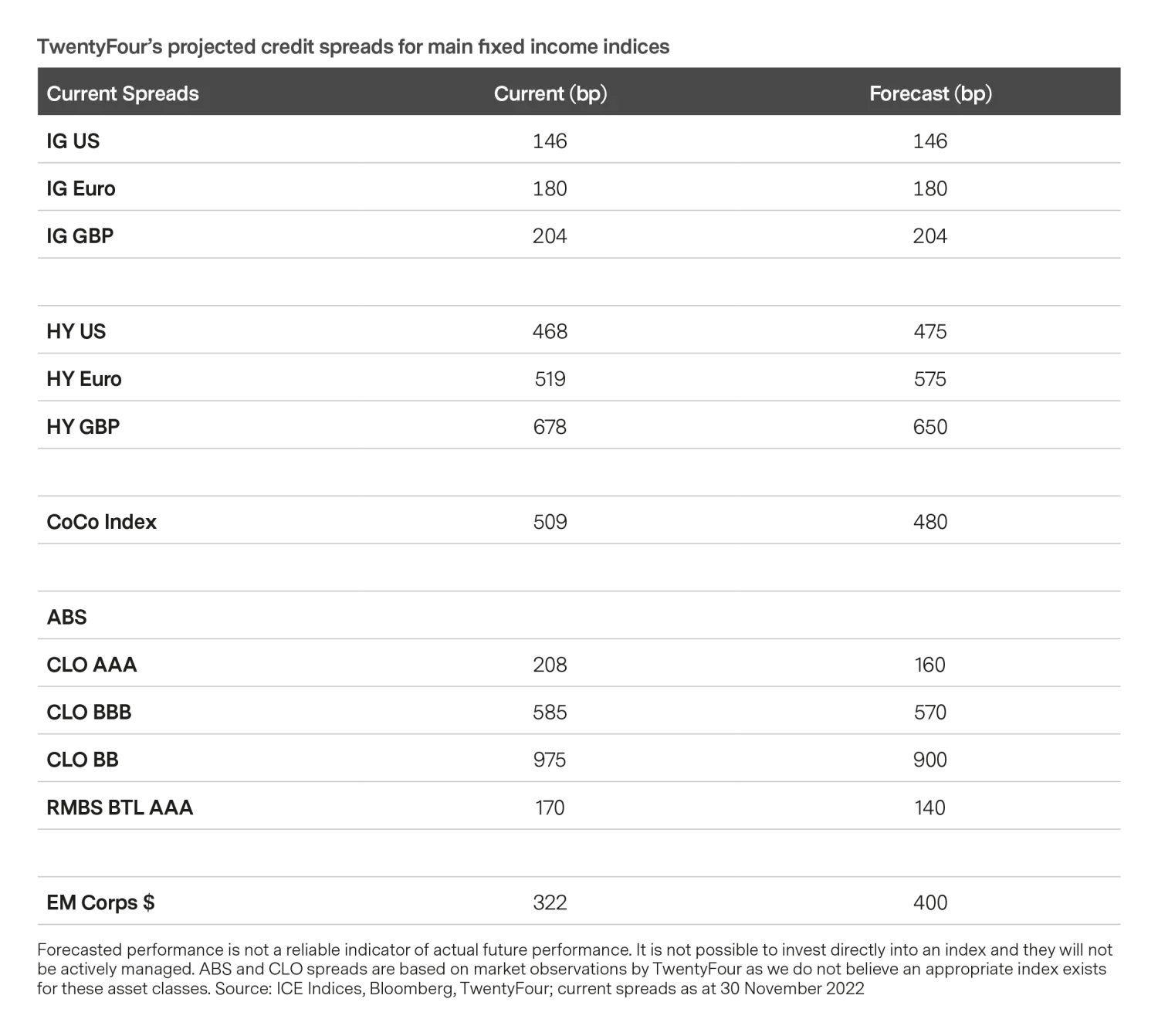

Despite an outlook that includes the US skirting recession and both the Eurozone and UK succumbing to one, the starting point for yields, combined with the expectation of a relatively mild default cycle, means we think fixed income can deliver strong returns for investors in 2023. Spreads have rallied strongly in Q4 and we think a retracement in high yield spreads is likely in H1 as recession fears build and the economy weakens, though we expect spreads to recover again in H2. There is a chance we are being too cautious in our outlook for credit, and that by year-end 2023 the prospect of rate cuts in 2024 will help spreads to rally more strongly than our base case.

Banks, ABS and IG all look compelling

Although we don’t expect a strong rally in US Treasury yields from where we are currently, we think that holding 10-year USTs can give a portfolio both yield and balance, as well as help manage downside risk if the US does enter a more severe recession. FOMC members are continuing with their hawkish rhetoric, and while it’s not our base case, we can’t dismiss the fact that they may continue to hike aggressively even if CPI continues to fall. There is a chance that Fed actions cause markets to build in the possibility of a policy error, which would increase the chances of a pivot, and history indicates Treasury yields can move very quickly when they are seen as the safe haven.

High starting yields across many fixed income sectors increase the likelihood of achieving positive returns in our view. The high yield sectors provide a lot of yield opportunities currently, but given the strong spread tightening recently, we think some of this may be given back early next year should recession fears persist and defaults begin to rise. Nevertheless, we think investors can be positively rewarded for this volatility, but they will need to be stock specific and continue to avoid cyclical sectors, in particular those exposed to the energy crisis continuing. For those investors who want to stay in higher quality bonds, with starting yields for investment grade indices now higher than at any time since the global financial crisis and with central banks having already hiked rates significantly, we think these sectors also look compelling.

The financials sector is again one of the areas we see some of the most attractive value opportunities persisting. Banks on the whole look to be very well positioned to deal with the expected recession, with very high capital levels and clean balance sheets. In addition, higher rates will allow them to achieve much higher net interest margin (NIM) than during the prolonged low interest rate environment they have experienced in recent years. We’ve already seen this impact during the last reporting period, when banks mostly reported higher than expected revenues. While we think non-performing loans (NPLs) are likely to increase in the more challenging period ahead, that higher NIM is the first line of defence for banks and we would also expect NPLs to be very contained. The AT1 sector is high beta, and we think call concerns will likely persist, however we expect reasonable tightening in spreads over the coming year, and with current yields at around 8.5% at the index level and over 10% on individual bonds, we think this sector is well placed to outperform broader credit. In addition, we also think there are compelling value opportunities along the capital structure; recent Tier 2 issuance has offered coupons of 7-8% in GBP for IG rated bonds, which in our view should provide strong returns over the medium term.

ABS sectors are also looking compelling in our view, with high quality RMBS expected to tighten significantly given yields now on offer are more attractive with rates having moved higher. The CLO sector has taken a lot of pain this year as recessionary fears have caused leverage loan spreads to widen, but with CLO spreads of around 600bp available for triple-B and 1,000bp for double-B rated tranches, the higher yield on CLOs compared with the start of 2022, added to the potential for capital gain as we expect spreads to tighten, could make this one of the top performers in fixed income in 2023.

On the downside, we think emerging markets will again struggle in 2023, with ESG concerns playing a part in this, but largely because we think there is such compelling value available in developed economies meaning fast money may not flow back to EM very quickly. Nevertheless, the high starting yield looks attractive and we think a lot of bad news has already been priced in, so returns should still be positive.

Bumpy recovery favours stock selection

In our view, 2023 is a year for fixed income investors to be very stock specific. Again, we anticipate an uneven recovery, and central banks are only just beginning their exit from an unprecedented era of low rates and liquidity provision; it is difficult for anyone to predict how this unwind could impact asset performance in the next 12 months and beyond. Volatility can cause fractures in areas that weren’t previously a cause for concern, as the UK’s Gilt sell-off and subsequent pension fund crisis at the start of Q4 neatly demonstrated. Equally the recent non-calls of hybrid bonds issued by several Real Estate Investment Trusts (aka REITs), for example, will increase scrutiny of that industry going forward.

However, while there are risks ahead, it was clear in our debate that confidence among the team was high that investors could look forward to a much more positive 2023, helped in no small part by the attractive starting yields.

The pain taken this year has left high quality companies trading at yields that rarely persist for very long, and as we approach year-end there is plenty of evidence from primary markets that buyers are coming off the side-lines looking to take advantage of the value opportunities available. For the first time in a long time, our team sees attractive value available in most parts of fixed income; rates can now give you yield and downside mitigation, while across credit yields are at near-decade highs, and confidence was high that investors could enjoy strong 12-month returns.

Some of the greatest confidence expressed in our discussions was in the resilience and attractiveness of the financials sector. Having IG rated banks and insurance companies with debt outstanding that yields up to 10%, or even more in some cases, is very unusual and unlikely to persist for a long period of time in our view. With attractive value options available across the debt stack, this was the sector where there was most optimism and we think it should be towards the top of the best performing sectors list next year. In addition, for those investors who can take slightly less liquid bonds, the CLO sector looks particularly attractive to us, and even without any capital gain the returns here could be very attractive.

All told, we think starting yields are giving fixed income a decent head start on potential returns for 2023, and crucially in our view investors don’t need to reach for risk to build a high income portfolio profile with potential for some capital gain as well.

1. Based on the ICE BofA US Corporate Index (C0A0), ICE BofA Sterling Corporate Index (UR00) and ICE BofA Euro Corporate Index (ER00) as of 30 November 2022

Important Information:

The views expressed represent the opinions of TwentyFour as at 6 December 2022, they may change and may also not be shared by other entities within the Vontobel Group. TwentyFour, its affiliates and the individuals associated therewith may (in various capacities) have positions or deal in securities (or related derivatives) identical or similar to those described herein.

Any projections, forecasts or estimates contained herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that TwentyFour or Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such.