At Quantitative Investments, we are responding to ESG investing by integrating environmental, social and governance (ESG) criteria into our systematic and hybrid strategies across different asset classes. We believe the use of ESG data encourages greater transparency and the ability to evaluate companies in a more objective manner. However, much of this data requires additional processing. This calls for a sophisticated systematic approach, in which we include forecasting methods, alternative data, and machine learning.

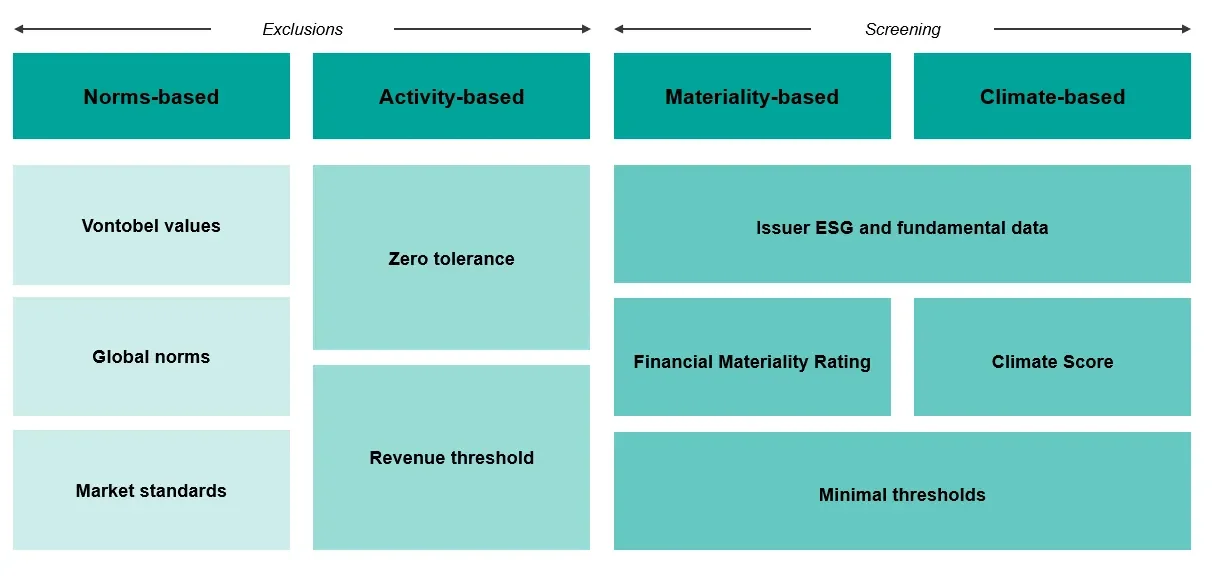

We developed a four-step ESG process, which combines exclusions with screening policies. In the first step, we use exclusion criteria, ensuring alignment with Vontobel values, global norms, and common market standards. In the second step, we apply the most sought-after activity-based exclusions in the global market, using different revenue thresholds. In the last two steps, we screen the investment universe based on two proprietary ratings we developed ourselves. Based on academic research, we focus on the concept of financial materiality and identify sustainability issues, which have a material impact on the financial performance of an issuer. In addition, we calculate a proprietary climate score to assess companies’ exposure to climate change risk by various backward- and forward-looking information.

With our approach we cover roughly 7,100 securities globally. In addition to this standard approach, which we use for our ESG strategies, we also offer flexible and tailored investment solutions for clients who have their own sustainability requirements.