TwentyFour

Macro data and central banks miss the year-end memo

Primary market and trading activity may be declining as is typical in late December, but macro data doesn’t sleep, and central banks haven’t got the memo on the wind-down into year-end either with policy meetings at the Federal Reserve (Fed) and the Bank of England (BoE) scheduled for Wednesday and Thursday respectively.

TwentyFour

Two overlooked economic variables that matter for bonds

With analysts steadily publishing their projections for 2025 (ours are here), the macro variables that tend to get the spotlight are naturally growth and inflation.

TwentyFour

Fixed Income 2025: Yields trump possibility of spread correction

With a macro backdrop of falling rates and solid global growth, TwentyFour Asset Management's Eoin Walsh says fixed income investors can expect healthy total returns in 2025.

TwentyFour

A difference of opinion in US and European CLOs

Last week, members of TwentyFour’s asset-backed securities (ABS) portfolio management team were in Dana Point, California for the Opal Group CLO Summit, an annual event with over 2,000 participants made up of investors, bankers, CLO managers, service providers and lawyers.

TwentyFour

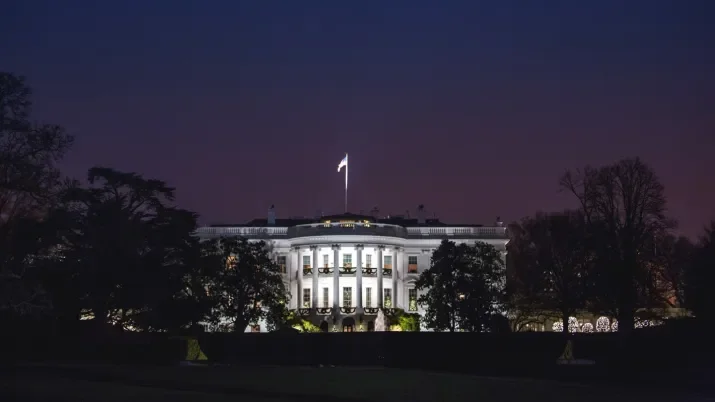

Does Trump’s win change anything for fixed income?

With Donald Trump’s solid victory helping the dust around the US election result settle faster than many might have expected, investors’ attention has promptly shifted to the potential economic and financial market implications of the new administration.

TwentyFour

The cutting cycle begins

Uncertainty is over, it was a 50 basis points (bps) move. As we mentioned in our previous blog, the most important take away from the Federal Open Market Committee (FOMC) meeting would be their assessment of the economy.

TwentyFour

Fed preview: Look beyond the size of the cut

While the majority of headlines have concerned whether the Fed will do 25bp or 50bp to kick off its cutting cycle, we think this is only one part of the discussion – and not necessarily the most important one.

TwentyFour

Powell’s Masterplan allows for earlier intervention

In his headlining speech at the Jackson Hole Economic Symposium, Federal Reserve (Fed) chair Jerome Powell’s message to the market was clear.

TwentyFour

Fixed income in strong position with Fed cut a done deal

It feels as though market news hasn’t taken a holiday so far this summer. From the US on Wednesday we got the minutes of the Federal Reserve’s (Fed) July 30-31 policy meeting, and revisions to a whole year of non-farm payrolls (NFP) data from the Bureau of Labour Statistics (BLS).

TwentyFour

US inflation makes case for (small) September rate cut

Recent US Consumer Price Index (CPI) inflation data brought good news for investors and central banks.

TwentyFour

Labour market dents soft landing sentiment

If you were on vacation last week, your holiday blues wouldn’t have been helped when you looked at your screens this morning, given how quickly sentiment has changed, mainly on the back of one data point.

TwentyFour

Politics won’t trump data for the Fed

The last few weeks have seen former President Donald Trump establish a lead over current President Joe Biden across polls in the run-up to November’s US election. Even though it is early days and a lot can change before November (including the Democrat candidate), it is worth considering what a second Trump term might mean for the world economy and for fixed income markets.