No, you haven’t missed the fixed income rally

TwentyFour

We expected 2023 to be a decent year for bond returns given the high starting yields on offer, but like all markets fixed income has rallied further (and sooner) than many would have thought in the first few weeks of this year.

In our view the January rally has been justified given the economic backdrop, but it does mean we are getting a frequent question from investors: “Have I missed the rally?”

While yields were certainly higher amid the market lows of October, back then investors faced a troubling set of risks. Primary markets were not fully open, inflation was still rising, central banks were still increasing terminal rate expectations, there was the very real prospect of energy rationing in Europe and a virtually unanimous view that the world was headed for recession.

Today those risks look rather different. Primary markets are open and showing healthy investor demand, headline inflation looks to be coming under control, central banks are getting closer to terminal rates and more robust economic data has reduced the chances of a severe recession.

So no, we don’t think you’ve missed the rally. In fact, on a risk-adjusted basis we think today’s yields are more attractive than they were in early Q4 last year, rather than less. In this context and after strong performance across most asset classes it is worth taking a step back to reassess relative value opportunities. Are there markets that still look cheap?

We think European CLOs stand out as one of the best relative value opportunities out there currently.

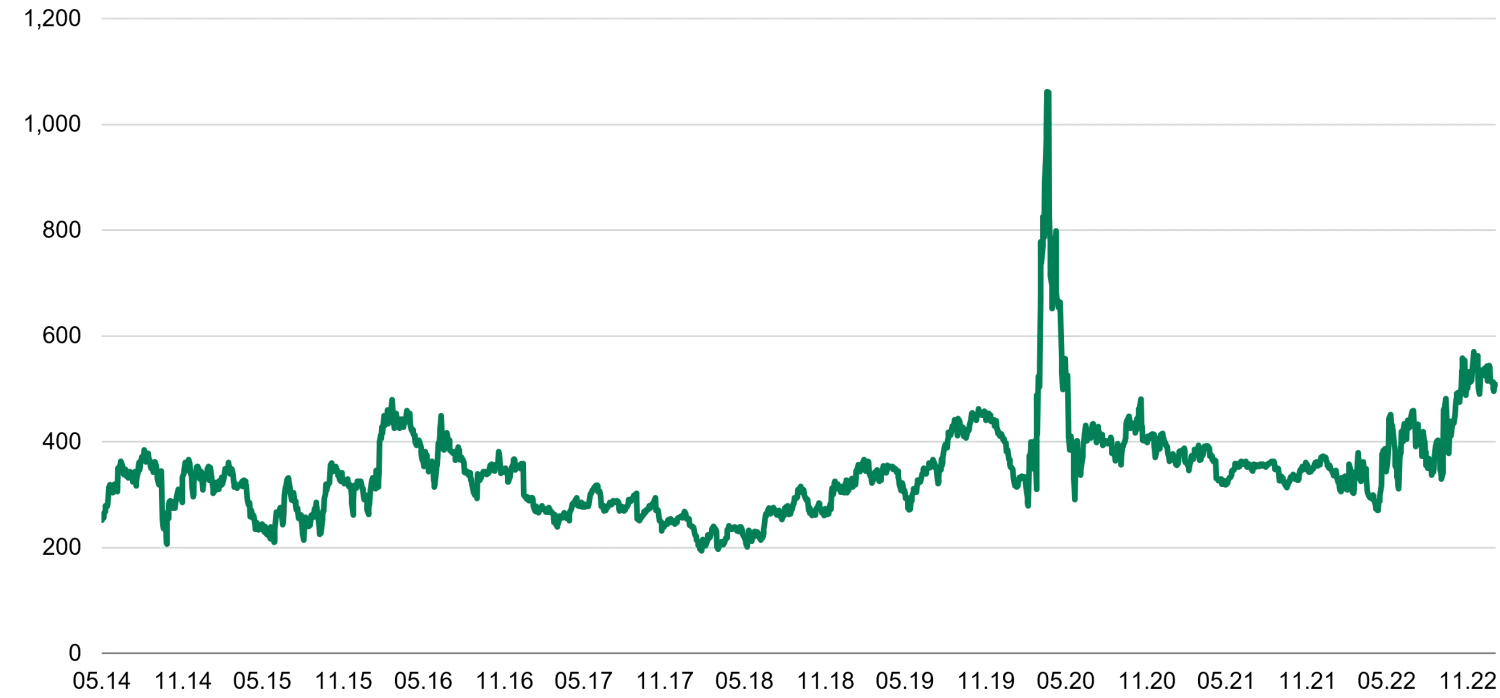

The graph below shows the difference between BB CLO spreads and European high yield bond spreads. While BB CLOs have historically traded at a premium to high yield, today this premium is at very wide levels. At the moment BB CLOs give investors approximately 500bp more spread than high yield bonds, which is significantly above the average of 340bp in the nine-year period the graph portrays.

BB CLO - Xover (bp)

Source: Bloomberg, Citi Velocity, 1 February 2023

In fact, if we take all the trading days since January 2014 this premium was higher than current levels only 4% of the time, and this was at the peak of the COVID-19 crisis in March 2020 when the prices being posted by trading desks could not be relied upon for transacting. Excluding that brief spike the premium is close to a nine-year high.

The rally we have witnessed so far this year (CLOs included) is more than a bounce following a period of poor performance, in our view. It has its roots in a reassessment of the economic outlook, prompted mostly by China reopening its economy and European energy prices coming significantly off recent highs. This has led to upward revisions in growth projections for most regions across the world, the first such revisions we have had in several quarters. Consequently the outlook for defaults and corporate earnings should also improve compared to what was expected only a few months ago. We tend to think that in this environment it is only a matter of time before the historic relationship between BB CLOs and high yield spreads normalises.

Strong across-the-board rallies such as the one we have just seen do not necessarily mean historical relationships between asset classes go back to normal. Headline yields have certainly been trimmed by the shift in economic sentiment that sparked January’s rally, but in our view today’s yields are supported by a more robust economic backdrop, making them better value than the higher yields available in Q4 which came with a large dose of uncertainty.

As the BB CLO premium demonstrates, there are still ample opportunities out there for fixed income investors who do the work.