Quantitative Investments

Systematic investment approach update: August 2024

Watch and learn about the latest trends in Quantitative Investment’s systematic approach, in volatility, equities, fixed income and Fx

TwentyFour

Fixed income in strong position with Fed cut a done deal

It feels as though market news hasn’t taken a holiday so far this summer. From the US on Wednesday we got the minutes of the Federal Reserve’s (Fed) July 30-31 policy meeting, and revisions to a whole year of non-farm payrolls (NFP) data from the Bureau of Labour Statistics (BLS).

Quality Growth Boutique

View short-term, election-related volatility through a long-term lens

How do you manage the impact of market volatility driven by election outcomes? Matthew Benkendorf, CIO of our Quality Growth Boutique, shares ways to help mitigate risks and stay focused on business fundamentals that point to enduring quality.

Conviction Equities Boutique

Global equities reimagined: structural growth, diversification, impact

A cleaner, more resource-efficient path to the future is clear. What's less discussed is the massive growth opportunity this presents for investors seeking to diversify their global equity portfolios. This article encourages global equity investors to rethink the role of environmental impact strategies in their portfolios.

TwentyFour

US inflation makes case for (small) September rate cut

Recent US Consumer Price Index (CPI) inflation data brought good news for investors and central banks.

Quantitative Investments

The Kamala rally

As we navigate this historic US election, with its many twists and turns, our latest Quanta Byte explores how real-time data can be used to forecast outcomes and the potential effect of these outcomes on US equities.

Asset management

Geopolitics and Climate Change

What is the intersection between geopolitics and climate change? The latest white paper by our Chief Economist Reto Cueni and Senior ESG Analyst Veronika Stolbova explores how these factors shape international relations, industrial policies, and the global power balance.

Quality Growth Boutique

Today’s market turmoil: a reminder that investing is a marathon, not a sprint

Investors have been chasing their favorite AI names around the track, without considering how they could sustain their earnings growth for a prolonged period or through a recession. As long-term investors, we aim to remain focused on resilient companies with durable business models, which we believe will finish the race.

TwentyFour

Labour market dents soft landing sentiment

If you were on vacation last week, your holiday blues wouldn’t have been helped when you looked at your screens this morning, given how quickly sentiment has changed, mainly on the back of one data point.

TwentyFour

The duration deliberation

TwentyFour Asset Management's Chris Bowie discusses the underweight duration across all of our outcome driven strategies, how this phase is now coming to an end, and why we are beginning to increase our interest rate duration in all of our funds.

TwentyFour

Opportunities within European credit

Positioning and fixed income markets have remained quite tricky this year, however credit markets have continued to perform very strongly. TwentyFour Asset Management's Eoin Walsh, discusses why he thinks there is opportunity within European credit despite the rate headwinds and pull back on some of the aggressive rate cutting expectations markets had at the start of the year.

Quantitative Investments

Tensor stacking unplugged

Stacking tensors is a routine task in machine learning, and it's included in most open-source packages. The newest Quanta Byte from Quantitative Investments provides an in-depth look at what tensor stacking is and its various uses.

Quantitative Investments

Systematic and Hybrid investment approaches: July 2024

Quantitative Investments is beginning a series of monthly videos, each with an update on both systematic and hybrid aspects of investment approaches. Watch the latest updates.

Quality Growth Boutique

Judgment Call: Looking behind the numbers to identify real quality

Navigating challenging markets requires assessing earnings and revenue trends and digging into balance sheets. But financial metrics alone can be backward looking. A fundamental understanding of industries, companies, and markets can provide important insights that can help avoid hidden risks and identify overlooked growth drivers.

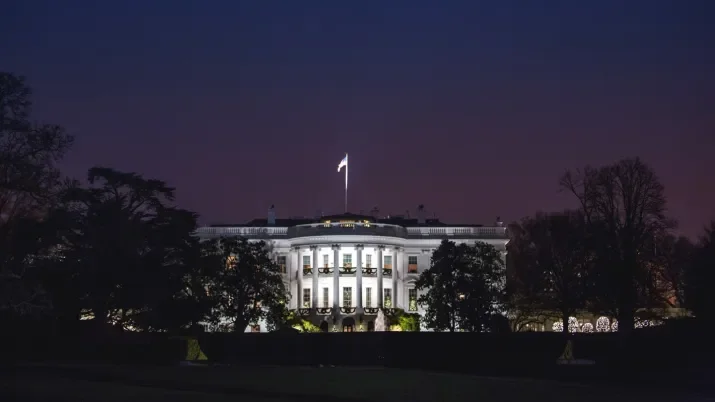

Conviction Equities Boutique

Trump 2.0: what would it mean for the trend towards net zero?

By the end of this historical election year, nearly half of the world’s population is expected to have gone to the polls to vote for their respective leaders. In the world’s biggest economy, the race has yet to be decided. What might a second Donald Trump term mean for net zero if he were to be re-elected?

TwentyFour

Everything you need to know about corporate hybrids

Corporate hybrids are a type of bond issued by companies – they are known as hybrids because they combine certain features of debt and equity.

TwentyFour

Politics won’t trump data for the Fed

The last few weeks have seen former President Donald Trump establish a lead over current President Joe Biden across polls in the run-up to November’s US election. Even though it is early days and a lot can change before November (including the Democrat candidate), it is worth considering what a second Trump term might mean for the world economy and for fixed income markets.

TwentyFour

Wages continue to rein in pace of ECB rate cuts

Last month saw the European Central Bank (ECB) get their cutting cycle underway with a 25bp cut in the deposit rate to 3.75%. However, any expectations for a rapid series of reductions after the first move were tempered by President Christine Lagarde, who at the subsequent press conference was clear that the ECB could move in phases in which they left interest rates unchanged.

Quantitative Investments

How do we play covered calls?

In this three-article series, we revisit covered call strategies. In this third article, we give a glimpse into our investment capabilities and provide readers with details on how to potentially capitalize on the opportunity.

TwentyFour

This strange economic cycle is finally starting to look familiar

There is little disagreement among investors and economists that the last few years have been highly unusual in many respects. An inflationary shock in developed markets, one of the fastest rate hiking cycles on record, the worst year in decades for government bonds (2022), and mild recessions with no movement in unemployment are just a few of the dynamics that have strayed from recent norms.

Quality Growth Boutique

Shades of Quality

Previously considered a niche strategy, quality investing is popular today for a simple reason – it has worked. While there are many nuances in defining a quality company, we focus on five convictions that we believe separate us from other managers.

TwentyFour

French result supports European spreads but budget concerns remain

After weeks of volatility following President Emmanuel Macron’s decision to call snap parliamentary elections in France, markets were breathing a sigh of cautious relief on Monday after the far-right Rassemblement National (RN) underperformed the polls.

TwentyFour

Labour market cooling justifies Fed’s dovish lean

One of the drivers of the dovish pivot from the Federal Reserve (Fed) in December was the acknowledgement that the risks to the policy outlook had become more two-sided. In other words, while higher rates were still needed to tame inflation, the Fed saw a risk that staying restrictive for too long and risk damaging a labour market that has so far shown remarkable resilience.

TwentyFour

Why Europe has jumped ahead of the US for fixed income value

The forecast-defying strength of the US economy has been one of the key drivers of financial markets in recent quarters, but as economic prospects diverge, Europe is where we see the better relative value in fixed income today.