Why inflation demands a global view in credit

TwentyFour

As we approach the quieter summer months, fixed income investors have some good news and they have some bad news.

The good news is several major economies have enacted swift and successful vaccine programs, and we are seeing a sharp economic recovery in the US, Asia and parts of Europe. Despite the damage wrought by COVID-19, credit fundamentals look better than they have done for many years, and both central banks and governments largely remain committed to the support schemes they put in place for the markets and the economy in 2020.

In the bad news column is the threat of inflation, particularly in the US, as economies open up and attempt to cope with rates of growth not normally experienced in developed markets. In addition, the weight of market support and the speed of the recovery have left valuations in many sectors of the bond markets looking lofty compared to long term averages, barely a year on from a widespread global recession. It is a frustrating scenario for investors facing what is expected to be a persistent low yield environment.

With inflation data continuing to beat expectations and the potential for the US Federal Reserve to start talking about tapering its asset purchases, we believe markets might experience a bump in the road as investors wait for clarity on where the US economy and the Fed will go from here. However, there are three major reasons I believe our global, unconstrained Strategic Income Strategy is capable of navigating this period while being able to protect returns and maintain income.

1. Credit fundamentals are flying

The remarkable pace of this new economic cycle, which has flown from recession through the recovery phase and arguably into mid-cycle conditions in a matter of months, is reflected in the rude health of credit fundamentals. The trailing 12-month default rate for US high yield bonds, for example, fell to a new cycle low of just 3.07% in May (1.19% if you strip out energy companies) and for loans it was a staggeringly low 1.96% (1.68% ex-energy)1. According to Moody’s, the ratio of upgrades to downgrades is also ratcheting higher across the globe. In the UK between April 1 and June 8 there were 2.4 upgrades for every downgrade and in Europe the picture was similar, but it was even stronger in the US where there were 3.8 upgrades per downgrade for the same period; if that ratio was maintained for Q2 as a whole it would be the single best quarter by this metric in the last decade.

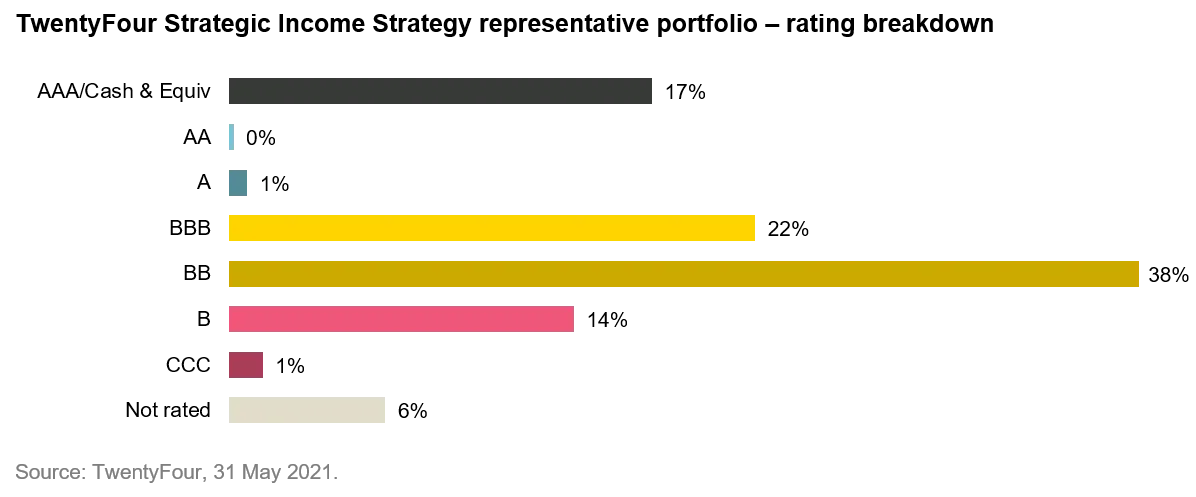

Bond investors in general then should be staying well invested in credit in my view. The data seems to justify the high valuations we see at present; with so much stimulus still to come and a roaring global economy expected in H2, the chances of picking winners currently looks to be rather higher than average, especially in the lower rated sections of the credit markets. This explains our current ~38% allocation to BB rated bonds and ~14% allocation to B rated bonds, where we see potential for further capital gains with these highly fertile conditions looking set to persist in the coming months2.

2. A global view can help unlock more value

For some time, traditional ‘risk-free’ rates products such as US Treasuries, German Bunds and UK Gilts have also been return-free, offering near-zero yields and the added risk of capital loss if government yield curves resume the bear steepening trend that took hold earlier this year. However, we don’t think all government bond curves are equally vulnerable to the threat of inflation and the corrosive impact of rising yields. Currently we see Gilts as the most vulnerable; UK inflation maybe running at 2.1% currently versus a blistering 5% in the US, but due to the UK’s faster vaccine program and the added supply chain complications of Brexit, we think UK price rises ultimately have the potential to outstrip the US. With Europe currently lagging on vaccines, economy re-opening and inflation, we see Bunds as the least vulnerable of these major rates markets.

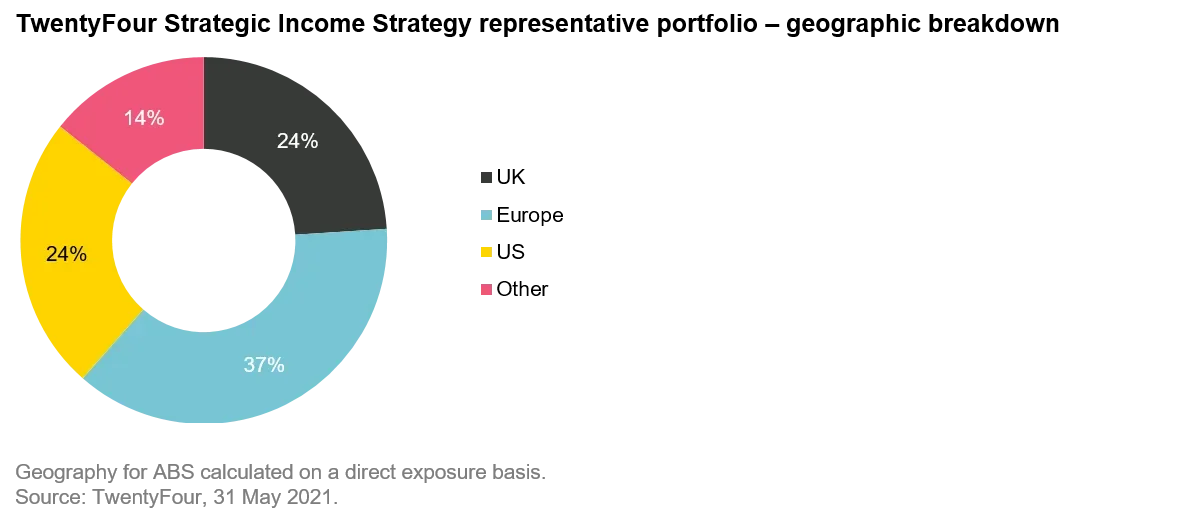

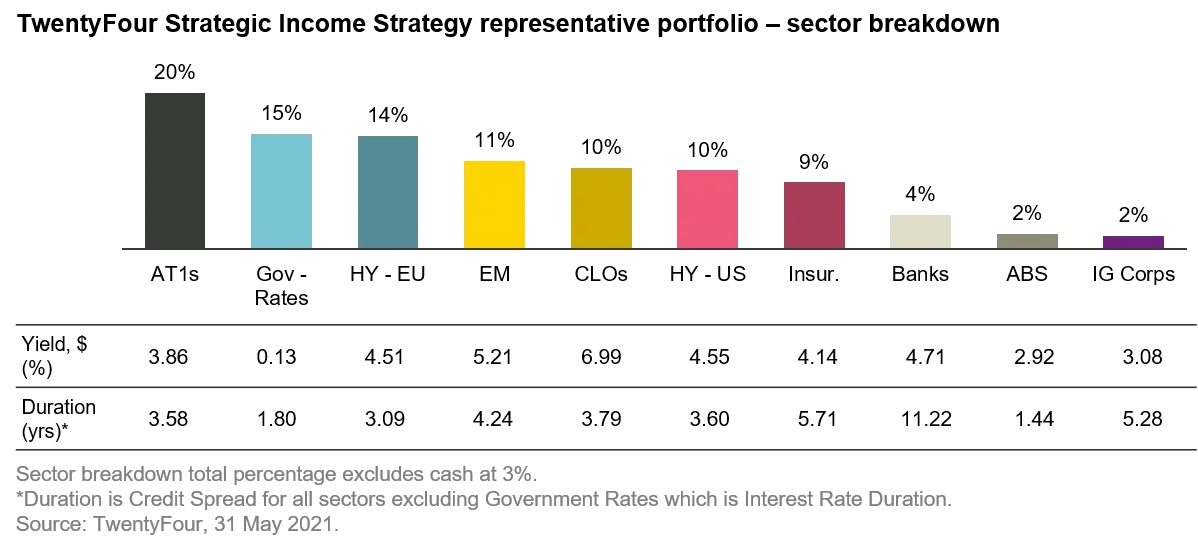

This is why we believe it is necessary for fixed income funds to have a truly global mandate. Our allocation to European high yield is currently slightly higher than US high yield, for example, despite the evident strength of the US economy in relation to Europe. While we believe there are certainly good credit opportunities in the US, on the whole we see better value in Europe currently. At the margin we prefer to be exposed to the European curve on a currency hedged basis as we see less chance of Bund yields rising sharply and eating into our credit spread.

3. Uncertainty can present buying opportunities

One of the biggest challenges bond investors face today is the divergence of views on the threat of inflation, or more accurately what type of inflation we are going to experience as economies continue to open up. The Fed’s message that any inflation stemming from the US economic recovery should be transitory and interest rates will stay put for some time yet has been extremely consistent for the last year, and it has remained so this year despite several data prints suggesting a more permanent form of inflation may be taking hold. We are not alone in thinking that not all of the inflation we are starting to experience will be transitory; it is too early to know for sure, but we can be reasonably certain that with 10-year US Treasury yields around 1.48% as of June 22, the market isn’t currently pricing in much non-transitory inflation.

With this uncertainty hanging over the market, we see potential for bouts of broader market volatility in the coming months as investors try to decipher changes in central bank rhetoric and uneven economic data. This is why in the last few weeks we have adjusted our credit spread duration down slightly and increased our cash and liquidity assets bucket, with the intention of giving us the flexibility to be able to take advantage of any market dips and buy into our favored assets at cheaper levels.

1. Source: Bloomberg

2. Based on a representative portfolio selected as is the oldest and most representative account of the strategy. Positioning as at 31 May 2021.