Panic Eases, But Pricing Peculiarities Persist in Fixed Income

TwentyFour

On day one of the historic lockdown of the UK we are seeing some return to normal correlations with ‘risk-free’ government bonds once again exhibiting a negative correlation to broader markets. Some of the panic selling has also abated as investors are gradually building their cash piles to desirable levels. However, we are still a long way away from normal bond markets. Allow me to show you some extreme examples that might otherwise go unnoticed.

The first example is a recent topic of ours; called bank capital bonds trading below par. Let’s take Aldermore’s 11.875% AT1s, for example, which were called on March 2 and have therefore been triggered to mature on April 30. Aldermore is one of the original UK challenger banks, but was acquired by FirstRand, the South African banking group. We’ve written about called bonds from SEB and ING trading below par, but these were at least close to par – the Aldermore bond appears to be a special case, being bid at around 90.0 by practically all the dealers that quote it on Bloomberg.

So surely investors would want to buy this bond? After all this is as close to risk-free money as one could get in our market. Well, any investor trying to do just that will likely have found this a frustrating experience, since we have seen zero offers despite the screens quoting the bonds at a cash price in the low 90s. Even at 99.00 there is no offer, but equally frustratingly for holders it sits in portfolios marked in the low 90s, which is a yield of around 100% for the next five weeks. This is extreme and it is real, though these stresses do not tend to last that long.

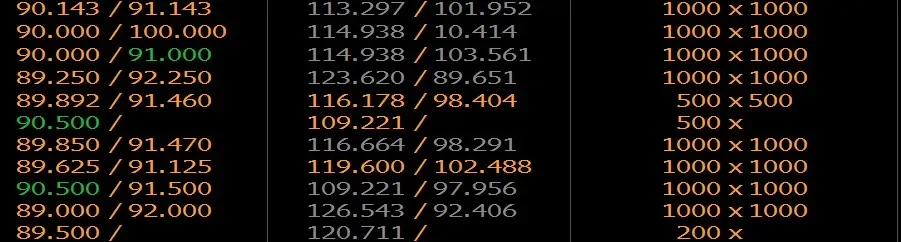

Here are some live quotes for the Aldermore AT1 as of midday GMT today:

The other anomaly is related to a much bigger market: FX and FX hedging. Our investors will know that we focus closely on the cost of hedging from one currency into another, because as base rates around the world have differed significantly in recent years, the yield an investor gets in their home currency (assuming they hedge the currency risk) can be significantly different to the yield quoted in a different currency. For example, over the last few years, purchasing a US dollar denominated bond and hedging it back to sterling could have taken anything between 150bp and 200bp from the dollar yield, because base rates in the US were much higher than in the UK. However, sterling base rates are now 0.1% and dollar base rates are 0-0.25%, so shouldn’t this hedging cost have disappeared? You would think so, but it was still over 100bp this morning. In addition, it is interesting that dollar denominated one-month certificates of deposit are still yielding around 90bp, despite the much lower current Fed Funds rate. The reason behind this is likely the shortage of dollars available due to the amount of hoarding taking place .

This is a relatively easy fix requiring intra-central bank swap lines, which are already part of the central bank toolkit having been made permanently available between the Fed, major industrial countries and the European Central Bank during the global financial crisis in 2008. Last week, the Fed established dollar swap lines with nine other central banks due to the global dollar funding strain, so efforts are being made to solve the dollar shortage. As these efforts gain traction, and the new swap lines are put to use, we would expect the hedging cost from the dollar to sterling, as well as other currencies, to narrow also, making dollar denominated debt more attractive for foreign based investors who hedge back to their local currency.