TwentyFour

Does Trump’s win change anything for fixed income?

With Donald Trump’s solid victory helping the dust around the US election result settle faster than many might have expected, investors’ attention has promptly shifted to the potential economic and financial market implications of the new administration.

Multi Asset Boutique

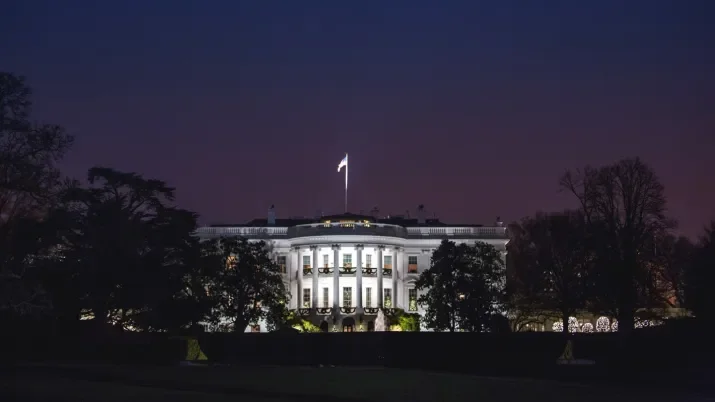

Donald Trump is back: What it means for investors

What lies ahead for investors with a Trump-led government? From tax policies to trade, the Multi Asset Boutique dives into market reactions and potential economic impacts.

TwentyFour

Why the macro outlook is tilted in fixed income’s favour

With elevated yields and inflation expected to come back to target, we think investors can target a level of real return that was extremely difficult to achieve in the previous cycle.

TwentyFour

Multi-Sector Bond Quarterly Update – October 2024

George Curtis from the Multi-Sector Bond (MSB) team at TwentyFour Asset Management reflects on the third quarter of 2024 and its impact on credit and equity markets. Despite some mid-quarter volatility, overall performance remained strong, with government bonds leading the way.

TwentyFour

Asset-Backed Securities Quarterly Update – October 2024

As the third quarter of 2024 comes to a close, TwentyFour Asset Management's Aza Teeuwen reflects on what this has meant for the Asset-Backed Securities (ABS) team. Not only were volumes across European ABS elevated throughout July and August, we also saw €34 billion in primary issuance – a significant increase from previous years.

TwentyFour

Investment Grade Quarterly Update – October 2024

Chris Bowie at TwentyFour Asset Management describes the third quarter of 2024 as a significant turning point in fixed income markets, marked by the Federal Reserve (Fed) cutting interest rates by 50 basis points (bps) for the first time in many years. This followed an earlier 25bp cut by the Bank of England (BoE), setting the scene for further rate cuts over the coming years.

TwentyFour

Can credit keep calm and carry on?

With cracks starting to show in the US economy, many are wondering whether tight corporate bond spreads leave investors vulnerable. But with corporate balance sheets holding firm and yields on higher quality bonds looking attractive, staying invested in credit should continue to reward investors.

TwentyFour

The cutting cycle begins

Uncertainty is over, it was a 50 basis points (bps) move. As we mentioned in our previous blog, the most important take away from the Federal Open Market Committee (FOMC) meeting would be their assessment of the economy.

TwentyFour

Fed preview: Look beyond the size of the cut

While the majority of headlines have concerned whether the Fed will do 25bp or 50bp to kick off its cutting cycle, we think this is only one part of the discussion – and not necessarily the most important one.

TwentyFour

Positioning for late cycle as rate cuts begin

Eoin Walsh delivered the keynote address at TwentyFour Asset Management’s Annual Conference in London on September 10, 2024.

TwentyFour

Powell’s Masterplan allows for earlier intervention

In his headlining speech at the Jackson Hole Economic Symposium, Federal Reserve (Fed) chair Jerome Powell’s message to the market was clear.

Quantitative Investments

Systematic investment approach update: August 2024

Watch and learn about the latest trends in Quantitative Investment’s systematic approach, in volatility, equities, fixed income and Fx

TwentyFour

Fixed income in strong position with Fed cut a done deal

It feels as though market news hasn’t taken a holiday so far this summer. From the US on Wednesday we got the minutes of the Federal Reserve’s (Fed) July 30-31 policy meeting, and revisions to a whole year of non-farm payrolls (NFP) data from the Bureau of Labour Statistics (BLS).

TwentyFour

US inflation makes case for (small) September rate cut

Recent US Consumer Price Index (CPI) inflation data brought good news for investors and central banks.

TwentyFour

Labour market dents soft landing sentiment

If you were on vacation last week, your holiday blues wouldn’t have been helped when you looked at your screens this morning, given how quickly sentiment has changed, mainly on the back of one data point.

TwentyFour

The duration deliberation

TwentyFour Asset Management's Chris Bowie discusses the underweight duration across all of our outcome driven strategies, how this phase is now coming to an end, and why we are beginning to increase our interest rate duration in all of our funds.

TwentyFour

Opportunities within European credit

Positioning and fixed income markets have remained quite tricky this year, however credit markets have continued to perform very strongly. TwentyFour Asset Management's Eoin Walsh, discusses why he thinks there is opportunity within European credit despite the rate headwinds and pull back on some of the aggressive rate cutting expectations markets had at the start of the year.

Quantitative Investments

Systematic and Hybrid investment approaches: July 2024

Quantitative Investments is beginning a series of monthly videos, each with an update on both systematic and hybrid aspects of investment approaches. Watch the latest updates.

TwentyFour

Politics won’t trump data for the Fed

The last few weeks have seen former President Donald Trump establish a lead over current President Joe Biden across polls in the run-up to November’s US election. Even though it is early days and a lot can change before November (including the Democrat candidate), it is worth considering what a second Trump term might mean for the world economy and for fixed income markets.

TwentyFour

Wages continue to rein in pace of ECB rate cuts

Last month saw the European Central Bank (ECB) get their cutting cycle underway with a 25bp cut in the deposit rate to 3.75%. However, any expectations for a rapid series of reductions after the first move were tempered by President Christine Lagarde, who at the subsequent press conference was clear that the ECB could move in phases in which they left interest rates unchanged.

TwentyFour

This strange economic cycle is finally starting to look familiar

There is little disagreement among investors and economists that the last few years have been highly unusual in many respects. An inflationary shock in developed markets, one of the fastest rate hiking cycles on record, the worst year in decades for government bonds (2022), and mild recessions with no movement in unemployment are just a few of the dynamics that have strayed from recent norms.

TwentyFour

French result supports European spreads but budget concerns remain

After weeks of volatility following President Emmanuel Macron’s decision to call snap parliamentary elections in France, markets were breathing a sigh of cautious relief on Monday after the far-right Rassemblement National (RN) underperformed the polls.

TwentyFour

Labour market cooling justifies Fed’s dovish lean

One of the drivers of the dovish pivot from the Federal Reserve (Fed) in December was the acknowledgement that the risks to the policy outlook had become more two-sided. In other words, while higher rates were still needed to tame inflation, the Fed saw a risk that staying restrictive for too long and risk damaging a labour market that has so far shown remarkable resilience.

TwentyFour

The Southgate bond strategy – no subs in the second half

For any fixed income investors that follow the England football team, the plan for H2 2024 may feel somewhat familiar – no substitutions in the second half.