TwentyFour

Italian Mortgages, Natwest and COVID-19

We noted with interest two headlines yesterday: Italy to suspend mortgage payments amid outbreak and RBS and NatWest offer mortgage breaks for customers affected by coronavirus

TwentyFour

Bank Of England Announces “Big, Big Package”

Our take on all of this is that the central bank has acted in a very targeted and timely way, adding large volumes of liquidity at even lower rates, along with significant capital to the banking system.

TwentyFour

What Next For Bonds After 'Capitulation Day'

Monday was one of those days investment professionals will remember all their lives, and compare with similar standout days from the past.

TwentyFour

Coronavirus Predatory Pricing is an ESG Red Flag

Companies, even earnings pressured ones, now need to seriously consider the negative impact on their long term cost of capital from short term decisions to shore up P&L.

TwentyFour

Coronavirus Contagion in Fixed Income

While there has been a rally in risk-off assets since January over coronavirus fears, credit markets have been largely resilient given strong technical demand, driven by huge inflows for bond funds and the wall of cash sitting on the sidelines.

TwentyFour

Could Fiscal Stimulus Inflate Expectations?

Given where asset prices are at the moment, we would categorise inflation as a low probability, but high impact, risk.

TwentyFour

Johnson Clears Path to Fiscal Stimulus

Next month’s budget now has the green light to be Johnson’s fiscal bazooka, with tax cuts, housing schemes and infrastructure projects already mooted.

TwentyFour

Which Central Bank Blinks First?

After a year of over 100 rate cuts around the world in 2019, we felt that 2020 would see major central banks engage wait-and-see mode.

TwentyFour

This Is No Time for Additional Alpha

This deal may well perform in the short-term, and we sincerely hope Alpha’s plan works, but we also recognise there is a high degree of execution risk and the domestic economy still has considerable headwinds.

TwentyFour

Treasuries Offering Good Virus Protection

Perfect timing is practically impossible in situations like these, but one way to tackle this risk is to gradually reduce ‘good’ duration by moving to the shorter part of the UST curve, which would be less sensitive to a move higher in yields.

TwentyFour

A Fond Farewell to the Unreliable Boyfriend?

In what was Mark Carney’s last meeting as governor of the Bank, the MPC delivered a mixed message.

TwentyFour

Slo-mo CLOs Could See Spreads Tighten

Given the material positive performance seen in other parts of the fixed income markets in 2019, the CLO relative value proposition now looks even more attractive.

TwentyFour

The BoE Should Wait and See

A rate cut now makes very little sense to us, and wastes one of the few bullets the BoE has left in its armoury. If they do decide to cut next week, we think it will be reversed within 12 months.

TwentyFour

Margin For Error in Credit Selection Narrows

We have talked regularly about avoiding ‘next year’s skeletons’, and this is now more pertinent given the strength of the current technical backdrop, combined with spread levels that are significantly tighter relative to this time last year.

TwentyFour

ABS Primary Slips Into Gear

We have already highlighted the blistering pace of bond sales in both Europe and the US, and this being met with apparently insatiable demand from fixed income investors. Since European ABS markets tend to lag broader fixed income, it seems fitting that we have had to wait another week before seeing that primary machine start to accelerate.

TwentyFour

Record Inflows Give New Energy to US Bond Market

While the European bond market was setting records last week, the US market has also begun 2020 with a flurry of transactions backed up by record inflows.

TwentyFour

Heavy Supply Meets Heavy Demand

Kicking off the new year, we expected the new issue market to be very active and we certainly haven’t been disappointed, with the good momentum created at the end of last year – thanks to the US and China reaching a ‘phase one’ agreement and the resounding victory by the Conservatives paving the way for Brexit negotiations to move forward – allowing pent-up borrowing demand to hit the market.

TwentyFour

Newell: Fallen Angel to Rising Star?

Fixed income investors are well versed in the risks of ‘fallen angels’, investment grade companies whose bonds tumble in value once they are downgraded to high yield.

TwentyFour

Carney to Leave UK Banks on Solid Ground

The Bank of England (BoE) on Monday published its latest financial stability report and the results of its 2019 bank stress tests, and declared that the UK financial system is well prepared for even a worst-case Brexit and consequent trade war.

TwentyFour

CoreCivic Shows ESG Will Take No Prisoners

"One group of issuers that appears vulnerable to us as we move into a new decade is those facing increased investor scrutiny due to Environmental, Social and Governance (ESG) factors. The case of CoreCivic, a listed REIT in the US, is a good example"

TwentyFour

What Next For Sterling Bonds?

Overnight markets have had significant news to digest, with two of the major geopolitical hurdles that had been worrying investors being removed.

TwentyFour

European HY Default Rates Doubling No Reason to Panic

"Where defaults get to exactly depends on a few things, but we can certainly analyse where we think the problem areas could be, whether cracks are already starting to appear, and what investors might do to protect themselves."

TwentyFour

Trade war volatility maintains grip on bonds

By now investors should be getting used to the ever more frequent hiccups in the trade negotiations between the US and the rest of the world.

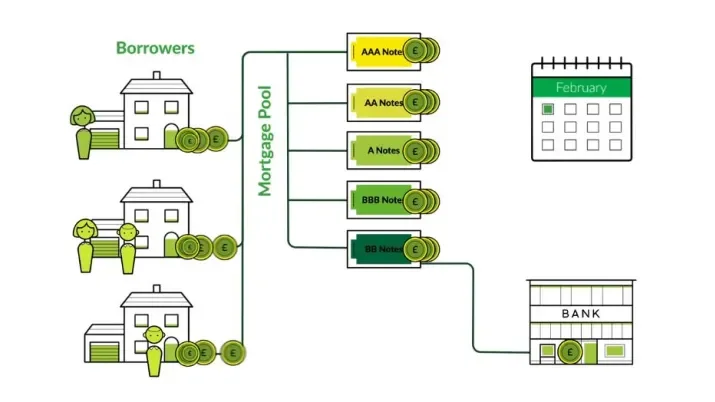

What is an RMBS, and how do they work?

Residential mortgage-backed securities (RMBS) are an under-utilised asset class for many investors, despite boasting some of the lowest default rates across the global fixed income market and offering higher yields and greater investor protections than vanilla corporate bonds of the same rating.