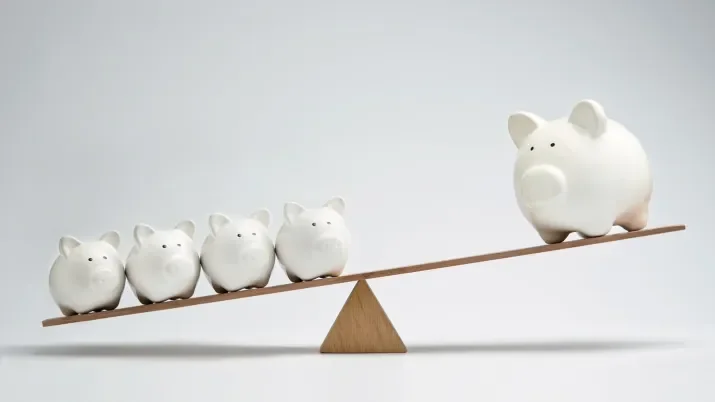

Growing CRE ABS offers diversification and yield

TwentyFour

Many market participants will be familiar with the concept of commercial mortgage-backed securitisations (CMBS), which are often backed by a single loan financing a large development such as an office building or a shopping mall. For smaller-balance CRE loans, the US has a well-established ‘Conduit CMBS’ market where deals are backed by multiple smaller loans, where issuance totalled $31bn in 2021.

CRE lending in Europe has historically been rather different. While European CMBS has become more active in recent years, many larger loans that would typically become CMBS deals in the US are still primarily funded by banks and kept on balance sheet. However, as the capital requirements attached to CRE lending have increased, particularly for higher loan-to-value (LTV) lending, the economics have become less attractive for banks and thus smaller CRE borrowers (loans of around £20m/€20m or less) have increasingly been turning to non-bank lenders to finance their portfolios.

This growth of specialist lenders, along with a tightening of lending standards sparked by the COVID-19 pandemic, has been an opportunity for European ABS investors, with recent CRE mortgage-backed deals having offered a significant premium over more traditional CMBS transactions from well-established sponsors.

Securitisation is a key source of funding for specialist lenders to finance their origination of residential mortgages, consumer lending and larger corporate exposures. But it is only with the recent growth in smaller-balance CRE lending that a sufficient volume of assets has been available to create a €250m+ viable public ABS deal, given the fixed costs of issuance. As adequate pools of assets have emerged, rating agencies have patched together criteria approaches and sufficient numbers of investors have also taken the time to perform due diligence. From an investor point of view, we think it is crucial that these deals remain proper funding trades for lenders with a long track record through the cycle, and with significant equity from the sponsors to reassure bondholders and support the strong yet limited historical performance; all of the primordial elements required to allow a new market to develop.

CRE ABS structures are very similar to standard consumer ABS or RMBS structures, with sequential amortisation, reserve funds and strong alignment of interest through large retention of junior notes by the sponsor. As the deal amortises over time, credit support will also build up. Smaller ticket loans make CRE ABS pools more granular and diverse than those backing larger CMBS. CRE loans predominantly finance the purchase or refinance of properties in industrial, retail, office or multifamily residential sectors, but deals can include a mix of these sectors.

One attractive feature of CRE ABS is the generally conservative LTVs of CRE loans, which average around 60% versus around 70-85% LTVs for RMBS, for example. This means we would have to see a 40%+ decline in commercial property prices for the creditor to take a loss on the loan if the borrower goes into bankruptcy. We do see CRE lending as more volatile and with a higher probability of default than residential lending, so low LTVs coupled with experienced sponsors and evidence of well managed foreclosure procedures are important for us. Another positive feature we see in CRE ABS is cross collateralisation among borrowers who have multiple loans, meaning that if a borrower defaults on one of its loans, any other property owned by the borrower can be sold to repay the loan in default.

To date we have seen five CRE ABS deals in Europe from three well established and experienced lenders in the UK, the Netherlands and Ireland.

- Pembroke 2, partly a refinancing of the Pembroke 1 transaction issued in 2019, consists of 151 Irish commercial mortgages originated by Finance Ireland, with a weighted average loan size of €2.1m and a weighted average LTV of 59%. This February 2022 deal was a proper funding trade, with large credit support for the AAAs at 50.40% and offering what we thought was an attractive yield at 3mEuribor+145bp on the AAAs and 3mEuribor+200bp on the AAs.

- DPF 2022 CMBS was issued by RNHB, a Dutch mortgage lender owned mainly by CarVal, in March 2022. RNHB has a track record in Buy-to-Let RMBS which also include a small proportion of commercial mortgages originated since 2017. The portfolio was backed by 65 loans across various industries with a weighted average size of €3.6m, a weighted average LTV of 50% and a weighted average Debt Service Coverage Ratio of 2.2x. The AAAs were priced at 3mEuribor+175bp, with Euribor floored at zero, which reflected some of the widening we saw across credit markets following Russia’s invasion of Ukraine.

- Together, a UK specialist lender, has issued two transactions backed by over 1,000 commercial mortgages with much smaller loan sizes (weighted average around £200k) to finance properties for various purposes, such as residential properties with retail space attached. Together has been originating small ticket CRE loans since 2010 and previously obtained financing through privately syndicated transactions, and its long track record shows losses have been negligible. Together’s first CRE ABS was sold in March 2021 with the AAAs and BBBs priced at Sonia+140bp and Sonia+315bp, respectively.

We think the CRE ABS market offers conservatively structured debt features, with generally short duration exposure and a spread premium rewarding the more intensive underwriting and due diligence required. So far, the AAAs have looked most attractive to us since we think they provide an attractive alternative investment to single-A and BBB rated European Consumer and Auto ABS. As the market develops, liquidity will get better and we expect other lenders to look at this funding channel more readily.