Fixed Income Boutique

Fixed Income Quarterly

Each quarter, our experts from the Fixed Income Boutique deliver actionable insights to help you make sense of the global fixed income universe. They uncover key risks, opportunities, and trends.

TwentyFour

Flash Fixed Income

Taking inspiration from the “flash” economic indicators that offer markets a preview of the final numbers, Flash Fixed Income is a monthly outlook that keeps investors ahead of the curve by dissecting the major trends across the global bond markets.

Fixed Income Boutique

Are emerging market bonds on the mend? Video updates by our experts

Luc D’hooge and Wouter Van Overfelt review the developments of the Vontobel Fund – Emerging Markets Debt and Vontobel Fund – Emerging Markets Corporate Bond and share their forecast for the remainder of 2023.

TwentyFour

Reinvestment risk growing, along with the soft landing narrative

What level of risk are investors willing to take? As central bank rates hike and a soft landing narrative makes its way into analysts’ forecasts, Eoin Walsh takes a look at what affects this has on investment risk and reinvestment risk.

TwentyFour

Soft landing narrative taking hold

What sort of landing will the global economy experience? With the recent release of the US CPI report, inflation has been on a downward trend and the resilient activity data has continued to surprise many. This report has acted as a trigger of sorts for increasing calls for a soft landing.

Fixed Income Boutique

Planets align for emerging market local currency bonds

After a tumultuous decade, the stars may be set to favor emerging market local currency bonds again. Portfolio manager Carl Vermassen says there are good reasons to believe their outperformance so far this year isn’t just a one-off lucky shot.

Fixed Income Boutique

Are EM bonds about to shine?

Last year's bond market disappointments now seem far behind us and investors tell us they are once again bullish on fixed income.

Asset management

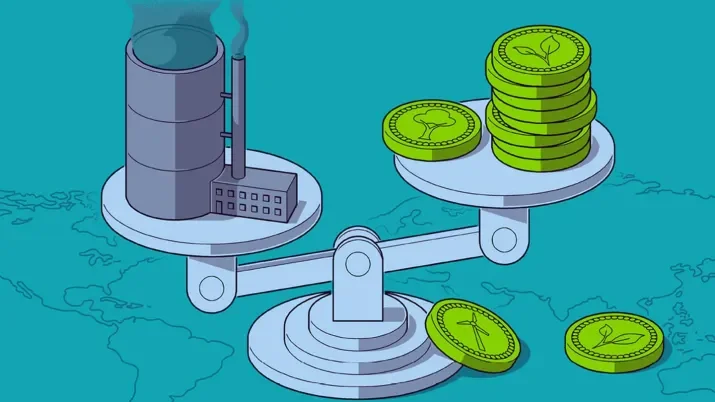

Fighting the good fight: The role of carbon markets

To say addressing carbon emissions is urgent errs on the side of understatement. Tackling the transition toward decarbonization requires a collective effort, and carbon markets have a key role to play in the climate change fight – though those opportunities also come with some challenges.