Fixed income 2022: Policy, economy and markets must converge

TwentyFour

It's that time again when we are tasked with forecasting what will happen in fixed income markets in the year ahead. The last couple of weeks have been hectic as we have tried to digest all the hurdles that the market will face in what we expect to be a far more challenging 2022 than the year we entered 12 months ago. Reading through our predictions from last year, our scorecard reads fairly well, though I think the team here will be glad that credit spreads have softened slightly in the second half of 2021, thereby giving us a bit more yield to play with as we look ahead to the next 12 months.

Like us, I imagine most investors are already knee-deep in research that has them scratching their heads, as we try to work out how to preserve the gains made so far in this incredibly fast evolving cycle. So many negative reports in one go may well weigh on the market in the near term and deprive us of our much desired ‘Santa rally’, but at least the news is out there so we can try to deal with the real issues confronting us.

Before we dive into these issues and perhaps depress you a little further, later on in this piece I will be laying out how we think it is best to navigate these markets. We believe there is a strategy that can sidestep most of the pitfalls while embracing the still strong fundamentals, and should provide the recipe for some sensible fixed income-like returns in 2022.

Policy, economy and markets must converge

What we are currently experiencing is a disconnect between monetary policy, the economy and the markets, a disconnect that in our view will struggle to survive much longer. We have central banks still enforcing early cycle policies, we have the world’s major economies essentially exhibiting mid-cycle characteristics, and we have valuations in many parts of the market looking decidedly late-cycle. In our view, these three elements must converge and will do so in 2022, meaning the low volatility we’ve enjoyed for most of 2021 is likely to end. Exactly how they converge will determine just how much volatility we are forced to endure, but providing that a major policy error does not force this cycle to end early, we think this should be viewed as an intra-cycle dip that investors can buy into, just like the many buying opportunities afforded us in the last cycle.

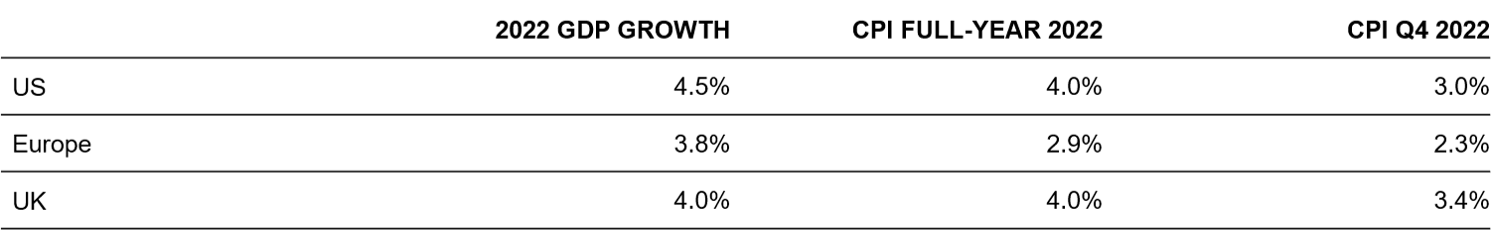

Our macro views tell us that growth will slow but remain comfortably above historical averages. We see inflation peaking at the end of Q1 and though part of it will be transitory, we do think there will be lingering and persistent inflation at a level significantly above most central banks targets. The supply chain shocks that struck many sectors in recent months are likely to ease somewhat, but again we think these will remain a feature throughout 2022 and will test companies’ ability to protect their margins. This could well be one of the key determinants of corporate winners and losers in the coming year.

TwentyFour's growth and inflation forecasts

Source: TwentyFour, November 2021

The other threat that is very much worth noting is the potential for a policy error, in particular from the Fed. Our concern is not around ever-rising inflation, since it is clear to us that there is already enough persistent inflation in the system for the Fed to worry. Rather we are concerned that the Fed is willing to sacrifice a little extra inflation in return for job creation as its seeks to fulfil the second pillar of its dual mandate, which is full employment. Essentially, we’re worried that full employment is a lot closer than the Fed predicts. Central to this view is the US labour market participation rate, which is proving to be very sticky around 61.6%, and may not pick up strongly any time soon since many workers might have left the workforce permanently as a direct consequence of post-pandemic lifestyle choices. In the last cycle the unemployment rate went as low as 3.6%, and without creating meaningful wage inflation, but full employment was typically deemed to be around 4% in the past and this is a figure that could be achieved by the end of Q1 2022 if the participation rate remains sticky.

Will the Fed then refer to the participation rate as transitory? Or will it be forced to act quicker as its goals have been met? A Fed forced into more aggressive tightening would not be good for risk assets. However, conversely, if the participation rate gives the Fed more headroom to pause for longer we think that would be supportive. In the same line of thought, the gap between the end of tapering and the Fed’s first rate hike is going to be viewed as a potential indication of a policy error. A small gap could be seen as the Fed being behind the curve once again, a likely headwind for risk assets.

In short the Fed has a very fine line to tread and the chances of the market not liking its actions is quite high. Having said that, we don’t think this type of error is enough to end the cycle prematurely, but it would certainly produce volatility and we think this could prove an opportunity to improve portfolios at some point in the first half of the year. In this scenario the three divergent elements I mentioned at the beginning would be converging towards a healthier balance and that would give the market a chance to recover.

This brings us nicely on to our outlook in a little more detail, and we start as usual by building up the government bond yield curves in the core markets, starting with rates policy.

The US and the Fed

The Fed’s QE programme of $80bn in Treasuries and $40bn of mortgage-backed securities (MBS) purchases per month is already being tapered with $10bn less in Treasuries and $5bn less in MBS as each month passes. In our opinion the Fed should have already finished tapering by now, but they have only just begun and at a very slow pace, suggesting it will take seven further policy meetings to complete. Given our fear of the Fed being behind the curve, we think the pace of tapering will be increased at the December 15 meeting and will be completed at the March meeting, thereby giving the Fed some much needed flexibility to hike sooner if it needs to deal with a rapidly declining unemployment rate.

We would like to see a gap between tapering and the first rate hike, with our base case being that the first hike comes in September, though ending asset purchases in March does leave the door open for a hike in June if needed. We’d expect a first hike in September to be followed by a second before the end of year, taking the upper bound of the Fed Funds Rate to 0.75%.

A Fed in tightening mode usually means upward pressure on the yield curve, and this coming year should be no exception with lingering inflation concerns meaning a series of hikes will get priced in. Consequently it is very hard to see a 10-year Treasury yield below 2% by year-end 2022 (our central forecast is 2.10%), meaning another year of losses in the world’s benchmark risk-free asset. Clearly this is a risk we would encourage investors to sidestep while yields rise, but higher Treasury yields are going to be a very useful asset in future, so we would view this as good news.

Europe and the ECB

On one hand this might be the easiest call for us as it’s very hard to see the ECB getting away from its minus 50bp deposit rate in 2022. In fact, it takes a bullish view to see them getting back above zero in the whole of the next cycle, but that’s one for next year once we know just how much of the current Eurozone inflation becomes more ingrained.

The more tricky forecast is what the ECB will do with its two ongoing QE programmes, namely the Pandemic Emergency Purchase Programme (PEPP) which is currently buying €70bn of sovereign debt a month, and the old Asset Purchase Programme (APP) which is buying €20bn a month. We could debate whether these two programmes are required at all given the recovery and also the inflation data, but the influence of both of these programmes on the market is significant and their withdrawal would be a negative shock. The conundrum is that the PEPP is due to complete in April, though coupons and redemptions will be reinvested at least through 2022, but a drop of €70bn a month is probably too much for the market to digest, especially in the face of the rising euro sovereign yields we are forecasting. Consequently we think the ECB will temporarily increase the APP and then try to ween the market off this increase in 2023. Our central forecast is for the APP to be boosted to €50bn a month to avoid an unwanted tightening of financial conditions.

What does this mean for 10-year Bund yields, which currently sit at negative 29bp? Despite the more supportive ECB the correlation to Treasuries is too strong and the market will be looking ahead to the phasing out of QE by the end of next year, so Bunds are not immune to rising yield curves. We see them going to 0.00% by year-end 2022, once again providing a loss for the calendar year of around 3%. As with Treasuries above, we think this risk is easily avoided through portfolio construction, or in fact through hedging, where carry costs are currently minimal.

The UK and the BoE

This is perhaps the hardest call of them all given the UK’s additional inflation concerns, labour market pressures and supply chain issues stemming from Brexit, and of course the seemingly never ending political risk that has shrouded the UK since its decision to leave the EU.

Having said that, the Bank of England has erred on the side of excessive forward guidance which eventually must come through. We expect a base rate rise to 0.25% at the BoE’s December 16 meeting, and an additional three 25bp hikes in 2022 taking the base rate to 1.0% by year-end. QE will have stopped by the end of this year, with a stock of Gilts standing at £875bn and a stock of corporates at £20bn. The BoE has been quite clear that once base rates go to 0.50% it will no longer reinvest coupons or redemptions, but it has also said that at 1% it would begin to sell down the portfolio of Gilts, which currently makes up 50% of the outstanding issuance of conventionals. We see this as unhelpful forward guidance and something that may weigh on Gilt yields as the base rate gets closer to this 1% goal.

Our forecast for Gilts is once again for negative returns, with the 10-year moving from 0.99% to 1.40% by the end of 2022. Again, however, this is a risk that can either be minimised through portfolio construction or hedged relatively cheaply through highly liquid interest rate swaps.

Credit spreads may struggle in the first half

Having constructed our risk-free curves, we can move to the other side of the risk spectrum and look at global credit markets. It’s hard to be too positive on credit spreads in 2022 given some of the risks markets are facing, especially in the first half of the year. Rising government bond yields, tightening financial conditions, slowing growth and concerns over policy errors dictate a cautious approach to risk. Overall our central forecast is for a modest widening of spreads over the year, but this clouds some of the story as we think volatility will pick up in H1, sending spreads wider than where we expect them to be by end-2022.

TwentyFour's credit sector spread projections

Source: TwentyFour, November 2021

A few sectors are worthy of comment here. Anything floating rate we think is worthy of consideration for 2022 as this avoids being negatively exposed to rising yield curves, as coupons rise with every base rate increase. Leveraged loans should get good support from this, as should all of the European ABS market. For investors looking to take advantage of both of these sectors, CLOs would be near the top of our performance outlook with the best results likely to be found lowest in the ratings spectrum. BB CLOs could return around 7% in our central forecast, made up mainly from the high carry on offer here.

Financials still look good relative value to us, and while at the index level their performance will be restricted by duration as banks have been locking in longer dated funding, they should also be a beneficiary of rising rates and good credit performance. It is worth noting that banks’ capital levels have probably peaked, and we think excess capital will now start to be distributed to shareholders, but this is still a sector where investors can make their coupon, especially if they keep exposures shorter.

Top of our performance projection list is emerging market high yield corporates in hard currency, but this comes with a health warning; timing and patience are important and our positive outlook here is based on the Fed not being too far behind the curve and avoiding having to tighten more aggressively, so this is not a Q1 trade. In addition, a lot of what happens with this sector will have to do with the Chinese property market. China HY is trading at spreads of around 2,000bp, and volatility is likely to remain very high in the short term. With spreads at 680bp over risk-free and a little tightening, high single-digit returns could be on the table for brave investors who get their timing right in EM HY.

Strategy for 2022

Initially our strategy is one of caution while the markets digest the negative forecasts and the hurdles we have discussed. Avoiding unwanted risks has been a major focus in our recent asset allocation meetings. Firstly, keeping rates duration low is clearly the path to avoid losses should our predictions be right. Ideally this would be done through portfolio construction, but this can be cumbersome and difficult to achieve so we think hedging rates exposure where appropriate makes sense, given its relatively low cost and our conviction that yield curves are pulled upwards. Sizing is important though as a rates hedge can quickly become the dominant position in a portfolio. Our favoured hedge curve would be sterling given our forecast for the Gilt market and also the low carry costs. The euro curve would be a good alternative but not quite so compelling in our view.

When it comes to credit, this is no time for excessive risk either as spreads are tight and will most likely widen modestly. Consequently keeping exposures shortish here too would make sense, focusing on sectors and companies that have pricing power and can benefit from ratings upside. A low default rate is once again your friend, so venturing down the credit curve to obtain better yields should be rewarding, but we also want to benefit from roll-down, which in our view has the strongest impact in the three- to five-year part of the yield curve and will help protect from any spread widening. We think earning your portfolio’s yield in the first half of the year would be a good outcome, and at that point given more information it can be determined whether adding more risk makes sense. However, to do this portfolios cannot be fully invested in risk assets or have low liquidity, so maintaining a healthy liquidity buffer to try to buy that intra-cycle dip would make sense should our forecast turn out to be correct.

All-in-all, while there might be a strong consensus around 2022 being a challenging year, we think there is very little consensus as to how many of the unknowns will actually evolve. The biggest of these is just how much tightening central banks will have to engage in, and in what time frame, with aggressive catch-up being bad for risk and not enough action questioning their credibility. It really is a fine balance and we will not be getting any answers here until we move through the first quarter. In our view the most significant data to follow is US jobs, and a potentially rapid decline in the unemployment rate that could leave the Fed wrongfooted. This data has become notoriously hard to predict post-pandemic, which is why early prudence is necessary.

Naturally we believe executing this strategy is not easy unless active management is employed and mandates are sufficiently flexible, so this is an opportunity for us active managers to show our worth in challenging conditions.

That just leaves me to thank our readers and investors around the globe for your continued incredible support. We genuinely appreciate your challenging questions and interactions as we seek to keep you informed on events in our exciting bond markets. We hope you continue to find our notes of use.