How we can help you

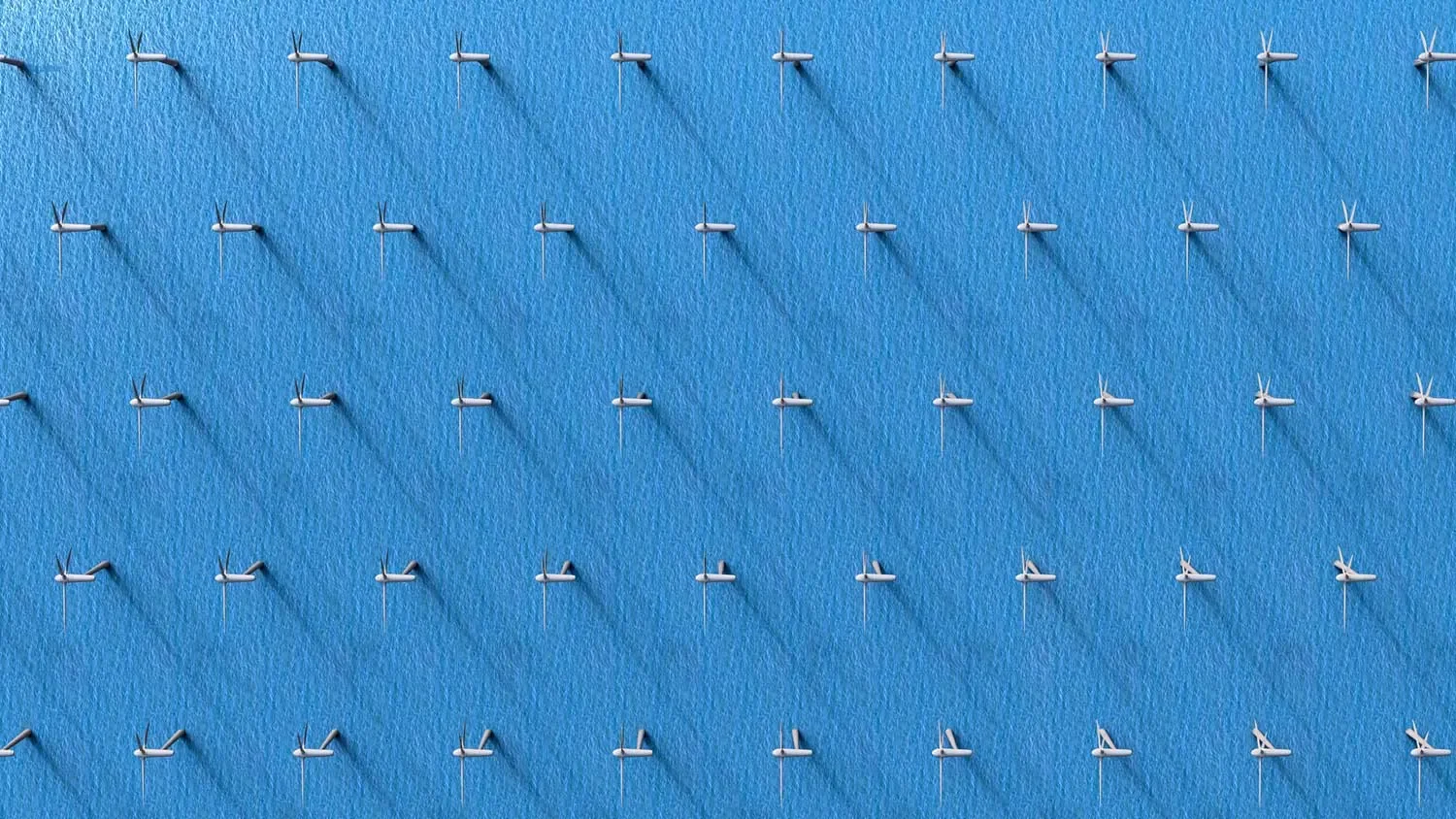

Taking responsibility for our society and environment leads us into a better world. A growing awareness among investors, behavioral shifts among consumers, and innovative solutions in the corporate world, drive this transition. Asset owners can benefit and accelerate the change through so-called impact investing.

We aim to deliver competitive risk-adjusted equity returns over a full market cycle and to create a measurable positive effect on the environment. In our opinion, investing in listed companies focused on creating positive, measurable impact is not only about avoiding risks, but also taking advantage of the opportunities that come with the transition to a low-carbon economy. We believe our approach helps investors to achieve their objectives in terms of sustainability as well as financial returns

Of particular interest to us are companies capturing the opportunities arising from long-term structural shifts , e.g. population growth, urbanization, or rising inequalities, and whose innovative products and services provide scalable solutions to the world’s most pressing challenges such as resource scarcity, rising pollution, or hunger in some parts of the world. These companies have the potential to gain market share and outperform their peers, especially if they boast solid balance sheets and superior long-term profitability.

Our aim is to construct equity portfolios with a sound mix of established names and disruptive newcomers. Our process is based on extensive research, and we show in a transparent way what informs our investment decisions.

Why partner with us?

Seeking outperformance over the cycle

Investing in problem solving companies can create long-term growth opportunities and strong financial returns.

Unconstrained

A concentrated portfolio of stocks selected bottom-up driven by conviction and purity.

Measurable impact

Driving positive change for people and the planet and delivering tangible benefits.

Global Environmental Change