Increased awareness – from growing climate change concerns through to changing behaviors and attitudes post-Covid, not to mention current social, inclusion and diversity drivers – is stimulating powerful, once-latent demand from investors for ESG solutions. As a result, ESG is becoming more mainstream with advisers now expecting ESG allocations to increase substantially in the next three years.

Find out what are the opportunities and concerns of investors and their advisers in our latest survey – ESG: Breaking Through the Barriers, which surveyed over 200 advisers from across the globe.

Covid-19, climate change, and awareness around diversity, equity and inclusion (DEI) issues have accelerated the shift to ESG investing in recent years. Being curious about how investor`s views have evolved in this “new normal”, we ran the third edition of our ESG Knowledge Barometer survey, this time focusing on end investors’ needs.

In addition, we hope to share results of a similar survey focusing on financial advisers and wealth managers needs, to provide a comprehensive picture of how investors’ needs and perceptions around ESG investing are changing. We are delighted to share the results of the third ESG Knowledge Barometer survey below.

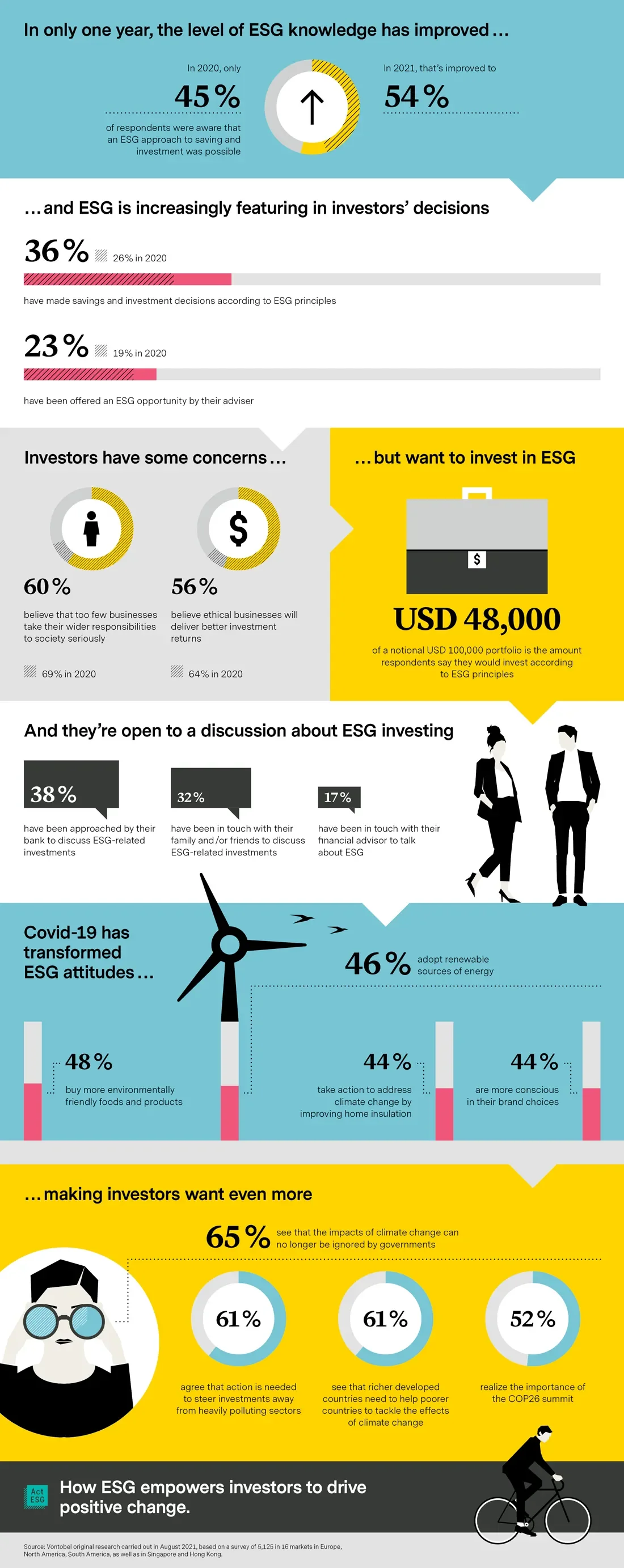

In the third edition of the ESG Knowledge Barometer, we surveyed more than 5,100 end investors from 16 markets to find out how their views on ESG investing have evolved over the past 12 months, and how they expect to adjust their ESG approach in the future.

Find out more about the narrowing ESG knowledge gap and learn what investors want, as they increasingly play an active role in the sustainable transformation of our economy.