Reinvestment risk growing, along with the soft landing narrative

TwentyFour

After years of rates being close to or below zero in the Eurozone, the aggressive central bank rate hiking cycle has made ‘cash’ an attractive investment opportunity once again for many investors. Government bonds with 1-year to maturity now offer yields of 5% in the US and UK and approximately 3.7% in the Eurozone (depending on the sovereign issuer).

After 18 months of difficult markets, it’s easy to see the attractiveness of holding short maturity rates; risk free, very low volatility and with a guaranteed attractive yield. In addition, while tax rates vary by geography, in the UK, capital gains are tax free, making the “grossed up” return look very attractive; for wealth managers, this is a very compelling aspect to help them attract new clients.

So far, so good. However, there is a cost to this, in the shape of significant reinvestment risk. Investors might well enjoy their 1-yr, risk free return, but of course, there is no guarantee that in 12 months’ time, they will then be able to roll into another, equally attractive, short-dated bond, or even longer dated bonds at their current, very attractive yields. This is an issue that asset managers have been grappling with since yields spiked higher – do you lock in these yields for the medium/long term, which should ultimately provide very attractive, long term returns, but with the risk that volatility could remain elevated, or focus on shorter dated rates, with more “guaranteed” returns, in the knowledge that investors have already had to endure a tough environment?

With a growing chorus that the US is now heading for a soft landing, the attractiveness of short dated treasuries should be called into question. While a soft landing shouldn’t necessarily result in a sustained rally in longer dated treasuries (as the higher-for-longer narrative is equally compelling if the Fed are missing a catalyst to cut rates), if you are in the soft landing camp, longer dated treasuries shouldn’t underperform, while credit should certainly perform very strongly, given the yields on offer. If however you believe the risk of a harder landing is being under estimated, then longer dated rates should rally and give you protection, which isn’t provided by shorter dated rates.

To complicate the decision further, we also know that when the market changes, it can do so quite quickly (as UK Gilts have today) – it seems almost incredible that one of the most frequent questions we were asked by investors in January this year was, “have I missed the rally?” – we even blogged about it at the time. While we understand the argument for short dated government bonds and can understand why they, and money market funds, have attracted significant flows, we find the longer dated options much more compelling, even with the knowledge that there could be further volatility ahead.

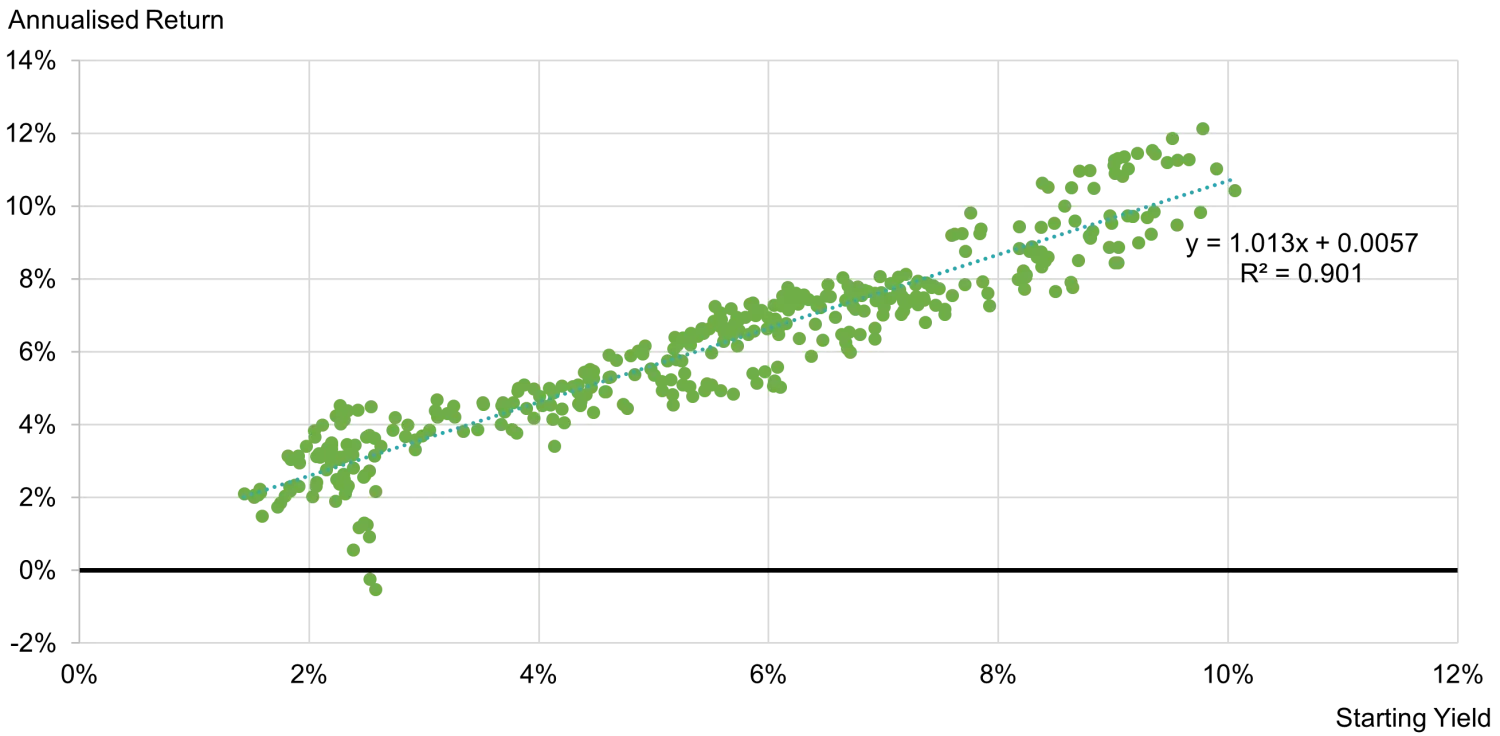

The US broad market index, with a rating of AA, provides a yield of 4.8%, with 8.6 years to maturity – this gives a total return of ~40% over the holding period, a target that will be very difficult to beat by simply holding short dated rates. In addition, given the rating, it should also provide reasonable protection in a harder landing scenario, although spreads would likely widen. Given the attractive yields available across fixed income, we would argue that rates duration is no longer your enemy, particularly in the US, while holding selective credit, from short to long dated maturities, will ultimately reward investors much more handsomely than shorter dated government bonds.

Investing is about identifying risks and pricing them correctly in the context of a time horizon for a given investment. The reward an investor ought to expect from taking a certain kind of risk should vary depending on market conditions and the macro environment, amongst others. With an inverted curve and a soft landing narrative making its way into analysts’ forecasts, the largest risk in a fixed income portfolio might become reinvestment risk. Paradoxically, the riskiest position to hold if that’s the case is very short dated, credit risk free assets, such as T-Bills or Gilts.

US $ Broad Market index

31/12/75 to 31/12/22

Source: TwentyFour Asset Management and ICE indices

Past performance is not a reliable indicator of current or future performance. Based on the ICE Global Broad Market Index – it is not possible to invest into an index and it will not be actively managed.