"In emerging market corporates there are always bonds that offer income and capital gains for an active manager who knows where to look."

We take a deeply contrarian approach to emerging market corporate bonds, aiming to take advantage of the dislocation in valuations that often present themselves in this inefficient and news-flow driven asset class.

We take a four-step process, which combines top-down strategic themes and bottom-up analysis with a focus on maximizing credit remuneration. The strategy managers deliberately avoid global rates risk and currency risk, instead concentrating on the credit component.

The size of the emerging market corporate debt universe comes as a surprise to many investors. At 1.4 trillion US dollars, the emerging market corporate bond universe is about the size of US dollar denominated emerging sovereigns1. With an average rating of BBB-, the credit quality of the corporates is better than their sovereign counterparts. Also, it is the asset class within emerging market debt with the lowest duration and volatility2. With the multitude of countries, industries as well as unique issuers in different phases of the economic cycle, there is a broad set of opportunities available, providing a combination of favorable yield and income. As the growth differential versus developed markets is increasing in the emerging markets’ favor, we believe this space is set to rise further.

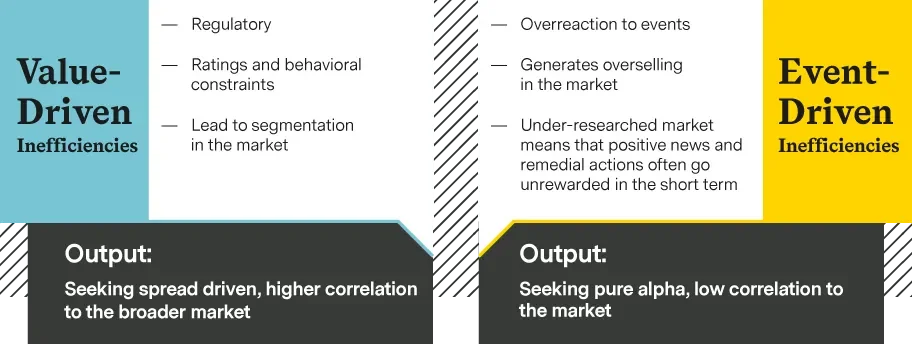

The main story though is the prolific inefficiencies in the emerging corporate bond space, which makes it an active manager’s paradise. We aim to take advantage of these inefficiencies by complementing our tried and tested value-driven strategies with event-driven opportunities. As contrarian, bottom-up investors, we actively seek stories which other managers avoid. What’s more, we seek to exploit the situations that they sometimes provoke! We believe these trades are highly rewarding, truly diversified strategies, but above all, uncorrelated from the broader markets because price action is issuer specific. In a nutshell we aim for, pure, uncorrelated and idiosyncratic alpha.

1. Source: EMBI Monitor from JP Morgan and as of 1st November 2021

2. Source: JP Morgan

Segmented markets and risk aversion can offer high return, low volatility and decorrelated opportunities. Our investment philosophy rests on two inefficiencies and sources of performance:

The fund is managed by Wouter Van Overfelt and Sergey Goncharov of the Emerging Market Bonds team. The team also has at its disposal the full capabilities of the Zurich- based Fixed Income boutique. We believe this optimal team structure enables proactive early idea generation and implementation.