The Bond Market Recovery has Outpaced Equities

TwentyFour

Towards the end of March, we speculated that the bond market would recoup its losses far more quickly than equities, for three reasons; 1) it always has in previous crises this century; 2) this time the pressure on dividends would be higher, especially on companies receiving government support and; 3) companies would hoard cash for precautionary reasons.

This morning (following a good question from a client), I refreshed the chart used in the blog back in March , and that has led to some points worth talking about.

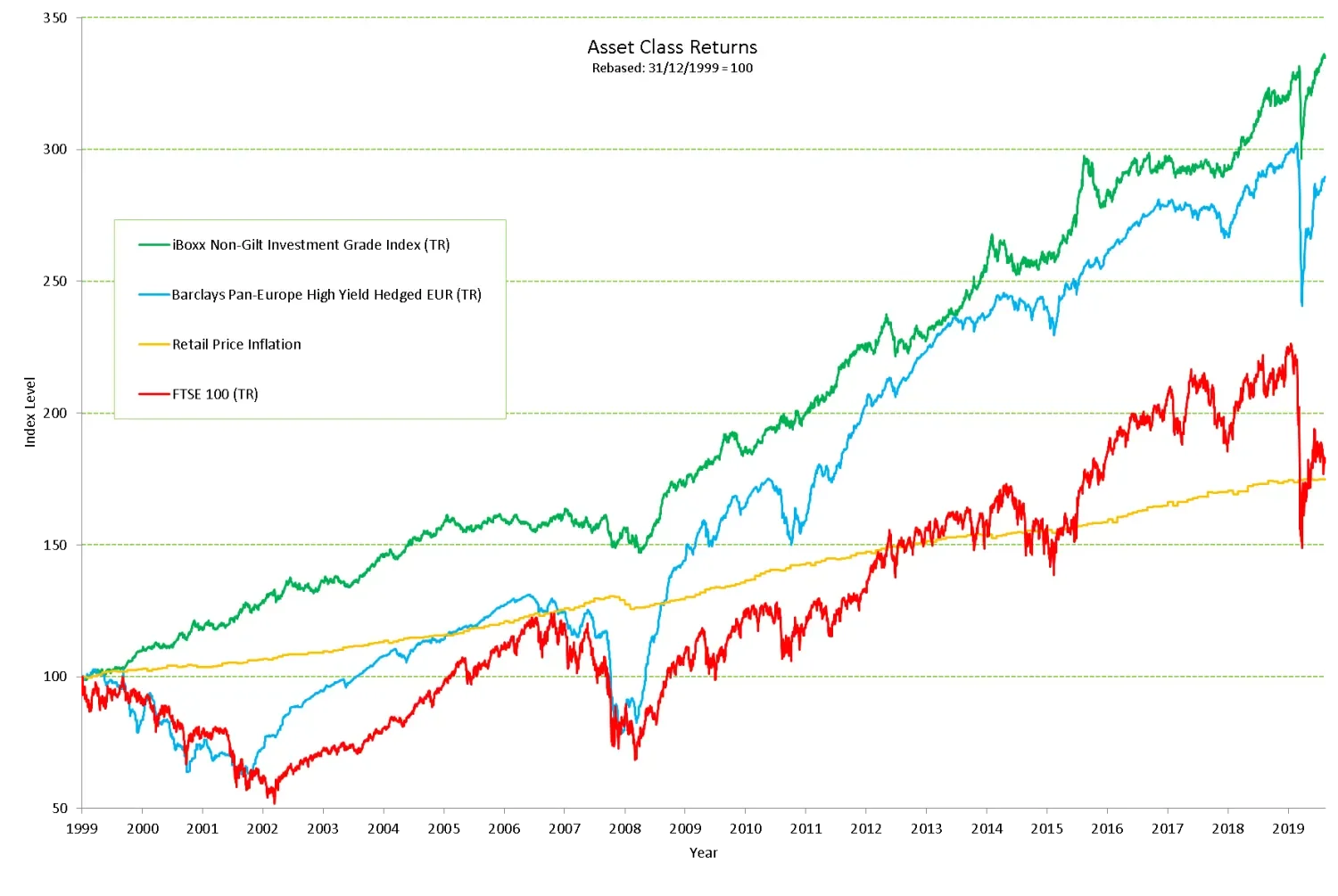

Chart 1: Asset Class Returns this century, Source: TwentyFour, Bloomberg

Firstly, the green line shows that Investment Grade credit has not only recouped all of its Covid related losses, but has actually gone further and marched into new highs for the asset class.

High Yield, as shown by the blue line, has recouped most – but certainly not all – of its losses. This is understandable given the remaining uncertainties about which sectors will see default risks loom large, and just how high the peak default rate could actually get to.

Lastly, equities (as shown by the red line) have struggled to recover even half of their losses, despite huge government support for the real macro economy and individual companies. As Gordon blogged last week in starved of income , the income falls from dividend paying companies have been large and have removed one of the key supports of the equity market, at least from bond proxies. With BP and Shell slashing dividends, interestingly BAT is now one of the biggest dividend contributors to the FTSE. In an era when ESG concerns are being pushed to the fore, how sustainable are Tobacco dividends? Secondly, as we also speculated back in March, for precautionary reasons companies have been hoarding cash and issuing debt to build war chests against uncertainty – and that may of course dent ROE for more growth oriented stocks.

So where do we go from here?

Well, we firmly believe the contractual nature of coupons versus the discretionary element of dividends means that predictable and attractive income will continue to be best provided from fixed income. The income is “fixed” after all.

However all is not necessarily rosy in the world of debt. Government bond yields are close to all-time lows, in fact negative in many cases. Even the front end of the UK yield curve has this problem for example, with Gilt yields negative out to seven years of maturity. Across developed markets, spreads on non-financial IG credit have retraced most of the widening, with corporate bond purchase programmes from central banks furthering already strong rebound rallies.

Combining the two factors, low government bond yields and spreads that have narrowed, the all in credit yield in many non-financial sectors is now lower than it was in January and February of 2020. To put that in context, back in January and February we were arguing that within IG credit, the valuations were such that reaching for risk was not justified. Now we have even lower yields in some cases.

The main area of optimism for us in the IG space is financials. As we have blogged about several times recently, by and large banks and insurers have given a good account of themselves during this crisis, in stark comparison to 2008 where they were the cause of the crisis. Twelve years on, capital is the best it has probably ever been, underwriting standards have been far better, meaning provisions have been remarkably low, emergency liquidity facilities exist to ensure no bank goes bust for liquidity reasons, and lastly, spreads still remain attractive.

The clear opportunity within IG credit from our perspective, without having to take excessive risk, is to buy legacy Bank and Insurance IG debt. From a valuation and fundamental credit perspective, our belief is that there are no better assets.