Labour Support Tapering Need Not Be Feared

TwentyFour

As we enter the summer period, one safety blanket for the labour market is being gradually folded away. On the 1st of July, the UK started to taper its Coronavirus Job Retention Scheme,[1] reducing the percentage of wages paid and maximum award gradually over a three month period. By the end of the summer, normal labour market conditions will resume.

The UK is not alone, though; across Europe, COVID-specific labour support schemes will also taper gradually. For example, from July, France’s activité partielle will pay a depleting percentage of wages (though the generous incumbent scheme remains) while Germany’s Kurzarbeitergeld remains open for registered employers and will continue to offer 24 months of wage subsidy. So whilst Europe’s safety net will continue to provide relief, we firmly believe that the need for extraordinary policy has receded.

It is a good moment, then, to evaluate the health of the jobs market as a critical driver of monetary policy tapering, central bank policy rates and the performance within consumer product backed ABS deals.

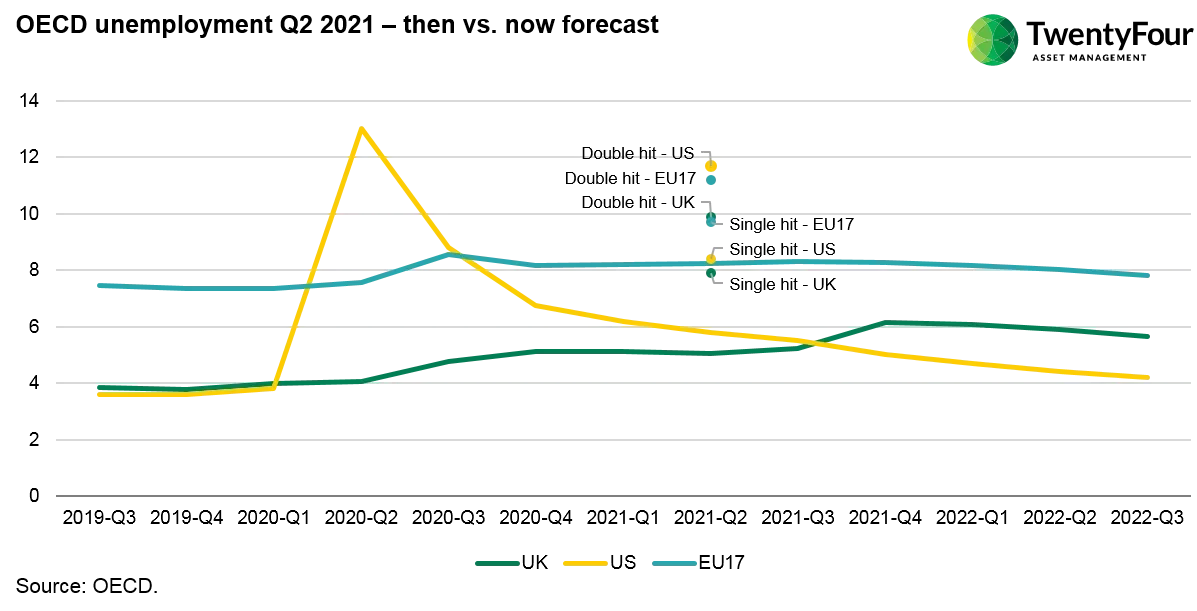

The changing expectations for unemployment since Q2 2020 are well illustrated when contrasting OECD data detailing its expectations under ‘single hit’ and ‘double hit’ COVID scenarios (the latter being the second outbreak and lockdown we saw in early 2021) and its current forecasts[2].

The chart below shows how the OECD expected unemployment by Q2 2021 in the EU17 nations to be 11.2% vs the actual rate of 8.2%. Analogous figures of other regions reflect similar dynamics, with the expected rate for the UK at 9.9% differing sharply from the actual rate of 5.0%. The difference between expectations and reality is most pronounced in the US at 11.7% vs 5.8%, respectively. The OECD now expects peak unemployment in Q3 or Q4 2021, admittedly at a marginal increase compared to current levels. Nevertheless, policymakers would surely have been thrilled with the current outcome had you offered it to them in the summer of 2020.

[1] https://www.gov.uk/government/publications/changes-to-the-coronavirus-job-retention-scheme/changes-to-the-coronavirus-job-retention-scheme

[2] https://www.oecd.org/economic-outlook/june-2020/#Key-impacts

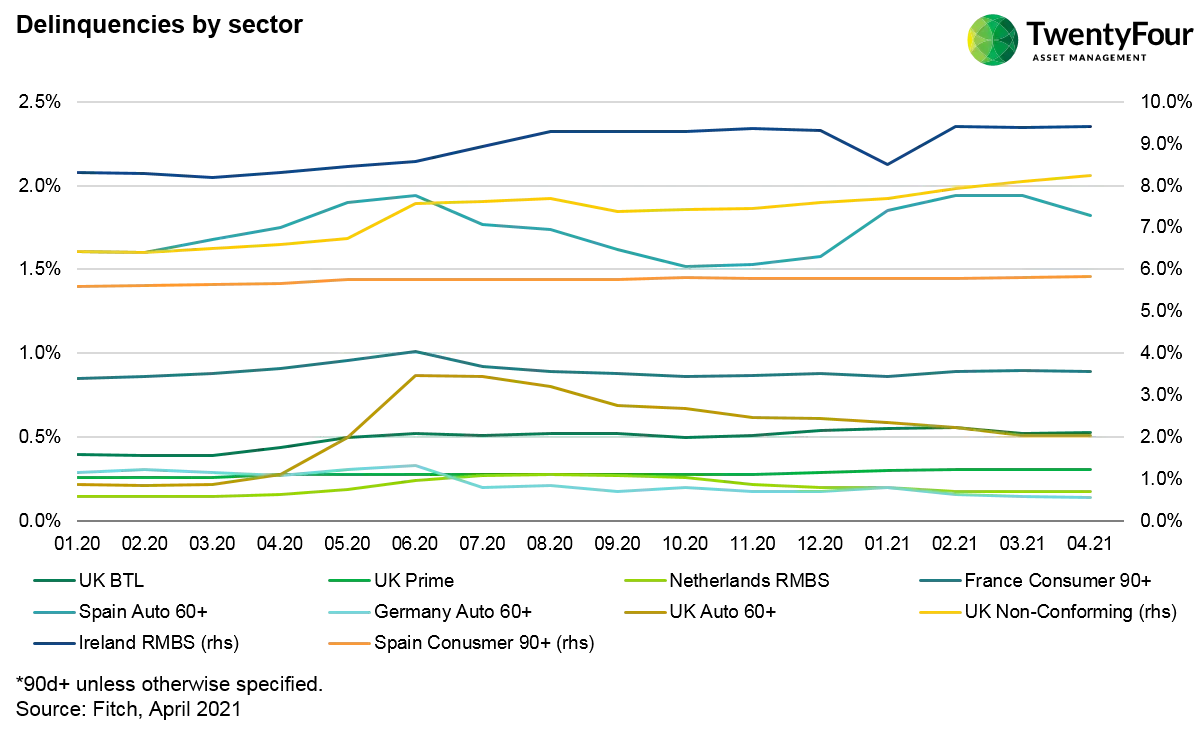

For European ABS, the outlook for borrowers is very positive, but more impressive is the performance of mortgage and consumer ABS since the start of 2020. The charts below are reassuringly uninteresting and include ABS consumer deals from a cross-section of the market. The change in performance has been negligible and a far cry from what investors would expect in a textbook recession and even further from how we would model and stress a transaction.

We maintain that any post-support unemployment spikes will be modest and contained within cohorts of the labour market less likely to use credit. As a result, performance is not likely to surprise. Accordingly, we remain confident that labour support tapering is not something that should be a material concern for investors. So, back to the inflation crystal ball it is!