Fixed Income Boutique

Fixed Income Quarterly

Each quarter, our experts from the Fixed Income Boutique deliver actionable insights to help you make sense of the global fixed income universe. They uncover key risks, opportunities, and trends.

TwentyFour

Flash Fixed Income

Taking inspiration from the “flash” economic indicators that offer markets a preview of the final numbers, Flash Fixed Income is a monthly outlook that keeps investors ahead of the curve by dissecting the major trends across the global bond markets.

TwentyFour

Bond Market Relief at Change of Lagarde

European bond markets can breathe a sigh of relief this morning as Christine Lagarde is poised to be the new president of the European Central Bank, succeeding Mario Draghi in October.

TwentyFour

Dollar Hedging is About to Get Cheaper

As we approach the end of Q2, a time when the price of currency hedging can typically spike, we have been reviewing the likely changes in the so-called ‘costs’ of currency hedging. I use the term so-called as these are not really costs, merely a differential in short term interest rates, which for some investors can be a gain and for others it will be a reduction in the yield or return of an asset.

TwentyFour

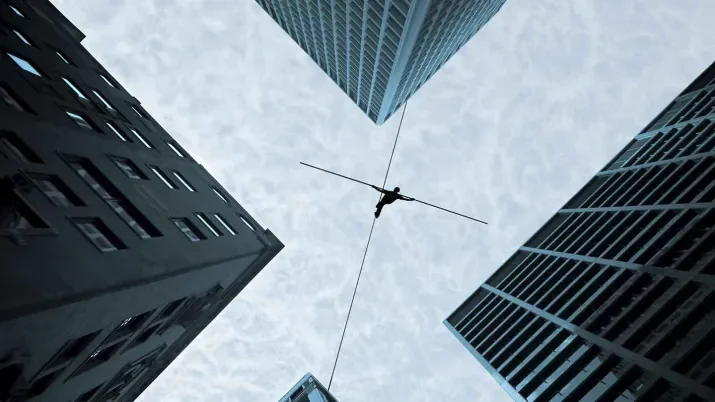

Powell’s Balancing Act

This week Jerome Powell and his fellow FOMC members sit down to determine the Fed Funds rate, and despite the expectation of no move, this meeting is going to be very closely monitored with market participants analysing every word of the subsequent comment.

TwentyFour

Due Diligence Critical for New Cohort of ABS Issuers

As we wrote on Friday, one of our biggest takeaways from last week’s Global ABS conference was the growing number of prospective new issuers in the market.

TwentyFour

Global ABS 2019: Issuers Out in Force

This week Asset-Backed Securities (ABS) market participants from across the globe gathered for the 23rd annual three-day Global ABS conference in Barcelona. And this year it proved more popular than ever with over 4,000 attendees (a post-crisis record) made up of issuers, arrangers, service providers, traders, analysts, market regulators, the industry press, and of course investors like ourselves. In particular, we felt the number of issuers represented was noticeably higher than we have seen in recent years.

TwentyFour

Cashing in on the Brexit Premium

Brexit deliberations are currently at a standstill in the UK parliament, as are negotiations with EU representatives. The next steps in the exit process are clouded in uncertainty, with numerous options on the table. In this environment, it’s no surprise that investors are still demanding a spread premium for sterling denominated credit, over and above comparable euro denominated issues.