What is in the price of AT1s after the sell off?

Deposits in the banking sector is a hot topic at the moment. After the ECB released their Monetary developments in the euro area: February 2023 report earlier this week, there have been somewhat incendiary headlines in the press pointing out that people are taking their deposits out and that this could mean more trouble for the banking sector and therefore for the whole economy going forward. We think it is worth highlighting a couple of points. Firstly, deposit creation or destruction is a function of quite a few variables which makes the interpretation of the aggregated data a bit difficult in our view. And secondly, what we believe matters the most at this juncture is whether or not a single bank or group of banks are experiencing deposit outflows. This cannot be easily observed in the aggregated data.

From a system wide point of view deposits are created and/or destroyed mostly by the banking sector. When a bank gives someone a mortgage a new deposit is created as a liability on the bank’s balance sheet offset with an asset called Loans & Advances to Customers. If a customer or a company repays a loan to their bank then a deposit is destroyed and the asset on the bank’s balance sheet is extinguished. When there is a QE programme, the ECB buys a bond from the public through a given bank. This translates in an increase in bank reserves on their asset side of the balance sheet which is again offset with additional newly created deposits as the bank bought the bond from an investor and in turn sold it to the ECB. The opposite happens when there is a QT programme. Lastly when governments issue debt this might be bought by banks through reserves or by the public via deposits. When governments spend money to pay a company for a given good or service a deposit is created in that company’s bank account.

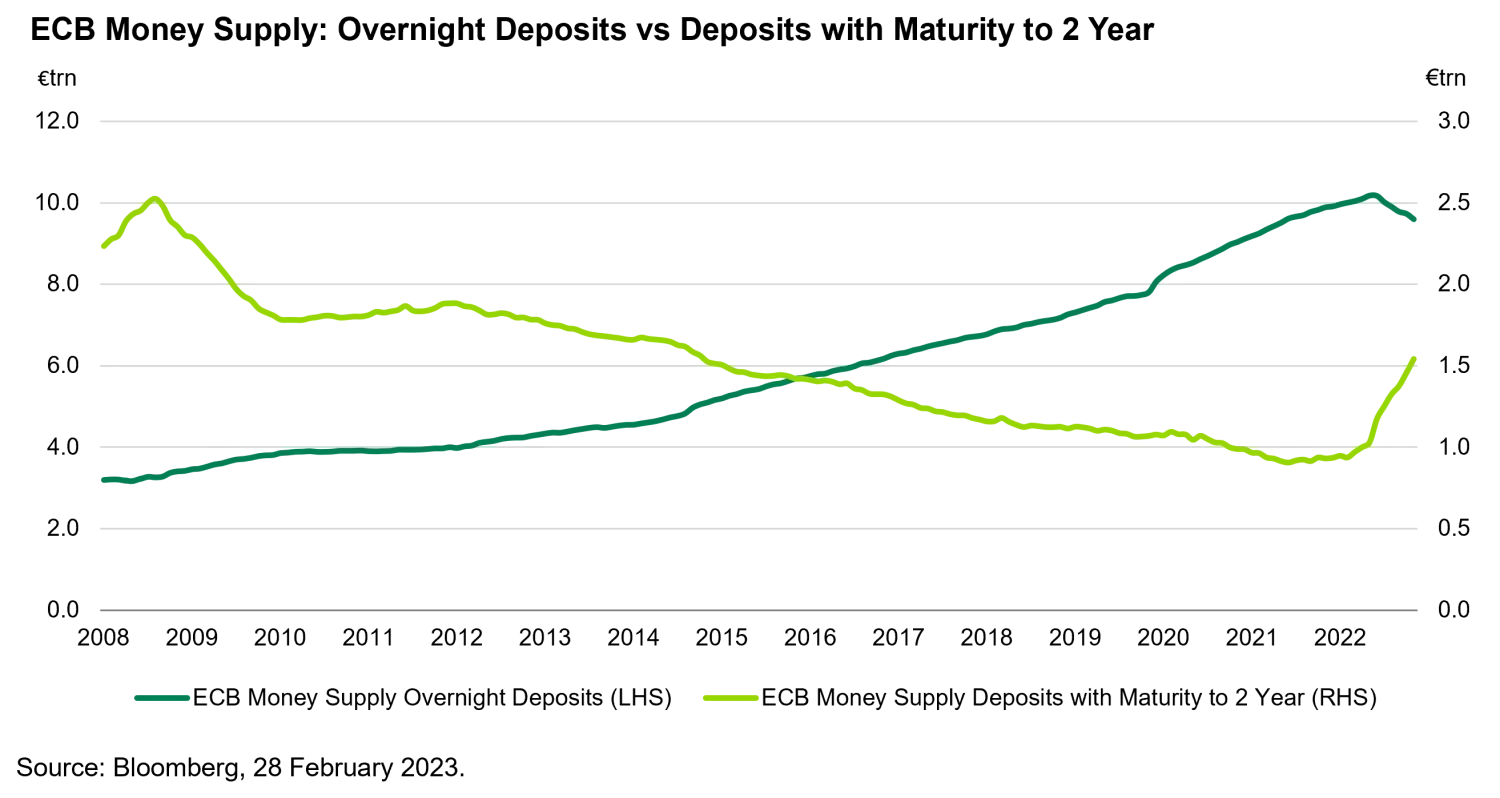

As you can see it is not straightforward to identify what the cause is for deposits to increase or decrease from a systemic point of view. Given recent events in the banking sector most people would be interested in knowing whether a single bank is having deposit outflows or whether the public is losing faith in the system as a whole. The first one cannot be answered by looking at aggregated deposit data (of which Credit Suisse would have been a minor part anyway given that it is mostly a Swiss bank). The second one can be answered by the composition of deposits. If people were losing faith in the European banking sector and they were fleeing the system because of an increased perception of credit risk, then it would make sense that longer deposits fell more abruptly than overnight deposits. After all, people should be more confident in forecasting that the banking sector will survive the night rather than the next month or year. The graph below shows that ‘Overnight Deposits’ peaked in August 2022 and have since declined by €582 billion. It also shows that since then the category ‘Deposits with an Agreed Maturity of Up to 2 Years’ has increased by €511 billion. In February’s report the monthly increase in ‘Up to 2 Years’ deposits was the second largest since 2008. This was confirmed yesterday by ECB Executive Board Member Isabel Schnabel who said: “We’ve seen some shift from overnight deposits into time deposits, but we’ve not seen a general deposit outflow of the banks. For now the banking sector looks rather resilient”.

In our view, these shifts in deposit composition are a function of deposit rates going higher and people looking for juicier alternatives for their money. Although it will be interesting to see the March report after the events with CS and SVB, we think the fact that longer deposits are increasing steeply is a signal that the confidence in the system remains strong. Regarding individual banks’ deposit flows, we cannot extract any decisive information from the ECB’s monthly report.

So while parts of the market are pricing in some sort of financial crisis arriving, the data in the eurozone does not currently support this. In our opinion, with bank debt trading at levels similar to March 2020, we see this as a significant opportunity not a threat and we would expect yields to drop meaningfully in the absence of a stream of further bad headlines.