The goal of income investing is to ensure that your portfolio generates a steady source of revenue regardless of market conditions.

Bids Wanted in Competition (or BWIC) lists are a unique characteristic of the ABS and CLO markets, where they are widely used in secondary trading when investors are looking to sell bonds.

The process differs markedly from trading in more mainstream markets such as government and corporate bonds, where dealers look to ‘make markets’ in bonds by matching buyers and sellers directly, as well as holding an inventory of various bonds on their books for providing liquidity to clients.

By contrast, a BWIC is essentially a list of ABS or CLO bonds sent by investors to dealers, who then share the list with their clients. The bonds are effectively sold via an auction process, which allows investors to receive bids from the broader market and theoretically helps them achieve better execution, as this client-to-client process supplements the liquidity provided by dealers. Colour on BWIC execution is also generally shared with the market after trading, which contributes to market transparency and overall liquidity, another marked difference from mainstream bonds where colour on trading flows is often a closely guarded commodity for dealers. ABS dealers that have executed a BWIC trade often share the second best bid price they received, for example, which can be particularly useful for holders of mezzanine bonds that don’t trade very often, as bid levels give investors an indication of where these bonds could be traded.

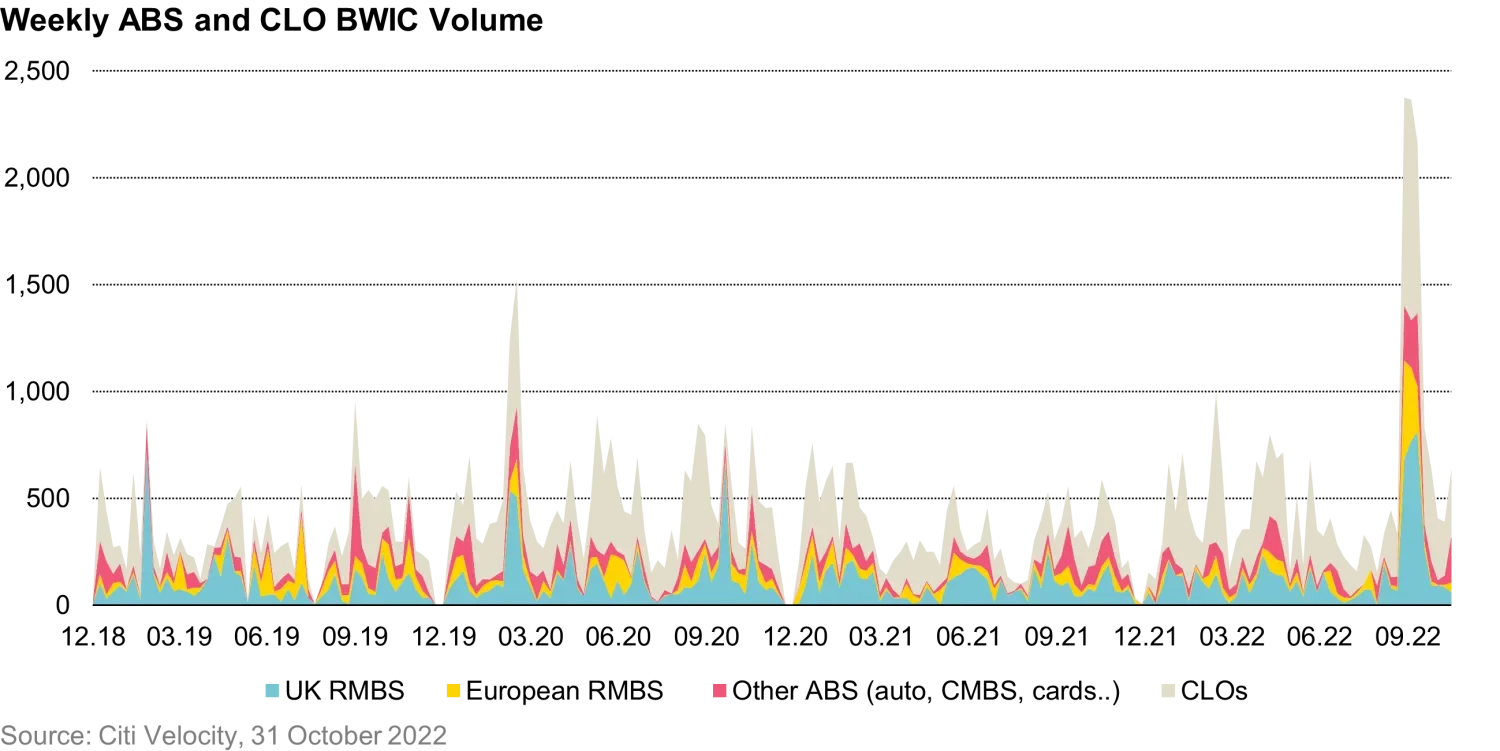

Looking at changes in BWIC trading volume can give us a good idea of the trading dynamics in the ABS or CLO market at any given moment. Generally, volume has increased in recent years in line with the overall size of the European ABS market, with annual BWIC volume having more than doubled from around €10bn in 2017 to just under €21bn in 2021.

Contrary to what one might assume, BWIC volume actually tends to increase in periods of greater volatility, which gives ABS and CLO investors access to a wider base of market participants at a time when they might need it most. Again this is slightly different to secondary trading in more mainstream bond markets, where dealers’ appetite for making markets tends to decrease in volatile periods as there is an increased risk to holding bonds on their balance sheets.

As the chart above shows, BWIC volume has jumped during two key periods of volatility in recent years. The first was the onset of the COVID-19 crisis in H1 2020, when asset managers were facing redemptions and hedge funds were hitting margin calls. As the COVID-19 panic hit the market, asset prices dropped sharply and due to the lack of appetite from investment bank trading desks, investors were forced to increase BWICs to in search for liquidity.

The second was the liquidity crisis among UK pension funds in late September 2022, which was triggered by an extreme sell-off in UK government bonds in response to the government’s disastrous ‘mini-Budget’ announcement. The Gilt sell-off sent pension funds running liability driven investment (LDI) strategies scrambling to raise cash to cover margin calls, which sparked heavy selling of liquidity assets like UK RMBS and higher rate CLOs.

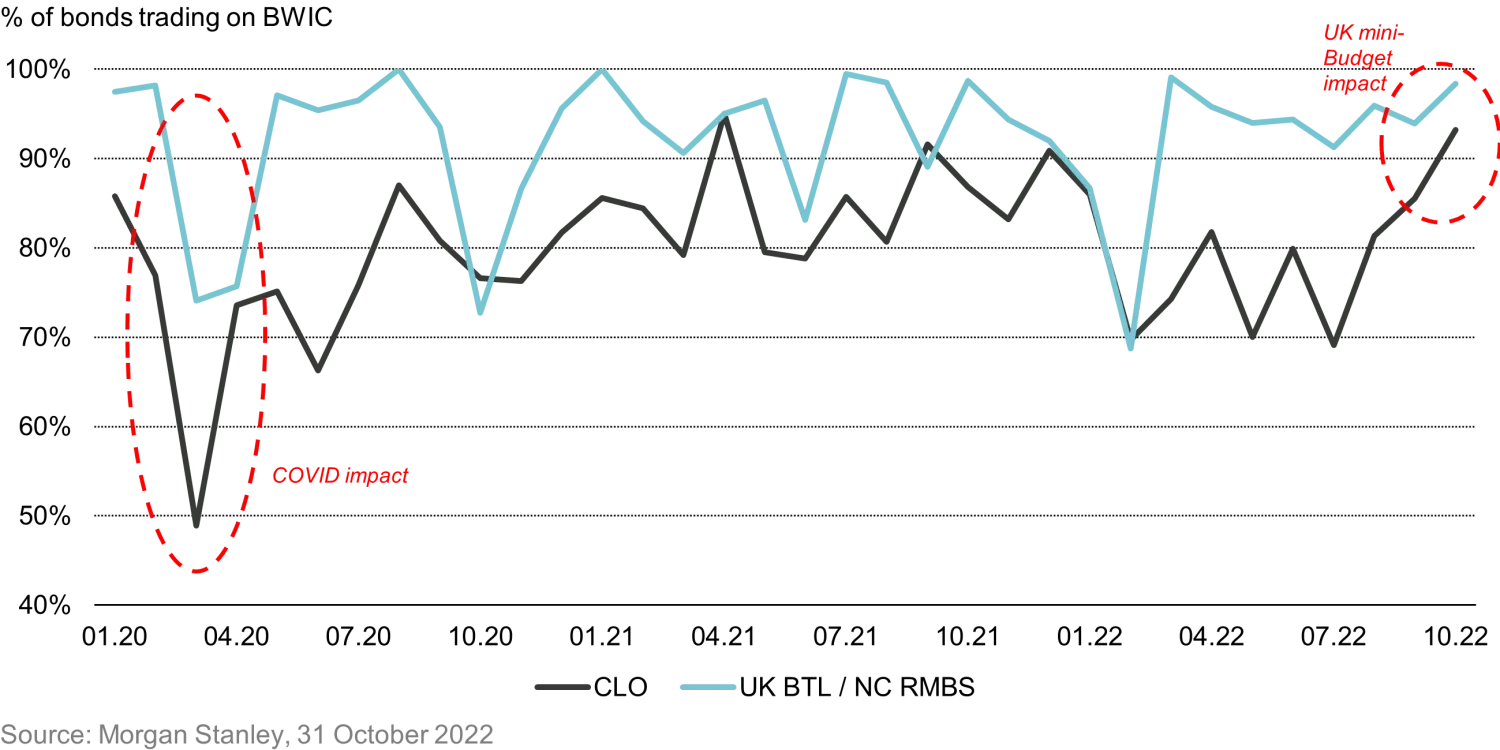

As shown in the chart below, the proportion of CLO bonds listed on BWICs in September and October that were ultimately traded was between 85% and 93%, broadly in line with the ratio across 2021, but clearly much higher than a low of 49% during the COVID-19 sell-off in March 2020.

However, a lower proportion of listed bonds trading doesn’t necessarily mean there are bonds that cannot be sold. In fact, it is more likely that during this period of significant broader market turmoil investors were looking for optionality. In other words, they were likely listing bonds from a more diverse range of sectors and ratings than they ever intended to sell in order to see which would attract the best bids. In a period as volatile as March 2020, 60% of listed bonds trading was widely regarded as a strong sign of liquidity for the ABS market, though liquidity was notably better for AAA RMBS and AAA CLOs.

Another difference between these two periods was that in the UK mini-Budget sell-off, dealers were more willing to put balance sheet to work as they were able to rotate their books given the high level of appetite from investors. Some dealers also took the opportunity to increase the balance sheet they committed to trading, as opposed to reducing their risk limits as many did during the COVID-19 sell-off. Bank treasuries, for example, stepped in to buy large volumes of UK RMBS from pensions funds. In both crisis periods, the dislocated trading levels also attracted hedge funds and private equity buyers as they saw an opportunity to buy high quality bonds at wider levels.

March 2020 and September/October 2022 are two examples of BWICs generating additional liquidity for ABS and CLO investors when they most needed it, but the BWIC auction process is widely used during less volatile markets as well. In a lower volatility environment, BWIC volume tends to drop in line with lower selling pressure and stronger general liquidity, as well as investors’ ability to get strong bids directly from traders. BWIC volume is also generally positively correlated to primary ABS issuance, since investors often look to fund purchases of new deals by selling assets to free up cash, but it also tends to be inversely correlated to general demand for the asset class. BWIC activity slowed materially in 2021, for example, as the floating rate format and extra yield opportunities available in European ABS compared to government and corporate bonds made the market more attractive to investors.

In short, in our view BWIC lists have proved to be an efficient process in periods of market disruption, which in turn helps to lower the risk of liquidity squeezes in ABS and CLO markets.

Fixed Income 101: Income investing

Fixed Income 101: Comparing yields in different currencies

Fixed income managers always want to have the flexibility to look for the best value across their investment universe, and in our view they therefore need the capacity to buy bonds in different currencies.

Fixed Income 101: Roll-down

Fixed Income 101: Inflation-linked bonds

Fixed Income 101: Hedging currency risk

Hedging currency or foreign exchange (FX) risk is a key decision for any manager running a diversified fixed income portfolio. Currencies are inherently volatile, so whether and how FX risk is managed can have a material impact on a portfolio’s risk and return profile.