Global Listed Infrastructure – 2024 Outlook

Quantitative Investments

2023 Retrospective

After outperforming the broader market last year, infrastructure investors faced a more challenging 2023 as equity markets narrowed to focus on large-capitalization technology stocks and artificial intelligence.

Utility and tower stocks lagged as investors appeared to shun defensive sectors such as consumer staples, real estate, and utilities. U.S. utilities traded lower despite constructive earnings results and management commentary. A mix of higher interest rates and a maturing of the independent tower business model contributed to the communication group’s underperformance. Midstream energy stocks turned in positive performance, supported by solid commodity prices and continued volume growth. Transportation was the best-performing sector, led by airports, which experienced a snap back in passenger volumes following the pandemic.

2024 Outlook

As we look at infrastructure’s fundamental performance over the last 20+ years in Figure 1, 2020 presented the only negative development of annual EBITDA growth. In contrast, the broader market showed more volatile results shaped by near-term events such as the financial crisis and an unprecedented global pandemic. The business models of infrastructure companies performed as designed and withstood challenging conditions. As we look forward to 2024, we see the following trends in each of the infrastructure sectors:

Communications

Wireless tower activity in the U.S. slowed from the rapid pace of 2022 as the big three service providers pulled back on spending. While there is potential for re-acceleration in tower activity, the long-term master lease agreements between the towers and the carriers provide a predictably healthy level of organic growth and cash flows for the tower companies.

Internationally, we expect solid organic growth to continue into 2024 as Europe and other regions forge ahead with their 5G expansion, while many emerging markets are still building 4G networks. In Europe, M&A activity in 2023 slowed due to financial market conditions. Still, we saw Cellnex sell a stake in their Nordic business at an attractive price, as private equity interest in towers remains high.

As interest rate headwinds begin to dissipate, we believe the attractive risk-reward profile for tower stocks supported by a solid business model and strong long-term fundamentals will become more apparent.

Utilities

The underperformance of North American regulated utilities versus the S&P 500 in 2023 marked the third worst annual relative performance in the last 40 years. The group’s valuation has seldom been this highly discounted while earnings and dividend growth prospects remain intact. In our view, capex visibility is significant given the need to invest in the modernization of the grid as the penetration of electric vehicles and renewables continues to grow. These technologies are now more attractive than their respective legacy alternatives, even excluding subsidies, given the decline in lithium prices. Perhaps most exciting is the recent acceleration in load growth, which should allow select utilities to grow rate base without pressuring bills, a paradigm shift that we believe has largely been ignored by the market. In light of these dynamics, we see an attractive set-up for North American regulated utilities in 2024.

Within Europe, the energy crisis has subsided and with it regulatory and political intervention risks for utilities. At this point, European utility valuations are attractive while aggregate earnings and dividend expectations have seen positive momentum. We believe the integrated utility companies possess a good risk/reward balance, offering a mix of regulated networks, power generation, and retail supply businesses in addition to renewables growth exposure. We also believe balance sheets and dividend sustainability will be of greater importance in 2024 given refinancing and capex needs.

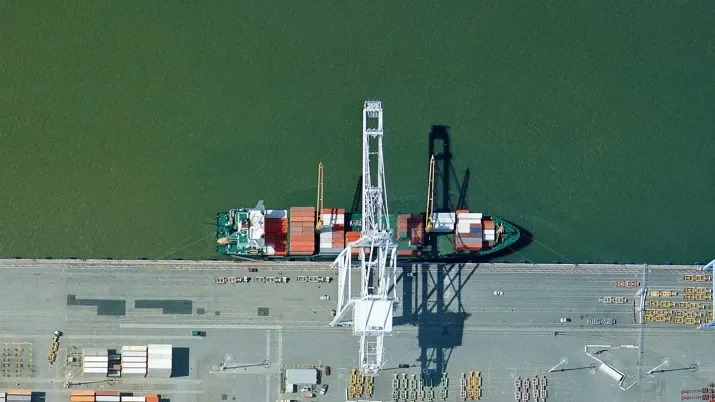

Transportation

Our view on the transportation sector is cautious due to mixed outlooks for the near and medium term. Toll road volumes continue to show resiliency as traffic recovers, and in many cases, exceeds pre-pandemic levels. Traffic growth related to leisure travel drove the recovery in 2023 and provided a critical offset to a slower-than-expected cadence for return to office traffic in select areas. Tighter monetary conditions remain headwinds heading into 2024, but toll roads are stable businesses with inflation-

linked tolling regimes and efficient cost structures. Given the durable nature of these businesses, we anticipate another steady year of operations in 2024.

North American railroads faced a challenging 2023 marked by weak freight demand, external operational disruptions, and margin pressures. Despite this adversity, the railroads improved their operational service offering, enabling them to win back market share from trucking, improve pricing, and drive fluidity gains. While these service improvements have come at the cost of near-term margin pressure, we believe railroads are well positioned to benefit from the positive inflection in freight demand in 2024.

Airport traffic soared in 2023 driven by sustained demand for leisure travel, the re-opening of Asian routes, and recovering business travel. While there is line of sight for continued momentum into 2024, we expect higher airline ticket prices and tighter monetary conditions to weigh upon demand for leisure travel. Business travel is likely to continue to face continued competition from video conferencing and corporate ESG objectives. Amid a challenging macro backdrop, airport stocks are likely to remain volatile until there is more certainty around travel trends.

Midstream Energy

We remain constructive on the midstream space heading into 2024.

Supply-side constraints are a key pillar of our positive outlook. OPEC+ production cuts should continue to drive fundamental tightness in crude oil markets for the foreseeable future, sustaining prices at elevated levels. This will enable North American energy companies to grow production volumes modestly, which in turn supports higher midstream earnings and cash flow.

For natural gas, all eyes remain on the intensity of this heating season. A normal to cold winter would likely drive global prices higher from here. The LNG market should remain fundamentally tight in 2024, with growing Asian demand and continued high imports into Europe.

From a demand perspective, macroeconomic uncertainty will be a wildcard in 2024. While current demand conditions generally appear healthy, the possibility of a global recession cannot be ignored. A moderate to deep recession would certainly dent demand and result in looser balances overall for energy commodities, especially natural gas liquids and refined products.