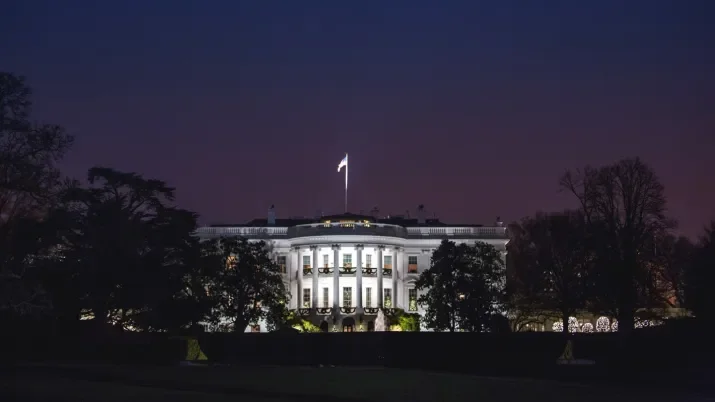

TwentyFour

Can credit keep calm and carry on?

With cracks starting to show in the US economy, many are wondering whether tight corporate bond spreads leave investors vulnerable. But with corporate balance sheets holding firm and yields on higher quality bonds looking attractive, staying invested in credit should continue to reward investors.