TwentyFour

Heavy Supply Meets Heavy Demand

Kicking off the new year, we expected the new issue market to be very active and we certainly haven’t been disappointed, with the good momentum created at the end of last year – thanks to the US and China reaching a ‘phase one’ agreement and the resounding victory by the Conservatives paving the way for Brexit negotiations to move forward – allowing pent-up borrowing demand to hit the market.

TwentyFour

Newell: Fallen Angel to Rising Star?

Fixed income investors are well versed in the risks of ‘fallen angels’, investment grade companies whose bonds tumble in value once they are downgraded to high yield.

TwentyFour

Carney to Leave UK Banks on Solid Ground

The Bank of England (BoE) on Monday published its latest financial stability report and the results of its 2019 bank stress tests, and declared that the UK financial system is well prepared for even a worst-case Brexit and consequent trade war.

Quality Growth Boutique

2020 Emerging Markets Equity Outlook

Jin Zhang provides insights on changes in the global supply chain, long-term beneficiaries of the trade war, India’s growth prospects and Brazil’s path to reform.

TwentyFour

CoreCivic Shows ESG Will Take No Prisoners

"One group of issuers that appears vulnerable to us as we move into a new decade is those facing increased investor scrutiny due to Environmental, Social and Governance (ESG) factors. The case of CoreCivic, a listed REIT in the US, is a good example"

Quality Growth Boutique

2020 International Equity Outlook

David Souccar talks about markets in 2019, long-term structural risks, performance over the cycle, investing in Japan, and international vs US exposure.

Quality Growth Boutique

2020 US Equity Outlook

Matthew Benkendorf discusses growth vs value investing, finding quality growth opportunities amid volatility and how to approach the markets in 2020.

Quality Growth Boutique

2020 European Equity Outlook

Donny Kranson talks about UK elections, fiscal stimulus, growth vs value investing, ESG issues and positioning for opportunities in 2020.

Quality Growth Boutique

2020 Asia Pacific Equity Outlook

Brian Bandsma discusses India’s slowdown, companies impacted by the trade dispute, redirection of global supply chains, and country rhetoric around trade and technology.

TwentyFour

What Next For Sterling Bonds?

Overnight markets have had significant news to digest, with two of the major geopolitical hurdles that had been worrying investors being removed.

TwentyFour

European HY Default Rates Doubling No Reason to Panic

"Where defaults get to exactly depends on a few things, but we can certainly analyse where we think the problem areas could be, whether cracks are already starting to appear, and what investors might do to protect themselves."

TwentyFour

Fixed Income 2020: A Brave Old World

Twelve months ago, as we wrote our annual review and forecast for 2019, backing 10-year German government bonds that were yielding just 0.24% at the time to perform would have been a brave call.

TwentyFour

Trade war volatility maintains grip on bonds

By now investors should be getting used to the ever more frequent hiccups in the trade negotiations between the US and the rest of the world.

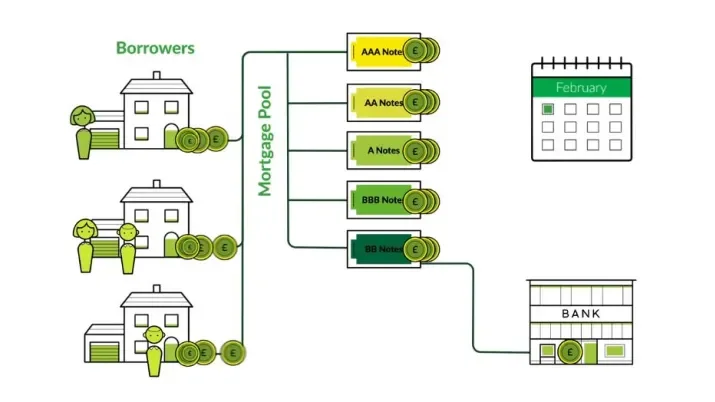

What is an RMBS, and how do they work?

Residential mortgage-backed securities (RMBS) are an under-utilised asset class for many investors, despite boasting some of the lowest default rates across the global fixed income market and offering higher yields and greater investor protections than vanilla corporate bonds of the same rating.

TwentyFour

What is a Residential Mortgage Backed Security?

Residential mortgage-backed securities (RMBS) are an under-utilised asset class for many investors, despite boasting some of the lowest default rates across the global fixed income market and offering higher yields and greater investor protections than vanilla corporate bonds of the same rating.

TwentyFour

Data decline eases for Germany and US

"In some parts of the global economy, we might be seeing a bottom in terms of low activity levels." TwentyFour's Felipe Villarroel discusses the factors behind these improving trends.

TwentyFour

NIBC leading the way in ESG

“NIBC, has been involved in ESG/CSR focused lending in Europe for some time, and is the first manager to issue what we might call an ESG CLO." Elena Rinaldi discusses why in terms of ESG, NIBC would receive a high score from us.

TwentyFour

Fitch keeps AT1 investors on their toes

"We have been participants in the Additional Tier 1 (AT1) sector since its introduction in 2013, albeit with a high degree of selectivity, but the risk-reward has been obvious to us." Gary Kirk discusses the latest AT1 news from Fitch

TwentyFour

IG demand would be key to Walgreens buyout

At this late point in the cycle, fixed income investors are on high alert for signs of potential excess in the capital markets, and a proposal for potentially the biggest leveraged buyout (LBO) in history would certainly fall into that category.

TwentyFour

US corporate credit demand slows again

The Senior Loan Officer Opinion Survey, combined with financial results from the banks, is probably still the most useful tool we have for gauging the cycle’s life expectancy.

TwentyFour

Risk well underpinned going into year-end

A number of threats to risk assets have dissipated and could become positive tail risks for markets moving into 2020.

TwentyFour

What Does US Loan Underperformance Mean for Bondholders?

"The European CLO market is much smaller, but given the US is further ahead in the economic cycle, the US market can provide a good indication of what might happen in Europe."

TwentyFour

Bank Earnings – US consumer remains in good health

For us, it is the insight into the US economy and the strength or weakness of their customers, that we find most interesting in the banking results, and especially so when the US economic data is increasingly pointing to a slowdown.

Quality Growth Boutique

Long awaited détente in US China relations reduces recessionary risks

The US-China interim agreement reduces recessionary risks in both countries. However, the trade war is far from over and risks of a re-escalation persist.