How Much Supply is There to Come?

TwentyFour

August is typically a tranquil month for the bond market and the last few weeks have been no exception, with limited issuance the prevailing theme. Following this summer break, we usually expect elevated levels of new issuance during September and October. This supply surge can be very welcome for those investors with cash to put to work, though it is also eyed with caution given its potential to act as a headwind to valuations into the year-end. This year’s post-summer period is likely to be unusual, given just how much primary supply we have seen across sectors over the last 18 months. Let’s review our expectations across a few sectors beginning with one of our favoured asset classes, AT1s.

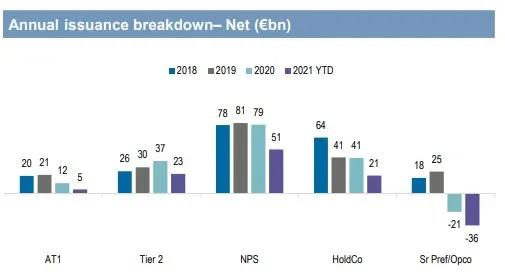

Year-to-date we have seen around €20bn of gross AT1 issuance, and we expect another €5-10bn of issuance and very little net new supply into year-end. A few issuers came to the market in August (Barclays, Nordea, Swedbank and Standard Chartered) with deals that were well oversubscribed despite the time of year, suggesting investors are generally comfortable with the supply they expect in Q3 and Q4. In Tier 2 and senior debt, too, the bulk of the issuance appears to be behind us. In fact across financials, net issuance YTD is well short of 2019 or 2020 levels, as the chart below from JP Morgan shows.

JPM August 27th report: YTD Net Issuance in 2021 vs previous years

Overall, the picture is somewhat similar in the investment grade corporate sector. For example, since the pandemic, European issuers have tended towards corporate hybrids as instrument of choice because the asset class allows them to protect their investment grade ratings at a manageable cost. So far this year, we have had nearly €30bn of hybrid issuance. Market forecasts indicate another €10bn of gross issuance before year-end, another elevated number in line with last year’s overall volume for the asset class. In the last week alone three new issues have met with solid demand, suggesting investors are happy to deploy cash and are not particularly fearful of a heavy calendar. Another tailwind for hybrid issuance is a relatively underwhelming calendar for European investment grade issuance. After record volumes in 2020, when investors faced €567bn of gross issuance and €186bn of net issuance, JP Morgan expects gross and net issuance for 2021 to fall to €450bn and €58bn respectively, with the majority of that net supply already completed.

Turning to European high yield, investors expect September and October to be busy months, with around €25bn to €30bn issued. Moreover, new transactions should represent the bulk of activity as opposed to refinancing. 2021 is already a record issuance year for European high yield, with volumes around €100bn, in line with 2020. This heavy pipeline is well flagged, and we feel investors have been preparing for the busy period with higher than usual cash balances. We also note that the European high yield market has grown considerably over the last year and a half and is now about 50% bigger than at the beginning of last year. Therefore, participants should expect a higher monthly run rate for issuance going forward.

As we prepare for the new issuance calendar, we feel prospective supply levels across sectors are easily digestible given how small the net supply figures are relative to the substantially higher cash balances that managers are currently running.