For Bonds, Q4 Will Present Similar Challenges to Q1

BWIC – or bids wanted in competition – lists, are a unique characteristic of the ABS and CLO markets, where they are widely used in secondary trading when investors are looking to sell bonds. A BWIC is a list of bonds sent by investors to dealers, who then share the list with their clients. It is run through an auction process and allows investors to receive bids from the broader market, theoretically helping them achieve better execution. Colour on BWIC execution is also generally shared with the market after trading, which contributes to market transparency and overall liquidity. Dealers often share the second-best bid price they received, for example, which can be particularly useful for holders of mezzanine bonds that don’t trade very often, as the bid levels give investors an indication of where these bonds could be traded.

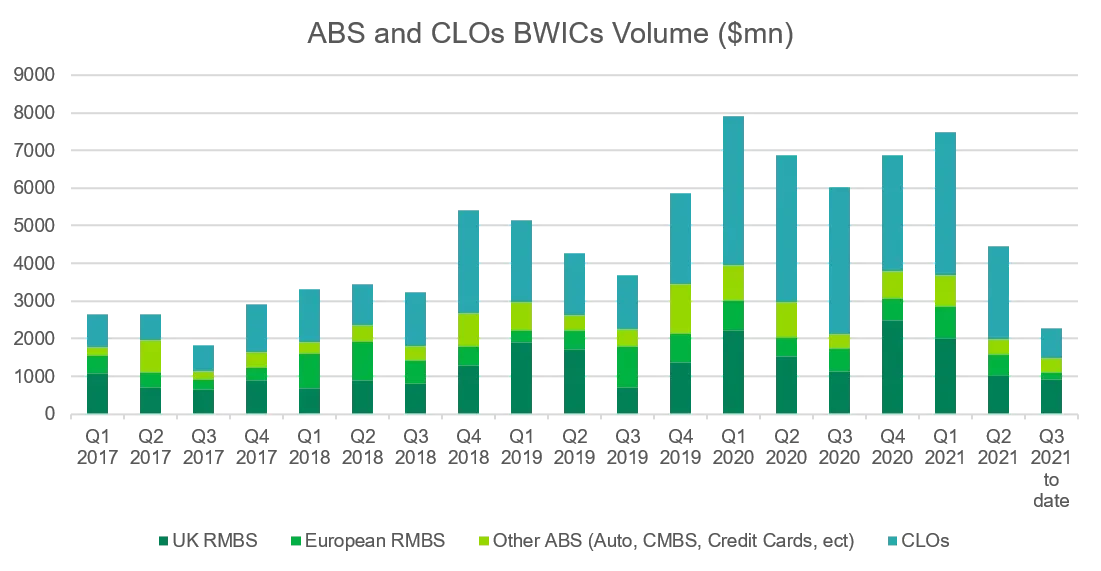

Looking at BWIC volumes can give us a good idea of the trading dynamics in the ABS or CLO market at a given moment. As we can see on the chart below, BWIC volumes have increased to $14bn-equivalent year-to-date from $6.5bn over the same period in 2017, as the European structured finance market has grown over the past years to €466bn.

During the COVID-19 crisis, we observed a spike in BWIC volume in H1 2020 as asset managers were facing redemptions and hedge funds were hitting margin calls. As the COVID-19 panic hit the market, assets prices dropped sharply and due to the lack of appetite from investment bank trading desks, investors were forced to increase BWICs to generate liquidity. As a result, the proportion of bonds that did-not-trade (DNT) ticked up, with the DNT ratio reaching a record high of 40% in March 2020 versus only 9% across 2019 under more normal market conditions. We should note here that a higher DNT ratio doesn’t necessarily mean there are bonds on the BWIC lists that cannot be sold. In fact, it is more likely that during this period of significant broader market turmoil investors were looking for optionality, or in other words listing more bonds than they ever intended to sell in order to see which would attract the best bids. Despite a significant widening in bid-offer spreads, well less than half of bonds not trading is a sign of strong liquidity even in a period of high volatility, though liquidity was notably better for AAA RMBS and AAA CLOs.

BWIC volume is often positively correlated to primary issuance, since investors often look to fund the new issue pipeline by freeing up cash to participate in new deals. In the past few months, BWIC activity has slowed materially as we have witnessed increased demand for ABS, and particularly for mezzanine bonds. This is thanks to their attractive yield pick-up compared to government and corporate bonds, for example, as well as the floating rate nature of ABS making it insensitive to anticipate rises in interest rates. In addition, lower secondary activity in European CLOs is being driven by record primary supply from the current refinancing wave, as well as new issues taking much of investors’ attention, a trend we expect to continue in Q4 2021. So with investors seemingly not selling to finance new purchases in primary, lower BWIC volumes today suggest that the net increase in CLO supply is being matched by asset managers’ net inflows.

Source: Citi Velocity, 31/08/2021

Contrary to what one might assume, BWIC volume tends to increase in periods of greater volatility, which gives ABS and CLO investors access to a wider base of market participants at a time when they might need it most. In a low volatility environment, BWIC volume tends to drop in line with lower selling pressure and stronger liquidity supported by the ability to get strong bids directly from traders. BWIC lists have proven to be an efficient process in periods of market disruption, and in our view they make the structured finance market less vulnerable to liquidity squeezes than many more mainstream bond markets.