Fixed Income Boutique

Fixed Income Quarterly

Each quarter, our experts from the Fixed Income Boutique deliver actionable insights to help you make sense of the global fixed income universe. They uncover key risks, opportunities, and trends.

TwentyFour

Flash Fixed Income

Taking inspiration from the “flash” economic indicators that offer markets a preview of the final numbers, Flash Fixed Income is a monthly outlook that keeps investors ahead of the curve by dissecting the major trends across the global bond markets.

TwentyFour

European banks continue to deliver, on earnings and calls

As earnings season kicks off in Europe, Eoin Walsh looks at what impact, if any, recent volatility in the banking sector has had on European banks.

Fixed Income Boutique

Ready for takeoff? Are corporate bonds set for a smooth climb?

After the “great repricing” of 2022, is corporate credit now ready for takeoff? Our corporate credit experts, Mondher Bettaieb Loriot and Christian Hantel, analyze the reasons behind the revival of high-grade corporate credit and explain why they remain optimistic about investment-grade markets in Europe and the US.

TwentyFour

Short Term Bond Quarterly Update – April 2023

Partner and Portfolio Manager Chris Bowie discusses recent Q1 events and gives an outlook for Investment Grade for the next quarter.

Asset management

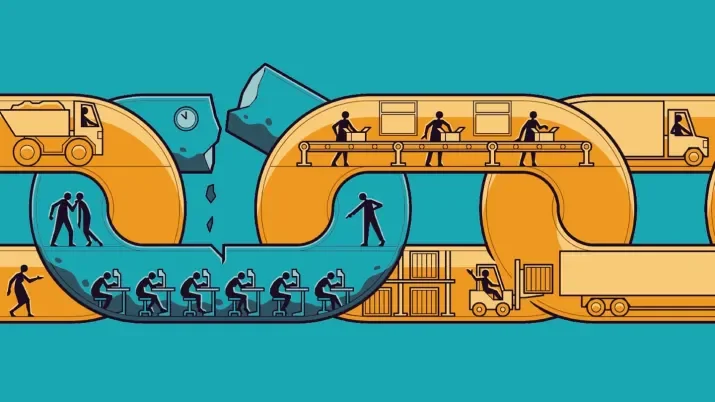

Knowing your supply chain is crucial for investing in a new era

For a single company, supply chain oversight can be complex. For professional investors with multiple companies in their investment portfolios, this task can become massive. Complexity, however, is not something to hide behind.

TwentyFour

Spotlight on Banks – March 2023

Given the recent headlines surrounding Credit Suisse and the decision from FINMA, the Swiss regulator, to write down CHF16 billion of Credit Suisse’s Additional Tier 1 debt to zero, we hosted a webinar looking at the possible wider implications of this write-down and what it could mean for fixed income investors.

TwentyFour

Spotlight on CLOs - March 2023

European ABS proved to be a valuable allocation for fixed income investors last year and we think the asset class looks to be even stronger in 2023, with rates and spreads combining to create an attractive income landscape.