Fed rate cut does little for clarity on policy path

TwentyFour

The Federal Reserve (Fed) cut interest rates by 25 basis points (bp) on Wednesday, exactly as markets had anticipated, marking its first rate reduction since December 2024. The decision passed with an 11-to-1 vote, with newly-appointed governor Stephen Miran dissenting in favour of a larger 50bp cut.

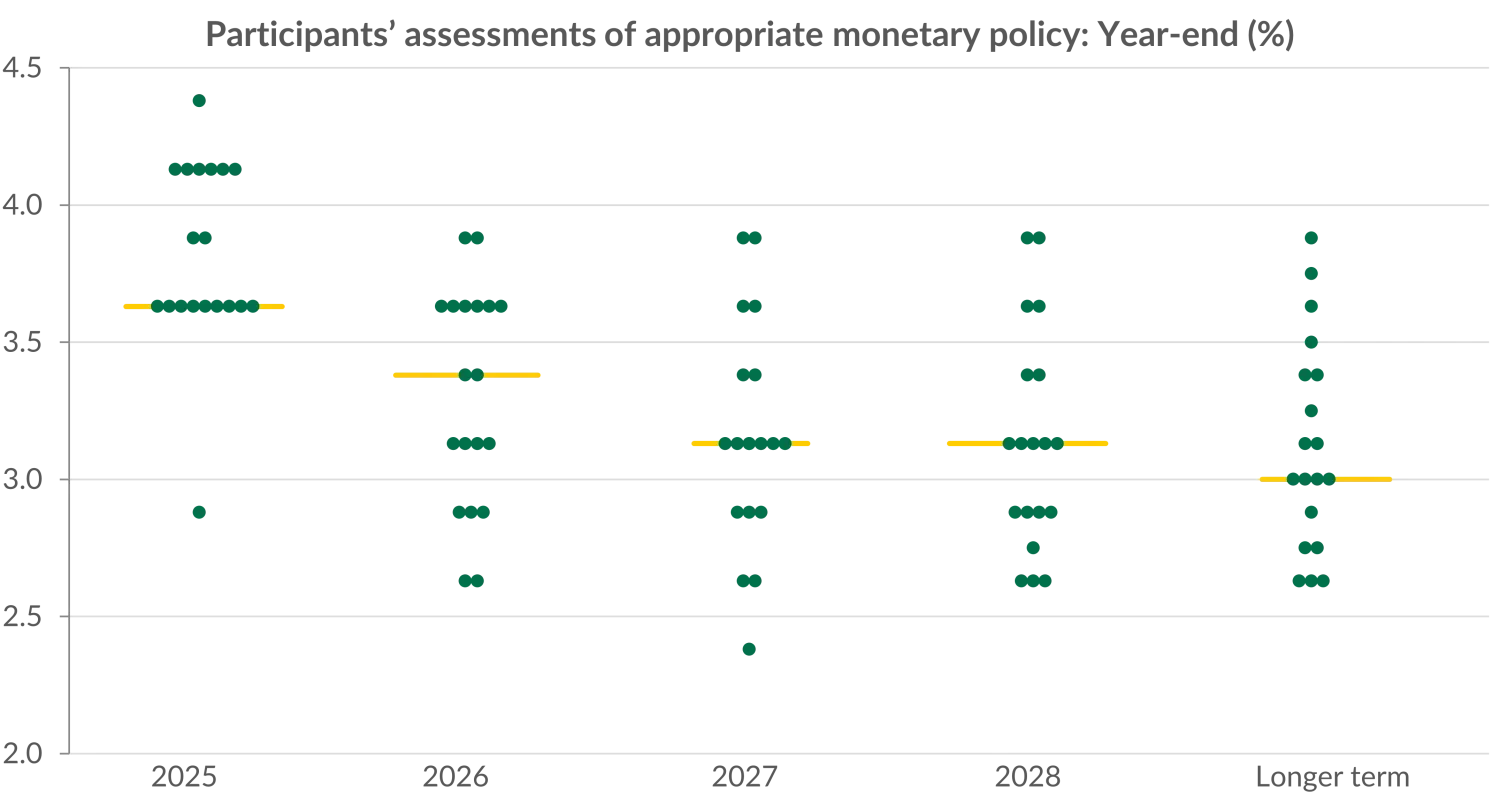

Alongside the decision, the Federal Open Market Committee (FOMC) released fresh economic projections and an updated dot plot, which showed a more constructive outlook on growth and unemployment. Inflation projections edged higher but remained broadly consistent with a gradual return to the 2% target. Notably, the dot plot revealed wide dispersion among policymakers over the pace and extent of future easing, underscoring uncertainty in the path ahead.

The updated Summary of Economic Projections (SEP) presented a modestly brighter growth outlook compared with June’s figures. Real GDP growth for 2025 was revised up from 1.4% to 1.6%, while projections for 2026 and 2027 also increased to 1.8% and 1.9%, respectively. Inflation estimates moved slightly higher: core PCE inflation was unchanged at 3.1% for 2025, but revised upward for 2026 to 2.6% (from 2.4%), before holding at 2.1% in 2027 and finally reaching target in 2028. The unemployment outlook also improved modestly, with the 2026 median forecast dropping to 4.4% (from 4.5%) and 2027 to 4.3% (from 4.4%).

The updated dot plot revealed a wide dispersion of views within the FOMC, reflecting the committee’s uncertainty over the appropriate pace of policy easing (see Exhibit 1). The median projection for the Fed Funds rate shifted lower across the forecast horizon, with the year-end median moving from 3.9% to 3.6% for 2025, from 3.6% to 3.4% for 2026 and from 3.4% to 3.1% for 2027, while the longer-run “neutral” rate held at 3.0%.

Exhibit 1: Fed dots show wide range of rate paths

Source: Bloomberg, 17 September 2025

Underlying these medians the distribution was highly fragmented, as was the case in June, though we saw a new development with one participant pencilling in 125bp of cuts this year. This is very likely to have been from the newly- and narrowly-appointed (48-47 Senate vote) Miran leaning into President Trump’s dovish demands. Nine members projected two additional cuts this year, two favoured just one more 25bp move, six anticipated no further easing, and one saw no rate change at all. This divergence underscores the committee’s balancing act between concerns over rising inflation and signs of a softening labour market, a tension which is clearly reflected in the wide range of views across participants.

Notably, none of Christopher Waller, Kevin Warsh, or Kevin Hassett, all considered frontrunners for the next Fed chair, pushed for a larger 50bp move, though they were likely among the more dovish voices at the meeting. While Waller is also a President Trump appointee, Miran, who continues to hold a White House role, is more clearly a Trump loyalist. The lengthy and staggered terms Fed governors serve could help to alleviate concerns about the Fed maintaining its independence, despite the president’s calls for “big” cuts.

The current chair, Jerome Powell, while cautious, struck an overall optimistic tone on the economy. He pointed to supply-side dynamics, noting that the significant decline in immigration is limiting the rise in unemployment even as the labour market softens. Powell emphasised that the labour market is “softening” rather than weakening, with job creation now running below the breakeven pace following the 22,000 jobs that were added in August. On inflation, Powell downplayed the risk of persistence, describing tariff-driven price increases as largely one-off, remarking that “the case for there being a persistent inflation outbreak is less.” Overall, he framed the rate cut as an “insurance cut,” underscoring the uncertainty ahead: upside risks from tariffs, downside risks from a cooling labour market, and the need to remain data-dependent with decisions taken on a meeting-by-meeting basis.

Following the release, US Treasuries (USTs) initially rallied but sold off throughout the press conference as Powell reinforced the dispersion of views among Fed members. The two-year UST yield ended the day 5bp higher and the 10-year yield 7bp higher. Equities finished modestly lower (-0.10% for the S&P 500), while credit spreads remained largely unchanged. Markets have slightly paired back their expectations for future rate cuts. Currently, four additional 25bp cuts are priced in by the end of next year, with a 65% probability of a fifth cut, down from a 95% chance prior to the meeting. This market pricing has the base rate at the end of 2026 at either 3.00% or 3.25%, below the Fed’s own projection of 3.40%.

For fixed income investors, the Fed’s message is clear: while the direction of travel for rates is lower, the pace and scale of cuts remain uncertain. Fed forecasts point to something of a Goldilocks scenario; growth improving, unemployment edging lower, and inflation gradually returning to target. But the continued wide dispersion in the dot plot guidance highlights just how uncertain that path is.

Against this backdrop, conditions remain broadly constructive for credit, though the uncertainty argues for a cautious, lower-beta stance until the outlook becomes clearer. However, given current pricing it is hard to envisage a sustained rally in USTs unless the economic environment markedly deteriorates, which makes longer duration in portfolios look less compelling.