Vescore Global Market Outlook August 2023

Quantitative Investments

In breve

- Risk environment: 2007/08 comparison lacks substance

- Economic Outlook: No relief yet from monetary policy

- Equities: Optimism with a grain of salt

- Bonds: Hawkish Fed weighs heavily on the asset class

The recession that never came

Investors, including us, have written extensively about the likelihood of a recession in countries such as the US and Eurozone since 2022 and yet, the recession has not materialized. Well, technically speaking it has, as the Eurozone and the US both have fulfilled the criteria of a technical recession1 over the last 12 months. But broader definitions of recessions, which usually include a significant rise in unemployment, have not been fulfilled. The main reason is the resilience of the consumer, who was pampered during the COVID crisis by a direct policy stimulus2. Higher savings makes the consumer more resilient against higher borrowing costs and has increased the chance of a soft landing, in particular in the US.

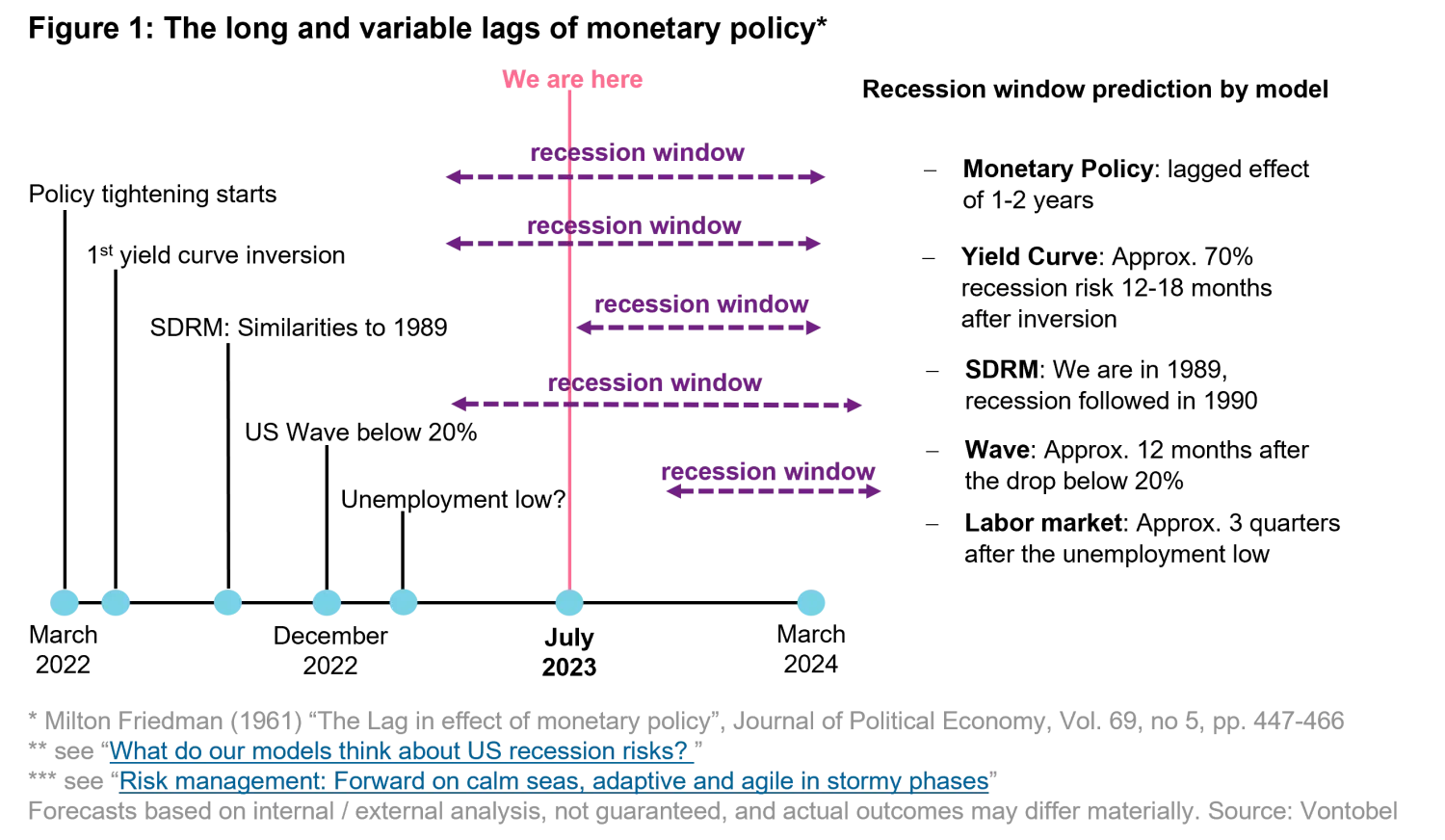

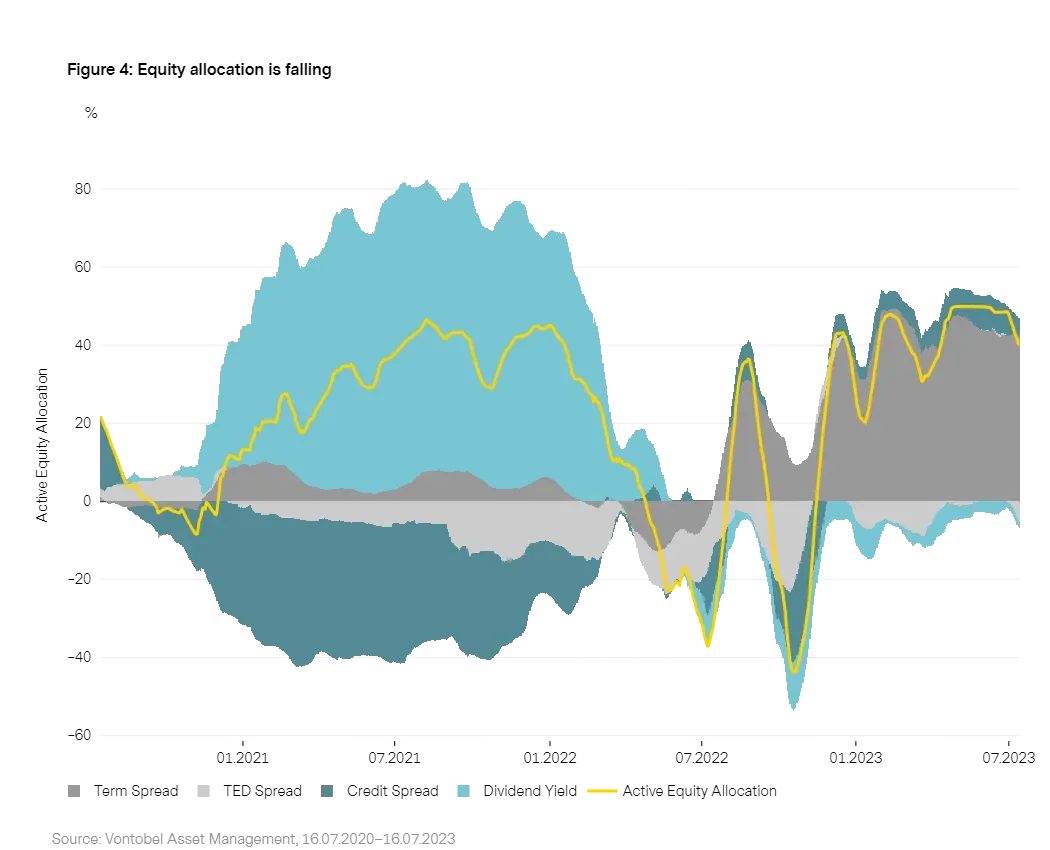

But the jury is still out. The main reasons for the wait are the long and variable lags of monetary policy3. Usually, monetary policy won’t unfold its full impact before 12 months have elapsed since the policy cycle has kicked off4. As shown in figure 1, this means that we only recently entered the phase during which policy-driven recessions show its effects. After months of running a high equity allocation our models have started to reduce the position in late June, just at the time when the Fed gave a surprisingly hawkish message after it hit the pause button on rate hikes. Whether this will turn out to be a policy mistake or not can only be answered at a later point in time. But our models prefer to reduce the exposure to riskier assets such as equities for the time being.

1. A technical recession is defined as two consecutive quarters of negative quarter-over-quarter growth.

2. See July edition of the

Global Market Outlook

3. See Milton Friedman (1961) “The Lag in Effect of Monetary Policy”, Journal of Political Economy, vol 69, no. 5.

4. See

“What do our models think about recession risks”

Risk environment: 2007/08 comparison lacks substance

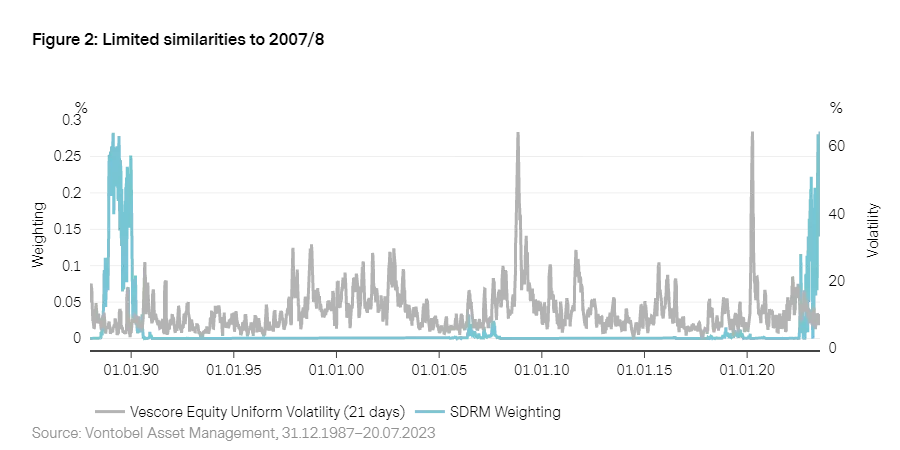

The Fed policy meeting in June led only to a temporary spike in bond market volatility which resumed its downward trend swiftly in early July. However, the spread between US equity (VIX) and bond (MOVE) market volatility remains high with the VIX/MOVE ratio trading at the lows of the 1990s.

Our risk model SDRM5 sticks to the comparison of the current environment with the late 1980s - a time period in which the US suffered first a pervasive loan and savings crisis (late 1980s) and, subsequently, a recession in 1990. But maybe even more interesting is the lack of grounds for making a compelling case for a comparison with the Great Financial Crisis (GFC) of 2007/8. As we pointed out in a recent edition of our market outlook6 , vulnerabilities of systemic relevant banks have fallen since the GFC. This does not mean that the weak commercial real estate activity in the US and high vacancy rates in the office segment will not have an impact. But the exposure of large US banks to the commercial real estate segment is moderate amounting to only 7% of their balance sheet, contrary to the exposure that smaller, less systemically relevant banks have (29%).

5. More information on our SDRM model can be found in “

Risk Management: Forward on calm seas, adaptive and agile in stormy phases

”.

6. See “

Vulnerabilities in the banking sector are below historical averages

” in the April 2023 edition of the Global Market Outlook.

Economic outlook: No relief yet from monetary policy

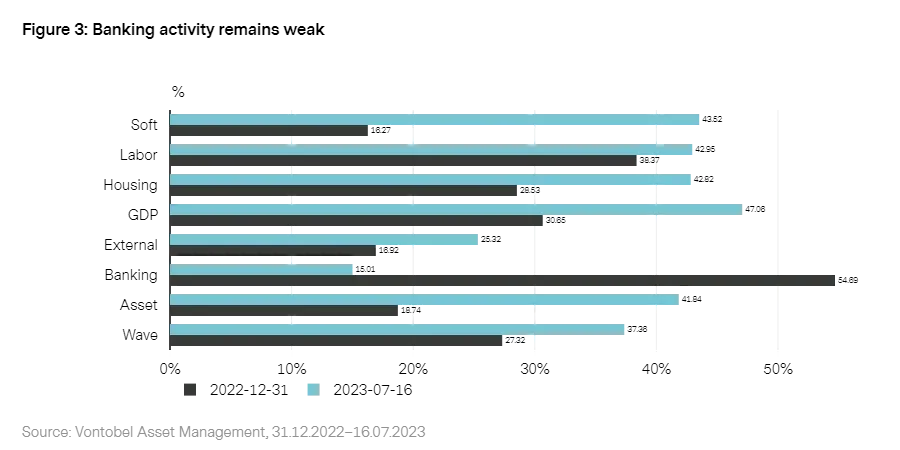

The world economy remains in contraction with currently only 40% of the 1’200+ time series processed by our business cycle model Wave gaining positive growth momentum. Despite the slowing pace of rate hikes, the effects of monetary policy tightening, which started in March 2022 in the US, are still building up. This is because monetary policy takes some time to fully unfold and make itself felt in the system. This is also why our transition model, based on real money growth, sees only a minor chance (7% probability) for the world economy to leave the contraction scenario in August7. The strongest contraction signals are still coming from the banking sector (figure 3).

Developed markets: EMU in technical recession

Developed markets remain in contraction, with rate-sensitive sectors of the economy such as housing8 and banking feeling most of the pain of the policy tightening cycle. The historically strong reduction in real liquidity (-12% year-on-year) keeps the probability of an economic recovery low (4%) for the next month. Both the US and the EMU have been experiencing a technical recession already since 2022 by fulfilling the criteria of two consecutive quarters of negative quarter-on-quarter growth in Q4 2022 and Q1 2023. However, labor markets remain tight. So far, the weak growth momentum is confined to the manufacturing sector and has not yet reached the service sector. The consumer resilience in the Eurozone and the US9 is the major reason for this astounding service sector resilience.

Emerging economies: Stronger growth momentum in LATAM and EMEA

In emerging markets, growth paths in the different regions are diverging. After a strong first quarter, momentum has eased in Asia due to the heavy weights China and India. This is in contrast to the continuously strong growth momentum in EMEA (recovery) and LATAM (expansion). A major driver of the weaker growth momentum in Asia, which may hit other regions as well, is faltering demand from developed markets. After an extremely weak April, May and June economic data releases point to growth stabilization. In particular, consumption and consumer sentiment have picked up again.

7. For a model description see

"The Vescore Wave – a superior business-cycle model"

8. See the special topic in the June edition of the

GMO

for more information on housing activity

9. See the special topic in the July edition of the

GMO

for more information on the consumer resilience

Equities: Optimism with a grain of salt

Our equity allocation model GLOCAP has reduced its equity overweight further (figure 4) after running a maximum equity allocation until late June 2023. The hawkish Fed communiqué however, led to a rise in rate expectations and – taking into account the deceleration of growth and inflation – a rising risk of over-tightening. Subsequently, the positive contribution of the credit spread to the equity allocation has fallen, while the contribution of the Ted spread turned even negative.

The contribution of the term spread remained strongly positive as policy easing gets more likely in an environment of falling inflation, weak growth and a rising risk of overtightening, even if relief may come later than expected. The contribution of the dividend yield remains unchanged, slightly negative.

Bonds: Hawkish Fed weighs heavily on government bonds

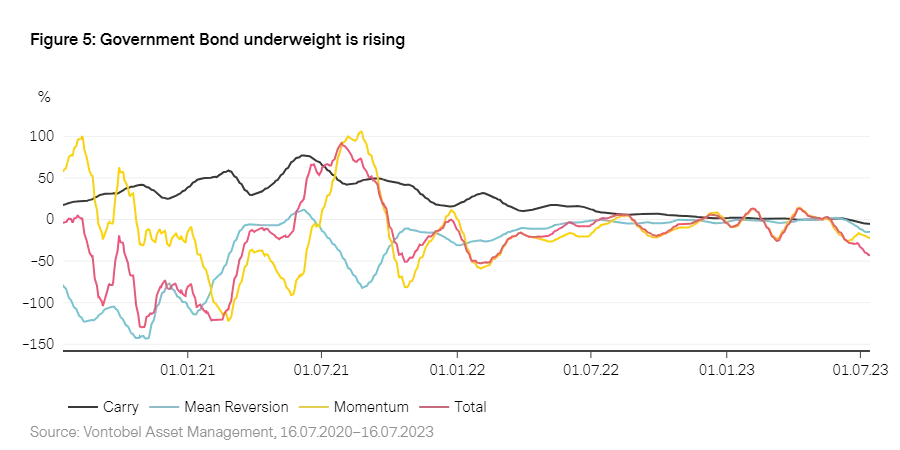

The hawkish Fed communiqué in June left skid marks on the bond market leading to a rise in the short and long ends of the curve in many economies. Our fixed income allocation model FINCA, which has been underweight government bonds since May, reduced its allocation further. Right now, all government bond markets as well as sub-strategies are contributing to the underweight, with momentum and mean reversion generating the biggest negative contributions (Figure 5).

Important Information: Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index

Any projections or forward-looking statements herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses.

Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.