Market update: Israel-Hamas conflict

Multi Asset Boutique

The Israel-Hamas conflict threatens to spill over into the wider Middle East. What does this mean for the price of oil?

En bref

- The immediate reaction of the financial markets was moderate.

- We are sticking to our positioning for the time being but are monitoring the situation carefully.

What happened?

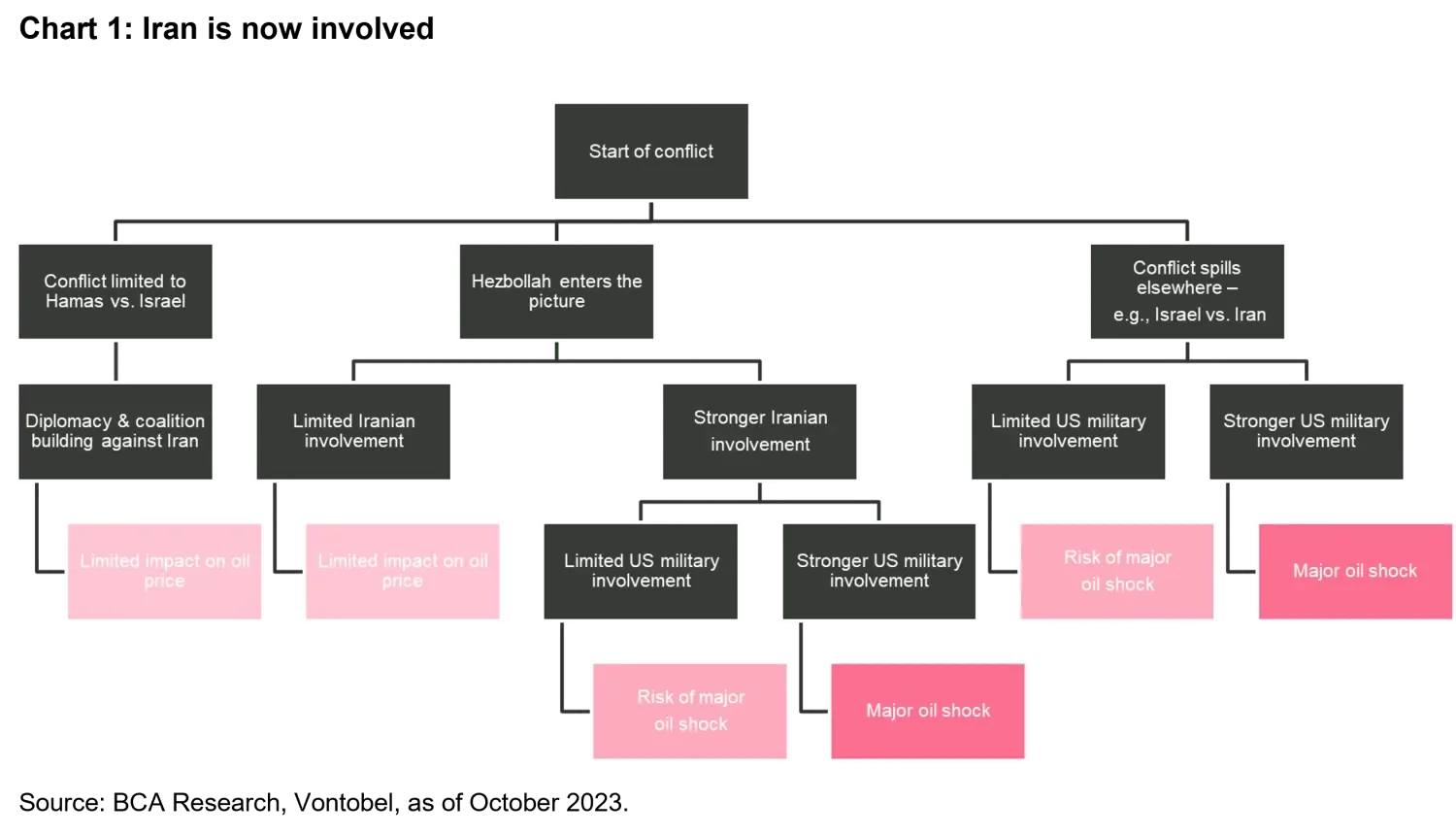

The Israel-Hamas conflict has dominated the headlines since October 2023. At the time we outlined three possible scenarios: a scenario in which the conflict remains limited to Israel and Hamas, a scenario in which Hezbollah becomes involved, and a scenario in which the “shadow war” fought between Israel and Iran escalates into a more “direct” conflict (chart 1).

Scenario 3 materialized over the weekend. On Sunday night (April 14, 2024), Iran sent drones and missiles towards Israel. Missiles were reportedly also fired from Lebanon and Yemen.

Tehran accuses Israel of attacking the Iranian consulate in Damascus on 1 April and killing several high-ranking Iranian officers. The latest attack marks a new, serious phase in the conflict that has been simmering for months.

Israel’s war cabinet met on Sunday 14 April to discuss further action. According to Channel 12, Israel’s Foreign Minister Katz emphasized his willingness to take further steps: “We said that if Iran attacks Israel, we will respond in Iran. This is still valid.” Israeli media also warned that Iran should be prepared for a “considerable reaction”.

How did the markets react?

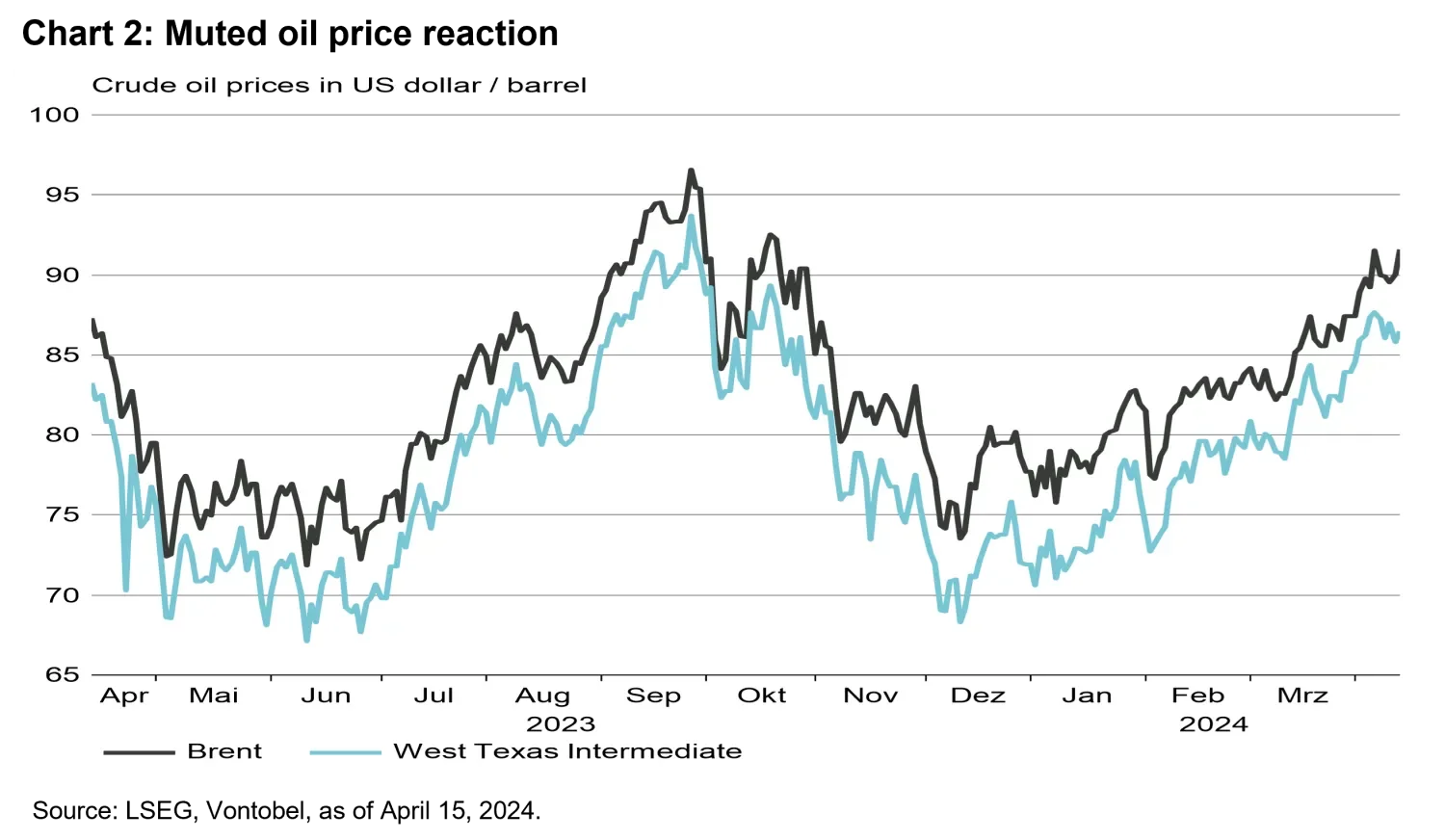

The immediate market reaction was moderate. US equity futures recovered at the start of the week, and the situation was also stable elsewhere. Those who had speculated on higher oil prices were proved wrong (chart 2). Brent futures for delivery in June fell by 23 cents (0.2 per cent) to USD 90.22 per barrel, while West Texas Intermediate futures for delivery in May fell by 29 cents (0.3 per cent) to USD 85.37 per barrel. This is probably also because oil prices had already anticipated a potential escalation in the previous days.

What happens next?

In the medium- to longer term, everything will depend on how the conflict develops, including whether Israel launches a retaliatory strike, whether Iran sticks to the one attack and how other parties (USA, Hezbollah, etc.) behave.

There is currently some evidence to suggest that the conflict (and thus the further upside potential for the oil price) is likely to be limited. If Iran is to be believed, this was it – at least Iran’s representative to the UN announced on the X platform (formerly Twitter) that the issue is now “concluded”. However, should the Israeli regime “make another mistake”, Iran’s response would be “considerably more severe”.1

According to a Reuters report, Iran also may have informed Turkey in advance of its planned operation against Israel. This is surprising: Iran could have hit Israel much harder if it had kept its intentions to itself. According to Israel’s army, 99 per cent of the missiles were intercepted.

On a positive note, other interest groups are also trying to de-escalate the situation. While US President Joe Biden assured Israel’s Prime Minister Benjamin Netanyahu of his support, he also warned against retaliation by Israel. In the event of an Israeli retaliatory strike, the US would more than likely not participate.

Saudi Arabia has also called for calm. In a statement issued by the Saudi Foreign Ministry, the kingdom expressed great concern about the military escalation in the region and called on all parties involved to exercise utmost restraint and to protect the region and its population from war.

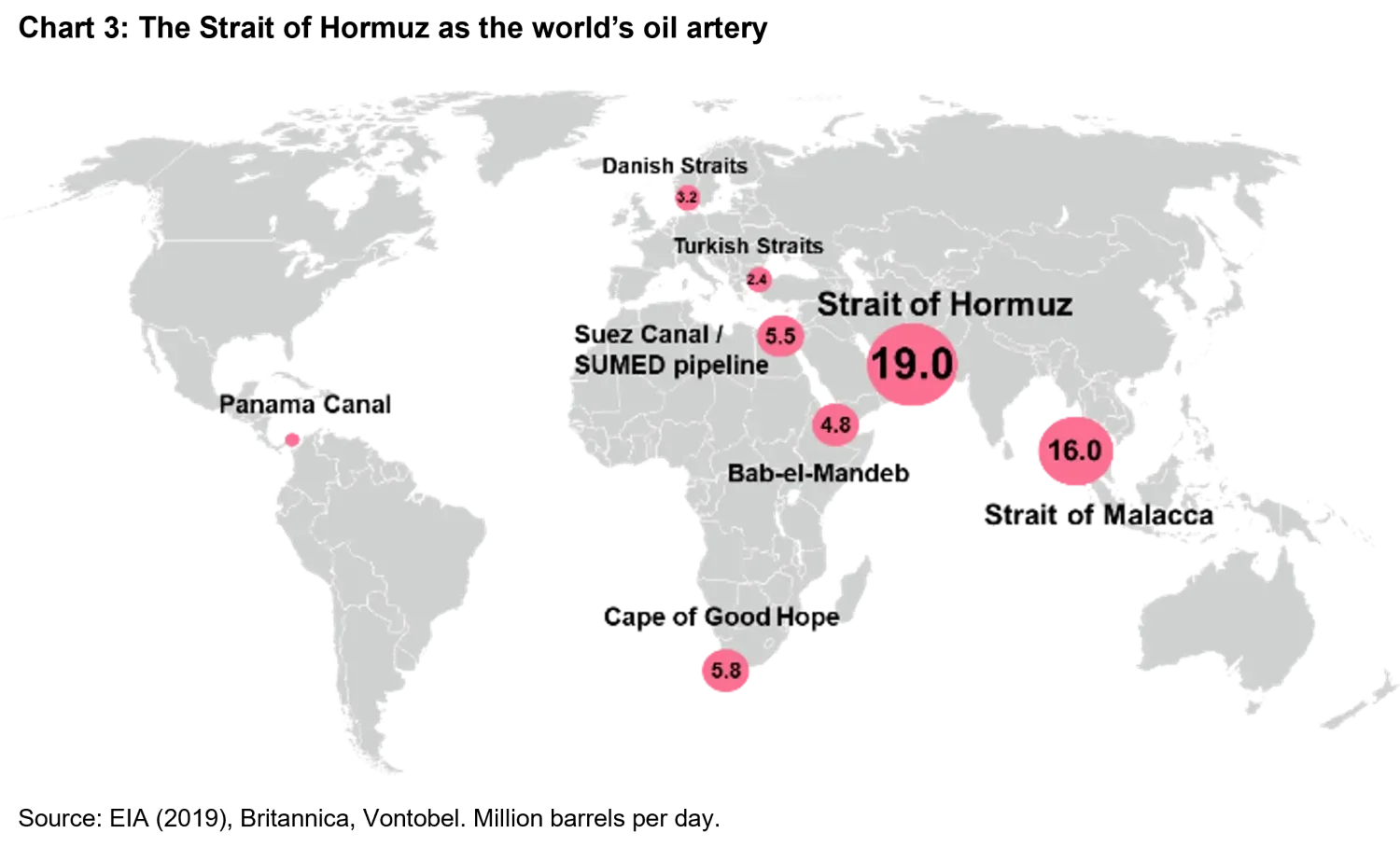

Of particular interest is the Strait of Hormuz (chart 3). The Strait of Hormuz connects the Persian Gulf with the Gulf of Oman and the Arabian Sea and separates Iran (north) from the Arabian Peninsula (south). It is estimated to be responsible for around 17 per cent of the world’s oil supply.

The Strait currently remains open. In our view, Iran has no interest in closing the Strait (as it is also dependent on the Strait).

If there is no further escalation, the focus will sooner or later return to the most important market factors. Specifically, these are inflation, growth, and central bank policy. However, the potentially higher geopolitical attention of the markets in general could remain.

In the event of a further escalation, a higher oil price (or even an oil price shock, depending on developments) can be expected. Should a shock occur, the US could release further crude oil from its strategic oil reserves. The Organization of the Petroleum Exporting Countries (OPEC) and its allies could also rush to the rescue, as they have around 5 million barrels per day of spare production capacity. Share prices are likely to suffer in such a scenario. Gold would benefit. However, higher inflation would then be reflected in higher yields and become a headwind for gold.

How is the Multi Asset Boutique positioned?

In our current allocation, we are slightly overweight equities. Recent developments are likely to represent a short-term headwind for equities, but we believe the downside potential should be limited by our defensive positioning (preference for US and Swiss equities).

At the same time, we reduced commodities to underweight at the beginning of the year, as we believed that equities are more attractive (from a relative perspective) than commodities. While the equity overweight has paid off so far this year, the commodity underweight means that we would not be “directly” protected against a potential oil shock. Instead, our portfolio hedge is expressed in an overweight in government bonds and gold.

We are maintaining our positioning for the time being but are monitoring the situation carefully as future allocation decisions could be influenced by the medium-term development of the conflict (escalation or not).

1. @Iran_UN on X (14. April 2024): “Conducted on the strength of Article 51 of the UN Charter pertaining to legitimate defense, Iran’s military action was in response to the Zionist regime’s aggression against our diplomatic premises in Damascus. The matter can be deemed concluded. However, should the Israeli regime make another mistake, Iran’s response will be consider-ably more severe. It is a conflict between Iran and the rogue Israeli regime, from which the U.S. MUST STAY AWAY!”