Powering the Future

Quantitative Investments

Prospects and Challenges in the Utilities Sector for 2024

Utilities, facing significant macroeconomic headwinds in 2023, have seen relative valuations fall precipitously, offering opportunity in 2024.

Could you provide a brief recap on public utilities stock performance in 2023?

Following good relative performance in 2022, which highlighted the sector’s defensive return profile, public utilities have had a challenging 2023 as investors tried to gauge the potential impact of “higher for longer” interest rates. Utilities were the worst-performing sector in the S&P 500, dropping 15.5 % YTD through October 31, 2023, while the broader S&P 500 rose 10.7 % during the same time period. In addition, the sector saw one of its worst quarterly returns on record.

Can utilities perform in a “higher for longer” interest rate environment over the long term?

Yes, but the road may be turbulent. Regulated utilities have the ability to pass through incremental debt financing costs to customers, depending on regulatory approvals, which is referred to in the industry as “rate case requests.”

While many rate cases are currently being evaluated, we believe regulators will ultimately pass through these costs to customers, thereby allowing companies to sustain their forward earnings outlook. Today, utility costs as a share of consumers’ total wallet is historically low, helping strengthen utilities rate case requests. In fact, nearly all public utility companies maintained their future guidance and growth outlook profiles during the third quarter 2023 reporting period despite the uncertainty around current rate cases.

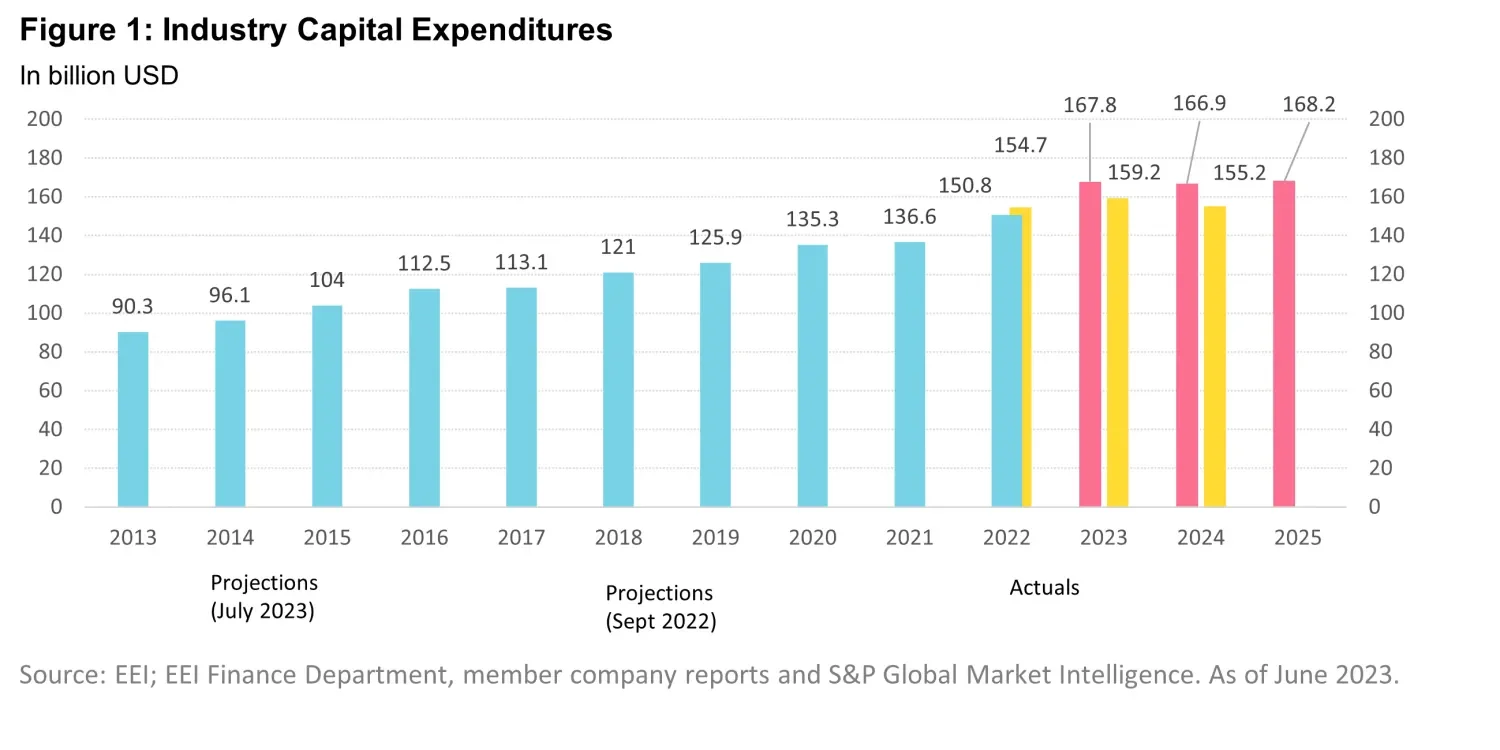

Additionally, passage of the IRA (Inflation Reduction Act), aimed at modernizing the electric grid, adds a significant tailwind. Substantial capital expenditures (capex) and investments in utilities will be required as companies look to shift away from fossil fuel-related production to renewable assets.

This is in part why the sector has seen a steady increase in industry capex as shown by the chart below from Edison Electric Institute (EEI), a trade association representing U.S. investor-owned electric utilities (See Figure 1).

The long-term case for utilities is supported by a fastgrowing appetite for more energy to support increasing consumer needs, rapidly rising data center demand, and electrification. While the trend has been present over the last few years, we expect load growth to remain elevated for the foreseeable future.

Then why have regulated utilities underperformed?

First, rising bond yields imply that fixed income alternatives are becoming relatively more attractive. For investors who place a higher emphasis on income, this year was particularly punishing as the Treasury 10-year yield now exceeds dividend yields offered by utilities for the first time in over a decade. Depending on the level of inflation and economic activity, it is possible that interest rates will be significantly higher for longer.

Second, utilities are capital-intensive entities that are regularly accessing capital markets via bond and equity issuances to fund growth through increased capex. With rising debt costs and lower stock prices, some investors are concerned that longer-term earnings guidance may not be achievable.

Does this impact utilities across the board?

No, in general we think utilities will come out of this environment in better shape. However, there are differences across the landscape. For some high-quality utilities, such as Ameren Corp. (Ticker: AEE), annual equity issuance was already a programmatic component of the company’s financing plan, and therefore higher debt costs are not materially impacting the company’s longer-term earnings prospects.

“When measured on a relative price-to-earnings valuation basis against the S&P 500, utility stocks are the cheapest they have been since 2009, indicating they may be undervalued versus the broad market.

Comparing utilities to other income-producing sectors, we think the upside potential in price they offer and margin of safety included, is hard to match for income-producing assets.”

By contrast, for companies with weaker balance sheets, the story is more complex. These companies have typically resorted to asset sales to shore up their balance sheets, as well as alternative methods of financing. These include the issuance of mandatory convertible preferred, hybrid, and junior subordinated notes.

Have there been any other challenges facing the sector outside of interest rates?

The most notable emerging concern has been the rise in natural disaster risk. Climate change has become an increasingly problematic issue for investor-owned utilities. The most recent example is Hawaiian Electric (HE), which experienced a 65 % drop in its share price after authorities blamed the company for starting the Maui wildfires in August 2023. However, it should be noted that no final determination on cause has been made.

However, we don’t think that climate risk makes the sector uninvestable. For example, Duff & Phelps Investment Management’s Global Listed Infrastructure strategy is invested in both Edison International (EIX) and Sempra Energy (SRE) because we believe California’s regulatory construct has vastly improved and there is an extremely attractive and sustainable rate base growth story that investors are ignoring. In the longer term, we also believe that these companies will experience an acceleration in load growth as California appears to be very focused on electrification.

Is now the time to consider utilities for your portfolio?

Yes, we believe utility investments are an integral part of portfolio construction. So far, we haven’t seen rising yields structurally impact longer-term growth rates for the sector in the Global Listed Infrastructure strategy. For the most part, high yields have predominantly hurt renewables’ asset valuations. This has negatively impacted companies that own significant amounts of renewables, as well as companies that are restructuring or divesting their renewable portfolios to strengthen their balance

sheets.

More recently, consensus expectations have started to shift to a soft landing scenario, helping strengthen the case for utilities as a defensive sector to perform better than the overall market in the face of a recession. Therefore, if rates are higher for longer, which markets are presuming, naturally the economy will cool down, which will likely result in a large rebound in sector valuation.

This argument is even more compelling in light of recent performance, given the margin of safety utilities offer relative to the broad market. When measured on a relative price-to-earnings valuation basis against the S&P 500, utility stocks are the cheapest they have been since 2009, indicating they may be undervalued versus the broad market. Comparing utilities to other income producing sectors, we think the upside potential in price they offer, and margin of safety included, is hard to match for income-producing assets.

When evaluating investment allocations across our strategies, we focus on long-term total return potential, which we believe utilities offer based on current valuations and long-term factors favoring growth. As the year has progressed, we have tactically added to our utilities weighting in Duff & Phelps Investment Management’s Global Listed Infrastructure strategy, in order to help build on the defensive nature of the strategy’s portfolios and to take advantage of the current market pricing opportunity.

Regardless of the approach taken, we believe every investor should have some exposure to utilities in a properly diversified investment portfolio.