Three strategies for beating inflation with bonds

After decades of being troubled by too little inflation rather than too much, central bank policymakers have been backed into a corner by persistent price rises stemming from the global economy’s post-COVID re-opening.

With consumer price inflation (CPI) running at a blistering 7% in the US, 5.1% in the Eurozone and 5.4% in the UK, investors have lost confidence that this global resurgence of inflation is merely transitory and have sent government bond yields sharply higher, with 10-year US Treasury (USTs) yields hitting a two-year high in January and losses also creeping into corporate bond markets.

Central banks today have little room for manoeuvre, which in our view they are at risk of making a potentially damaging policy error in 2022. But why can these errors be so dangerous for fixed income investors? And how can we try to protect a portfolio from the risk?

Looking at some famous central bank policy errors, we can highlight some of the potential issues.

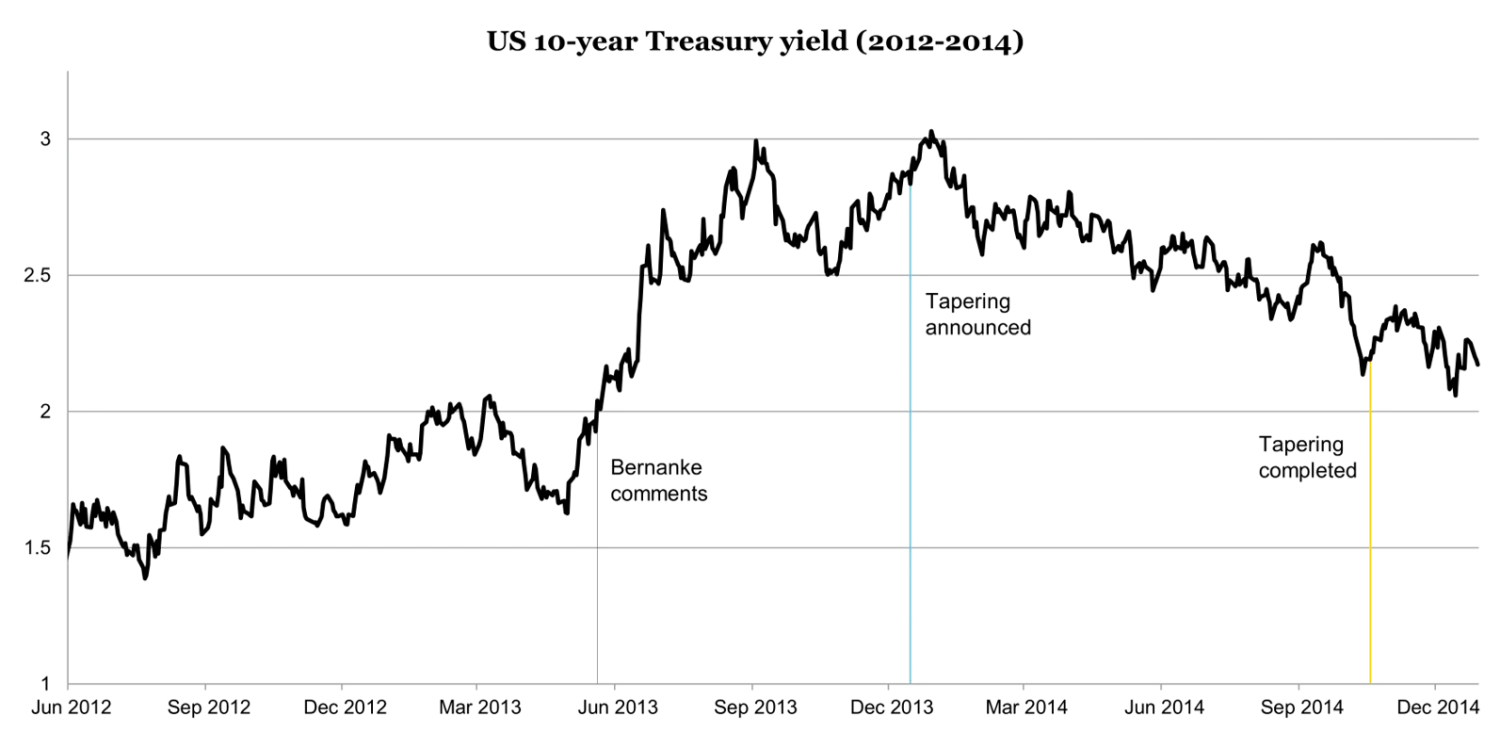

In the wake of the global financial crisis, the US Federal Reserve supported markets by buying some $2tr of US Treasuries and other financial assets. Using quantitative easing (QE) as a multi-year policy tool was a novel approach at the time, and one that tripled the size of the Fed’s pre-2008 balance sheet. In May 2013 the then chairman, Ben Bernanke, suggested the Fed would start to slow (or ‘taper’) the pace of its purchases. No date was given for the move, but with market participants having become used to (or arguably dependent on) the Fed’s support, the bond market reacted badly and 10-year UST yields surged upwards, reaching 3% by September having been 1.92% before Bernanke’s comments.

It is worth noting UST yields returned to their pre-taper levels relatively quickly – in fact they fell while the Fed was actually tapering between December 2013 and October 2014 – but not before significant damage had been done, with the reaction hitting everything from investment grade corporate debt to emerging market bonds. The market turmoil also likely persuaded the Fed to delay the start of tapering, not a luxury central bankers can always afford.

Source: TwentyFour, Bloomberg, February 2022.

July 2008 was a neat demonstration of what can happen when a single-minded obsession with inflation dominates central bank policy. The global financial crisis was arguably only just beginning at this point, though credit markets had already seized up and economic growth in Europe was barely positive. Both the Fed and the Bank of England had reacted to the emerging crisis by making several interest rate cuts (traditionally a tool for helping the economy in a downturn). Eurozone inflation, however, was running at 4%, twice the ECB’s target, and so ECB President Jean-Claude Trichet decided to hike base rates by 0.25% to 4.25%.

This apparent disregard for the deteriorating wider financial situation is believed to have been driven primarily by Germany’s dominant position in the ECB, and the country’s deeply-held fear of inflation following the Weimar Republic’s destructive hyperinflation episode of the 1920s. The ECB also overlooked that inflation was being driven by surging oil prices, while core inflation (now the more popular central bank measure excluding energy and food) was below 2%. Within a couple of months the global economy nosedived and the ECB embarked on a swift reversal, cutting its main refinancing rate to 1% by mid-2009.

Sometimes the policy error is not embracing novel tools quickly enough. At the time of the Great Depression, the BoE governor, Norman Montagu, was generally considered to be very skilful at foreseeing risks. An opponent of demanding war reparations from Germany, he raised the alarm in the 1920s that the world was running short of gold reserves and also warned of the dangers of the US stock market bubble. However, his historical legacy is tarnished by his staunch belief in the benefits of the gold standard – the backing of all paper money by gold.

In the early 20th century all the world’s key economies were on the gold standard, but the rigidity of that system is now considered a primary cause of the economic catastrophe that overtook Europe and the US during the Great Depression. As investors panicked and began trading paper money for gold, the BoE was in danger of running out. Ultimately it required a nervous breakdown from Montagu in 1931 amid a series of bank collapses for his colleagues to take the UK off the gold standard. This break from gold was required to give policymakers the new tools they needed to stimulate their economies and lift them out of the Great Depression.

Today, central bankers’ task is all the more difficult because inflation isn’t their only concern; controlling it must be balanced against preserving a global economic recovery that is beginning to look more fragile. It is a fine line policymakers must tread, and for investors it raises the risk that central banks could end up being either too dovish or too hawkish.

If central banks take too dovish a stance and let the status quo continue for too long, they risk being seen as behind the curve in controlling inflation. In that scenario, investors would likely continue to shun longer dated bonds in an attempt to avoid being locked into large drops in purchasing power, and yield curves would be expected to steepen aggressively as the market prices in the need for years of hawkish rate hikes to control inflation in the future. Steepening yield curves do offer the potential for more attractive roll-down gains, but they hurt any existing holders of longer dated bonds as yields rise.

However, in our view a 2022 policy error could be more akin to 2013’s if a pivot towards hawkishness is sold too aggressively to the market, perhaps through a combination of faster-than-expected rate hikes and an announcement of imminent quantitative tightening. This scenario should also result in rising government bond yields, though likely with flatter yield curves as markets start to price in falling inflation in future years and the possibility of recession. A rapid tightening of financial conditions would likely cause risk assets to sell off and prompt a widening in corporate bond spreads.

As fixed income investors, how can we look to try and protect our portfolios from this dual risk of policy error?

Both errors threaten higher government bond yields, so the first tactic is sticking to bonds with limited duration; their prices are traditionally less sensitive to changes in yield and thus experience smaller drops in value when yields shift higher. We suggest building portfolios at the front end of the yield curve in shorter dated bonds. An allocation to asset-backed securities (ABS), specifically European ABS, can be one particularly effective way of doing this, in our view, since their floating rate nature means they have very little interest rate duration, and they also tend to offer higher yields than vanilla corporate bonds of the same rating.

While credit spreads may come under pressure as part of a wider sell-off, ultimately we believe corporate fundamentals remain supportive. In short, we prefer credit risk to interest rate risk. Ideally this is done with careful stock selection; we believe portfolios should only contain names that can be comfortably held through periods of volatility. Bonds that combine lower duration and higher yield have higher ‘break-evens’ – the level a bond’s yield can rise to over a one year holding period without the capital loss being higher than the income collected over the year. Filling a portfolio with higher break-even bonds means it should be better able to withstand greater levels of stress and still deliver a positive return.

Since we anticipate a period of heightened volatility, we believe it is essential to maintain higher levels of liquidity through both cash and very short dated government bonds. These should help preserve value in a sell-off and offer the opportunity to take advantage of the dip by allowing rotations into higher yielding bonds.