Preparing your portfolio for a recession

Quality Growth Boutique

Chuck Prince, an ex-CEO of Citigroup, came to symbolize the excessive attitude towards risk on Wall Street that led to the global financial crisis after his infamous quote “…as long as the music is playing, you’ve got to get up and dance.”

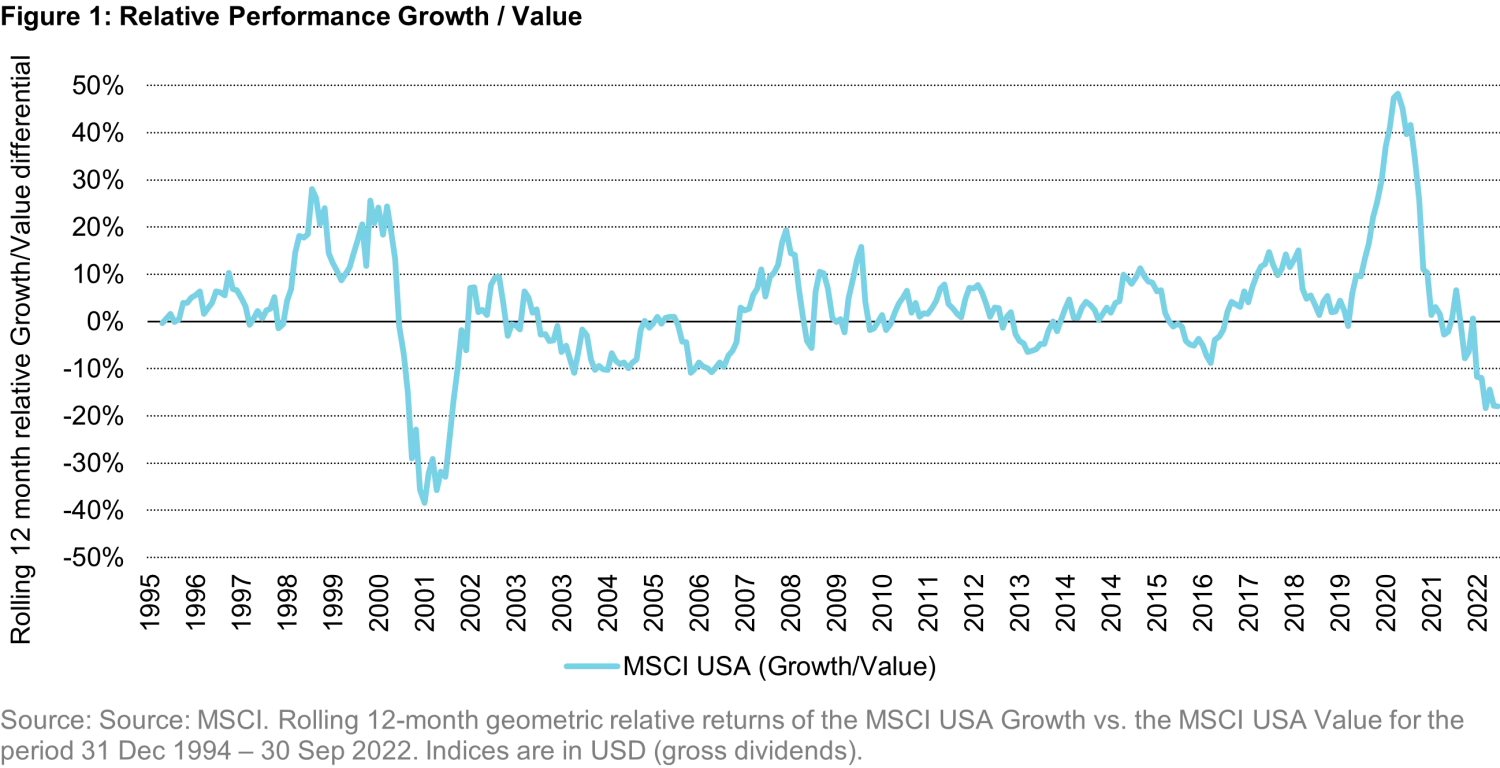

The music has stopped in the capital markets. Ultra-low interest rates and TINA (There is No Alternative to equities) are relics of the past. The degree of outperformance between growth and value was unprecedented even when compared to the tech bubble in the late 90’s (Figure 1). In our view, speculative portfolios that outperformed in the last five years are unlikely to do as well in the upcoming cycle.

With multiple forces interacting simultaneously, from persistently high inflation to war in Ukraine, and high and volatile energy prices, investors are at a point of maximum uncertainty since the global financial crisis. After the recent crash in UK government bonds, Jamie Dimon, CEO of JPMorgan Chase, warned that investors should expect more blowups.

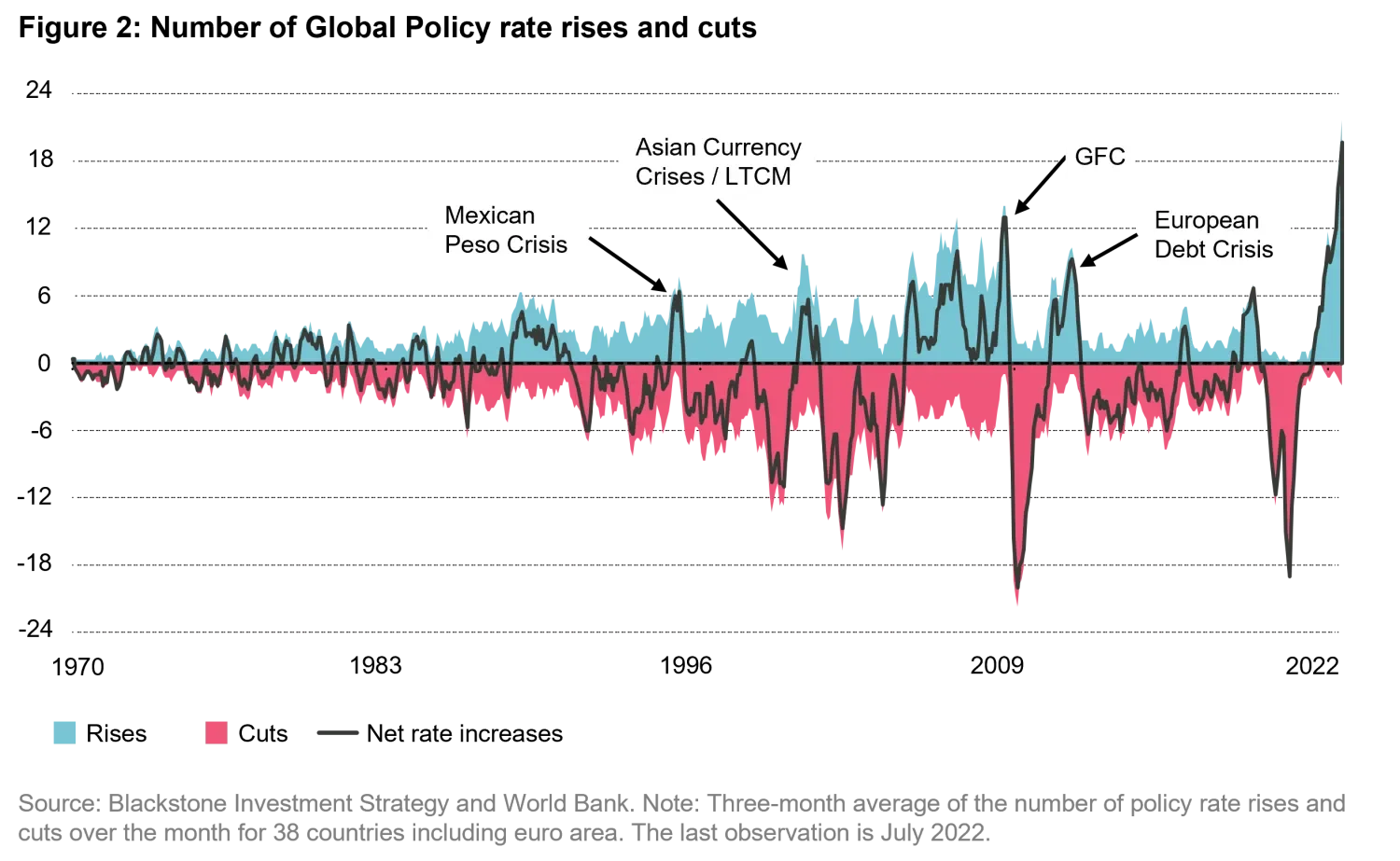

Further, history suggests that financial crises coincide with periods of large increases in global interest rates (Figure 2). Economies around the globe have increased interest rates in a more coordinated fashion than ever before.

Preparation & downside protection

While it is not always possible to accurately predict individual events, advance warning signals can trigger preparation. The S&P 500 is down nearly 20% year to date, yet consensus expectations are for 7% EPS growth in the next 12 months. Considering the median earnings decline during recessions in the last 30 years was in the low to mid-teens, today’s consensus numbers seem optimistic.

In the event of a market correction, downside protection can make a meaningful difference in the long-term accumulation of capital. Looking back at market corrections over the last 50 years, on average, markets fell by 30% from peak to trough and it took approximately 5 years to return to previous highs.

Here are three ways we are preparing for what’s ahead at the Quality Growth Boutique:

- In a recession, not all companies are impacted equally. As consumers deplete their excess savings and the economy weakens further, there will be a greater differentiation among firms in their ability to protect margins. We seek companies in less-cyclical markets that have pricing power. One example is Keysight, which manufactures electronics test and measurement equipment that is critical for product research and development. Its high quality and differentiated solutions can enable pricing power. And consumer staples companies, particularly the Coca-Cola Company and PepsiCo, have delivered strong pricing in the current inflationary environment.

- Don’t mistake a great story for a quality company. Some of the most popular stocks in recent years declined significantly this year. A company with an interesting business model but without a clear track record of profitable growth, in our view, is just another story.

- Mitigate risk. We stress test every holding for earnings downside and balance-sheet risks for a recession scenario. We expect our portfolio companies to demonstrate greater earnings resilience, in aggregate, compared to a potential decline in aggregate earnings for the benchmark. Further, an overweight to consumer staples and lack of exposure to energy can protect against volatility.

Note: Companies discussed above are holdings of the representative portfolio for our US Equity strategy. For illustrative purposes only and basis for the selection is that the portfolio is the oldest and most representative account which we believe most closely reflects portfolio management style for the strategy.

Innovation ultimately creates value for shareholders

Despite the gloom and doom in the market these days, human ingenuity is not limited by the macro environment. In fact, periods of great uncertainty, like the first half of the 20th century, were prolific in technological breakthroughs such as the invention of the automobile, airplane, radio, and penicillin. The world is not standing still; the number of patents issued in the US doubled in the last decade.

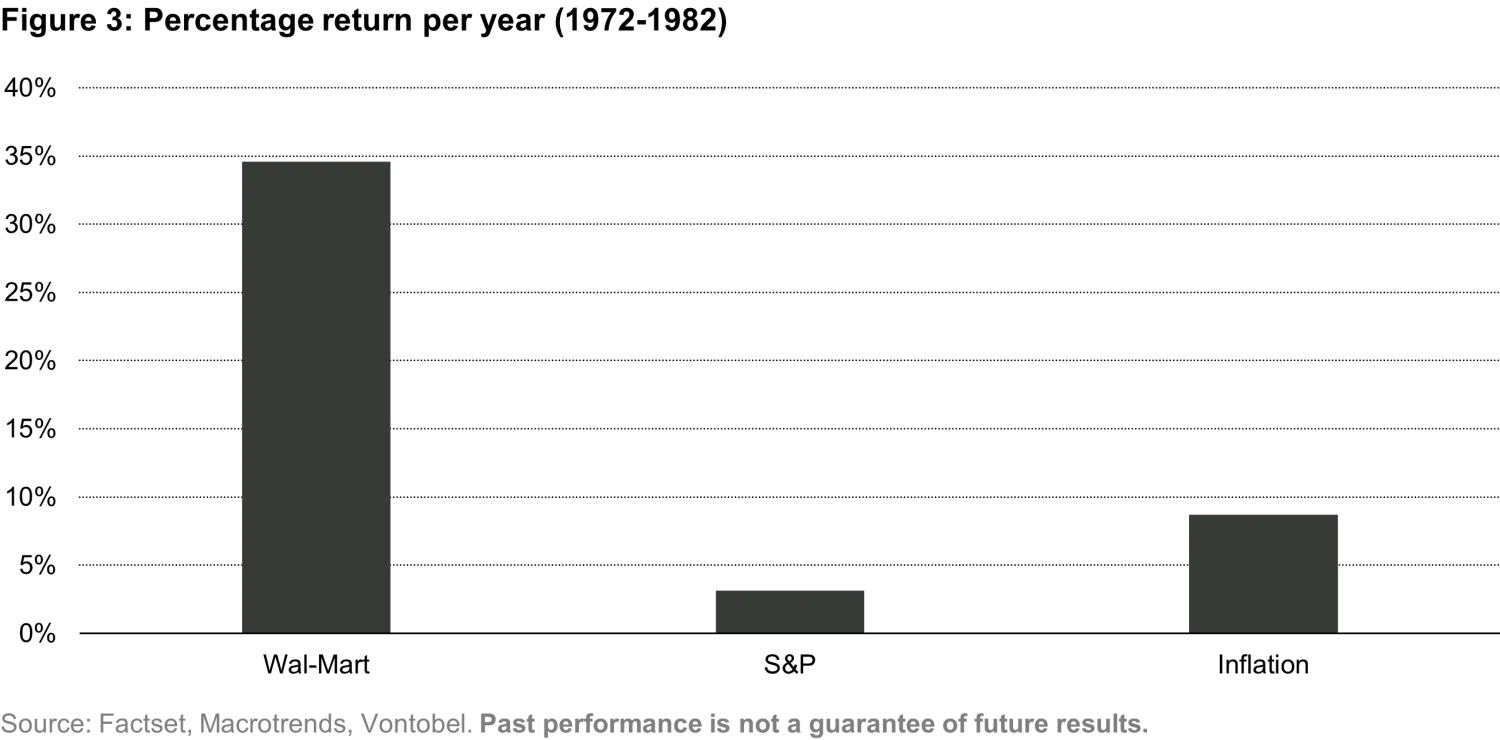

It’s difficult, but not impossible, to find great businesses that can perform through challenging markets. Wal-Mart, one of the most popular brands in the US, is a perfect example: By revolutionizing supply-chain management in retail, Wal-Mart’s simple but powerful proposition – “Lowest Price Every Day – turned a local grocery store chain into the largest global retailer with sales of US$600 billion. In the 1970s, despite high inflation and economic volatility, Wal-Mart’s stock price handily outperformed both the market and inflation.

The cycle of market excesses is coming to an end. While greed and fear will continue to drive markets, our investment philosophy anchors our foot on the ground during extreme ebullience or pessimism. Even during difficult economic periods, we will seek great businesses and aim to create absolute wealth for our clients.

Important Information:

The companies presented herein for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Provided for illustrative purposes as a means of demonstrating our investment management processes and for further elaboration on the subject matter under discussion. References to holdings and/or other securities should not be considered a recommendation to purchase, hold, or sell any security. No assumption should be made as to the profitability or performance of any company or security associated with them. There is no assurance, as of the date of publication, that the securities referenced held in the strategy or that securities sold have not been repurchased. Additionally, it is noted that securities discussed do not represent all of the securities purchased, sold, or recommended during the period referenced. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Certain information herein based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. We believe that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, there is no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions. Past performance is not a reliable indicator of current or future performance.