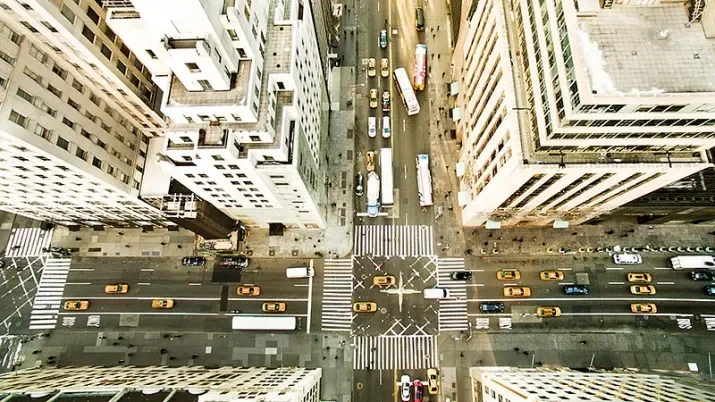

We serve investors in the United States from our offices in New York.

We are an active investment manager with international reach and a multi-asset class approach. Our investment capabilities draw on specialized investment talent and robust risk management, operating within a strong performance culture. We deliver leading-edge solutions for both institutional and private clients.

Our commitment to active management empowers us to invest on the basis of our convictions. We deliver value through our diverse and highly specialized teams.

Vontobel Asset Management Inc.

66 Hudson Boulevard

34th Floor, Suite 3401

New York, NY 10001

United States of America

+1 212 804 9300

Vontobel Asset Management Inc.

200 E Broward Boulevard

Suite 2030

Fort Lauderdale, FL 33301

United States of America

+1 212 804 9300

From sustainable investment solutions, to environmental sustainability, through to serving communities: corporate responsibility has a long tradition at Vontobel. The company fulfills its corporate responsibility in every sense – an achievement for which it regularly wins awards.

Take ownership and bring opportunities to life. Be Vontobel of course.