Data as of 03.31.2024

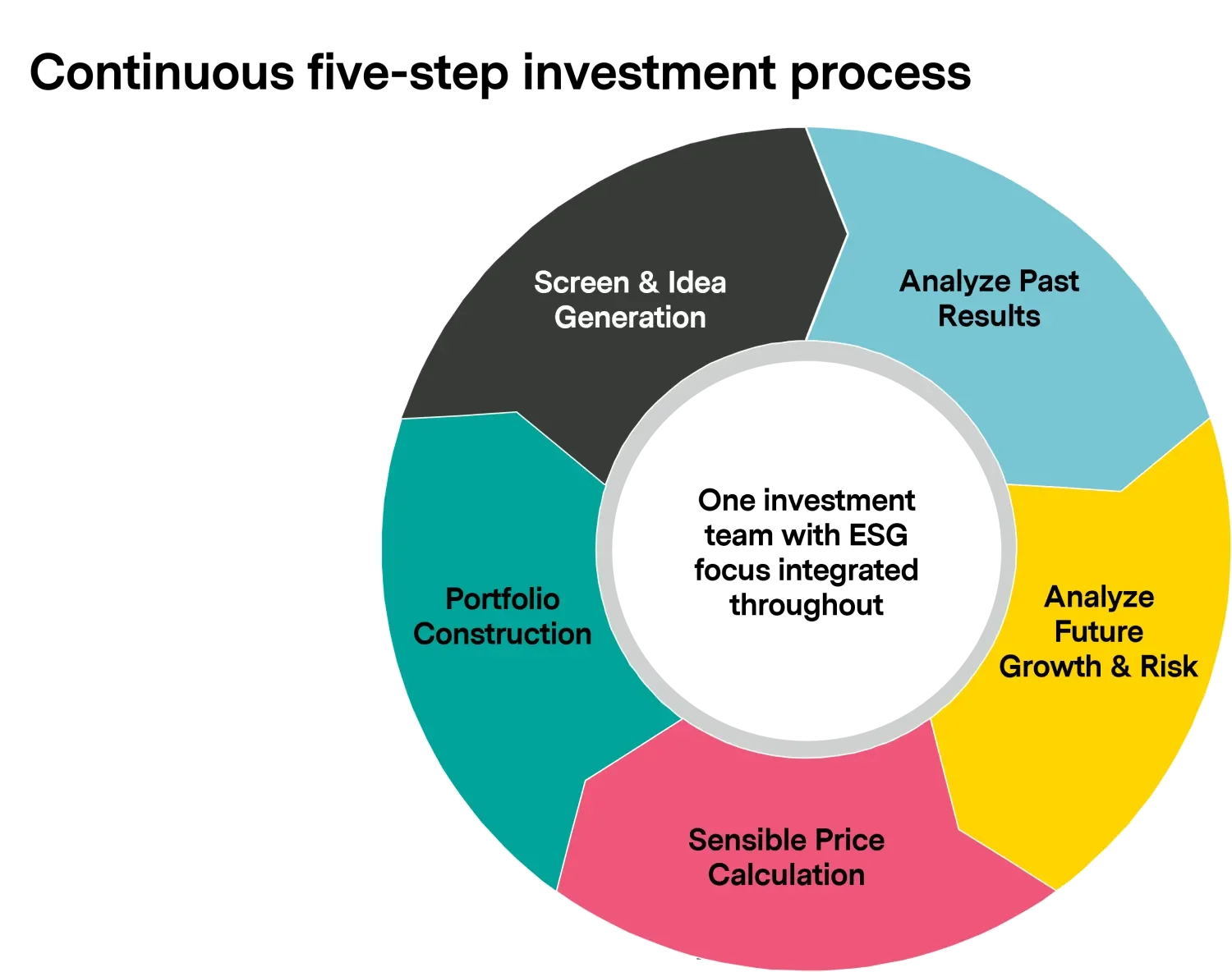

Our Global Equity Strategy is an actively managed, concentrated portfolio covering both developed and emerging markets. Our approach is based on returns being driven by a long-term investment in companies with relatively stable and predictable earnings growth that can be sustained for extended periods of time. The strategy draws on the expertise of our exclusive 31 strong investment team. ESG is integral to our approach given our focus on relatively stable and predictable ‘quality’ earnings growth combined with long-term holding periods. While the strategy is benchmark agnostic, performance is shown relative to the MSCI All Country World Index.

Many asset managers follow a high quality growth style, but what sets the Quality Growth Boutique apart? We have spent decades building our team and distinct investment approach. Members of our research team discuss our philosophy and process.

Source: NorthernTrust. All results portrayed are expressed in U.S. dollars. Periods under one year are not annualized. Past performance is not necessarily indicative of future results.

The composite‘s gross rates of return are presented before the deduction of investment management fees, other investment -related fees, and after the deduction of foreign withholding taxes, brokerage commissions and transaction costs. An investor’s actual return will be reduced by investment advisory fees. The composite‘s net rates of return are presented after the deduction of investment management fees, brokerage commissions, transaction costs, other investment-related fees and foreign withholding taxes. Results portrayed reflect the reinvestment of dividends and other earnings. The comparison to an index is provided for informational purposes only and should not be used as the basi s for making an investment. There may be significant differences between the composite and the index, including but not limited to the risk profile, liquidity, volatility and asset composition. The MSCI All Country World Index is a free float-adjusted market capitalization index that is designed to measure global developed and emerging market equity performance. It is a market -weighted aggregate of 47 individual country indices that collectively represent major markets of the world. The index is calculated on a total return basis with net dividends reinvested. It reflects withholding taxes, but not fees and other investment expenses.

| Vontobel Global | |

|---|---|

| Capitalization (US$ bn), weighted avg | 502.4 |

| P/E - Forecast 12-month, weighted harmonic avg | 24.9 |

| Dividend Yield (%) | 1.3 |

| 5 Yr Historical EPS Growth (%) | 12.1 |

| Return on Equity, weighted avg (%) | 22.3 |

| Vontobel Global | |

|---|---|

| Annualized Alpha | 0.3 |

| Beta | 0.9 |

| Sharpe Ratio | 0.5 |

| Annualized Standard Deviation | 16.9 |

| % | |

|---|---|

| Microsoft Corporation | 6.4 |

| Amazon.com, Inc. | 5.2 |

| RELX Plc | 4.7 |

| Coca-Cola Company | 4.0 |

| HDFC Bank Ltd. | 3.9 |

| London Stock Exchange Group plc | 3.6 |

| Mastercard Incorporated | 3.6 |

| Nestle S.A. | 3.6 |

| UnitedHealth Group Incorporated | 3.4 |

| Taiwan Semiconductor Manufacturing Company Limited | 3.4 |

| % in Top 10 Holdings | 41.9 |

Source: FactSet.

1 Based on a representative portfolio and shown as supplemental information to the composite presentation. Other accounts contained in the composite could have materially different statistics. The basis for which the representative portfolio was selected is that the portfolio is the oldest and most representative account. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

2 Based on gross performance of the Global Markets Equity Composite. The composite‘s gross rates of return are presented before the deduction of investment management fees, other investment-related fees, and after the deduction of foreign withholding taxes, brokerage commissions and transaction costs. An investor’s actual return will be reduced by investment advisory fees. Effective June 2012, the composite for the Global Equity Strategy was replaced with the Global Markets Equity Composite.

3 The top 10 holdings are based on a representative portfolio, and are shown as supplemental information to the Global Markets Equity Composite. The securities identified and described do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Source: FactSet. Data is based on a representative portfolio and shown as supplemental information to the composite presentation. Other accounts contained in the composite could have materially different statistics. The basis for which the representative portfolio was selected is that the portfolio is the oldest and most representative account.

The index comparisons in this presentation are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of the composite and the Index may not be comparable. There are significant differences between the composite and the indices referenced, including, but not limited to, risk profile, liquidity, volatility and asset composition. Please note that an investor cannot invest directly in an index. Investments discussed in the presentation is based on a representative portfolio and there is no assurance that Vontobel will make any investments with the same or similar characteristics as the representative portfolio presented. The representative portfolio is presented for discussion purposes only and is not a reliable indicator of the performance or investment profile of the composite.

Any projections contained in this presentation are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of projections should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and projections should not be relied upon as such. This disclaimer applies to this presentation and the oral or written comments of any person presenting it.

The inclusion in the composite of the performance of wrap accounts and private client assets could result in a material difference in the performance returns. There can be no assurance that investment objectives will be achieved. Clients must be prepared to bear risk of a total loss of their investment. Due to a varying frequency of the fees being paid and associated compounding effects, the actual difference between gross and net returns may differ from the stated annual fee. For example, on an account with a 0.50% fee, continuous monthly gross performance of 1.50% and the fees being deducted monthly, the compounding effect will result in an annual gross return of 19.56% and a net return of 18.97%. Thus, a $10,000 initial investment would grow to approximately $14,295 gross of fees, versus $14,155 net of fees, over a two-year period. Effective January 2016, the net-of-fees rates of return are calculated based on the fee schedule. All net returns that were previously calculated on a cash basis are linked to the returns being calculated under the new methodology, reflecting daily accrual of fees.

Vontobel Asset Management, Inc. (“Vontobel”) is registered with the U.S. Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940, as amended, in the USA. Registration as an Investment Advisor with the U.S. Securities and Exchange Commission does not imply a certain level of skill or expertise. Vontobel is exempt from the requirements to hold an Australian Financial Services License under the Corporations Act in respect of the financial services it provides to Australian wholesale clients under ASIC Class Order CO 03/1100. Vontobel is regulated by the US Securities and Exchange Commission under US laws, which differ from Australian laws.

'Vontobel is an investment advisory firm registered with the Securities and Exchange Commission, under the Investment Advisers Act of 1940, as amended, and a subsidiary of Vontobel Holding AG, Zurich, Switzerland. For GIPS purposes, the firm is defined as all institutional accounts managed by Vontobel Quality Growth boutique, excluding wrap accounts and private client assets managed in previous years.

Vontobel Asset Management, Inc. (“Vontobel”) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Vontobel has been independently verified for the periods from January 1, 2001 through December 31, 2022. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm's policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Global Equities ex-Tobacco composite has had a performance examination for the periods from May 1, 2016 through December 31, 2022. The verification and performance examination reports are available upon request.

The Global Equities ex-Tobacco Composite includes all discretionary accounts that invest mainly in non-tobacco equity or equity-linked securities of issuers located in the developed and emerging markets in the United States, Europe, Asia and Latin America. This composite consists of accounts that are not required to be at least 75% hedged at all times, and these accounts can hold as many as 70 stocks at any given time. The minimum account size for this composite is $1 million. The composite was created and incepted on April 30, 2016. 'The firm maintains a complete list and description of composites as well as a list of broad distribution pooled funds, which are available upon request.

Results of the composite are shown compared to the MSCI All Country World Index (the “MSCI ACWI“), an unmanaged index of stocks traded in major world markets. The benchmark is used for comparative purposes only and generally reflects the risk or investment style of the investments in the composite. The index is a free float-adjusted market capitalization index that is designed to measure global developed and emerging market equity performance. With approximately 2,920 constituents, it is a market-weighted aggregate of 23 Developed Markets and 24 Emerging Markets country indexes that collectively represent major markets of the world. The index is calculated on a total return basis with net dividends reinvested. It reflects withholding taxes, but not fees and other investment expenses, and is expressed in U.S. Dollars. Investments made by Vontobel for the portfolios it manages according to respective strategies may differ significantly in terms of security holdings, industry weightings, and asset allocation from those of the MSCI ACWI. The index has not been examined by an independent verifier.

Net composite performance is presented after the deduction of foreign withholding taxes. Capital gains, dividends and interest income received may be subject to withholding taxes imposed by the country of origin and such taxes may not be recoverable. The U.S. Dollar is the currency used to express performance. Returns include the effect of foreign currency exchange rates. Returns are presented gross and net of management fees and include the reinvestment of all income. The gross rates of return are presented before the deduction of investment management fees and other investment-related fees, and after the deduction of foreign withholding taxes, brokerage commissions and transaction costs. The net rates of return are presented after the deduction of investment management fees, brokerage commissions, transaction costs, other investment-related fees, foreign withholding taxes and bundled fees. Such investment management fees are actual fees. Withholding tax rates for the indices are applicable to Luxembourg withholding companies. Our withholding taxes, as captured in the composites, may vary from those captured in the index. The net rates of return are also reflective of performance fees, where applicable. The standard annual management fees charged by Vontobel for the Composite are: 0.75% on the first $100 million, 0.65% over $100 million. Certain accounts may have negotiated management fees, which may be higher or lower than the standard fee schedule. Investment advisory fees are further described in Part 2 of its Form ADV.

Past performance is not indicative of future results. Investing involves risk, including possible loss of principal. Value and income received are not guaranteed and one may get back less than originally invested. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.